In 1785, following a methodical research process, Thomas Jefferson presented the results of a detailed climate study in his Weather Memorandum Book. As described in Rain: A Natural and Cultural History by Cynthia Barnett, Jefferson took aim at a European scientist who claimed that America’s weather was miserable and practically unsuitable for habitation. In fact, Jefferson argued that Virginia had both more rain and more sunshine than London and, therefore, a superior climate. Such an argument may have seemed inconceivable at the time as Europe was deemed unsurpassable in many ways, including weather. Furthermore, how could a location have both more rain and more sun? Yet, modern technology has confirmed his statistics to be surprisingly accurate. However, one challenge not anticipated by Jefferson was the variability in rainfall. While the average amounts were sufficient for crops, periods of intense drought spurred Jefferson to innovate, adapting ancient techniques to deploy cisterns.

Jefferson’s expertise and challenges with weather mirror the complex situation facing investors today. Like Virginia’s sun and rain, economic indicators point in conflicting directions of both growth and slowdown. The concentration of equity market gains in a small segment of companies is similar to the challenge Jefferson faced with the average figure not telling the whole story. While Jefferson’s cisterns never fully solved his specific rainwater challenges, innovation remains a hallmark of the U.S. economy. Today, innovation is unfolding at a ferocious pace, unleashing a retooling of the American economy and inflicting consequential changes in the investment landscape.

Sun & Rain: Conflicting Economic Signals

The airline industry is a microcosm of the broader U.S. economy. Recent statistics from the Transportation and Safety Administration (TSA) show that passenger throughput at airports in the U.S. recently eclipsed three million for the first time. However, revenue guidance from airlines has been mixed, with the preponderance of commentary pointing to high and rising demand from premium and business travelers and a more challenging backdrop in the leisure market. Similar signals are appearing in reports from hotels and restaurants.

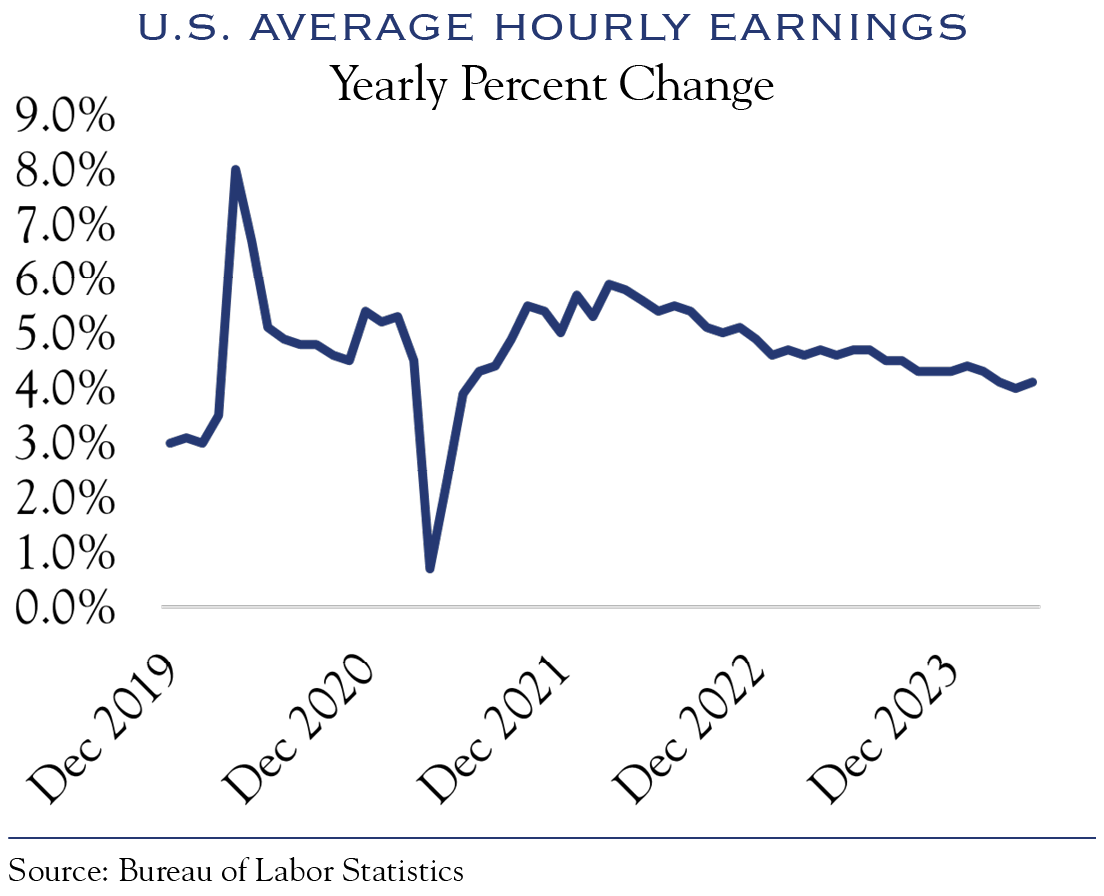

The isolated slowdown in the leisure market is unsurprising. Wage gains and employment growth have slowed. Further, while inflation has cooled somewhat, price levels remain high relative to five years ago, placing a heavy burden on lower-income groups; this has led companies to note slowing revenue in some consumer segments.

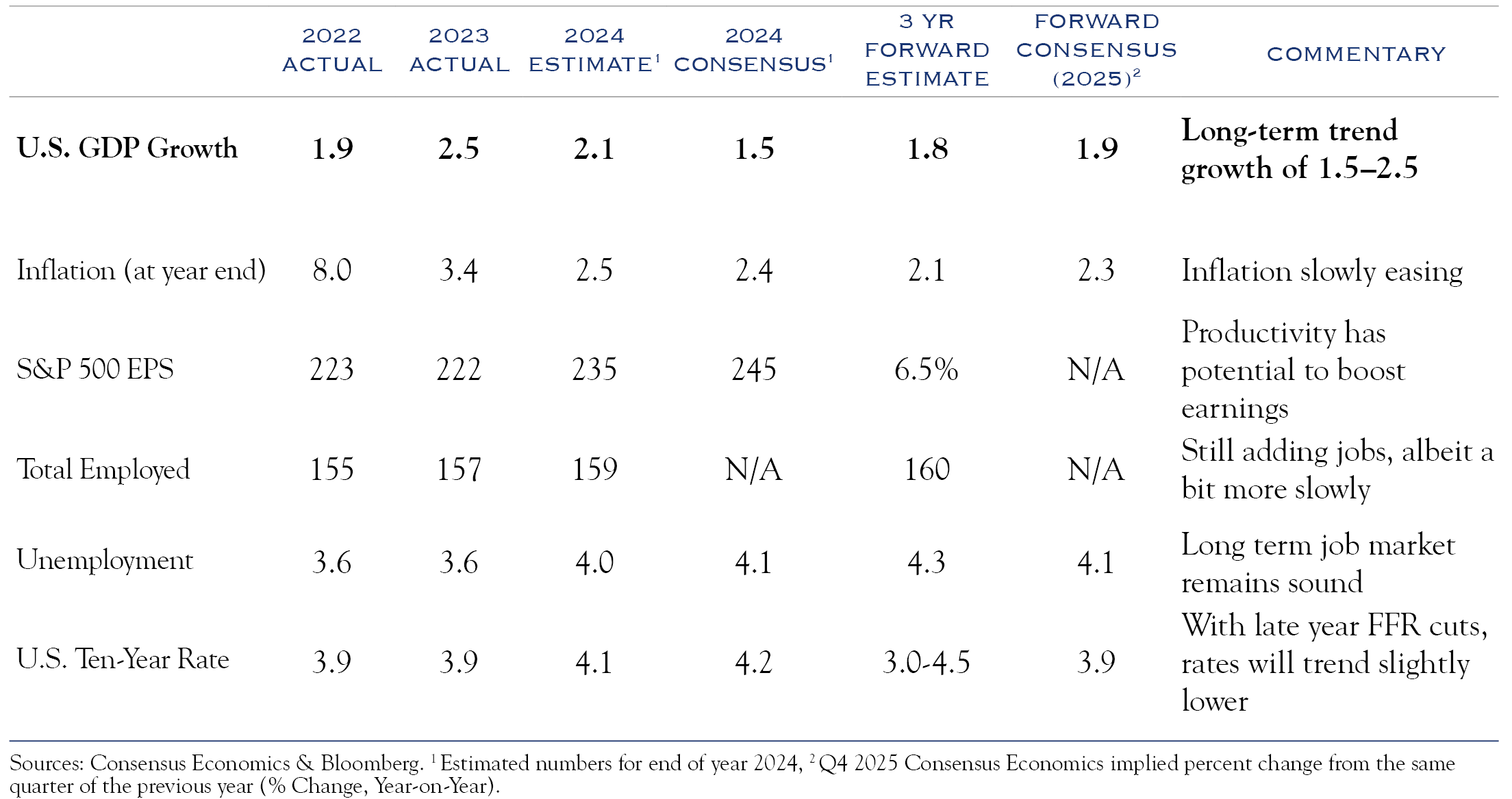

At the same time, the overall economy continues to expand. A recent estimate from the Atlanta Fed’s GDPNow model points to GDP growth of +1.7%. The payroll gains situation, while somewhat muted, remains positive. Wage gains are similarly additive to overall income in the economy.

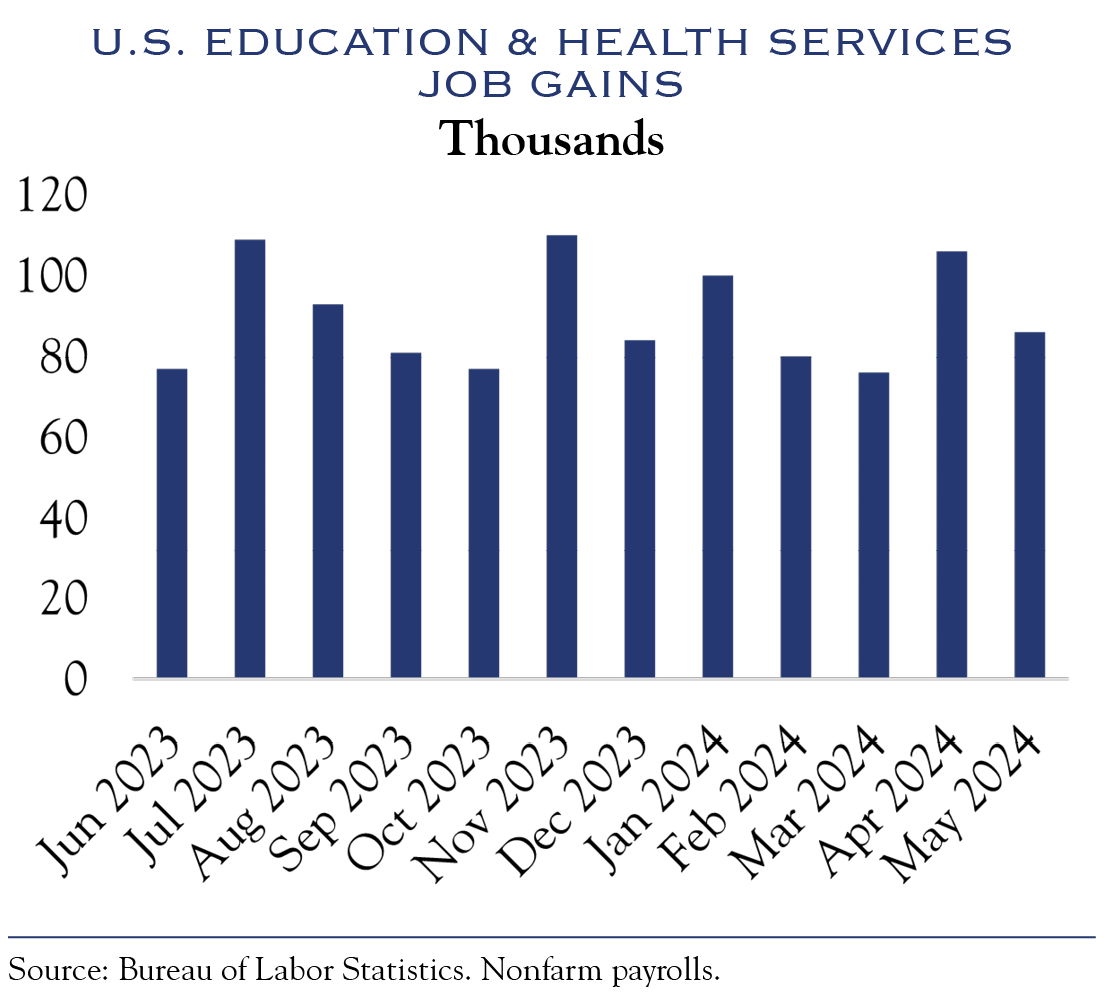

We expect job gains to continue, as some areas seem poised for continued expansion. One example is government employment, where payrolls often expand in election years. Another area likely to see continued gains is the healthcare segment, which faced significant challenges in hiring during the pandemic. With the U.S. population currently concentrated in younger (millennial) and older (boomer) cohorts, healthcare will likely see continued employment gains.

Our estimate of the long-run growth rate in the U.S. economy is 2.0%, consistent with very long-term trends in population growth and productivity gains. We look for the economy to slow towards that trend line, avoiding recession. Our work shows that 2.0% economic growth is consistent with earnings growth of around 7.0%. Simply put, a slow-growth economy can be a good setting for investing.

The Misleading Average

The proportion of index gains generated by a small subset of stocks is quite high. For most of the year, the proportion of gains from the top ten contributors in the S&P 500 has been well over 50%, and a single stock (Nvidia) has at times been responsible for over 30% of gains in the index. This concentration presents a challenging investment environment. About 300 stocks in the index have posted gains through the midway point of the year, while 200 have posted losses. The average price change across all 500 stocks in the index is +5.4%. The average winner is up +15.6%, while the average loser is down –11.6%.

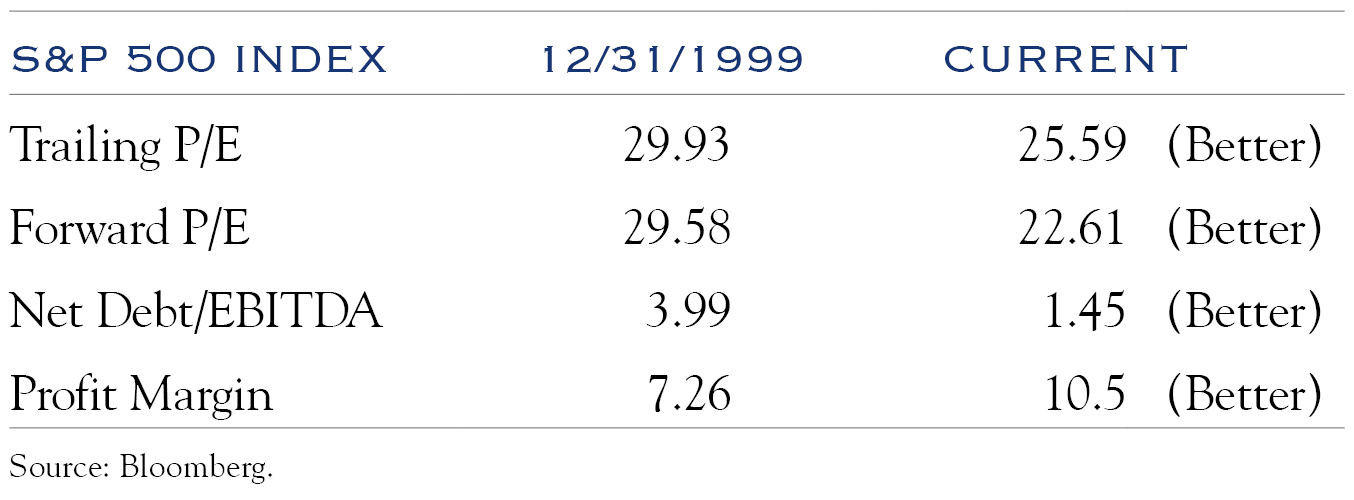

Given the concentration of gains, some commentators have compared the current environment to the late 1990s’ internet boom. However, the conditions are meaningfully different.

One similarity with the 1990s is that we expect innovative technologies to spread throughout the economy.

Innovation & Change: The New U.S. Economy

Though we expect economic growth to slow, we expect innovation and change to increase, spreading through the broader economy. The economic changes are wide-reaching, covering three areas: re-onshoring, new consumption patterns, and innovation.

In recent years, corporations and politicians of both parties have been unusually aligned in pushing for a “re-onshoring” of domestic production capability. U.S. manufacturing construction spending is up significantly, and tremendous efforts to boost domestic chip production and reconfigure supply chains are creating an ongoing source of economic growth.

Healthcare is another industry poised for dramatic change. The push for efficiency has accelerated with available technology, and the industry has been rebuilding employment ranks following the disruptive pandemic. Healthcare has been one of the most consistent sources of payroll gains over the past year. It is also likely to see continued spending in technology in the quest for efficiency.

Another source of economic change is the evolution of consumption patterns. Partly, this is a post-pandemic rebalancing of demand between goods and services. However, shifts in working patterns and demographically driven consumption changes create longer-lasting effects. The evolution of hybrid and remote work increases the amount of leisure time available to some consumers. Demographics play an important role as well. The older “boomer” cohort is shifting from purchases of goods to services and experiences, a preference also expressed by younger “millennial” consumers.

The most meaningful disruptive force comes from innovative technology and the quest for efficiency. Massive investments in artificial intelligence and robotics will continue to spread throughout the economy, with Darwinian forces only starting to unfold. Those who don’t adapt will struggle to survive, as competitive dynamics will bring meaningful productivity gains.

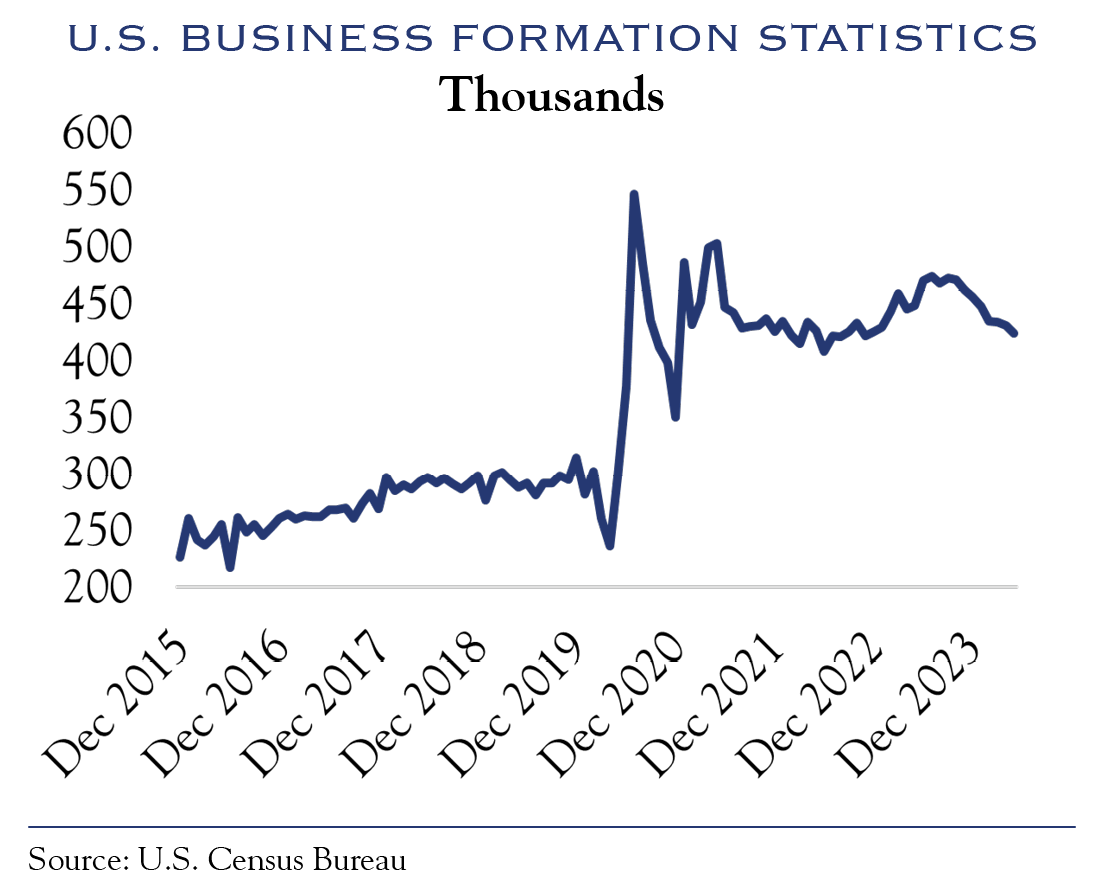

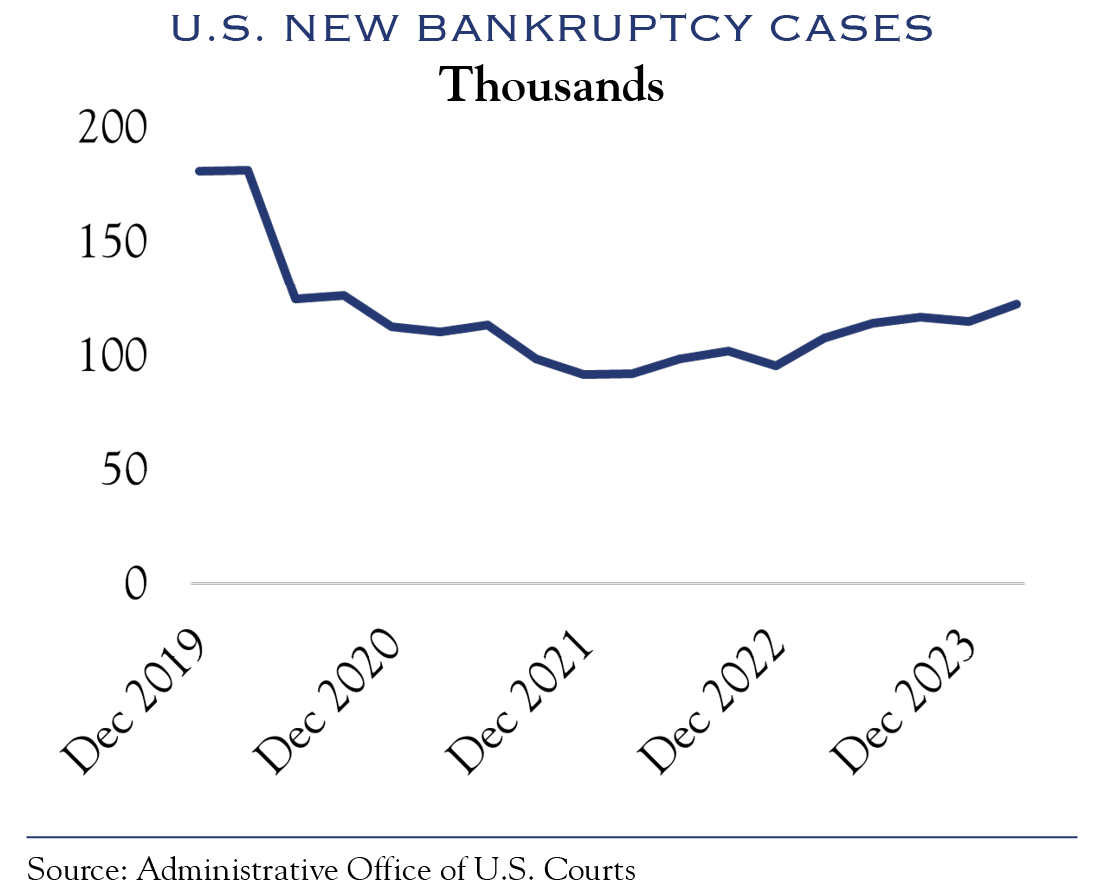

The quest for change can be seen in the ongoing surge in new business formation and a recent uptick in bankruptcy filings.

Business executives remain mostly positive despite the rapid pace of change and likely disruption. Surveys from The CEO Magazine, the Richmond Fed/Duke University, and the Business Roundtable point to relatively strong outlooks from corporate leaders.

As a sign that innovation still has a long runway, only 55% of large firms and 29% of small firms indicated that they have used AI tools to automate tasks. In a sign of the widespread application of AI, John Graham, Duke finance professor and academic director of the CFO survey, said of the survey results, “CFOs say their firms are tapping AI to automate a host of tasks, from paying suppliers, invoicing, procurement, financial reporting, and optimizing facilities utilization… This is on top of companies using ChatGPT to generate creative ideas and to draft job descriptions, contracts, marketing plans, and press releases.”

While recent press coverage of AI has focused on the incredible developments in Large Language Models (LLMs) and tools like ChatGPT, the applications in data science are similarly stunning, enabling analysis that was previously impossible. One advantage is improved techniques designed to deal with large amounts of data. As these methodologies improve, so do the results. Another change has been the increased ease of access to more data and computing power, thereby spreading the reach of these techniques. An example we encountered demonstrated how the simple insertion of a few lines of code is all that is required to access a new set of cloud-based GPU chips, thereby unleashing a 150x improvement in processing speed and enabling large-scale computations that weren’t previously available to individual users. The increases in computing speed and the evolution of data techniques are expanding well beyond the early novel and eye-catching innovations. We expect change to accelerate in areas where big, unexplored data exist, such as biology, healthcare, economic analysis, consumer data, business process operations, and many other spaces. In our view, the application of AI within a range of industries is in the early phases.

Outlook

The interaction of elevated valuation levels and Fed policy heavily influences our near-term outlook. The PE ratio on the S&P 500 is 25.59 on a trailing 12-month basis and 22.61 on expected earnings over the next 12 months. The figures for equal-weighted are similarly elevated at 19.63 and 17.56. Another reason to expect some choppiness in the short term is that sentiment metrics largely reflect a moderately bullish posture. The AAII survey reports 44.50% bullish, which is near typical highs. Fed policy also plays a vital role in valuation. In recent weeks, yields on the U.S. Ten-Year Note have declined, primarily reflecting expectations for slowing economic growth rather than cuts in Fed Funds. Until the Fed Funds Rate of 5.50% begins to decline, valuations aren’t likely to go any higher.

The Fed is providing very little transparency on why and when they may cut rates. For now, the Fed will continue to present a “tough-on-inflation” posture, even though inflation is largely receding. We anticipate some guidance from the Fed at their Jackson Hole event this August. With a steady job market, we expect the Fed to outline once again a case for cutting rates to lessen some of the restrictiveness on the economy. This case is more nuanced than simply cutting rates due to a weak economy or because inflation has declined to meet the Fed’s 2.0% target fully. Because the rationale for cuts is more complex, we look to the Jackson Hole forum as an ideal time for the Fed to outline its thinking on the path ahead.

Over our three-year forecast period, we anticipate modest economic growth, in line with 2.0% trend growth, paired with mid-to-high single-digit earnings gains. We expect valuations to remain steady as interest rates come down. This combination allows earnings to power future gains for equities.

Investors face a complex and nuanced economy. Much like Jefferson’s collection of weather data, we rely on economic statistics to develop our view. The two most consequential metrics are payroll gain and real-time spending data. Both continue to expand, albeit at a slowing rate of growth.

Like Jefferson’s challenges caused by drought, benchmark comparisons have been difficult for many investors, as index gains have been concentrated in a handful of securities. While the average stock is posting gains, most stocks aren’t keeping pace with the top performers. A lower rate backdrop and a broadening of visible benefits from technology will help spread gains to a larger swath of stocks.

Investors should follow Jefferson’s instinct to utilize technology. We expect the implementation of artificial intelligence and robotics to spread to a larger proportion of companies. Adaption will be critical to improving profit margins and growing earnings in a slower-growth environment.

Equities

While valuation levels are elevated, we look for equities to generate returns of 6–8% annualized over the next three years, driven by continued progress on earnings. A slow-growth economy and continued productivity gains will deliver expanded margins, earnings growth, and equity gains.

Growth & Value

We recommend a balance between the growth and value investing styles. Similar to the last few years, individual company activity is far more likely to drive results. Individual company adaptations to artificial intelligence tools will further heighten this dynamic. We expect continued rotation between growth and value and prefer to focus on stock selection.

Small Cap & Large Cap

While large-cap returns continue to exceed those of smaller companies, we see a two-part catalyst for a broadening of the market to small caps. First, we anticipate that an eventual easing of interest rate stress will accrue to the benefit of small caps. Second, the cost of access to productivity-enhancing technologies will spread to smaller companies. Small caps have compelling valuations, though quality considerations are important. We continue to recommend a modest allocation to small caps above benchmark/policy targets.

U.S. & Non-U.S.

While many great companies based outside the U.S. have compelling valuations, we remain cautious about the global outlook. Less-compelling demographics in China and Europe present macro headwinds. We continue to advocate for exposure to non-U.S. equities through active management focused on identifying compelling individual companies.

Fixed Income

While rates are likely to remain elevated in the near term, an eventual shift in language from the Federal Reserve will ultimately bring relief to interest rates. Current yields are compelling, and the long-term outlook for bonds is favorable. Within credit, we continue to advocate for careful active management, as higher rates will require diligent navigation of the financing environment.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed.

© Silvercrest Asset Management Group LLC