Equity investors and the Fed have different opinions on inflation, allowing valuations to remain elevated in the face of persistent inflation. Earnings have been solid, but trailing price-to-earnings (P/E) ratios entered the year at 22x and now reside at an even loftier 23x. So, what’s driving the increase in valuations?

- U.S. 10-Year interest rates are working against valuations, as yields on the benchmark U.S. 10-Year Note have increased from 3.9% to 4.5% in 2024.

- Furthermore, Fed Funds Rate Expectations for rate cuts have evaporated and should also be weighing on valuations. Entering the year, expectations were for six cuts (via Bloomberg WIRP); expectations are now for just over one cut in 2024. The Fed is on a “hard pause” and will need to see either a downside surprise on inflation or convincingly weak employment data. Absent those factors, the only path to a cut is through outlining a case for reducing real rates. Until the Fed starts laying the groundwork for that approach (maybe at Jackson Hole in August), rates will remain on a hard pause.

- Finally, inflation has barely budged. Following December’s 3.4% reading, CPI is presently at 3.4%!

Rates are higher, fewer Fed rate cuts are expected, and CPI has been stuck.

What’s going on? We see the Fed and investors taking differing views on inflation. In the Fed’s view, the path of CPI shows minimal progress and is well above the 2.0% target. Hence, the Fed will maintain its current policy. In investors’ view, the tail risk of a move higher in CPI is off the table; inflation is heading lower slowly, and it is only a matter of time until the Fed cuts rates. Another clue to the investor’s view comes from the brief inflation scare in April. When CPI came in a touch hot, the VIX spiked higher, and stocks took a brief –5% dip lower. This demonstrates that the fear factor for equity investors is a spike higher in inflation, not a sustained patch of plodding progress from here to 2%.

The Path Ahead

We expect the investor view to play out. Inflation is coming down slowly, and the Fed will eventually cut. However, valuations are elevated, so earnings must drive any forward progress on equities. First-quarter earnings were solid; we expect more of the same

as the year unfolds.

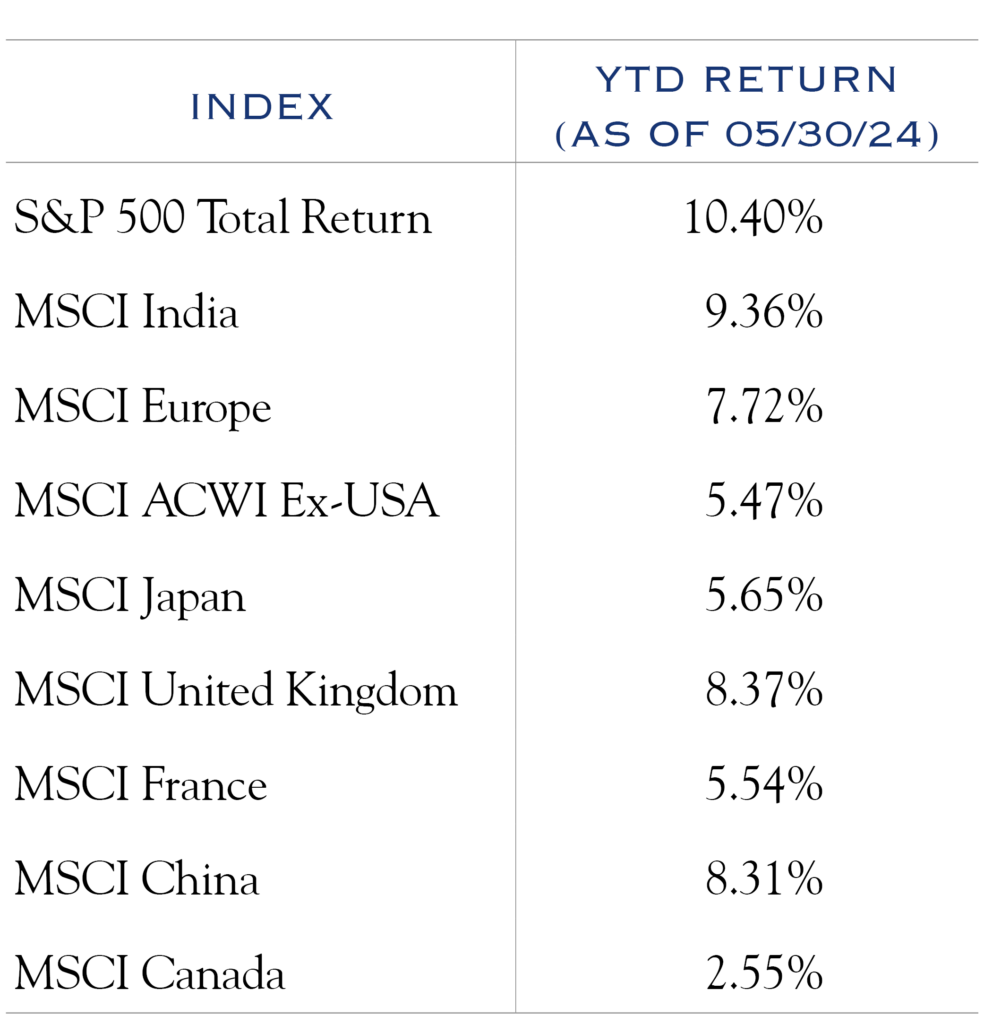

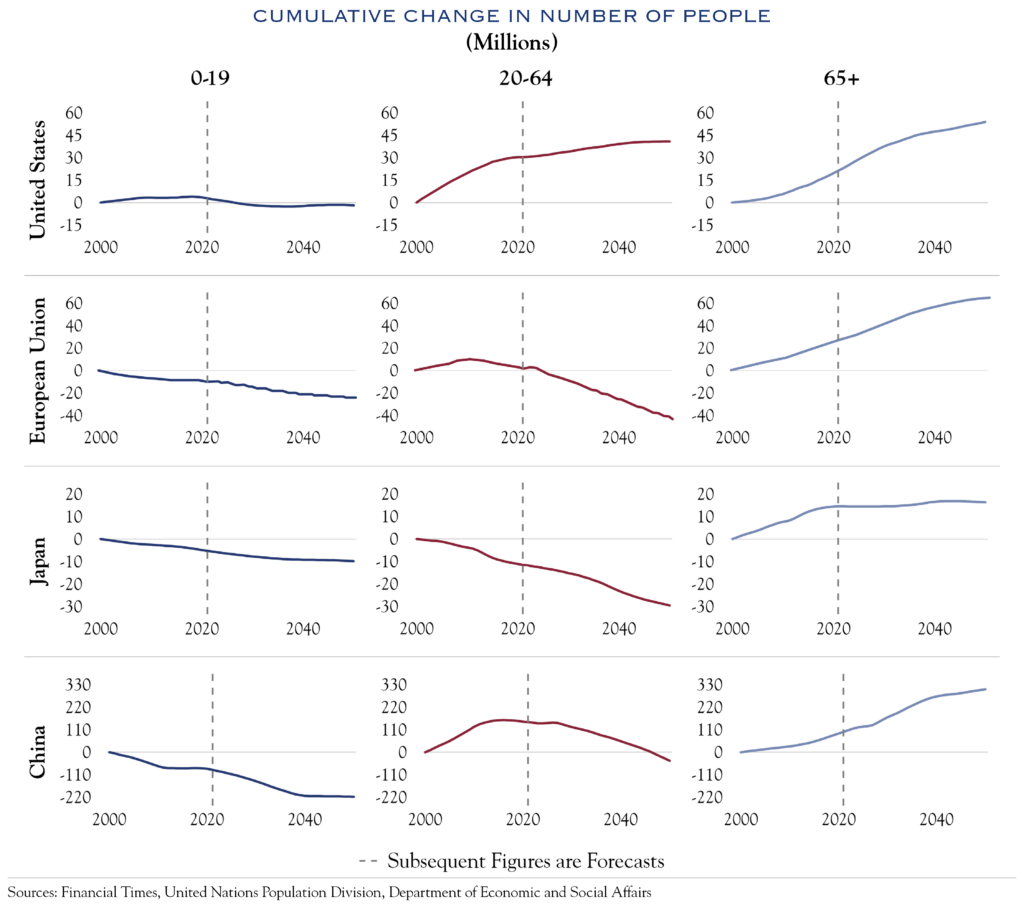

Few markets have kept pace with U.S. equities this year, especially in U.S. dollar terms. One reason is near-term economic growth in the United States has seen more consistent strength than most other G10 countries over most of the past five years. Meanwhile, some countries with historically rapid economic growth are seeing some moderation in their expansion rate. Looking further ahead, divergences in expected demographic trends bode well for the U.S. in relative rankings of economic expansion. As reported recently in the Financial Times, “What is becoming clear is that the E.U.’s long-predicted demographic inversion appears to be coming sooner than many experts predicted … The E.U. is not alone in facing these pressures. Japan’s demographic decline has become an enduring problem while China and South Korea now have some of the lowest fertility rates—the number of children per woman of reproductive age—in the world.”

Demographics have a potent influence on the rate of economic expansion. It is much easier for companies to generate earnings growth and returns of capital in the form of dividends and share repurchases in a growing economy. The stark divergence in demographics is one reason we favor allocations to non-U.S. investments at levels modestly below those of the MSCI All-Country World Index. However, some countries and regions offer a stable economic and demographic backdrop, as well as the potential for interest rate cuts ahead of the U.S. In addition, U.S. equities are more expensive on a relative valuation basis, meaning that great companies outside the U.S. represent an important opportunity set.

Taken together, we have a favorable view of U.S. economic growth, earnings power, and equities relative to the rest of the world. At the same time, compelling valuations and pockets of growth offer incredible opportunities for fundamentally driven security selection.

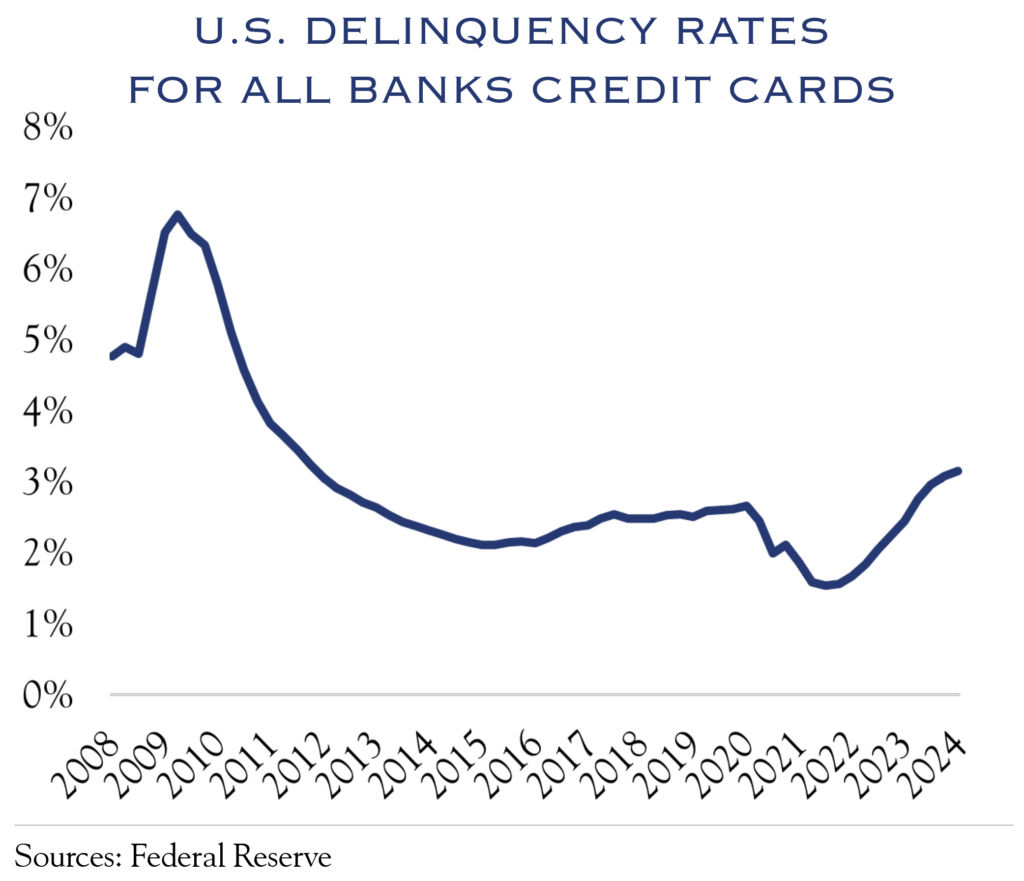

The solid economic growth in the U.S. is not without pockets of weakness. Metrics on labor markets are generally slowing, and some consumer segments are struggling. Those struggles are showing up in anecdotal commentary in earnings reports and increased rates of delinquency on consumer credit like auto loans and credit cards. Below is a chart from the Federal Reserve of U.S. Delinquency Rates showing an increase to levels above those seen before the pandemic bust-boom cycle. While far from the stress seen in the global financial crisis, these metrics indicate an economy that is slowing to a normalized growth rate. Two of the more common phrases on earnings calls of consumer-facing companies were “normalizing” and “moderating”.

With the S&P 500 trading at a trailing P/E of 24.3 and a forward P/E of 21.5, valuations are high relative to historical norms. Thus, future gains in equities are likely to be dependent upon earnings gains. Despite modest expectations for economic growth—around 2% in the years ahead—we expect earnings to expand at a more rapid mid-single-digit pace. One reason is the potential for productivity gains—and improvement in profit margins—from technological innovation through artificial intelligence and robotics.

Bloomberg recently reported on the future of industrial robots and the Chicago Automate trade show, highlighting some challenges and opportunities as robotics evolve to handle more complex tasks. Robots with better mobility and learning capabilities are on the horizon. The article noted 44,303 industrial robot installations in the U.S. in 2023—a relatively modest number relative to the U.S. workforce of 158 million.

Looking ahead, robots and more widespread applications of artificial intelligence will fuel margin expansion and earnings gains. Seven of eleven S&P 500 sectors are posting profit margins above their five-year average. Those five years cover four quarters before the pandemic, the highly disrupted calendar year of 2020, the following economic resurgence, and the more normal environment of the past few quarters. That wide range of circumstances provides a good observation of the ability of companies to operate dynamically. First-quarter earnings reports revealed good profit margins, and we think there is more to come as technology boosts efficiencies in the years ahead.

We see U.S. equities as fully valued and look for future earnings gains to drive returns. Eventually, Fed policy will shift to rate cuts, alleviating some pressure on interest rates and allowing valuations to remain steady or perhaps tick a bit higher. That more favorable rate environment will also provide a lift to smaller capitalization companies, which have struggled relative to larger peers with a more restrictive financing environment. At present, we expect the Fed to begin to outline a plan for rate cuts at their August Jackson Hole meetings, with that plan predicated on inflation continuing to decline slowly and employment to remain stable. With the Fed in a data-dependent mindset, market volatility could increase over the summer as investors scrutinize every data point. With elevated valuations and no imminent changes in Fed policy, we counsel patience, allowing earnings gains to lift equities slowly. We expect bonds to be in a holding pattern until further clarity emerges from the Fed later this summer.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC