As the drumbeat of discontent against hedge funds grows louder within the financial press, assets managed by the industry remain at or near record highs. How can this apparent inconsistency be explained? Admittedly, the hedge fund industry has created an easy target on its back, with many investors having experienced frauds, unexpected side-pockets or redemption restrictions, high fees and poor performance. At Silvercrest, our team has dedicated significant resources and built a rigorous process focused on avoiding these types of problems. But the question remains, why invest in hedge funds at all? In my mind, that is somewhat analogous to asking why invest in stocks?

The primary reason we invest in hedge funds is to get exposure to strategies, risk premia and asset classes that are not easily accessible via other mechanisms.

The equity markets have also experienced frauds, bankruptcies, trading halts and excessively compensated management teams. Equities clearly offer better liquidity which can be a very valuable characteristic and some argue that hedge funds are less regulated, although that is increasingly becoming less true. These arguments somewhat miss the point though. The primary reason we invest in hedge funds is to get exposure to strategies, risk premia and asset classes that are not easily accessible via other mechanisms. Further, we seek to do it with highly experienced management teams that can be accessed as frequently as needed.

At Silvercrest, we spend less time attempting to classify hedge funds and more time determining what type of fund would best complement a specific client’s portfolio and investment objectives.

By most counts, there are more hedge fund vehicles than there are actively traded public stocks in the U.S. Just as we don’t expect all stocks to behave similarly, we should not expect a structured credit fund to behave like a long/short equity fund, nor should we expect that one long/short equity fund will behave like another.

At Silvercrest, we spend less time attempting to classify hedge funds and more time determining what type of fund would best complement a specific client’s portfolio and investment objectives. If a client is looking to reduce equity exposure, for example, the swapping of higher beta to lower beta investments can be instrumental as can the inclusion of other orthogonal strategies. However, it is critical to really understand the exposures and behaviors of the hedge funds being added given that hedge funds often have fairly broad mandates.

For some portfolios, highly complex hedge fund strategies can be very useful in improving risk-adjusted returns, through higher returns, correlation benefits or lower volatility. For other portfolios, similar benefits can be achieved through much simpler fund strategies as long as there are clear exposure guidelines, repeatable processes and strong organizations and infrastructure. Furthermore, many of these funds have adopted longer-term investment horizons, leading to more tax-efficiency, and additionally, fees across the industry have finally started to decline.

As the current bull market in stocks and bonds continues to mature, we welcome the opportunity to discuss the many benefits of a targeted approach to including hedge funds in your portfolio.

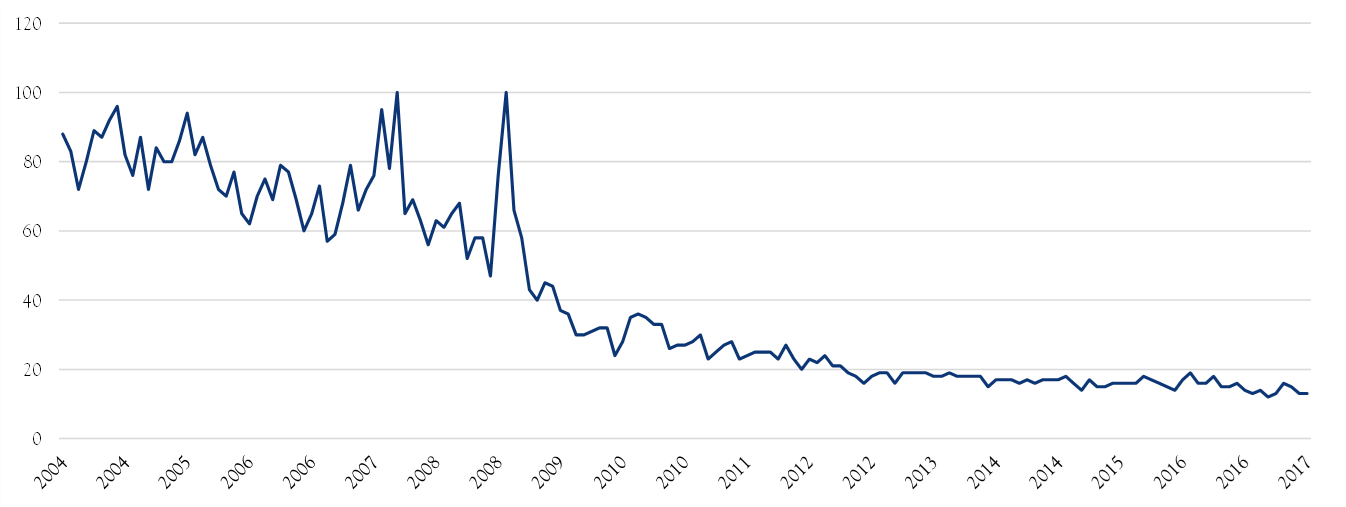

Worldwide Google Search Trends: “Hedge Funds”

Source: Google, as of May 2017

Interest in hedge funds has been on a steady decline. Generally negative press coverage, combined with mostly lackluster returns have damped enthusiasm for investing in hedge funds. Before writing off hedge funds, it is useful to consider three different eras in time and how they have contributed to an identity crisis in hedge fund investing.

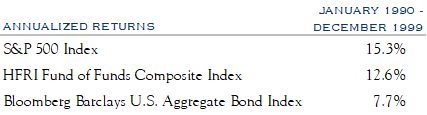

1990–1999

Source: Bloomberg, as of May 2017

In this era, hedge funds often took relatively high levels of risk and their returns tracked fairly closely with equities. Investor sentiment was that hedge funds were often comparable to equities. During this time, relationships and networking were key to finding the “best” managers.

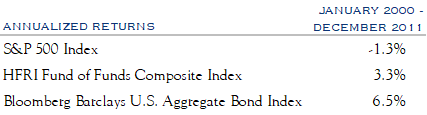

2000–2011

Source: Bloomberg, as of May 2017

Starting with the bursting of the tech bubble in 2000, hedge funds really began to shine. Many long/short equity funds had a well-constructed profile, characterized by being long small cap value stocks and short large cap growth stocks. As the valuation and performance disparity between these styles and market-caps converged, the result was healthy outperformance compared to equities. Many funds posted gains in 2000-2002 while equities fell as the tech bubble burst. This helped to create the reputation for hedge funds as capital protectors. However, the 2008 financial crisis struck and many funds didn’t live up to, perhaps unfairly, elevated expectations. Shorts often did not provide the protection that they had in earlier market corrections and, in some cases, even compounded losses. Further, some funds had liquidity problems and there were a few noteworthy frauds.

Despite this mixed performance during the 2008 crisis, fund returns were quite solid as compared to equities during the time frame shown (below), which includes several years before and after the crisis.

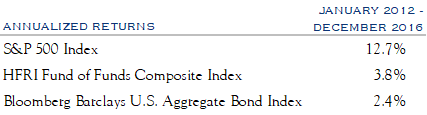

2012–2016

Source: Bloomberg, as of May 2017

As many institutions began to realize that the characteristics of hedge funds could be additive to portfolios, the hedge fund industry continued to grow assets under management. However, with growth came some confusion over the question “what is a hedge fund?” Were hedge funds really the high return vehicles of the 1990’s or were they the capital protectors of the 2000’s?

Conclusion

The reality is that there are nearly limitless configurations of risk profile and strategy and it is no more meaningful to group all hedge funds than it is to group all mutual funds.

Our belief is that in many cases, carefully chosen funds can improve the profile of a portfolio. However, it is essential to define objectives and select the right fund for the job.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Loeser. No part of Mr. Loeser’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed.