Bullishness reigned in November as markets reacted favorably to the election outcome and substantial progress on vaccines.

Smaller companies led the way, with the Russell 2000 index up +18.4%, though large cap companies also fared quite well, with the S&P 500 posting an +11.0% gain.

Such a rapid rise in stock prices against a backdrop of rapidly rising COVID cases might seem incongruous except for the tremendous progress in vaccine development. The realization of a light at the end of the pandemic tunnel is particularly beneficial to the most disrupted industries, and to companies who may have been struggling to find financing during COVID.

While markets have been ebullient, risks are building in the short term as COVID cases rise and state-imposed restrictions on activity increase. This near-term slowing of economic activity must be coupled with an improving longer-term outlook as an image of a post-COVID world comes into focus. This conundrum of short-term risk versus long-term opportunity is the essence of investing. The key is to avoid stock market fluctuation noise on any given day and focus instead on a longer-term time horizon over which fundamental progress will be the key driver of investment results.

The most recent data from the New York Fed’s Weekly Economic Index shows an economy running at about 97% of 2019 levels. According to Consensus Economics, estimates for calendar year 2020 GDP have been rising and now show a decline for 2020 of just under −4% and an advance for 2021 of just under +4%. Recent survey data from the National Association of Business Economists (NABE) shows that 73% of surveyed economists expect the economy to return to pre-pandemic levels by the second half of 2021. This is a massive increase from the 38% in October who predicted such a speedy recovery. This shows just how powerful the positive vaccine news is in driving sentiment.

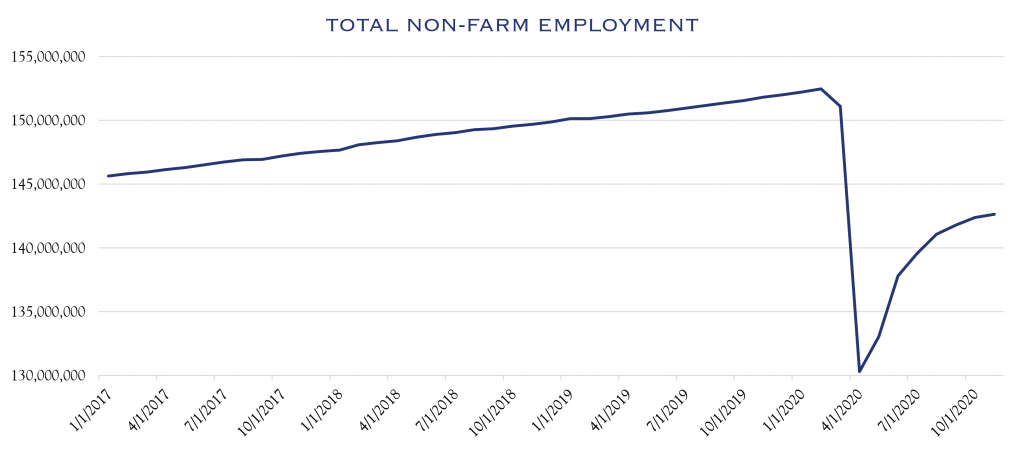

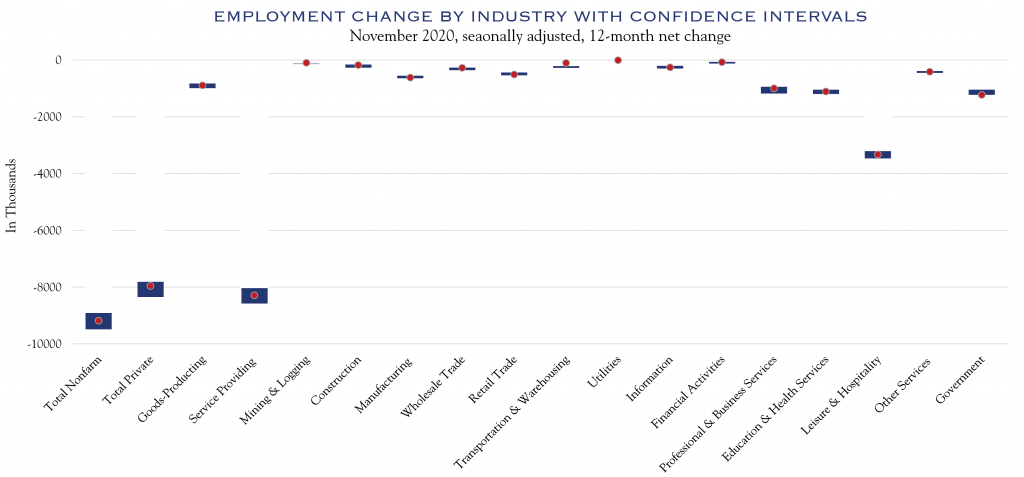

The Bureau of Labor Statistics (“BLS”) reported an increase in non-farm employment of 245,000 in November. While workers are returning to jobs, they are doing so at a slower pace. At 143 million employed, the total number remains about 10 million lower than pre-pandemic levels. There are two key dynamics influencing future gains in employment. First and foremost, COVID restrictions, health concerns, and anxiety over indoor restaurant dining, air travel, hotel stays, and indoor entertainment must dissipate before a full recovery in leisure and hospitality jobs—representing one-third of remaining job losses—can occur. Second, a recent small business survey notes that filling positions with qualified applicants is a challenge. The National Federation of Independent Business (“NFIB”) reports that 53% of small businesses are actively hiring, while 34% reported job openings they could not fill. Until COVID disruptions ease in the hardest hit areas or until workers are able to cross industries to seek employment, many of these jobs are likely to remain unfilled.

Source: Bureau of Labor Statistics, Macrobond

Source: Bureau of Labor Statistics

The ISM Manufacturing survey registered a reading of 57.5, a decrease from the prior month and slightly behind consensus. However, this reading is consistent with economic expansion and is the seventh month in a row of expansion in manufacturing activity. Over the past few months, customer inventories have been at their lowest levels in more than a decade. This generally bodes well for future manufacturing activity as inventories are re-stocked.

The ISM Non-Manufacturing index was at a level of 55.9 which was a touch lower than the prior month. Services represent about two-thirds of U.S. GDP, so continued improvement is important to overall economic health. Meanwhile, consumer spending remains steady. Various metrics of bank spending illustrate this, as does the recent Johnson Redbook retail sales figures, which remain above prior year levels by 2.1%.

Productivity metrics are on the rise as employment cuts have been more substantial than economic declines. It remains to be seen whether these gains are sustainable as employment comes back online in disrupted industries. It is certainly possible that some work practices, enabled by technology, will continue to benefit productivity and boost economic growth.

A key driver of stock prices is earnings growth. Recent consensus forecasts for calendar year 2021 earnings are rising, reflecting an improved outlook for a return to something close to normalcy. Current consensus estimates of around $170 for the S&P 500 implies a Price/Earnings ratio of 21.3, a bit higher than the 18.5 average over the last ten years. With interest rates and bond returns at the very low end of their ten-year range, these higher stock market valuations are justified.

With stock prices near all-time highs, and COVID cases rising, caution in the short term is merited. However, with vaccines coming online, liquidity support from the Federal Reserve, the likelihood of some fiscal stimulus, improving sentiment, a strong outlook for economic activity in 2021, and rising earnings estimates, optimism over a reasonable time horizon is warranted.

December 11, 2020

Robert Teeter

Managing Director

Investment Policy & Strategy Group

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC