An Update on AI

Lorne Michaels, the enduringly successful creator of Saturday Night Live, said about finding great comedy: “If there’s a better joke from somebody who’s been there for an hour, you take it.”

DeepSeek is the newcomer in the AI race for dominance. While it has been around for a while, it explodedinto mainstream financial news and triggered a significant disruption in stock prices. We see three parts to the DeepSeek story.

1. It raises questions on demand for chips: This issue is undecided in our view. Recent developments call into question whether the amount of expenditure on computing power that is required to build a high-quality model is increasing, has stabilized, or will decline. Yet, there hasn’t been definitive proof that the DeepSeek model was cheaper to build. Further, capex pipelines are robust, with plenty of demand for the foreseeable future. Longer-term, as the tech arms race continues, prices may fall, but volumes will increase.

2. A wakeup call on open source: Some models are built and trained with an open source framework. This allows users to see the inner workings, build upon the technology, and make improvements. Historically, open source software catalyzes broad-based usage. The DeepSeek news provided a wakeup call to markets, highlighting that models by several participants are open source, making it more than likely that the technology will continue to improve and spread rapidly.

3. A sign of things to come: The most important message in our view is that most developments happening under the banner of “Artificial Intelligence” are progressing quickly and spreading rapidly.

A simplified way to understand the effects is to recognize that the access and capabilities available to an average consumer or business have experienced a tremendous leap forward. We expect this to further fuel the productivity and profit margin race that will unfold in the quarters and years ahead.

The productivity race is just getting underway. Two recent Wall Street Journal articles, “Why Costs Avoidance Became an AI Buzzword for Holding Down Headcount” and “The American Worker is Becoming More Productive” included examples of the concepts we believe will drive higher margins for companies who implement AI.

“Rather than hiring more knowledge workers for repetitive tasks such as filtering emails, Bodenski said, implementing a new AI-based sorting process has allowed TS Imagine to hold headcount at existing levels. AI can do the work at 3% of the cost of the employees, he said.”

“Take Vic Viktorov, a gym owner who increased revenue at his Boston business in 2024 by 30% without adding a single salesperson to the two already on staff. Instead, he has been using an artificial-intelligence model”

The consumer and economy are fine, for now.

Earnings season is off to a solid start, with banks and airlines affirming the continued well-being of aggregate consumer activity. One possible concern is that the state of the consumer, while positive, is slowing at the margin. Consider the following:

-

-

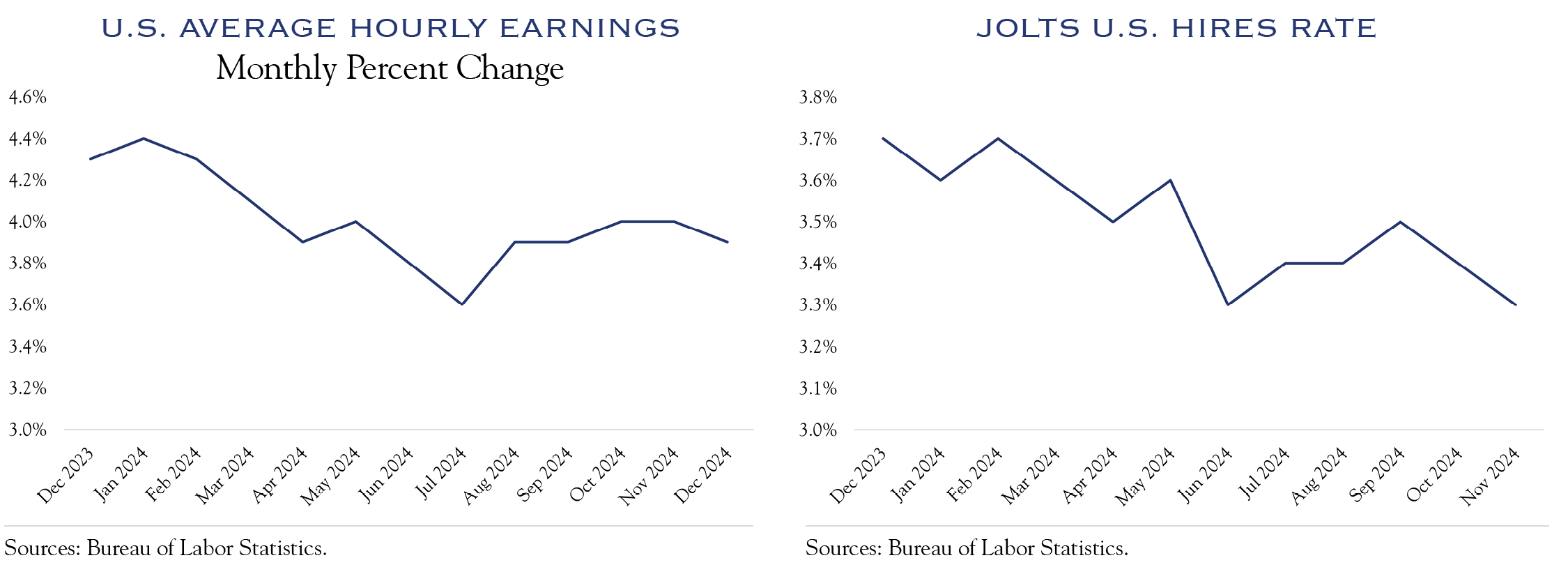

- Wage gains decelerated from 4.3% to 3.9% over the past year.

- The Hires rate slowed from 3.7% to 3.3% over the past year.

- Consumer credit metrics (overall debt, delinquencies) are slowly heading in the wrong direction.

-

Nonetheless, payroll expansion continues and with more jobs comes more spending and more economic growth. We expect growth of 2.0-2.5% in 2025.

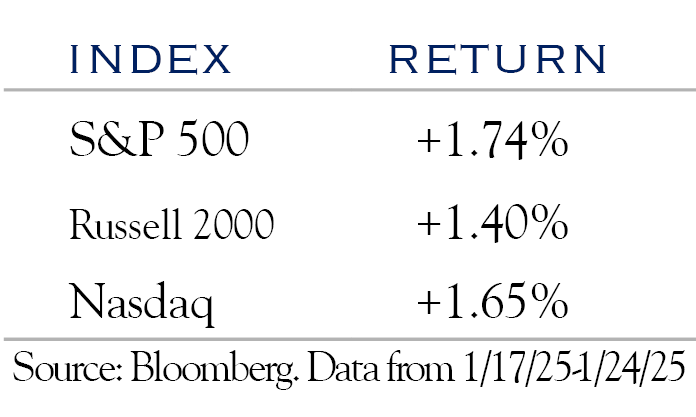

On the policy front, stocks seem to like the first week of the Trump administration as a broad-based set of equities rallied.

We expect continued strength in small caps. We will be monitoring three things:

1. Policy will translate to activity. M&A and construction spending could tell the story. We look ahead to February and March M&A activity as a first read on the year. There is widespread talk of abundant pipelines and it is reasonable to assume that announcements will occur in the post-inauguration period. Another sign will come from a re-acceleration of non-residential domestic construction spending. After rising at a rapid rate, the pace has slowed. An uptick in domestic construction spending would signal that corporate America will focus on the U.S. economy.

2. Small-cap margins will continue to expand. The S&P 600 small-cap index of high-quality small-cap companies has seen gross margins rise to levels not seen since the post-GFC recovery period. Similarly, the gap between S&P 600 and S&P 500 margins is narrower than seen in the pre-COVID period. Our thesis is that small-cap companies are beginning to unlock the same productivity levers as their large-cap brethren. This is especially true as AI becomes more pervasive and less costly.

3. The Fed will stay the course of policy easing, but very slowly. Critical to expanding market breadth is an easing of financing concerns stemming from higher interest rates. While we expect the process to be slow, the direction of rates is critical for sentiment on smaller companies. Per Bloomberg’s WIRP tool, the Fed is expected to be on hold through May. At the recent FOMC press conference, Chair Powell retained flexibility if employment should falter, but was nonetheless fairly resolute in moving cautiously with further interest rate reductions as inflation has been slow to decline.

Elevated valuations for equities are likely to create some volatility.

High valuations mean high expectations and all incoming data on the economy, policy, and individual securities will be heavily scrutinized. A classic Wall Street phrase is “valuation is a terrible timing tool.” The reason is that prior periods of high valuation often continued for long stretches, with values going ever higher, and with painful corrections eventually taking place alongside challenges with earnings.

Outlook

We close with a thought inspired by the 50th anniversary of Saturday Night Live. From Deep Thoughts—“If you’re a horse, and someone gets on you, and falls off, and then gets right back on you, I think you should buck him off right away.” With expected changes in policy, a slowly-evolving Fed, rapidly-evolving technology, and elevated valuations, the market this year might act a bit like that ornery horse.

Our base case view is that equities track earnings higher, with stocks growing into their valuations. We see elevated valuations as a limiting factor but acknowledge the possibility that irrational exuberance could return, in a rerun of 90’s optimism. Significant downside would likely be accompanied by a weak economy and dour outlook for earnings. For now, the economy remains sound, so we see this as a lower probability. We expect the market to broaden, with compelling gains from high quality smaller companies. We see rates very slowly moving lower and credit spreads remaining tight.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC