The “Plus Ça Change” Economy

Recent market action indicates that investors are anticipating significant change. On July 11, a lower-than-expected CPI print increased the probability of a Fed Funds rate cut, leading to a dramatic rotation across market cap segments in equities. Many are concluding that massive change is afoot. Yet, whether the Fed cuts rates in September or not (and we think they will), fundamental conditions such as economic growth, inflation, and earnings are unlikely to change much in the near term. A single 25-basis-point cut won’t significantly influence these fundamentals. While investor sentiment fluctuates daily, economic fundamentals are best characterized by an expression popularized in the Olympic host country of France: “Plus ça change, plus c’est la même chose” (“The more things change, the more they stay the same”).

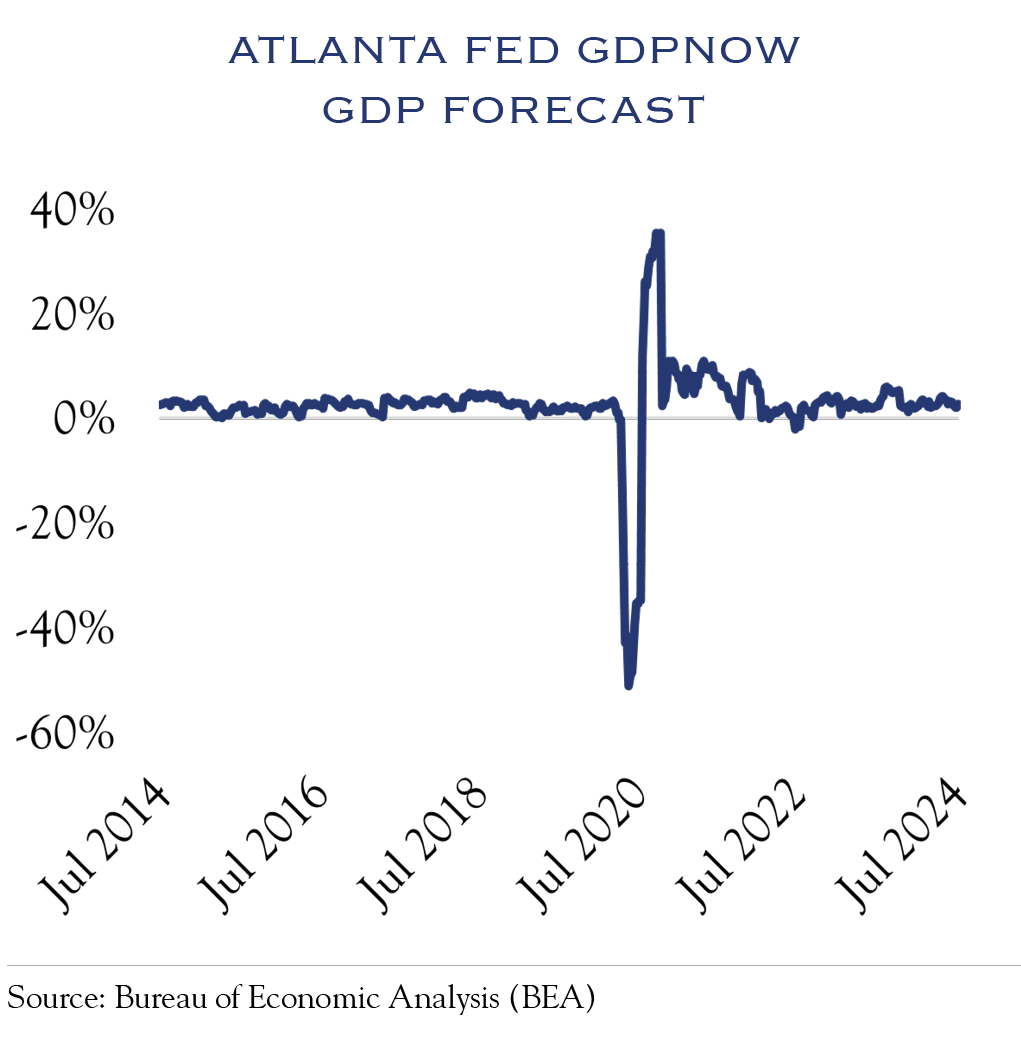

The “plus ça change” economy is growing at a rate of around +2.5%, based on models run by the Atlanta Fed (GDPNow) and Dallas Fed (WEI). Over the past ten years, GDP has averaged +2.4%.

Employers created 206,000 jobs last month, with an average of 164,000 over the past ten years.

Large-cap equity earnings are expected to increase about 10% in 2024 vs. 2023, similar to their 9% average expansion over the past ten years.

After an exceptionally unusual economic cycle, conditions are mostly reverting to long-term trends of modest growth rates.

As Fed cuts eventually begin, we do not anticipate rapid impacts from lower rates. Unless employment weakens, the pace of cuts is likely to be relatively slow, with “long and variable lags” before the effects are felt.

Fed Cuts, Then What?

The impact of Fed Funds rate cuts on the U.S. Ten-Year note is also likely to be slow. Futures markets show a high probability of three rate cuts by January 2025, bringing the Fed Funds rate to 4.75%. Even a rapid series of rate cuts—say eight in the next twelve months—would put the Fed Funds rate at 3.50%. With the current yield on the U.S. Ten Year around 4.15%, dipping as low as 3.79% in December of 2023, there’s limited room for the short-term yields to drop much further until the rate-cut cycle is well underway.

This round of cuts will likely begin under favorable economic conditions. Historically, rate cuts have led investors to embrace risk and rotation as they anticipate an end to weak economic conditions. In this cycle, the cuts will aim to reduce the level of restrictiveness placed on the economy, and rather than to boost economic growth, the Fed will be looking to stick a “Simone Biles-style” perfect soft landing.

Debt and the Economy

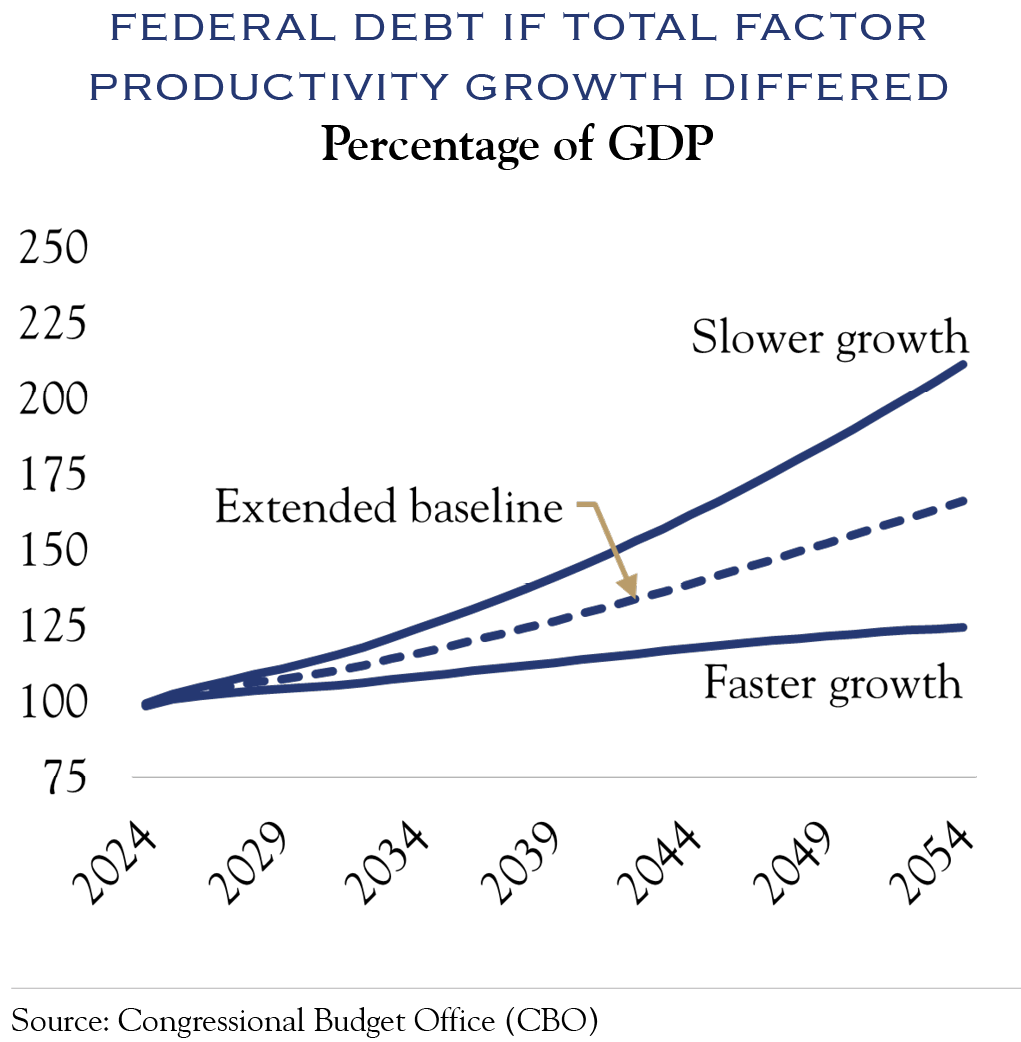

One common concern amongst investors is the size of the U.S. debt. The most useful metric for its assessment is debt relative to the size of the economy. With $34 trillion in debt and a $27 trillion economy, the U.S. debt/GDP ratio is 125%. Future estimates of this ratio rely critically on economic growth expectations. The Congressional Budget Office estimates that the debt/GDP ratio will increase to 166% under modest growth conditions. However, an additional 0.5% growth in GDP per year would stabilize this ratio over the next 30 years. AI and robotics offer significant potential to boost productivity in the coming years. In our estimation, the productivity boost to GDP is achievable and realistic, representing only about half the productivity gains that occurred during the internet years. While the internet years produced a stock market bubble, they also unleashed a torrent of communication technologies, which provided massive efficiencies to the economy. Though today’s valuations aren’t at the nosebleed levels of the late 90s, the concept of enthusiasm around innovative companies spreading out to the broader economy could repeat.

Catalysts for Change: Rates & Earnings

Two catalysts are required to maintain broad equity-market gains across both large and small companies. First, interest rates must decline sustainably to relieve financing pressure from smaller companies. Rate cuts will likely begin in September, though with a measured pace that will not immediately influence economic conditions. The second catalyst is the broader realization of earnings gains across market caps. Consensus expectations embed a significant uptick in smaller company earnings in coming quarters and through 2025. In a normal rate-cut cycle, with the Fed seeking to boost growth, that quick improvement in earnings would likely occur. However, we expect broader participation in earnings gains to unfold slower than consensus, particularly if economic growth remains modest.

Outlook

We anticipate more of the same from the economy and the Fed. Growth will continue, albeit at a slowing pace. Inflation will slowly fade, and the Fed will eventually begin a series of slow-moving rate cuts. With decent economic growth, we expect steady earnings expansion, with gains slowly broadening to a larger segment of companies. While change is underway, it will likely unfold slowly, leaving things much the same for now.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC