Wealthy individuals often receive requests from friends, family, or acquaintances in their network to invest in new ventures. When clients come to their advisors for guidance, it is essential to address these requests thoughtfully to preserve both long-standing personal relationships and financial security.

Given that approximately 20% of new businesses fail within the first two years, 45% within the first five, and 65% within the first 10, these high-risk investments require careful scrutiny to avoid financial loss.

These opportunities are rarely traditional venture capital deals. Instead, they are often illiquid, one-off investments in high-risk start-ups. They typically involve minority positions in ventures such as a new restaurant, an organic food product, or even a unique brand of beverages. We should expect a higher level of return for the higher level of risk being undertaken, hence the need for a heightened level of due diligence. Given that approximately 20% of new businesses fail within the first two years, 45% within the first five, and 65% within the first 10 (U.S. Bureau of Labor Statistics), these high-risk investments require careful scrutiny to avoid financial loss.

Drawing on 18 years of experience helping clients handle these situations, I have developed a set of guidelines to achieve the best outcome while preserving important relationships—even when the answer is “no.”

1. Evaluate the Relationship

An honest assessment of the person presenting the investment opportunity is critical. Has this person established a pattern of making similar requests? Do they have some relevant industry expertise or sophistication in new business ventures? Often, these individuals lack investment experience, which may lead to a polite “no” after an initial review. However, sometimes the connection has a proven track record in starting businesses. In these cases, the request warrants a higher level of analysis and review. Once the context of the relationship is understood, the next step is to conduct a thorough investigation of the opportunity.

2. Conduct an In-Depth Analysis

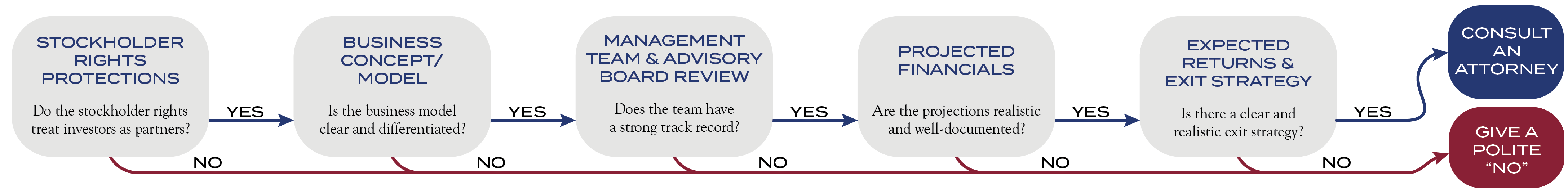

The opportunity is typically accompanied by substantial documentation containing all the pertinent details. It is crucial to bring in someone with experience in reviewing these documents to conduct the analysis. The following is a list of some key sections this business advisor will want to review in order of importance:

Stockholder Rights & Protections

Stockholder rights are vital to understanding whether the investor will be treated as a true partner—given close to the same rights as the founders—or merely a passive shareholder with limited protections. A partner scenario usually indicates a level of fairness that will be reflected throughout the documentation. A passive shareholder scenario can be a non-starter; however, the potential investor may still want to make a decision based on a review of the following sections. In that case, the shareholder rights need to be adjusted significantly so that the investor is treated similarly to the business founders.

Business Concept/Model

The competitive landscape needs to be analyzed, and how this business concept will stand out needs to be well-defined. If the business model seems unclear or lacks differentiation, this is a major red flag.

The underlying premise of the investment opportunity should be clear and concise, leaving no room for ambiguity. In outlining the business model, the competitive landscape needs to be analyzed, and how this business concept will stand out needs to be well-defined. If the business model seems unclear or lacks differentiation, this is a major red flag. However, if the concept is unique and offers great appeal, such as having a first-mover advantage in a particular industry or a very differentiated product, then the review should continue.

Management Team & Advisory Board Review

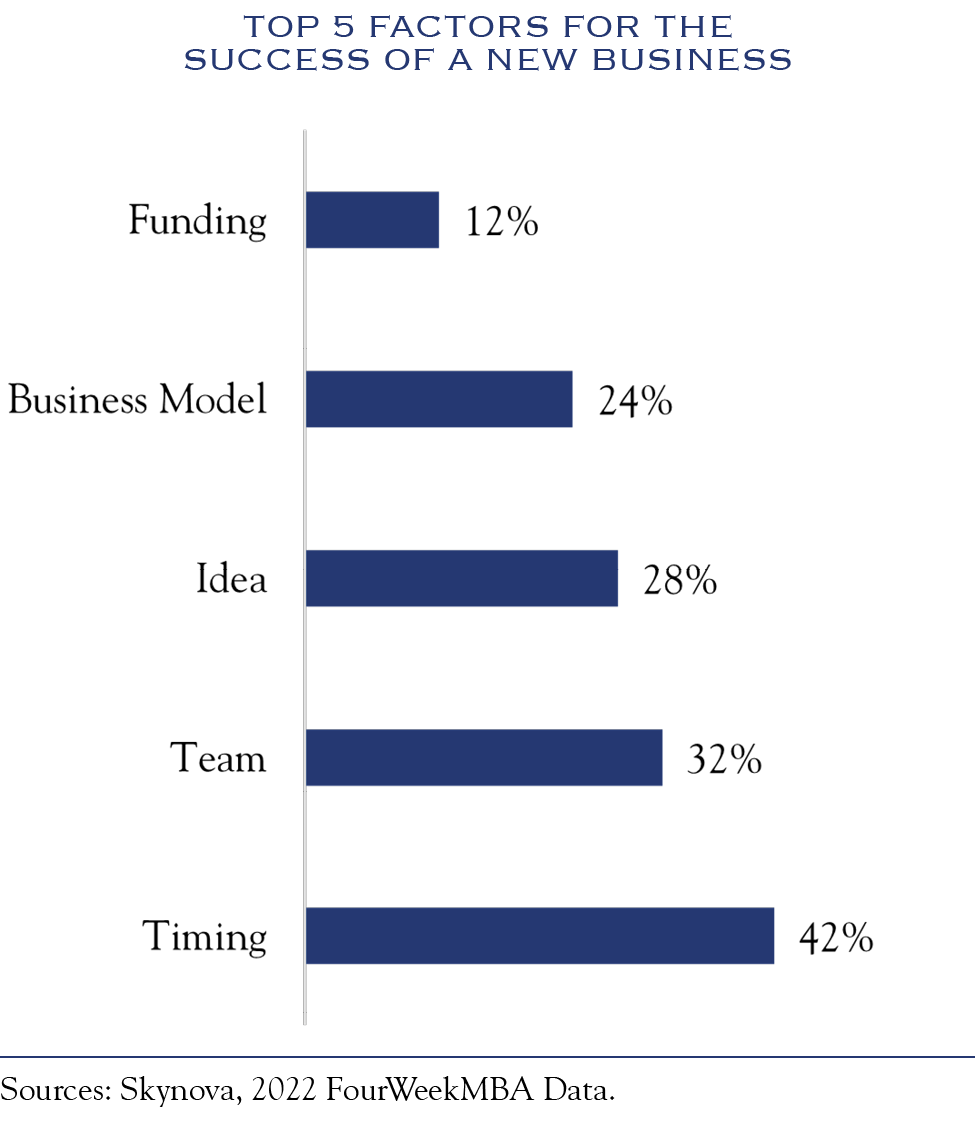

A great idea means little without a capable team to execute it. In fact, according to Skynova, the team is the second reason businesses succeed. Impressive professional and educational backgrounds are important. However, there are other essential aspects. Do the founders have a successful track record of starting businesses either in this industry or an adjacent one? Have they sat on boards of dynamic companies for long periods of time with specific responsibilities (e.g., audit committee)? These types of questions will give you an idea of the talent and capabilities of the management team. An impressive track record in the industry—or even in adjacent fields—is critical. The presence of an advisory board, though not always mandatory, adds an extra layer of oversight and accountability.

Projected Financials

The eventual success of the investment will depend on the business’s ability to generate strong performance over the next few years. The summary of projected financial performance should not be confusing; it should cover essential line items with well-explained and realistic assumptions. There should also be commentary and a scenario analysis provided to illustrate what would happen if there were deviations from the assumptions (high, medium, low). The key components here are cash flow generation and how long the capital being raised will last under each scenario.

Expected Returns & Exit Strategy

While expected returns are essential, they should only be considered after evaluating the business’s fundamentals. A clear, realistic exit strategy—whether through a sale, buyout, or another means—is crucial, ideally three to five years, not typically longer. If the time frame is longer, then a higher level of return should be expected to compensate for the extra risk being taken. Given that the level of returns depends on the underlying business’s industry, the overall return should be multiples of the initial investment.

3. Consult an Attorney

A clear, realistic exit strategy—whether through a sale, buyout, or another means—is crucial, ideally three to five years, not typically longer. If the time frame is longer, then a higher level of return should be expected.

If, after the assessment of the business proposal, the business advisor and the potential investor believe the venture appears worthy of further examination, then it is critical to hire an expert attorney who is focused on the particular industry from an early-stage investment perspective. This attorney will be able to flesh out the various documents and work with the business advisor to negotiate the best possible deal. This will likely be an iterative process that can take weeks or even months. Based on experience, this scenario happens less than 10% of the time, with the vast majority of investment proposals coming from friends and family not making it past one or several of the sections outlined above.

4. Respond with a polite “No”

As over 90% of the cases will need to be declined, we need to understand how to handle this response properly. Declining these requests can be delicate and is often best left to the business advisor. He or she can communicate the decision in a way that preserves the client’s relationship while providing clear, logical reasons for passing on the opportunity. The decision should be framed as a thoughtful and well-considered judgment, not a personal rejection. This generally ends the request discussion; however, if the friend or family member persists, a more detailed response can be delivered outlining some of the concerns uncovered while reviewing the documentation provided.

Handling investment requests from friends and family requires a careful balance of financial insight and relational sensitivity. By following a structured approach—evaluating the relationship, conducting a thorough analysis, and responding diplomatically—clients can make informed decisions while preserving meaningful personal relationships. With this framework, advisors can help clients navigate these delicate situations confidently and responsibly.