Back to School, Back to Basics

With the back-to-school season underway, focusing on the basics is a helpful guide to markets. Expected returns can be assessed by establishing an outlook for earnings and valuation. This is easier said than done, and our model contains multiple elements to project each component. There is also the vexing issue of determining what the consensus has already “priced in” to these expectations. Nonetheless, going back to basics is a valuable exercise to avoid the hyperbolic commentary of stock market plunges and rallies and consider the fundamentals.

We form a view on earnings via an assessment of the economy and subsequent translation into earnings power for the major equity asset class categories. Based on slowly expanding payroll counts in the United States, real-time data on spending and wage gains, and economic modeling, we anticipate U.S. GDP growth of around 2%. For the S&P 500, historical data imply that the economic backdrop equates to earnings gains of around 7%. Numerous other factors are involved, but if the economy continues to expand within a range of 1.5% to 2.5%, earnings in the S&P should grow in the mid-to-high single digits.

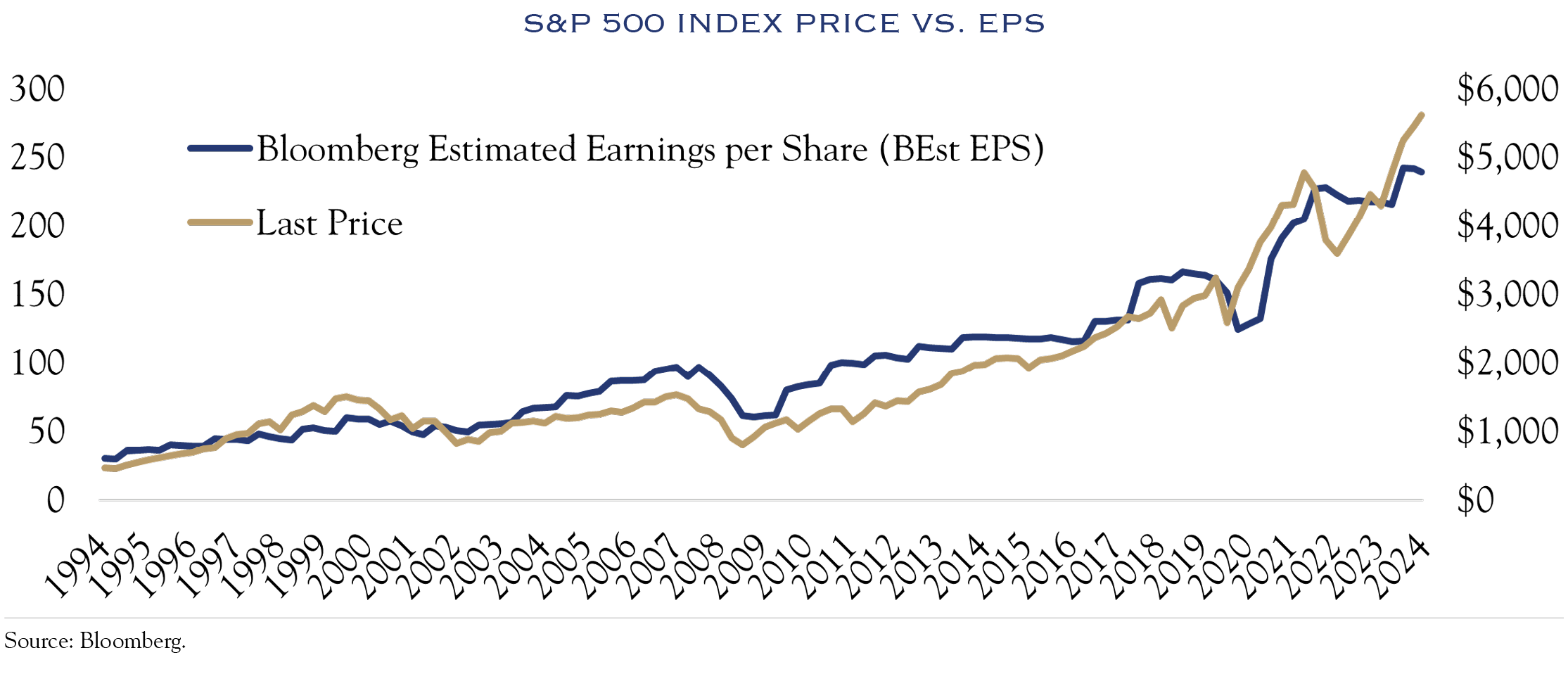

The legendary investor Peter Lynch popularized a chart illustrating the interaction between earnings and price. See below for an example using the S&P 500. The important takeaway is that when the price line exceeds the earnings line, stocks become more expensive. As can be seen, many of the gains in equity prices have come from the long-term earnings power of the underlying companies. The ratio of the two lines is the Price/Earnings (PE) ratio. Currently, this is above the long-term average, but not significantly so.

With the PE ratio at elevated levels compared to historical norms, it is reasonable to assume that valuations aren’t likely to expand. Unlike many other forecasters, we anticipate that continued improvements in inflation and an inflection point in Fed policy could bring enough positivity to the valuation picture to allow valuations to stay roughly in place.

The words and deeds of the Federal Reserve will continue to be consequential for investing. With Fed Chair Jerome Powell’s Jackson Hole presentation in the rearview mirror, we can again look through the windshield to see the road ahead.

Base Case is the Best Case

While Chair Powell’s comments increased the likelihood of forthcoming interest rate reductions, incoming data must corroborate the base case of inflation heading to 2%, along with data showing that the economy is slowing but still growing. This is our base case, and we expect current conditions to continue, remaining mostly favorable for the economy and investing.

However, with full valuation levels, every data point can inject volatility or even push the Fed onto another path. Those two paths—inflation hawk or labor dove—would be problematic.

Inflation Hawk

Suppose incoming data prove challenging on the inflation front. In that case, the Fed may signal an intent to proceed very slowly with rate cuts, keeping pressure on the economy and likely creating a volatile investing backdrop.

Labor Dove

If incoming labor data prove weak, the Fed will be forced to abandon the soft landing posture and proceed with more aggressive rate cuts. This treacherous path would require nimble adjustments by the Fed and investors to calibrate the positive effects of lower rates vs. the elevated risk of economic and earnings shortfalls.

Outlook

Taking a back-to-basics approach shows that valuation levels, while elevated, can be sustained if Fed policy and the economy remain on their current trajectory. Meanwhile, earnings gains will provide the fuel for future gains in equities. However, the investing environment has elevated valuations and a high degree of sensitivity to data, which is typically a volatile mix.

The path for fixed income could also be a bit choppy, as yields will be highly sensitive to Fed Speak and incoming data. Turning points are often volatile as investor thinking evolves from one regime (the post-COVID era of strong economic growth and a higher Fed Funds Rate) to another (both normalized economic growth and interest rates). In aggregate, the shift is a good one all around, as current rates can support the economy and valuation. Overall, we see a constructive runway for equities and fixed income but remain vigilant for any data that would push the economy or the Fed onto another new path.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC