A specter is haunting markets—the specter of a recession. The S&P 500 index fell −6.2% by year’s end, down −14.5% from its peak in late September, erasing virtually all of its gains since September 2017. The 12-month trailing P/E ratio for the S&P 500 has fallen from 21.5x at the beginning of 2018 to 16.0x, its lowest valuation multiple in nearly six years. You don’t have to look far to find commentators saying that the business cycle has turned, and that the market’s downturn will only deepen further from here.

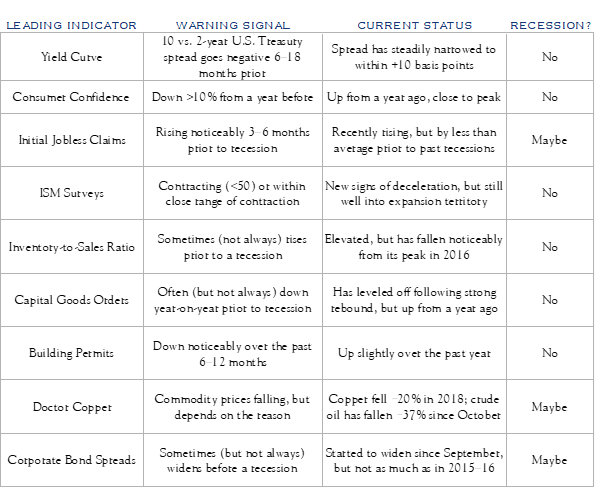

But is that really the case? Nine leading indicators that frequently flash warning signals of a coming recession suggest that the market’s reaction is premature. The U.S. economy is slowing, from its peak earlier this year, and may slow further, but still appears to have some ways to go before its positive momentum turns negative. Just as we cautioned against excessive exuberance six months ago, noting that we had entered a mature stage of the market cycle, we now caution against excessive despair, and advise investors to keep their eyes on the historically attractive longer-term rewards likely to accrue to those with the capacity and stomach to ride out the cycle.

1. Yield Curve. An “inverted yield curve” happens when long-term interest rates fall below shorter-term rates, implying that the market expects the Fed to go from rate-hiking mode to rate-cutting mode at some point in the foreseeable future. Starting around 1917, the development of an inverted yield curve for U.S. Treasuries has been an uncannily accurate predictor of a recession coming—eventually. But the typical lead time can be anywhere from 6 months to 2 years.

After the Fed announced its latest rate hike, in December, the much-watched spread between the 10- year and 2-year Treasury yields narrowed to less than 10 basis points, a hair’s breadth from inversion. Meanwhile, the 2, 3, and 5-year rates fell below the 1-year rate, triggering much discussion and anxiety. The shape of this “dip” (or partial inversion) in the yield curve suggests that the market is convinced the Fed will make a mistake by hiking rates too aggressively this year, which it will then have to reverse. However, recent comments by Fed Chairman Powell indicate that, given the moderate rate of inflation, he is inclined to show some patience in hiking rates to avoid such a mistake. If that’s true, the front part of the yield curve could be signaling a false alarm.

It’s important to keep in mind that an inverted yield curve does not imply a recession is right around the corner. If the 10-year vs. 2-year Treasury spread went negative today, the average lead time from the last five cycles would imply a recession taking hold sometime around September 2020.

Nor does an inverted yield curve imply a deepening bear market. The last three times the 10-year vs. 2-year spread went negative, the S&P 500 climbed until peaking much closer to the actual recession. When the yield curve inverted in December 1988, the S&P 500 rose another +35% before peaking in July 1990, a few weeks after the recession started. When it inverted in June 1998, the index rose another +37% before peaking in March 2000, about a year before the recession began. When it inverted in December 2005, the S&P 500 rose another +24% before peaking in October 2007, about a month before the recession started. In the two previous recessions (1980 and 1981), the index was relatively flat (albeit volatile) between the time the yield curve inverted and the recession started.

Historically, there has often been significant remaining upside to the stock market even after the development of an inverted yield curve signals a coming recession at some point. It is for this reason that we can’t look at the yield curve alone to guide us in our economic and market outlook.

2. Consumer Confidence. Household spending accounts for 69% of the U.S. economy, so the ability and willingness of consumers to spend plays a major role in determining its direction. Both the leading surveys, conducted by the University of Michigan and the Conference Board, typically give some warning of a coming recession. One month before each of the last seven recessions, with the exception of the “double-dip” recession in 1981, the two indices were down from a year before, an average of −15.9% and −13.0% respectively. The Conference Board gauge peaked an average of 12 months, and never less than five months, before the onset of the recession, including 1981. The month before a recession, it had fallen an average of −14.5% from that peak.

So far in this cycle, there is no sign of such a decline. The University of Michigan and Conference Board gauges are both up from a year ago, +1.7% and +4.1% respectively. The latter hit a new cycle peak just two months ago, in October, and has dipped −6.1% since. If the U.S. economy is taking a turn for the worse, as markets fear, consumers aren’t feeling it yet—which would be highly unusual.

3. Initial Jobless Claims. A key factor influencing consumer confidence is the state of the job market. While the unemployment rate is a lagging indicator, rising only after a recession has fully kicked in (and coming down only gradually after the economy begins growing again), the months leading into a recession hits typically see a noticeable pick up in initial jobless claims for unemployment insurance. For all seven of the past seven recessions, the 4-week moving average of initial claims at the onset of the recession has been higher than six months before, by an average of 30,571 claims. For all but one, it was higher than three months before, by an average of 21,250.

For most of this year, initial jobless claims trended downwards, reaching 49-year lows. In late September, however, they started moving upwards, though in December they retreated again. The 4-week moving average is now 11,750 higher than where it stood three months ago, but −6,000 lower than six months ago. There’s no clear evidence yet of a sustained shift towards mounting layoffs, but it’s worth keeping an eye on. The absolute level of new jobless claims (218,750) remains well below the average that heralded recent recessions (341,429), though the U.S. economy once entered recession with an even lower rate (204,500) in 1969.

4. ISM Surveys. Every month, the Institute of Supply Management (ISM) surveys company purchasing managers and compiles a composite index for both manufacturing (since 1948) and non-manufacturing (since 1997) across all industries. A score above 50 indicates a larger number of companies are seeing expansionary conditions, while a score below 50 indicates more are experiencing a contraction. Seven of the past 11 recessions have recorded a <50 reading the month before their onset, with all but one (1973) coming in below 54, for an average of 49.7. The average reading for the six months leading up to a recession was 51.3.

It’s not unusual for the ISM Manufacturing Index to signal a “false positive”, falling below 50 without taking the overall U.S. economy into recession. That’s precisely what happened two years ago, when the ISM Manufacturing Index went into a 5-month contraction caused by a stronger dollar and a sharp drop in oil prices, but the ISM Non-Manufacturing Index remained solidly positive. The Non-Manufacturing Index covers a much larger portion of the economy but has a much shorter history. That history suggests, however, that when both indices show increasing weakness, a recession may be in the offing.

To the contrary, for most of 2018 both ISM Manufacturing and Non-Manufacturing Indices showed solid expansion, with November readings of 59.3 and 60.7 respectively. Survey respondents may have fretted about this impact of tariffs, but reported strong levels of new orders streaming in. In December, the Manufacturing Index cooled noticeably, falling −5.2 points to 54.1. The sudden deceleration in new orders, down −11.0 points to 51.1, was particularly concerning. The Non-Manufacturing Index also cooled in December, falling −3.1 points 57.6, though new orders actually accelerated. We will be keeping our eyes on these gauges in the new year for any signs of further weakness. Nevertheless, both their latest readings and their average readings over the past six months remain in expansion territory, well clear of the “danger zone” that typically signals heightened recession risk.

5. Inventory-to-Sales Ratio. One reason recessions can happen is that production outpaces demand, causing inventories to pile up, prompting companies to scale back output to more sustainable levels. This isn’t always the case: inventories built up going into the 2001 recession but weren’t a major factor in the 2008 subprime crisis. Still, it’s something to keep an eye on.

The inventory-to-sales ratio rose to the somewhat alarming level of 1.43 in early 2016, about the same time the ISM Manufacturing Index went into contraction. It has since come down to the more manageable level of 1.35. That’s still higher than it stood for most of the previous cycle, but lower than the levels it maintained through most of the 1990s. The widespread adoption of “just in time” supply management makes it difficult to directly compare today’s inventory levels with historical ones, but the trend over the past two years has been towards ramping any inventory overhang down, not up. That’s no guarantee against a downturn, but it likely takes one common recession trigger off the table.

6. Capital Goods Orders. Consumer spending may drive the U.S. economy, but the willingness of companies to invest in new plant and equipment can also be a key factor. In six of the last seven recessions, monthly orders for nondefense capital goods, excluding aircraft, dipped negative year-on-year before the recession began, in some cases for an extended period of time. In the last three recessions, cumulative orders for the three and six months preceding its onset were both down from the same periods the year before. Heading into the previous four recessions, however, they were not, and in 1973 orders were up significantly, so the pattern does not always hold.

Capital goods orders have been lackluster for much of this recovery, often dipping negative year-on-year starting in 2012 and taking an extended two-year dive when oil prices collapsed in 2015–16. More recently, however, they’ve seen a strong rebound. Orders have plateaued a bit, since the summer, but have remained positive year-on-year. Cumulative orders were up +3.9% for the past three months and +6.1% for the past six months, compared to the same periods a year ago. For now, the data suggests that business investment, while no guarantee of continued growth, at least isn’t dragging the economy down, as it did in the months going into the last three recessions.

7. Building Permits. Housing construction may only directly account for 3–6% of the economy, but like automobiles, it’s an industry that has a large multiplier effect across other industries. It employs a lot of otherwise idle hands and can have a big impact on how wealthy consumer households feel. The number of new permits issued for single-family homes offers a sneak preview of the construction pipeline and can often signal a broader downturn ahead. Eight of the last nine recessions saw building permits fall in the six months leading to its onset, for an average decline of −15.0%, while all nine saw them fall in the preceding 12 months, for an average of −19.8%. All nine saw total permits issued in the six months before a recession down, by an average of −11.5%, compared to the same period a year before. Seven out of nine saw total permits for the 12 months leading up to a recession down from the year before, for an average drop of −9.4%.

The sluggish housing market has added to investor anxiety lately. Residential investment was a negative drag on GDP growth for the past three quarters. But the figures are still a far cry from their historical benchmarks. New building permits in November were up +2.1% from six months before, +0.4% from a year ago. Total permits for the past six months were down −1.1% from the same period a year before but permits for the past 12 months were up +2.5%. New building plans may not be powering the economy forward, but there’s little sign of the collapse that typically heralds an approaching recession.

8. Doctor Copper. Vibrant economic growth often translates into competition for raw materials, boosting commodity prices, while flagging demand can pull those same prices down. For much of the 20th century, the price of copper—a key input for a variety of manufactured goods, as well as construction—was commonly looked to as a “doctor” capable of diagnosing the economy’s direction. While a clear historical pattern can be difficult to discern, there certainly were times, especially early last century, when a steep fall-off in copper prices heralded a coming recession.

Copper prices dropped −19.6% in 2018, after surging +31.2% the previous year. Some point to this decline, along with a −37.5% drop in the Brent price of oil since its peak in early October, as signaling troubled times ahead. The real takeaway isn’t quite so simple. With the shift of the U.S. towards a service economy, and the rise of China as a manufacturing giant, Doctor Copper—and the price of other industrial inputs—may be offering more insight into China’s condition, these days, than our own. Moreover, commodity prices are affected by supply as well as demand, and when supply expands in anticipation of growing demand, even a slowdown in the rate of growth—not necessarily a downturn—can send prices tumbling. That is what happened to crude oil in 2014, when China’s outsized investment binge started to falter, and while that put pressure on some sectors of the U.S. economy, others benefitted from cheaper inputs. With China stumbling again, industrial commodities are feeling the pinch, but their falling prices alone do not mean that the U.S. will stumble as well.

Copper and other commodity prices may have been a go-to indicator in the past, and they may tell us some interesting and important things now. But we should be cautious in assuming it’s actually our chart that Doctor Copper is looking at.

9. Corporate Bond Spreads. The higher interest rate, or “spread”, charged on corporate bonds compared to (presumably risk-free) U.S. Treasuries reflects how seriously markets view the risk that businesses may encounter financial problems and default. An approaching recession can sometimes—though not always—be preceded by a sharp widening of those spreads. For instance, the last seven months of 2007 saw the spread between Moody’s Aaa-rated corporate bonds and the 10-year Treasury yield suddenly rise by 70 basis points, while high-yield spreads rose by 350 basis points.

Both spreads have seen a noticeable pick-up since September, reflecting rising market anxiety. The Aaa spread rose 36 basis points in Q4, while high-yield spreads rose 205 basis points. However, it’s worth noting two things, to keep this in perspective. First, Aaa spreads are still lower than where they stood through most of the recovery, before they started falling in early 2017. So they are partly rebounding from a recent dip, not scaling new heights. Second, the new spike in high-yield spreads so far falls well short of the 424-point rise triggered by the collapse of oil prices in mid-2014, which peaked in early 2016. That run-up reflected risks concentrated in the heavily-leveraged energy sector and did not herald a broader downturn. Like the yield curve, though for different reasons, corporate bond spreads provide potentially useful information, but we can’t look to them alone to form our economic and market outlook, without other data points to give them context.

Some might wonder why we haven’t discussed debt, a perennial concern cited by those warning of a coming downturn. It’s certainly true that excessive debt levels can have important implications. They can deepen and prolong a recession—but they don’t, by themselves, trigger or predict one. The extension of credit has both an upside for economic growth (when things are looking good) and a painful downside (when they’re not). Observing that “what goes up must come down” may be true, as far as it goes—but it doesn’t tell us when or why that momentum is likely to shift.

Risks and Rewards

The leading indicators that do tell us something about that momentum were, in several cases, signaling greater recession risk at the start of 2016—a risk we highlighted at the time—than they are today. When we sent out our quarterly note that January, sketching out the possible scenario of downturn that year, the ISM Manufacturing Index was in contraction, the inventory-to-sales ratio had surged to worrying levels, and capital goods orders were down −8.6% from a year before. The price of oil had fallen by more than half in the previous 18 months, and high yield spreads had widened to nearly 700 basis points. As it turned out, the U.S. economy navigated that gale. Two years later, despite a host of concerns weighing on markets—Fed rate hikes, trade battles with China, the looming approach of Brexit, political turmoil in Washington—a lot of those warning lights have stopped blinking.

There are multiple indications that U.S. economic growth is decelerating, from its highs earlier in 2018. We project S&P 500 operating earnings per share growing next year by +4% (compared to a consensus +10%), down from a phenomenal +26% in 2018, which was boosted by a large corporate tax cut and a surge in share buybacks. GDP growth is widely expected to slow from +2.9% in 2018 to around +2.0% in 2019. Throughout this sluggish and uneven recovery, the U.S. economy has revved up and slowed down repeatedly. But the data that we have does not support market anxieties that an actual recession is right around the corner.

The point of trying to discern where we are in the business cycle, and whether a recession may be coming or not, is not about trying to time the market. Sometimes the stock market peaks well before a recession hits, sometimes just afterwards—guessing exactly when is more an exercise in mass psychology than either business or economics. To the contrary, the purpose of studying the business cycle is to be able to step back from it, to put the market’s movements in perspective, and temper our reactions to them.

For instance, it might make sense to expect that after a long bull market, equities would be overvalued, and their prospective returns unattractive, compared to the risk involved. But that isn’t always the case. Throughout this recovery, the equity risk premium (ERP) has remained well above its historical average of 4.2%, suggesting that, in the wake of the global financial crisis, strongly risk-adverse investors have been willing to leave plenty of returns on the table, for fear of another downturn. The latest fall in share prices already pushed the risk premium back to 5.7%, by the end of November. That may not tell us anything about which direction the stock market will move next month or next year, but for longer-term investors, it has important implications. From 1960 to 2012, years where ERP was 5.0% or higher saw compound annual equity returns over the following five years average +11.8%. For years where ERP was 3.4% or lower, returns for the following five years averaged +3.2%. The historical data suggests that, precisely because markets are so anxious, U.S. equities are actually positioned to outperform over the next five years, whether a recession occurs in the meantime or not. For an investor concerned where share prices will be a year from now, this may not be very helpful. But for an investor who is able to ride out any short-term storm—and is prudently skeptical of their ability to get out and back into the market at exactly the right time—it’s a very useful metric.

The market fears a recession. The leading indicators that typically warn of a coming recession suggest that the market has gotten a bit ahead of the story. Even if those indicators are wrong, investors are wiser to look to longer-term trends than trying to game the shorter-term cycle. And those trends tell us that investors have rarely been better paid for putting up with risk and uncertainty, to the extent they can handle it.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Chovanec. No part of Mr. Chovanec’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC