What is inflation?

Inflation is traditionally measured by examining a basket of prices compiled by the U.S. Bureau of Labor Statistics. This basket, the Consumer Price Index (“CPI”), measures prices of around 80,000 items and weights their relative importance on a monthly basis. Items range from granular components such as frozen non-carbonated juices and drinks at 0.006% to the most meaningful metric, cost of shelter at 32.5%. The basket also accounts for changing quality metrics. Adjustments can be as simple as a change in the size or quantity of a packaged item, to more complex modifications that include an analysis of an item’s value based on features or quality. For example, an increase in vehicle costs associated with the addition of new safety features. Overall, it is an imperfect, but reasonable gauge of price fluctuations across the economy.

Why does inflation matter?

Investors typically associate inflation with a challenging investment environment. Often, inflation breeds higher interest rates, which can be problematic for stocks for two reasons. First, the higher discount rate reduces the value of future earnings and dividends. Second, higher yields on low-risk investments offer a more compelling alternative to equities. Research indicates interest rates above 4% tend to be a headwind to equities markets. That said, some equities can be one of the best hedges against rising inflation—those of businesses able to raise prices, grow revenues, and expand margins. A notable exception was the highly inflationary era of the 1970s. Absent this sort of runaway inflation, investors can focus on the positive flywheel of an expanding economy, growth in earnings, and a receipt of dividends as drivers of long-term capital appreciation. Recently, investors have begun to worry whether that “bad” double digit inflation of the 1970s will return.

Inflation Sources & Uses

One framework for thinking about inflation is examining imbalances. When the quantity of an item in demand exceeds the quantity of the supply (at a given price), the price will move higher such that demand decreases and/or supply increases. This basic economic principle is at the heart of inflation.

One framework for thinking about inflation is examining imbalances.

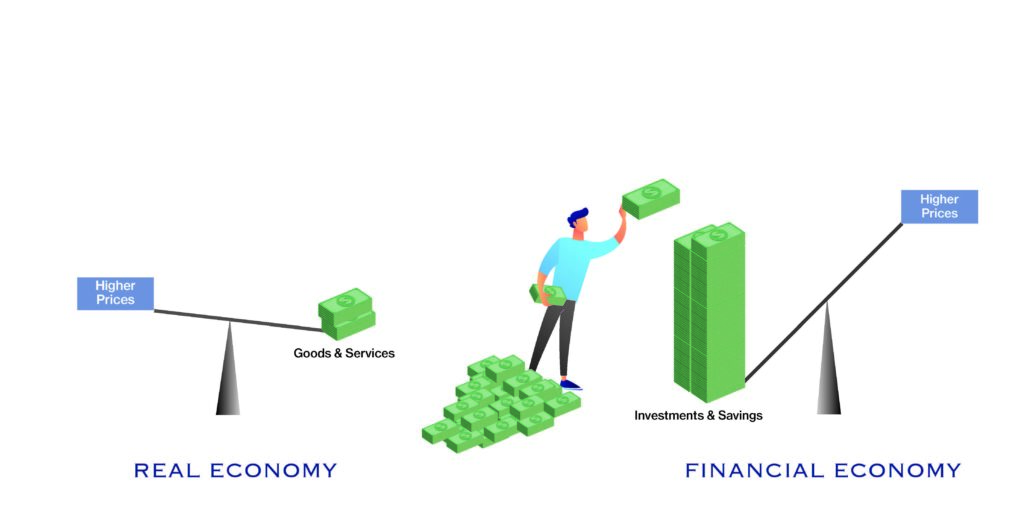

Mapped through the below flowchart, a source of money and income creates an ability for one to spend, and the spending will either land in savings/investment in the financial economy or consumption in the real economy, each of which will have a corresponding change in prices.

Sorting the Increased Supply of Money

Presently, sources are booming while aggregate income levels are strong (owing to stimulus and a mostly healthy economy) and money supply is up, thanks to stimulative monetary policy. Therefore, an increase in the ability to spend—one ingredient for inflation—is currently in place.

Therefore, an increase in the ability to spend—one ingredient for inflation—is currently in place

Some inflation is emerging as prices have risen in narrow components of the CPI, causing the overall index to rise over 5%. This is the largest 12-month increase since a 5.4% increase in August 2008. While we believe many of the price pressures are temporary and related to the massive COVID cycle, we need to consider the possible effects of increased money supply and income.

The Monetarist School of economic thinking adheres to Milton Friedman’s often quoted remark that inflation is “always and everywhere a monetary phenomenon”. Often overlooked is the related and important concept that money supply can be employed in two ways: national product transactions (the real economy) and capital transactions (the financial economy).

If we consider inflation as measured by the CPI, we need to assess not only the increase in money and spending, but the destination for that spending across both the financial and real economies.

Currently, the financial economy remains a worthwhile destination. Though interest rates are low, banks, money funds, and bonds remain a safe and reasonable store of value. Equities have posted exceptional results due to strong earnings, attractive valuations, and capital appreciation. The emergence of cryptocurrencies has augmented traditional stores of value in commodities, such as gold. Overall, financial investments have proved lucrative as prices have increased for financial assets.

The second major outlet for spending is in the real economy through the purchases of non-financial goods and services. Whether or not an increase in demand for goods and services is inflationary depends largely on competitive dynamics and whether supply can be increased quickly. For example, consider the ease with which a software company can supply additional licenses for usage compared with the challenges of building a new factory to increase the supply of semiconductors. Traditionally, raw materials and labor created bottlenecks to the rapid expansion of supply. The composition of the U.S. economy has changed over time such that large swathes of the economy now have very flexible and dynamic supply chains benefitting from advances in technology, the substitution of capital for labor, and an ongoing focus on productivity improvements. In other words, the supply side of the economy, as a whole can expand volume/quantity to absorb increases in spending, without major adjustments in price.

The net result is that inflation potential is being absorbed through asset purchases in the financial economy and through supply expansion in the real economy. Unless those conditions change, inflation is unlikely to be sustained at elevated levels.

The net result is that inflation potential is being absorbed through asset purchases in the financial economy and through supply expansion in the real economy.

This backdrop is good for investors. As inflation eventually recedes and remains at bay, the focus will turn to economic growth and earnings where the outlook remains quite favorable.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed.