A one-two punch from COVID-19 and the oil price war has taken what might have otherwise been an overdue, normal correction, and left stocks at the brink of a bear market. Economic disruption from the virus’s global spread and investor fears of credit market stress for the energy sector have led to steep declines in stocks.

As of March 11, 2020 the S&P 500 is down (−19.0%) since the high on February 19, while the average performance across all 500 stocks had crossed below the −20% bear market threshold.

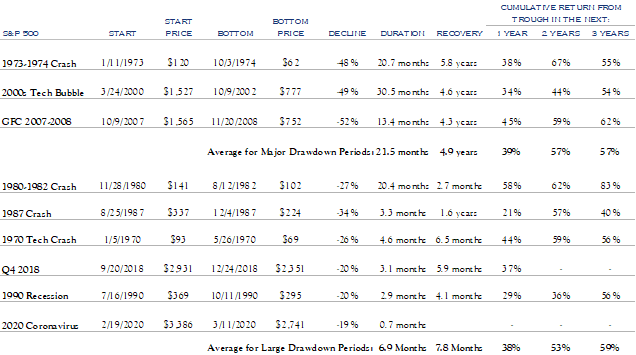

Since the 1970s, there have been nine −20% declines. The likely forgotten fourth quarter of 2018 proved to be a recent example. While that decline didn’t quite breach −20%, it was quickly reversed.

As shown in the table below, excepting runaway inflation, the global financial crisis, and the bursting of the tech bubble, −20% declines normally correct quickly and result in positive forward returns.

Note: Duration measures length of period from start price (peak) to bottom price (trough).

Note: Recovery measures length of period of recovery from bottom price back to start price (prior peak).

Very Volatile

Recent days have seen exceptional volatility. The VIX has hovered near 50, a level rarely seen since the financial crisis. The market on March 9 proved to be a good example of why any attempt at market timing is futile. Despite increased virus cases in the U.S. and globally, and a lack of any substantive news regarding financial stimulus, markets staged a hearty rally of nearly 5%.

Various forms of “fast money”—whether systematic, quant trading, algos, risk parity, or rules based—will likely exacerbate volatility in the short term. We think that maintaining a lengthened time horizon provides an advantage and that with the proper asset allocation, portfolios can survive the storm. Most Silvercrest clients invest using a balanced portfolio approach, acknowledging that stocks are volatile and that the appropriate asset allocation allows investors to maintain investments over the long term, including through unknown exogenous risks. This approach allows the solid economic fundamentals to shine over time, providing a healthy return in exchange for risk.

Asset Allocation

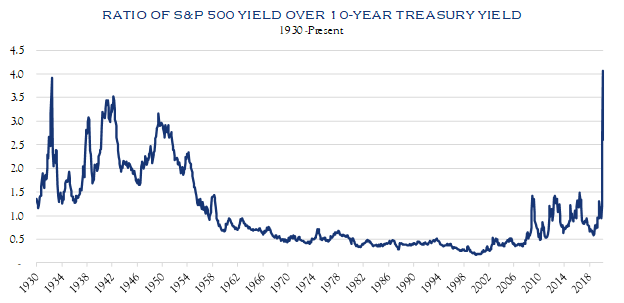

From an asset allocation perspective, the decline in stocks has further widened the valuation spread between bonds and stocks. One can see below that the dividend yield on the S&P 500 (currently 2.21%) compared with the current yield on the U.S. 10-Year Treasury (0.82%) is at a level not seen since the 1950s.

Source: Macrobond, Shiller (1930-1970 S&P 500 data, 1930-1961 10-Year Treasury data)

The decline in stocks and rise in bond values (lower rates) implies that investors see high odds of recession and a significant drop in earnings. Earnings and the economy will be challenged in the near term, although we believe COVID-19 disruptions will be very challenging in some areas, less problematic in others, and eventually transitory for all. In China, early signs are emerging that businesses and consumers are moving toward a more normal economic environment.

The Economy

While inferences can be drawn from the virus timelines of other countries, it is highly uncertain how long COVID-19 sticks around. For now, the number of cases in the U.S. is expanding. Markets will be looking for a change in the “second derivative”—in other words, when the rate of growth of new cases begins to slow domestically. That will likely take multiple weeks or even months.

Markets will get the first glimpse at virus-influenced data with the University of Michigan consumer sentiment survey on Friday, March 13, and from the Empire State and Philadelphia Fed the following week. Prior to COVID-19, economic data were encouraging. Going forward, there will be negative effects and eventually, those effects will start to dissipate. Prospects for weathering the economic storm are improved by a high consumer savings rate and reasonable balance sheets in most sectors. Further, while downward adjustments in activity can come quickly in an economy dominated by the consumer and services, it can also rebound quickly. To date, we have heard mainly of travel and leisure disruption and much more telecommuting and have not yet heard of domestic U.S. supply chain disruptions.

Though the short-run will see challenges from COVID-19, eventually these lower interest rates, low oil prices, potential stimulus and maybe some pent-up demand will set a compelling stage for growth. Importantly, just as the virus itself was unexpected, the timing of a more forward-looking equity environment also will be unexpected. It is far better to maintain and manage an appropriate exposure to equity markets than to attempt to time a market that has seen 5% moves in either direction during a single day.

Active Management

This does not mean complacency is the correct approach. We are continually updating our analytics regarding asset allocation and risk assessment. We are closely monitoring economic and virus data, through our own research and in conjunction with our external vendors.

We believe high-touch, client-tailored portfolio management adds value over time. Rebalancing, opportunistic tax-loss swaps, reinvestments of maturities, and other forms of ongoing portfolio management are essential. At the individual security level, for both stocks and bonds, Silvercrest’s internal teams as well as our outside managers continue to upgrade their portfolios, focusing on quality and forward-looking expectations.

During these unusual, uncertain and volatile times, we will continue to communicate our views and look forward to an ongoing dialogue with all clients.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC