Despite a plethora of information, the 2024 investing environment primarily depends on two factors: bond yields and corporate earnings growth. Below we share our scenario analysis for each. Overall, we expect gradual declines in yields and a modest expansion in earnings, which should help ease valuation pressures and improve the backdrop for a broader set of equities, including small caps.

Yields: A Story of Inflation and the Fed

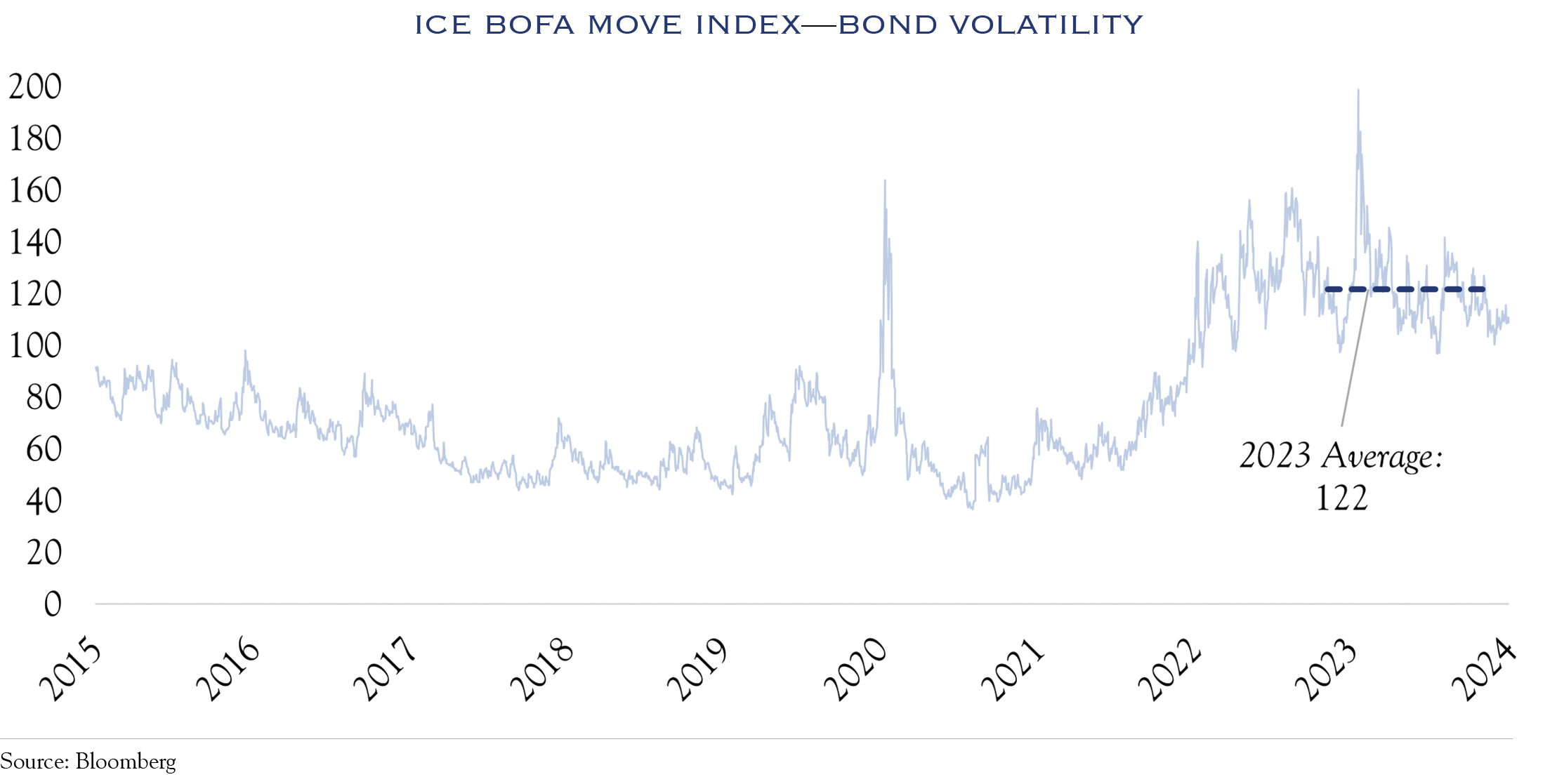

The yield on the U.S. 10-Year Note traded in a wide range of 50 basis points—from a low of 3.8% to a high of 4.3%. Similarly, the MOVE Index, which measures bond market volatility, posted an average reading of 122 in the past year, notably higher than its average of 60 from 2010 to 2019. These figures indicate bond yields have been jumping around much more than normal, with movements nearly doubling the usual rates.

One reason for this heightened volatility is sensitivity to economic data. If an important inflation measure, such as the Consumer Price Index (CPI), posts an unexpected reading, the reaction in bond prices (and yields) will be severe. The other reason is communications from the Federal Reserve, often referred to as “Fed Speak”. When the Fed says something that changes perceptions of interest rate policy, bond prices and yields will respond quickly and forcefully.

In this volatile environment, it is helpful to look through the noise and consider the outlook over a longer time frame.

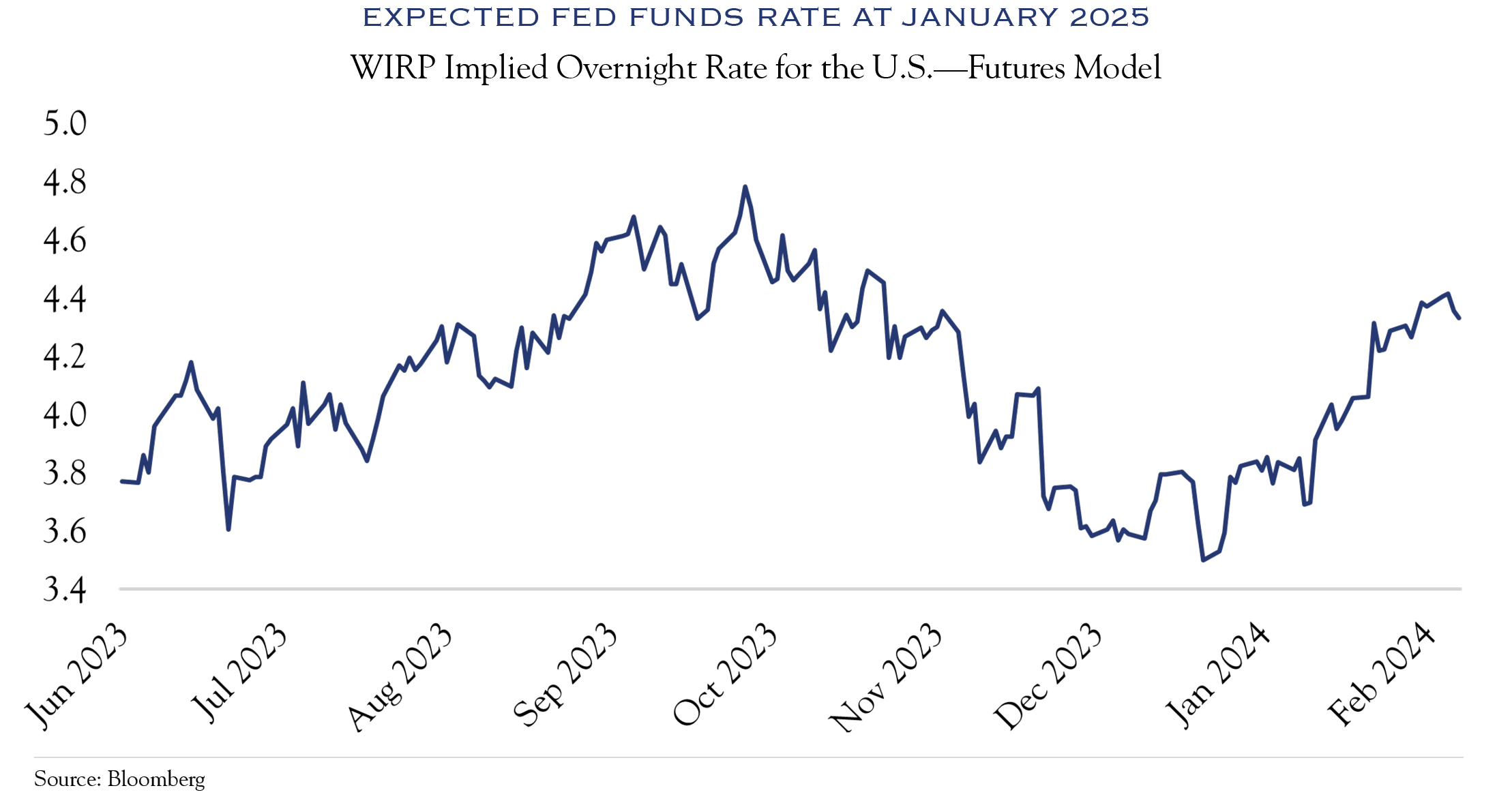

The Fed’s decision on when to cut interest rates will be highly influenced by their view of how restrictive a policy they choose to implement in response to inflation and economic growth. Currently, the Fed funds rate is at 5.5% and the implied expectations for the Fed funds rate in January 2025 are shown in the chart below. These expectations mirror the bond market volatility, varying considerably in response to inflation data and Fed commentary. In the short term, the expected rate will likely remain volatile as both investors and the Fed navigate incoming data. However, looking out towards summer and beyond, we think it is likely rates will be lower and the Fed will begin cutting interest rates. We expect the Fed funds rate will be about 100 basis points lower a year from now, which is consistent with the consensus view of a 4.4% Fed funds rate in January 2025 implied in the chart below.

Despite a recent CPI reading that was slightly higher than expected, inflation ought to continue its decline. The most recent year-over-year CPI reading in January 2024 was 3.09%, but it is important to recognize that shelter accounted for most of this increase, contributing 2.08%. While shelter is important, it is a quirky metric. The calculation uses several peculiarities, such as geographic weightings and data lags, which can skew the inflation measure. The San Francisco Fed suggests that shelter inflation will begin to moderate in the late spring as the lags dissipate and the data reflects more current readings. Alternatively, the Fed’s preferred measure of inflation, the Personal Consumption Expenditures Price Index (PCE), assigns a much lower weight to housing—about 15% in the PCE vs. 33% in the CPI—which significantly reduces the effect shelter has on inflation. Regardless of which index weighting should be used, if resolving data lags leads to declines in shelter inflation, overall inflation will decline as well.

Another reason for confidence on declining inflation is that most sources of inflationary fuel have dissipated. While we can’t know exactly what caused inflation, there are a few primary suspects: supply chain disruptions, money supply growth, government spending during COVID, and wage gains. Of these, only wage gains remain an active player in the economy, with wages up about 4% over the past year. Such a gain contributes modestly to inflation, but not high enough to create the 1970’s style “wage price spiral”, where rising wages and prices fueled each other in a vicious cycle. Without any other catalysts driving prices higher, inflation should continue abating.

We expect economic growth to remain resilient around 2.0% or so, consistent with recent models from the Atlanta Fed and NY Fed as well as our interpretation of real-time data. James Bullard, the former head of the St. Louis Fed, recently affirmed this expectation at a presentation to the National Association of Business Economists:

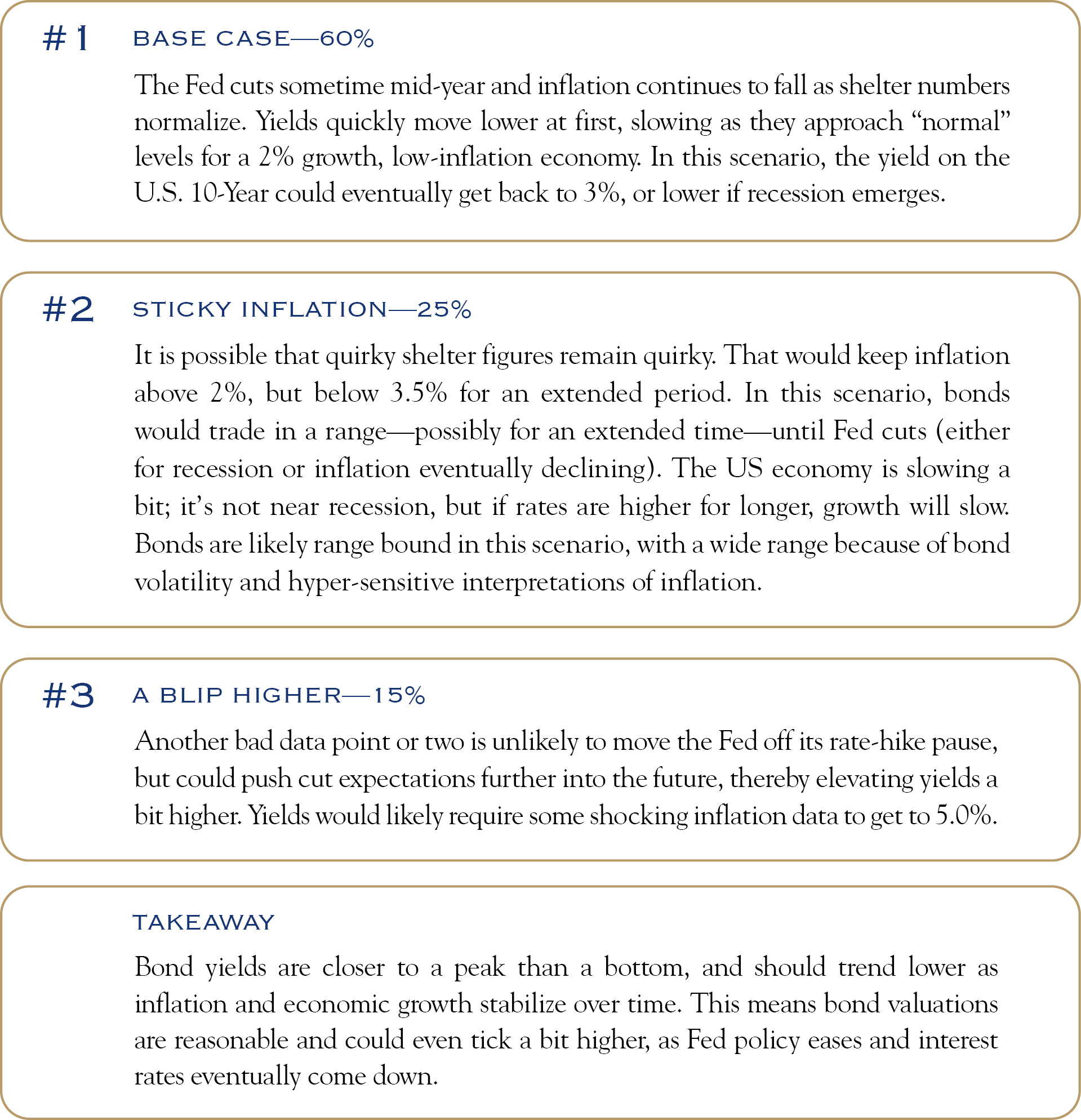

Our research points to a similar conclusion as Bullard. We outline three scenarios for rates below, with our base case being gradual Fed cuts starting mid-year 2024 as both growth and inflation eventually settle in around 2% later in the year. However, it is possible the shelter component of inflation remains sticky, delaying Fed action, and keeping yields range bound. It is also possible a few more quirky readings emerge on inflation, causing yields to briefly pop higher. Most likely though, we think inflation and yields head lower over time.

Earnings: A story of the economy and productivity

Another earnings season has come and gone, and the results continue to be positive. With 465 companies in the S&P 500 Index reporting, revenues are up +3.9% and earnings are up +7.4%—of the reporting companies, 63% reported earnings gains. This is yet another victory for margins.

Consensus expectations for the full-year 2024 S&P 500’s earnings are $243, mirroring the projections expected one year ago. Even after the strong fourth quarter earnings reports, and continued economic resilience, the figure has barely budged. Normally, this estimate overshoots the mark. This tendency, as well as continued drag from higher interest rates and the incremental, slow-moving issues in commercial real estate and regional banks, influence our view for a lower-than-consensus earnings estimate of $235 for 2024. Below, we outline three scenarios for earnings:

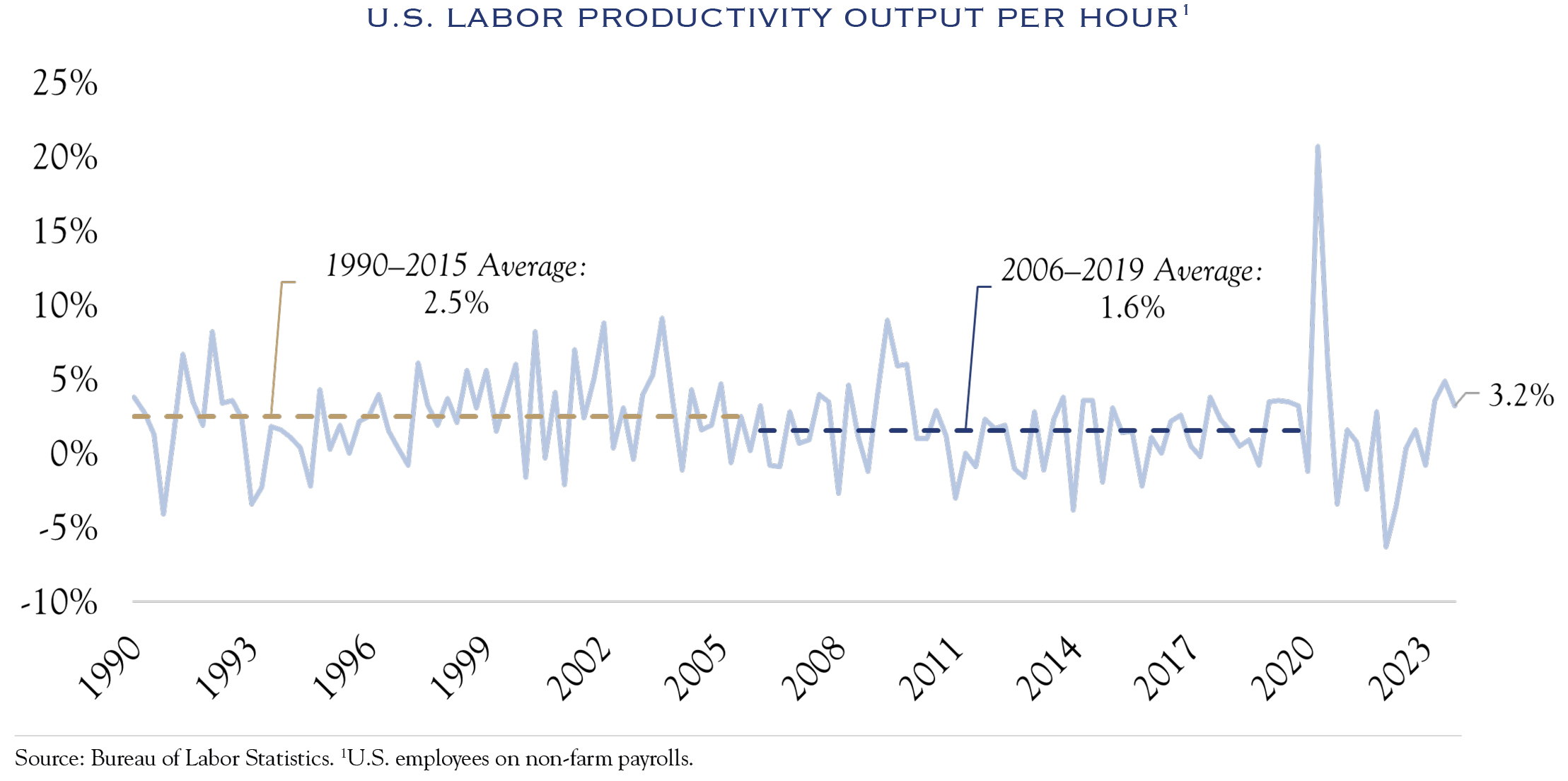

As a final note, between 1990 and 2005, U.S. productivity grew at an average rate of 2.5%. This rate slowed to an average of 1.5% from 2006 through the end of 2019. While the pandemic did disrupt these calculations, the most recent reading was a promising 3.2%. A critical question in years ahead will be whether or not promising technologies such as AI and the increased utilization of robotics will sustainably boost productivity. Early signs are encouraging, and should even a fraction of the enthusiasm translate to advances in productivity, it will have powerful effects on economic and earnings growth.

Outlook

In the short term, conditions are likely to remain choppy, as each new data point is considered against a backdrop of Fed commentary and the perceived policy changes. Until the Fed rate cut cycle gets underway, this volatility is likely to continue. However, with the passage of time, inflation will continue to cool, and yields will come down. This will alleviate some valuation pressure on bonds. At the same time, the improved interest rate backdrop should produce a broader set of winners in the equity market. As seen in the fourth quarter of 2023, an improved rate picture can quickly bring a lot of strength to small cap equities. For now, rates and earnings are the two drivers, though we don’t expect any major developments on either front in the immediate future.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC