Art & Science

Stay at home has meant that broadband data usage has increased 38% compared with last year, according to data vendor OpenVault. This massive spike in data consumption is no surprise. Some large portion is surely for leisure during the pandemic, though news and information flow are also growing exponentially. Before reviewing the plethora of economic and market news and data from July 2020, it is worthwhile to ponder a superb textbook discussion of statistics:

“Statistics is the science and art of learning from data. Data are numbers with a context.”

Data on the economy and markets must be evaluated inclusive of context. For example, considerations include comparisons to the depths of the crisis, comparison to last year, and comparison to prior periods. Further considerations include regulations in a region or industry, or seasonal adjustments. At this point in the COVID recovery, direction of travel is more important than the absolute level of activity. Real-time metrics have been providing great insight into the path of recovery and traditional economic metrics are beginning to gain some relevance, especially if used in the proper context.

Horrible Headlines, But Not as Bad as Expected

Headline news on the economy was expected to be awful—and it was—although not as bad as expectations. On July 30th, the U.S. Bureau of Economic Analysis (BEA) released the second quarter report on Gross Domestic Product (“GDP”). While many headlines reported the annualized rate of decline of −32.9%, the current level of GDP is −9.5% as compared with the second quarter of 2019. Thus, GDP is running ~90% of prior year. These figures were somewhat better than consensus estimates.

The Federal Reserve Open Market Committee met on July 29th and re-affirmed its commitment to use a full range of tools to support the economy, with Chair Jay Powell stating that the Fed is not even thinking about raising interest rates. The actual quote involved three consecutive mentions of “not thinking about”—as in, “not even thinking about thinking about thinking about” raising rates. Further, the Fed noted the strength of banks during this economic crisis. Overall, the announcement and subsequent Q&A showed level-headed leadership from the Fed.

COVID Strikes Again

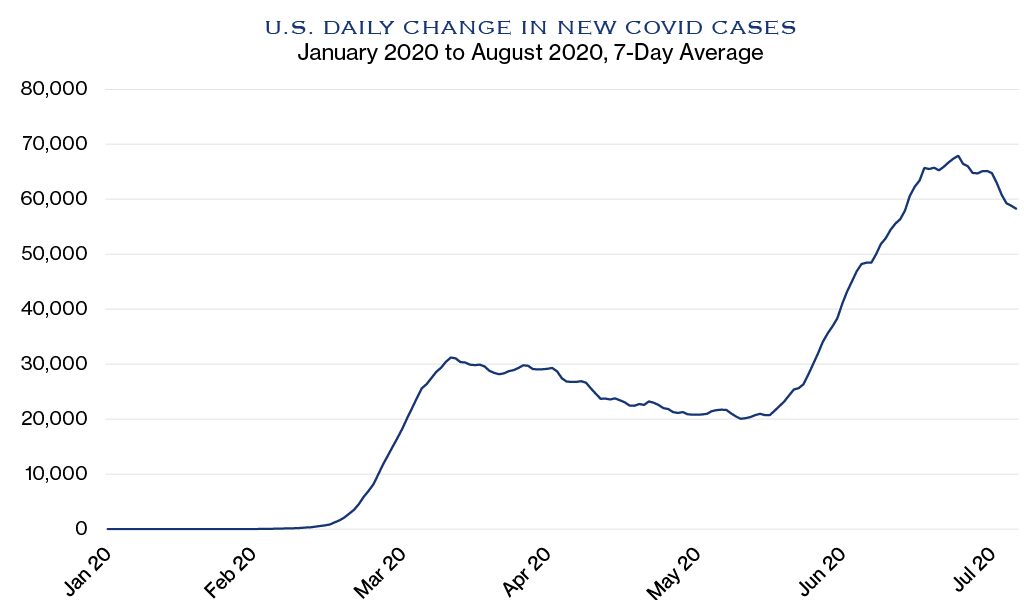

COVID spikes cause another slowdown in activity—this time a pause rather than a sharp decline.

Source: The COVID Tracking Project

These spikes in COVID cases, primarily in the sunbelt, presented yet another significant challenge to economic recovery. However, most economic metrics remain stable, and COVID cases are beginning to subside once again.

The Economy

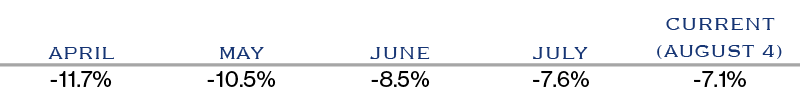

Beyond GDP, another important gauge of overall economic activity is the New York Fed Weekly Economic Index. This indicator is updated weekly and corresponds to anticipated level of economic activity. Facing a rebound in COVID cases, economic activity continues to improve, albeit at a slower pace. The indicator’s current level shows an economy running at about 93% of the same quarter last year, consistent with our view.

Federal Reserve Bank of New York—Weekly Economic Index

Indicators such as airport checkpoint data and OpenTable restaurant reservations offer a readily relatable view on consumer behavior. Air travel and dining, though continuing to slowly improve, are operating at a level only 30–40% of the prior year. Scores of other metrics show varying levels of activity.

It is important to add some context regarding the size of each area relative to the overall U.S. economy. Consistent with our view that COVID is creating wildly disparate outcomes, there were vast differences between services and goods. Alongside the GDP report, the BEA publishes data on Personal Consumption Expenditures (“PCE”), otherwise known as consumer spending. Overall, spending in June 2020 declined −5.5% as compared to June 2019. Spending on goods—things like cars, furniture, recreational goods—increased +4.4%. Goods comprise about 36% of spending. Services, which account for 64% of spending and include things like restaurants, recreational services, transportation and, importantly, healthcare, declined −11%. Healthcare is a big component of spending, weighing in at 17% of total personal consumption. Many non-essential healthcare services were postponed or cancelled due to COVID shutdowns. This category of spending ought to recover nicely as COVID cases begin to moderate. Other segments, such as travel and restaurant dining, may rebound a bit more slowly.

Asset Allocation

To evaluate the appeal of stocks and bonds, context is required, particularly in evaluating each relative to the other. Equities encompass a wide range of revenue stability and balance sheet strength, and this creates opportunity for active management. In aggregate, we believe current equity valuations are supported by a reasonable earnings outlook and current levels of interest rates and inflation. One noteworthy divergence is the level of the risk-free rate, currently 0.55% for the U.S. Ten-Year Note, and the dividend yield on equities, currently 1.8%. Rarely has the difference been so stark. This configuration supports the relative appeal of stocks. We continue to emphasize safety and careful credit selection in bonds and see appeal in both the dividend yield and further earnings growth for equities.

Outlook

The second sunbelt wave of COVID has begun to moderate. With it, we believe economic activity will resume its recovery. Our near-term outlook remains for an economy around 90%, recovering to 100% at some point in 2021. We see 2021 earnings at a level similar to 2019 and expect valuations to remain strong. As the recovery continues, we expect a broadening of equity markets into areas more dependent on that recovery. While the road ahead will continue to have bumps, twists and turns, we believe the path overall is one of progress toward recovery.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC