The S&P 500 started the year with a +6.3% rally. Some of the gain can be attributed to the cash flows that often accompany the start of the year (the January effect), and driven by the latest data on the economy, commentary from the Fed, and earnings, against a predominantly bearish backdrop.

The Economy

While there has been a deceleration in economic activity, the fourth quarter’s GDP reading of +2.9% demonstrated that the economy continues to expand. Consumer spending slowed but remained positive, with a +2.1% gain in personal consumption expenditures. Services spending remained strong, while spending on durable goods declined—part of an ongoing adjustment to normal patterns that were in place prior to the pandemic. Housing remained a detractor, though the outlook has slightly improved as mortgage rates have declined nearly 1% from their peak of 7.3% in October of last year.

The job market remains resilient, despite high-profile layoffs in technology and finance. Jobs offered, measured by the JOLTS survey, are holding strong and have even increased a bit to 11 million. Hiring plans were announced by companies such as Chipotle and Boeing. The unemployment rate of 3.5% is near an all-time low, and the headcount of total employed is at an all-time high of 154 million. Strength in the job market is likely to keep the economy on steady ground.

The Fed

Federal Reserve policy and commentary hit a level of peak hawkishness in August. By October, the U.S. 10-year note hit a level of 4.3%. Since then, inflation has improved, and interest rates have declined nearly 1%, hitting 3.4%. Only recently has sentiment from the Fed become less aggressively hawkish.

When stocks posted large gains during the Chair Powell’s most recent press conference on February 1, they reflected this change in tone. Inflation has improved, and he acknowledged it, notably saying, “the disinflation process has begun,” yet he was careful to note this is only for certain segments of the economy. For now, core services (excluding housing) remain an inflation hot spot, though it has also shown some signs of improvement in recent months. The commentary was not dovish, and Powell said all the right things about staying the course. Powell’s message confirmed that progress has been made, but that vigilance will remain.

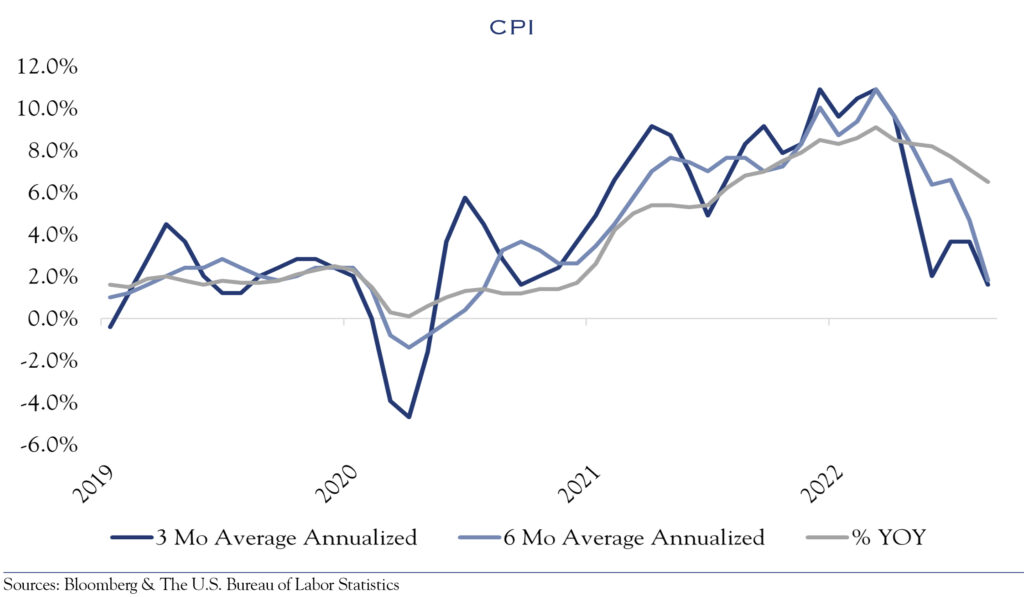

One positive signal on inflation comes from taking month-over-month (MOM) Consumer Price Index (CPI) readings and annualizing them to compare to headline inflation readings (which are on a year-over-year basis). The most recent CPI report showed an increase in prices of +6.5% compared to one year ago. Meanwhile, the annualized MOM rates for the last three and six months show inflation running at a rate of around +2%. This reflects a significant downshift in inflation pressures since mid-summer.

Earnings

Nearly half of the companies in the S&P 500 have reported earnings. It has been a mixed bag, with earnings barely exceeding estimates by about 2%. Banks were mostly cautious yet noted ongoing consumer strength. Consumer-facing companies like airlines observed strong spending patterns. Technology and finance companies announced some layoffs, though these were relatively minor and typically erased half of hiring gains made in the last few years. Analysis of earnings calls transcripts shows a decrease in talk of “labor shortages” and an uptick in mentions of “economic slowdown,” “AI and automation,” as well as more mentions of expected headwinds for profits due to a slowing economy and the lagged effect of higher interest rates and labor costs. However, a slightly weaker dollar will benefit revenue from abroad, and an increased focus on efficiency can help to cushion margins. Fourth-quarter GDP figures also showed an uptick in productivity, and while that figure is noisy, it is a good reminder that a slowdown in growth doesn’t always produce an earnings wipeout. In fact, Mark Zuckerberg declared 2023 “the year of efficiency.” We expect small gains in earnings, with a lot of dispersion across industries and individual companies.

Outlook

As Chair Powell’s comments indicated, there has been a meaningful improvement in inflation, and this has coincided with a decrease in interest rates. That drop in rates will provide some support to housing and the consumer and helps boost valuation levels on equities. While the economy and earnings are losing some momentum, they are likely to remain slightly positive. Overall, we look for inflation to be the key driving force for the year, mostly following an improving trend.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC