Entering the final quarter of the year, it was hard to believe 2020 could possibly generate any more bold-print headlines. Then, over the span of a few days, the President tested positive for COVID; entered and exited the hospital; fiscal stimulus talks rapidly cycled between being on and off; and a host of controversies and debates ensued. Investors are surely asking, “Are we there yet? Are we past COVID?” Rather than speculate on the battle’s timeline between the virus and medical advances, we must assess the conditions as they exist, form a view of the future, and carry on.

Any assessment of the current economic and market environment encompasses many important issues, along with endless data points and opinions leading to confusion over what is important. Similarly, a complex work of art may have many interesting elements and interpretations, though often one central theme emerges. For example, in Raphael’s classic painting, School of Athens, 50 individuals are dynamically positioned throughout an expansive area. The placement of two men at the focal point under a beautifully lit archway indicates that they are perhaps more important than the others. Indeed, Plato and Aristotle—the men under the archway—are worthy of the attention.

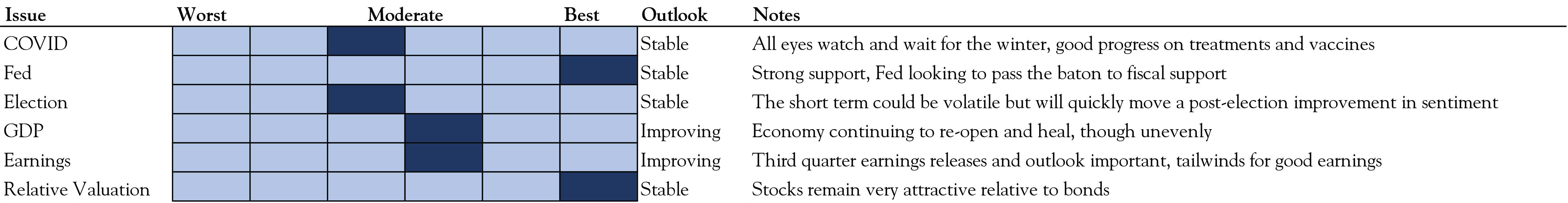

In the incredibly complex COVID investing climate, our focal point has been the metrics fundamental to investing: earnings and valuation. We aim to prodigiously consume data yet remain focused on developing a view on the few simple metrics that matter. Our roadmap has been as follows. COVID leads economic growth, which drives earnings and dividends. Inflation, interest rates, and sentiment play a key role in valuation. Election year politics influence how each is perceived and the 2021 policy agenda will play a role as well. Below we share our view on each.

COVID Continues

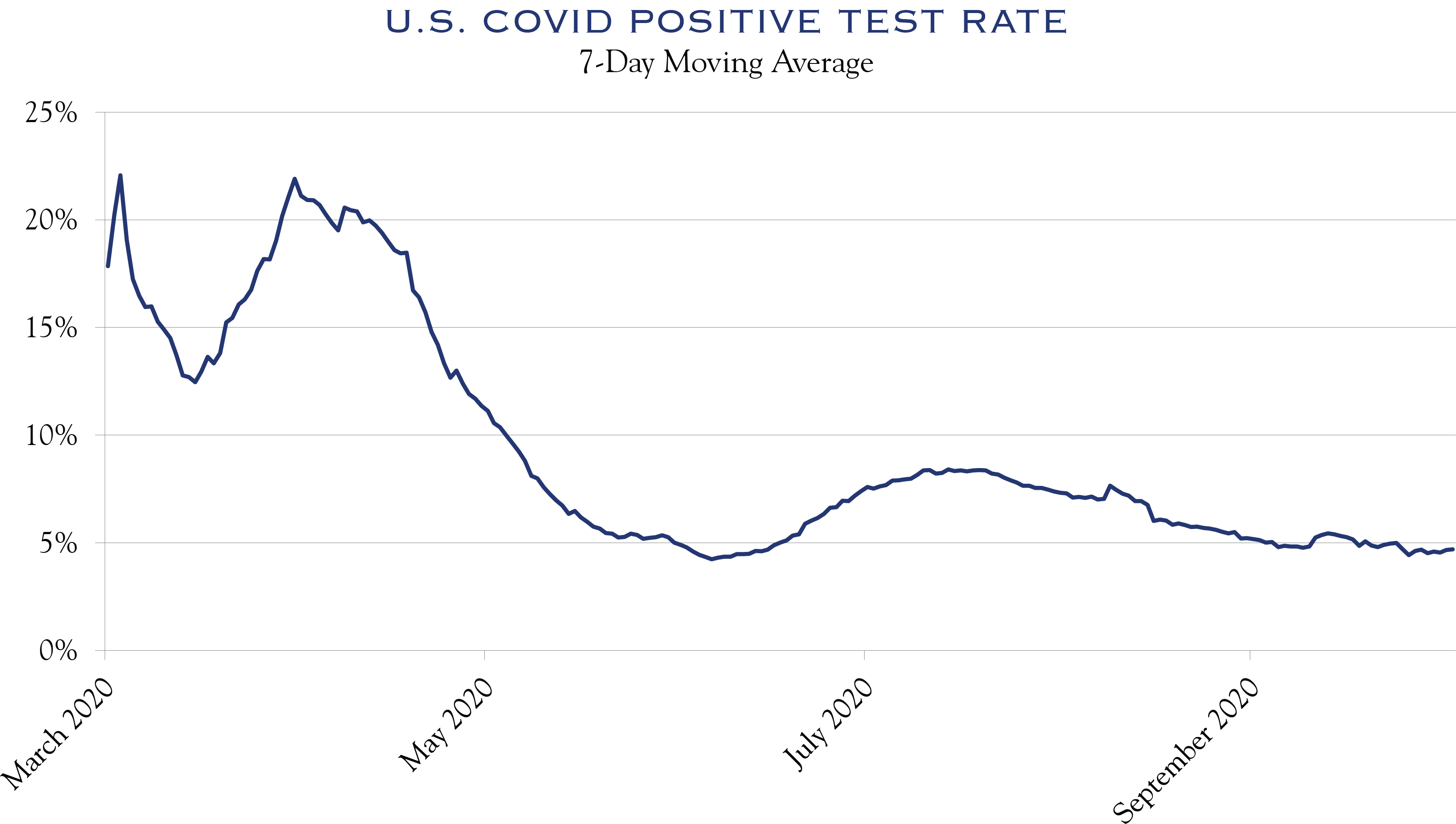

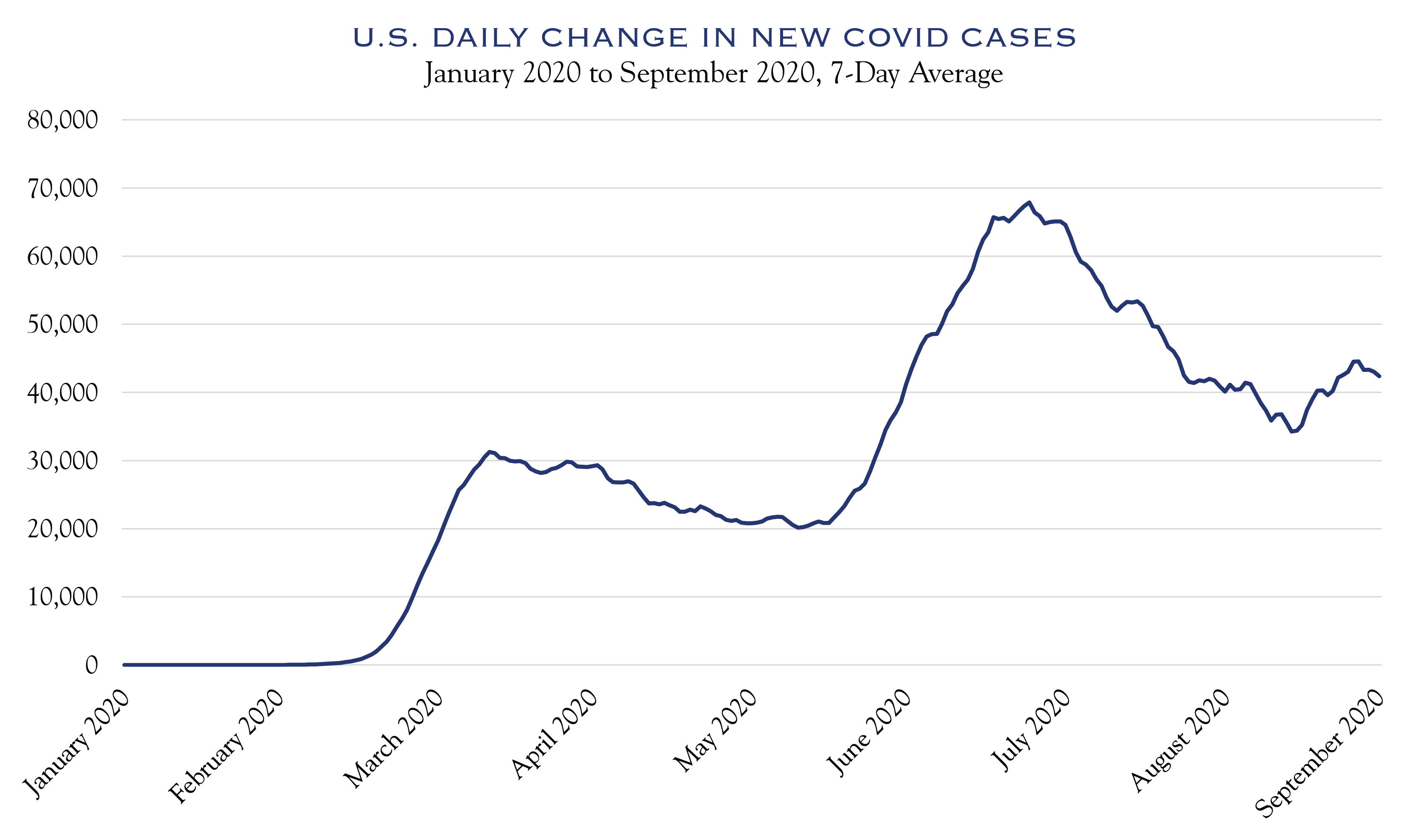

In a nation as large and diverse as the United States, it is perhaps not surprising that COVID has followed varying paths in different geographies. With cases remaining stubbornly high, test rate positivity has remained around 5% nationally for several weeks—not horrible but not great either. As we enter the traditional cold and flu season, all eyes will be on COVID cases. Individuals seem to be fatigued by COVID news. This is a marginal negative with regards to individuals remaining vigilant, though it is a positive for an eventual return to activity. While this will keep markets on edge, the positive underlying trends in vaccine prospects (now 11 candidates in phase 3) and progress on prevention and treatment are good reason for longer-term optimism.

Source: The COVID Tracking Project

Source: The COVID Tracking Project

A Tumultuous Election Year

As expected, election year politics are raising the volume on an already clamorous 2020. Every issue, from the response to COVID, to the economic decline and recovery, is being presented and perceived through a political lens.

The exercise of investing based on an election outcome is comparable to correctly guessing several coin tosses: “Who wins?” “What policies are implemented and when?” “What is the market reaction?” This is not a winning exercise.

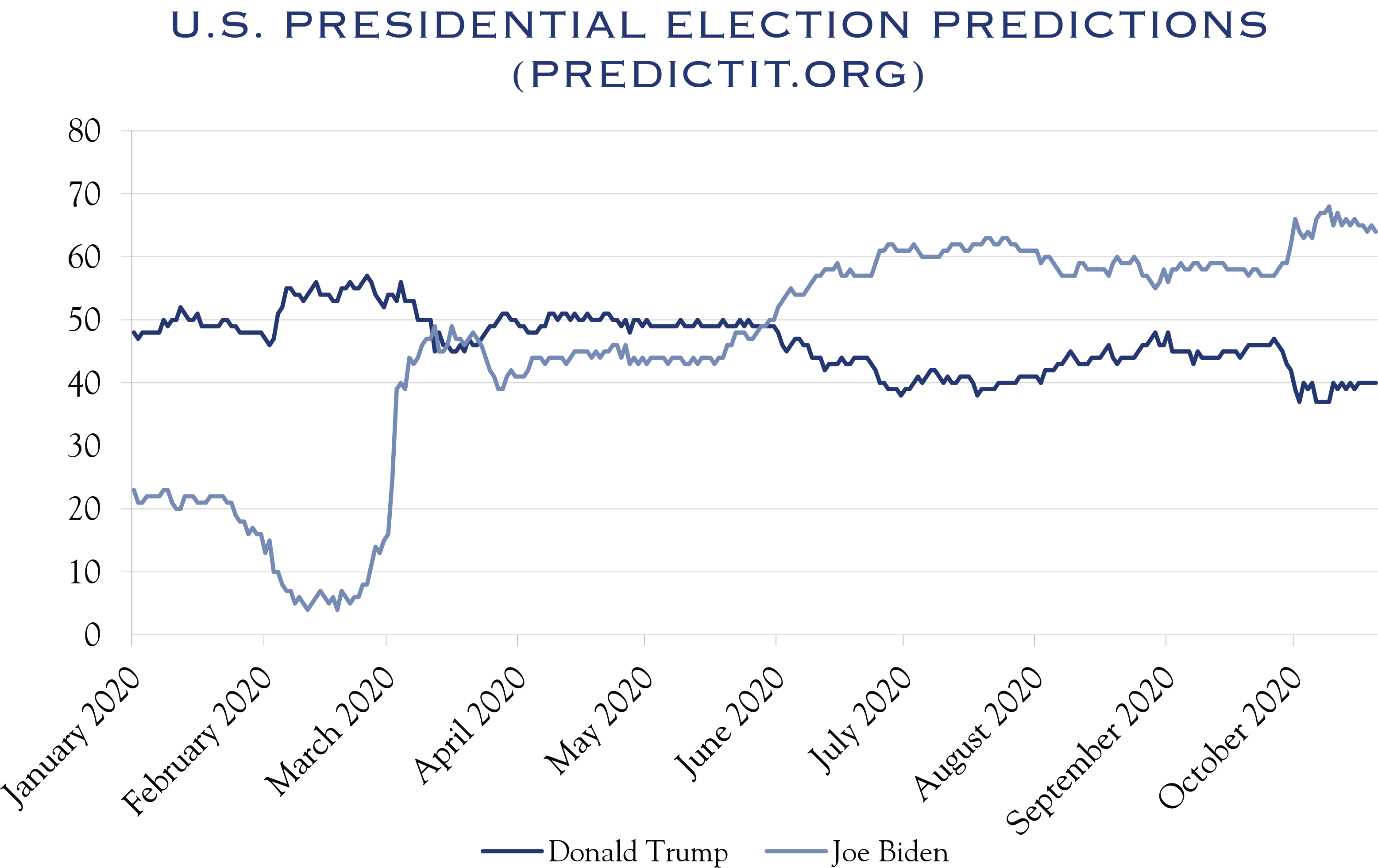

The year began with strong odds for President Trump’s re-election and Republicans holding control of the Senate. In fact, as recently as Memorial Day, predictions leaned towards Trump and Republicans. The race continued to tighten throughout the year, and in recent weeks polls and prediction sites have turned further toward Biden and the Democrats. Currently, the probabilities and polls point to a “blue wave” resulting in single-party control of both houses of Congress and the Presidency. Red or blue, it is fair to say that neither outcome would truly be a surprise.

Source: Bloomberg

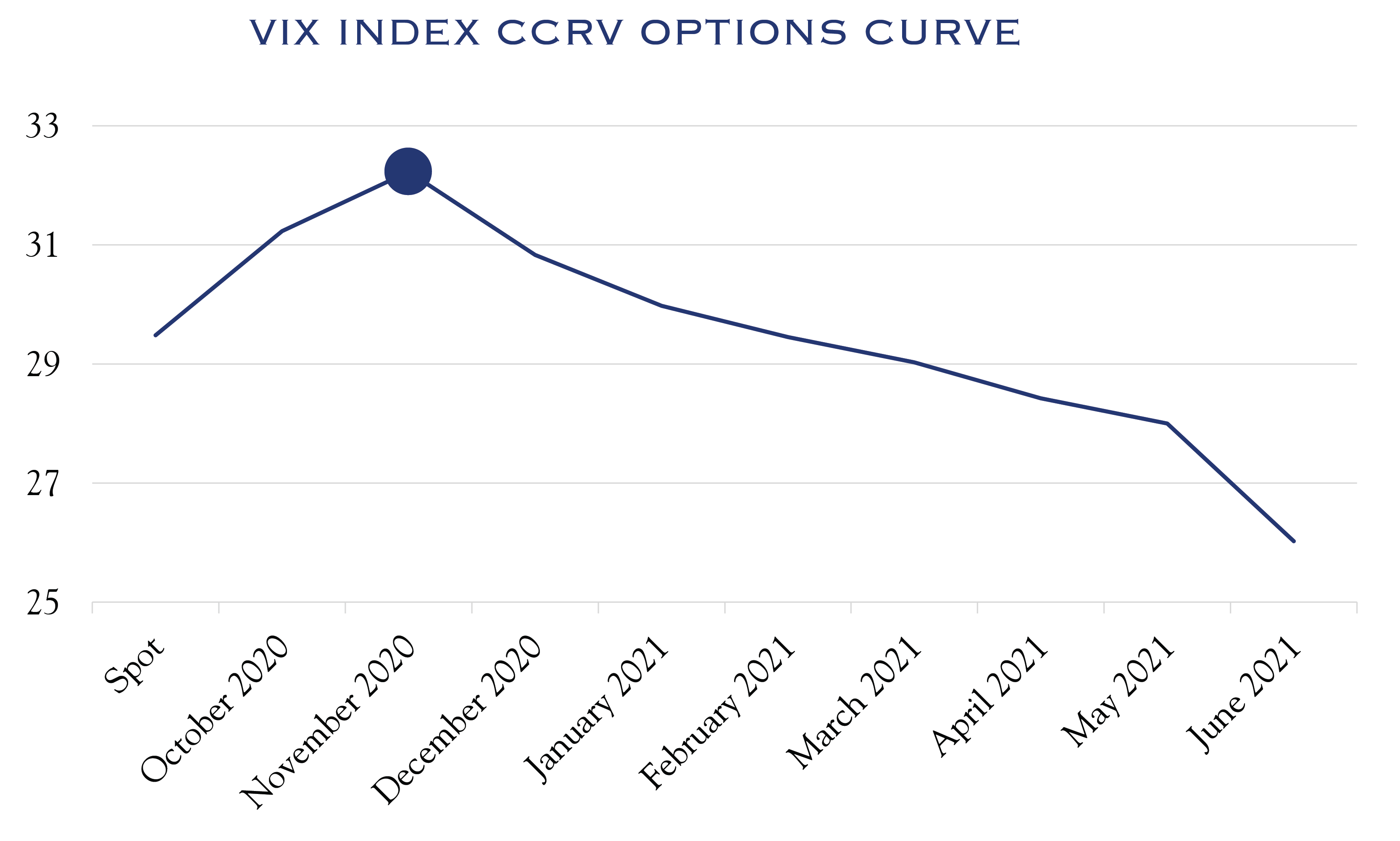

Given the twists and turns of the year, the imperfect nature of polls, and the new influence of a projected massive increase in mail-in voting, some anticipate a tumultuous conclusion to the election. This possibility is reflected by options pricing for the volatility index. In essence, investors are willing to pay more than usual amounts for risk protection in the period immediately following the election. Despite the polls and prediction sites moving strongly towards Biden, this premium for protection remains.

Source: Bloomberg

Nonetheless, there are strong and established procedures to drive the issue to a conclusion by the “safe harbor” date of December 8, 2020, when states must certify their electors for the Electoral College. Over time, the same elevated pricing of volatility declines as the election nears probable resolution.

Taxes

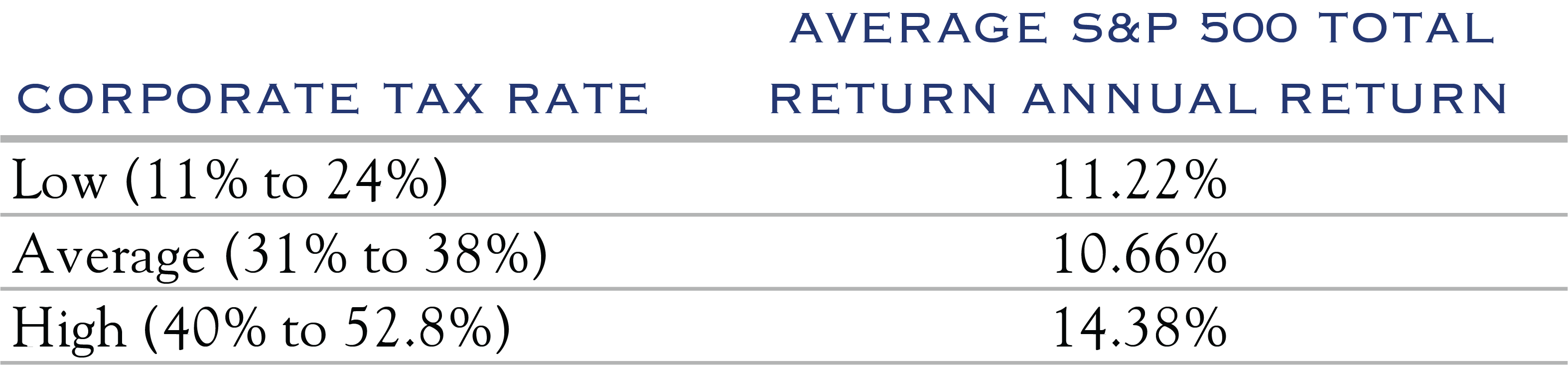

A “blue wave” of Democrats controlling Congress and the Presidency would likely result in a move towards tax increases for corporate profits and capital gains, although it is difficult to assess a timeline for these legislative priorities vs. COVID recovery priorities and agendas. Higher taxes are unfavorable for earnings, yet our research shows that other influences often play more important roles for investment results, making it hard to draw a clear line from higher taxes to worse returns. Tax legislation normally takes years to accomplish and major tax reform tends to occur once a generation.

Sources: Wolters Kluwer, Bloomberg

Regulation, Stimulus & Spending

Regulatory pressures are likely to increase under a blue wave scenario and this could put pressure on costs and revenues, pushing down earnings. It is also likely that a blue wave results in higher spending, perhaps on infrastructure or “green” projects. It must be noted, however, that Trump and the Republicans have hardly been exemplars of fiscal probity. Whether these types of projects bring robust benefits and whether government is best positioned to execute this work are open political questions. However, the spending would likely accrue benefits to some segments of the economy.

A government that increases borrowing more quickly than it is growing the economy creates a long-term problem. For now, Treasury and the Fed remain focused on economic growth and recovery, with deficit issues taking a spot on the back burner. The objective has been to support industries and individuals so as not to damage economic capacity.

Increased spending is often marginally inflationary and could put some modest downward pressure on the dollar. A slight uptick in inflation could benefit cyclical stocks, and with a steeper yield curve, would be favorable for banks. Each of those sectors are heavily represented in value indices. However, this outcome is highly dependent on the magnitude and type of spending.

The pace of organic economic recovery will continue to play the leading role. In upcoming quarters, that growth is likely to remain strong, particularly as the pandemic comes under further control. Nonetheless, longer-term trends for slow, positive growth will eventually resume. So long as those trends are in place, companies that are able to generate organic growth in revenue and earnings will command a premium. For that reason, we maintain diversification across investment styles and sectors.

Sentiment

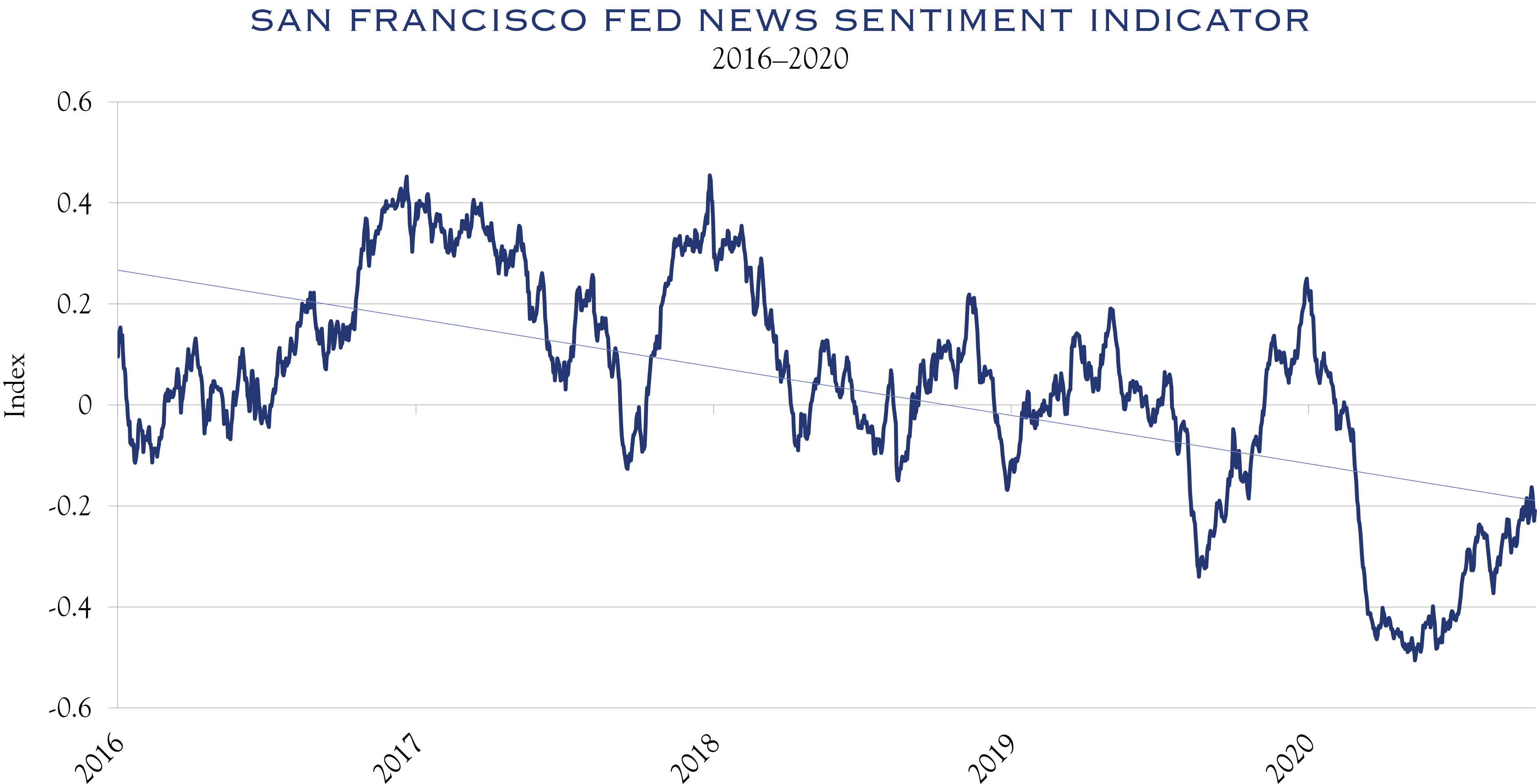

Sentiment is a possible offset to the marginally negative influence of tax and regulation on earnings. Simply put, the conclusion of the election season—in either direction—should lift sentiment. This is a typical short-term pattern as investors “wait and see,” and then resume normal investment activity when the election has concluded. Life, and investing, can only be put on hold for so long. It is interesting to ponder sentiment in a more robust manner, such as work conducted by the Federal Reserve Bank of San Francisco. Their daily news sentiment indicator is compiled from 16 major news publications. Sentiment has been trending down for several years. A reasonable hypothesis would be to attribute this to a highly volatile and fragmented news environment. Markets hate uncertainty, and it is likely that a post-election environment would be more stable than a pre-election environment, allowing sentiment to trend higher.

Source: Shapiro, Adam Hale, Moritz Sudhof, and Daniel J. Wilson. 2020. “Measuring News Sentiment.”

Overall, if there are no changes in control of the White House and/or Senate, divided government will mean minimal new policy changes. All else being equal, this is favorable for the tax and regulatory outlook. A blue wave would create change, although it would not be a surprise and may not be as negative as some investors often perceive. In our estimation, some of the potential negative tax and regulatory issues could be offset by a stabilization of sentiment. Regardless of timing or election results, it is highly probable that at least some further fiscal stimulus will emerge.

Overall, while politics are interesting and important, we believe the main focal point will be the economic recovery’s capacity to propel earnings growth in 2021—followed closely by low interest rates that will enable multiples to remain elevated.

The Economic Recovery is Progressing

Global economies, industries, markets, and companies have come a long way from the nadir of activity in the United States this past April. Now comes the hard part—recovery for the most disrupted areas, preventing temporary job loss from becoming permanent. At a recent event for the National Association of Business Economists, Fed Chair Jay Powell referred to this as a “slog.” The longer the slog, the more emphasis is placed on balance sheets in disrupted areas; this is an advantage to active stock selection.

Much of the remaining recovery requires healing the most disrupted segments—industries such as restaurants, travel, and hotels. It won’t be easy, and it may not be quick. It may elicit additional stimulus spending, either soon, or in 2021, or both. With additional spending comes additional scrutiny on inflation.

Money supply growth has mainly been primarily focused on income replacement, debt service, and debt restructuring (extension of maturities)—all by design—and is not likely to enter the economy in an inflationary manner, as it would if it directly targeted increased spending. At some point, likely in 2021, and dependent on the election outcome, excessive spending may create some narrow inflation pressures. Nonetheless, longer-term established trends such as demographics, labor market dynamics, the prevalence of technology, and global competition will prevail. As of now, we believe any inflation is likely to be muted and short-lived.

In the press release from the September meeting of the Federal Open Market Committee (“FOMC”), Chair Powell said, “The path of the economy will depend significantly on the course of the virus.” We concur.

Full recovery will be a challenging climb, but it is happening. For example, while the services portion of the economy is well below prior highs, the goods portion of the economy is nearly back to normal.

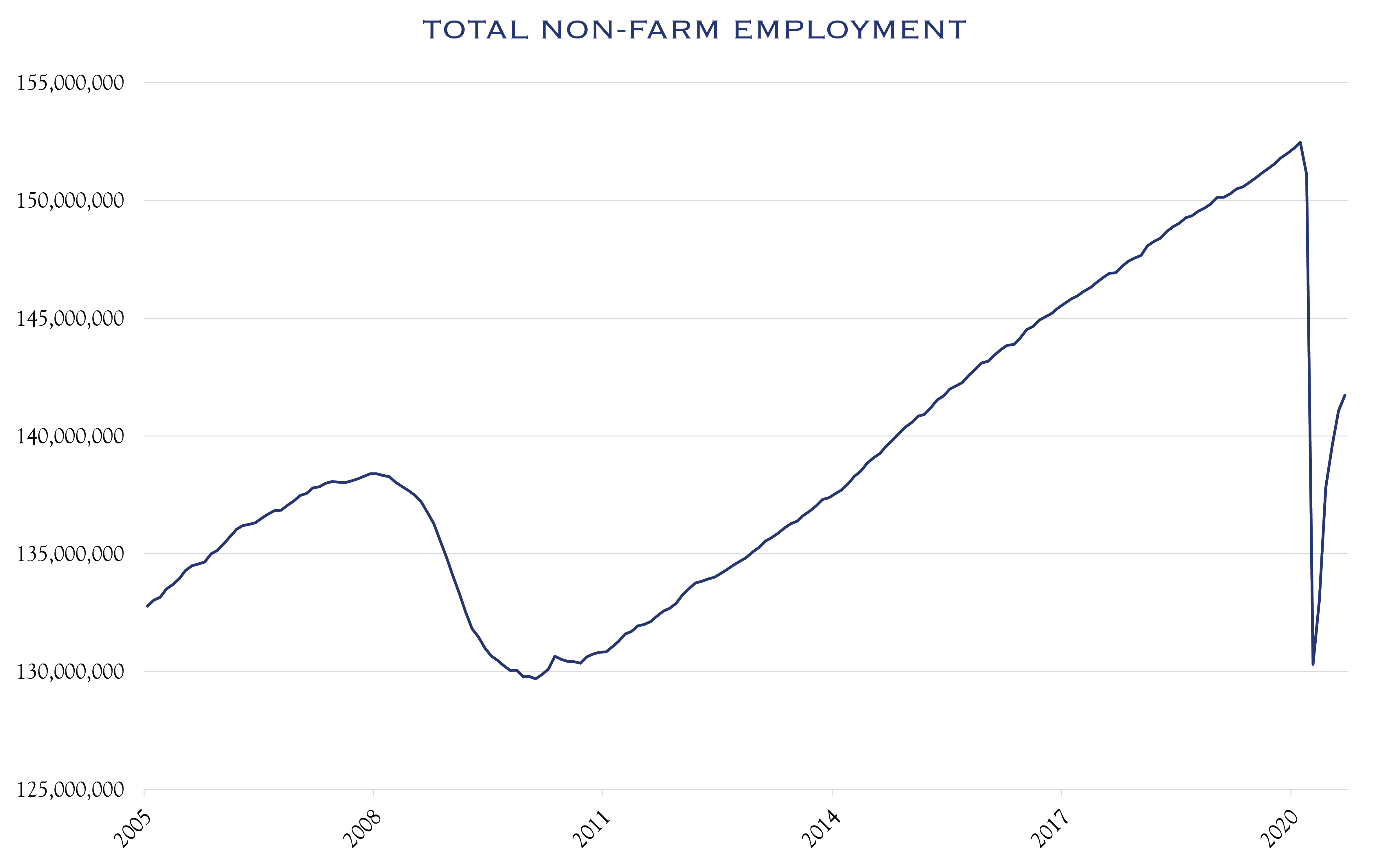

The unemployment rate of 7.9% and total employed numbering 141 million are reminders that the economy is well below peak potential. The employment situation has seen disparate effects from COVID. Employment in the bottom 25% of wage earners (often in leisure and hospitality) has declined by −21%, while the rest of the job market has seen much lower losses of −4%. In aggregate though, a Fed survey in July reported that 77% of respondents felt “OK” or “comfortable” with their financial situation, a level very similar to pre-pandemic responses.

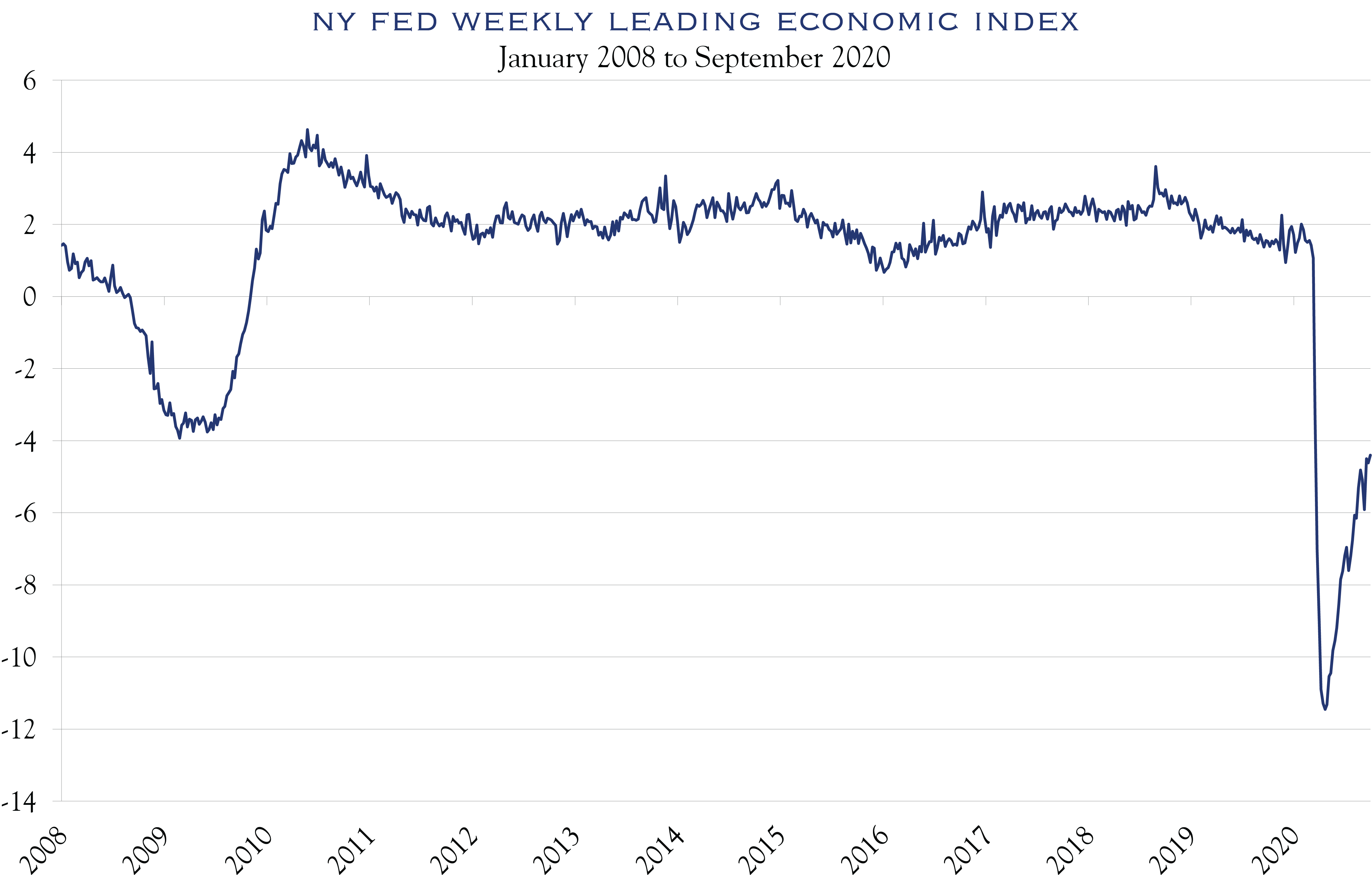

Bank data continue to show that spending is running at about 95% of prior year levels, and the New York Fed Weekly Economic Index shows the economy operating at about 96% of prior year. Interestingly, new business formations are up significantly over the prior year, showing the entrepreneurial spirit throughout the country. Overall, the path forward is one of progress and markets will continue to focus on the favorable, albeit choppy and slow, direction of travel.

Economic Assessment

Source: Bloomberg

Source: Bloomberg

The Weekly Economic Index from the New York Fed estimates the level of economic activity relative to prior year. The current reading shows an economy running at about 96% of 2019. The total number of employed is an excellent gauge of the size of the consumer-focused U.S. economy. While there have been significant improvement, this reading remains well below peak levels. Combined, these metrics show an economy that has seen a lot of improvement from April, but also has requires much recovery to attain prior peak levels.

Source: MacroBond

Source: MacroBond

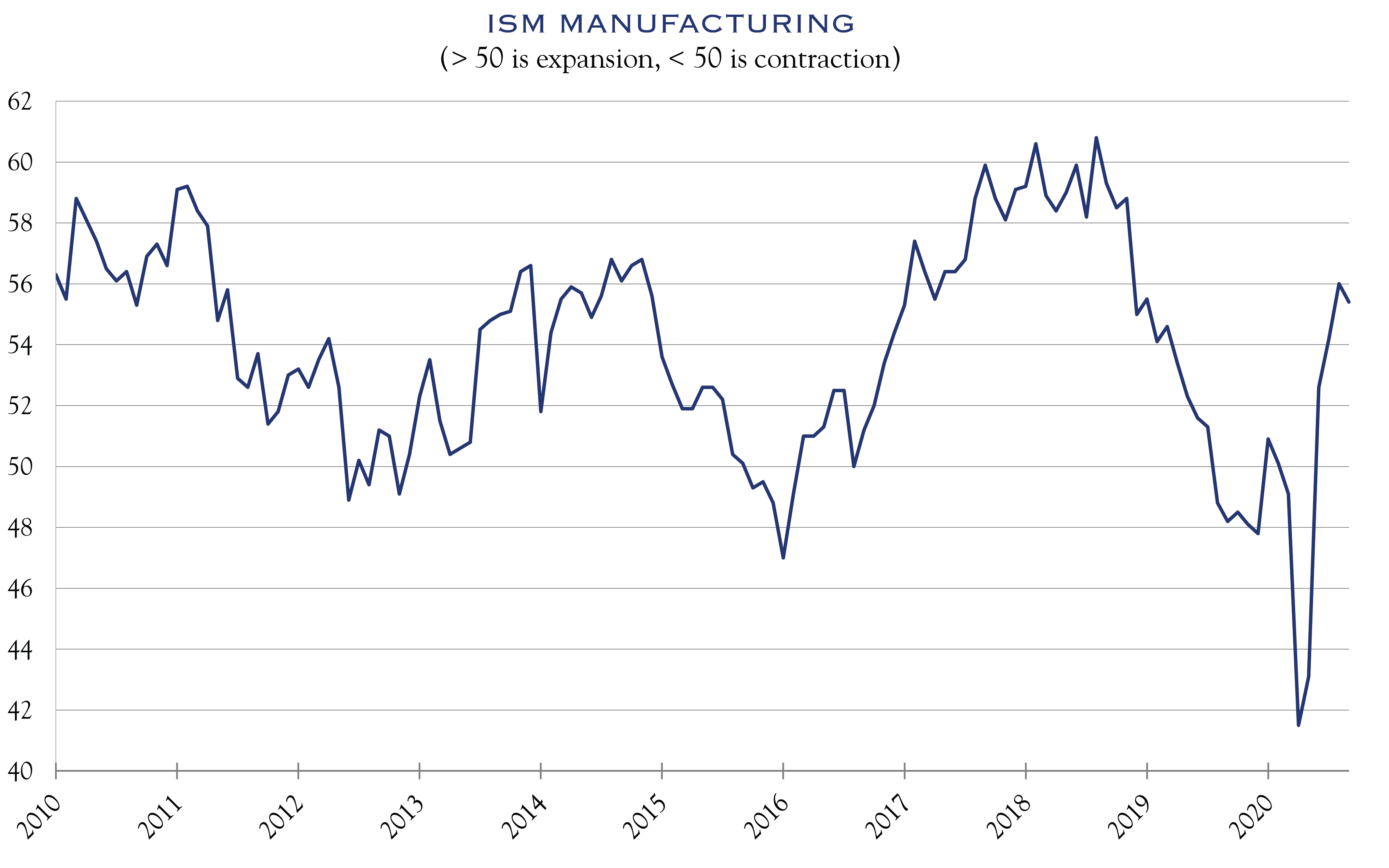

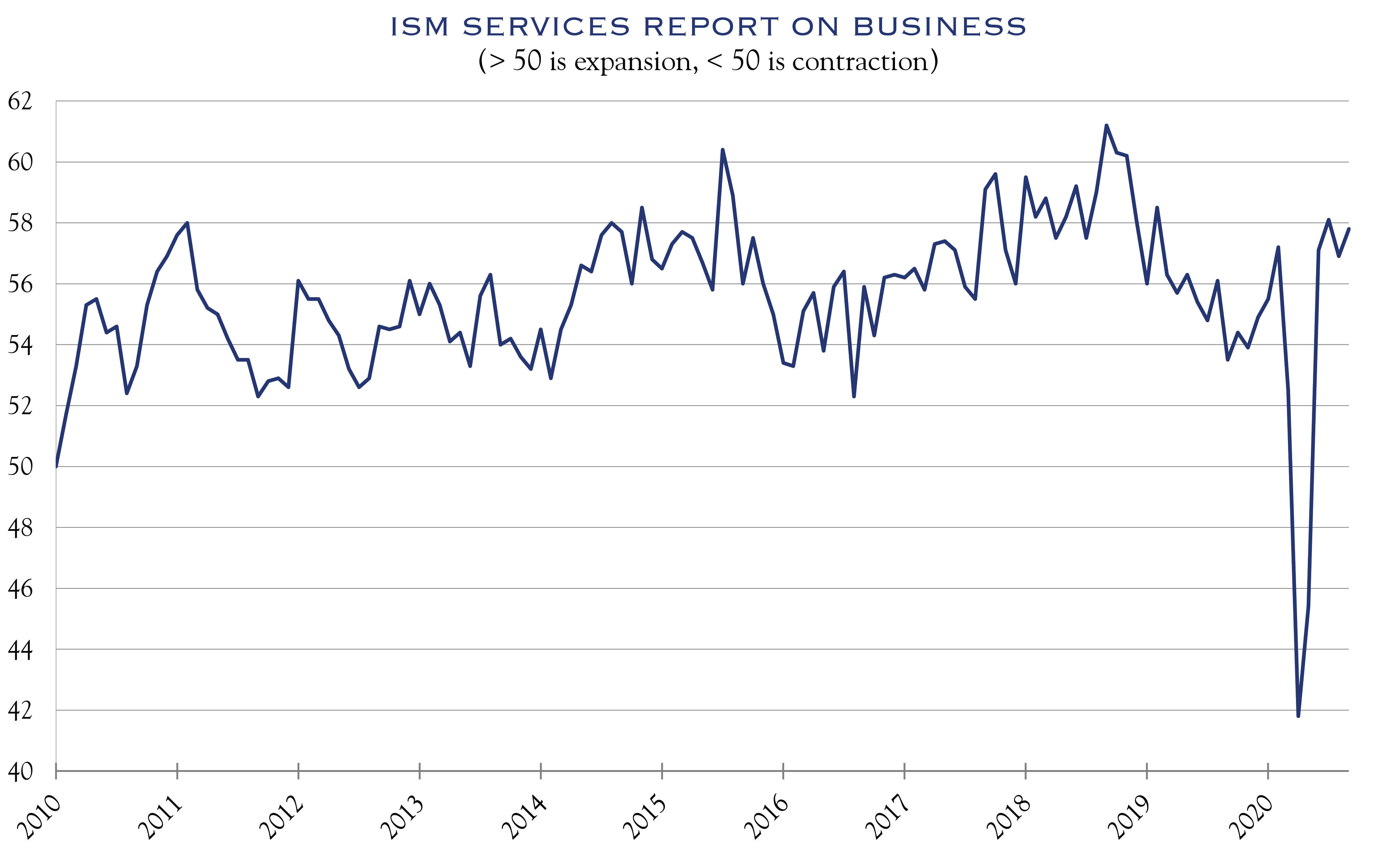

The ISM indicators for manufacturing and non-manufacturing (services) show that economic activity is in expansion mode (a reading of greater than 50 is expansionary. Comments from the ISM surveys reveal views that vary widely by industry. This is also indicative of good progress, albeit with more ground to travel for a full recovery.

Markets—Off to the Races?

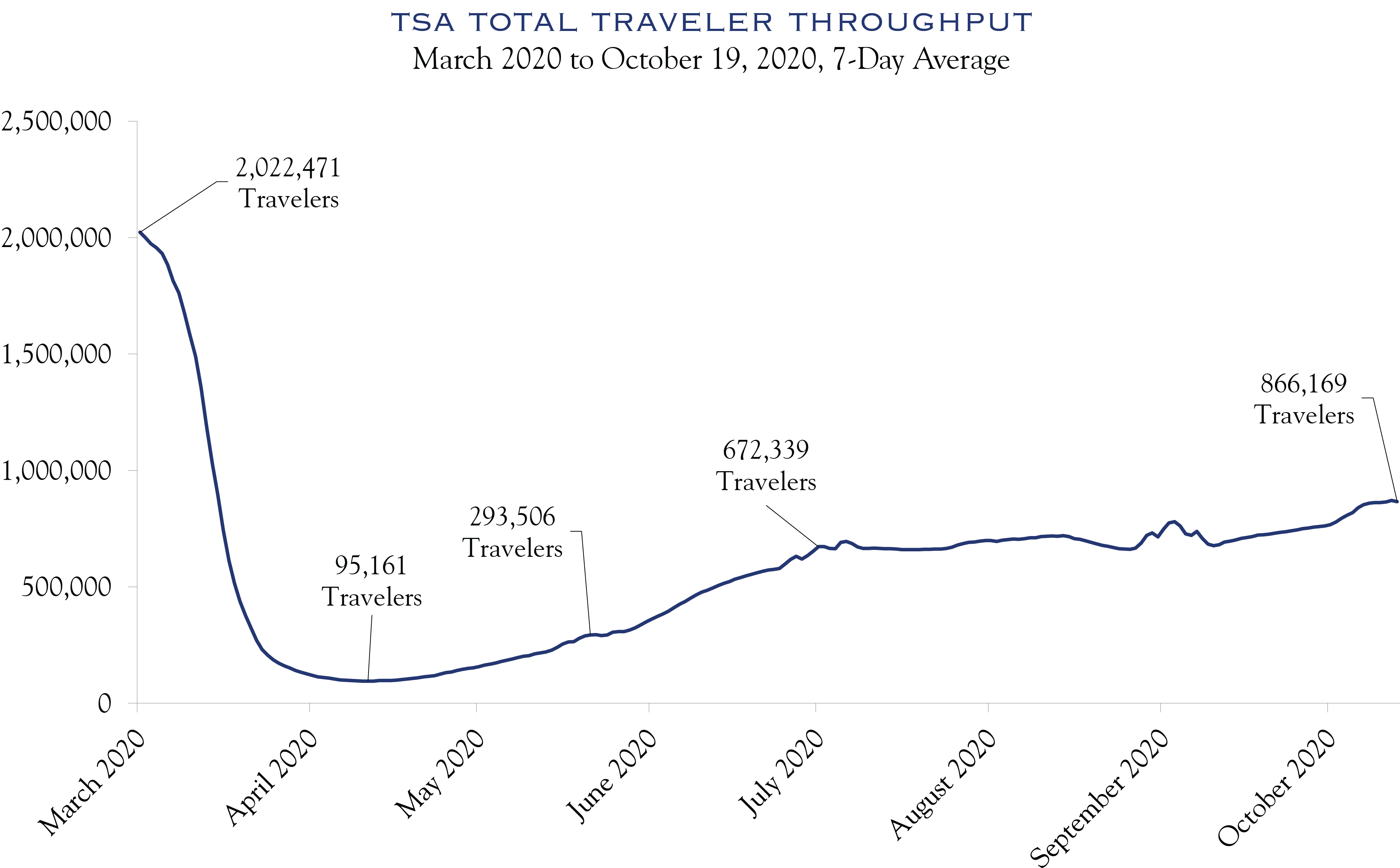

Source: TSA

Traveler checkpoints at airports, as measured by the TSA, are a useful gauge on consumer attitudes regarding income and confidence in the nationwide health situation. The most recent week of data included the most travelers at any week since March—another sign of improvement—though this metric remains well under 50% of the level from last year.

Source: Bloomberg

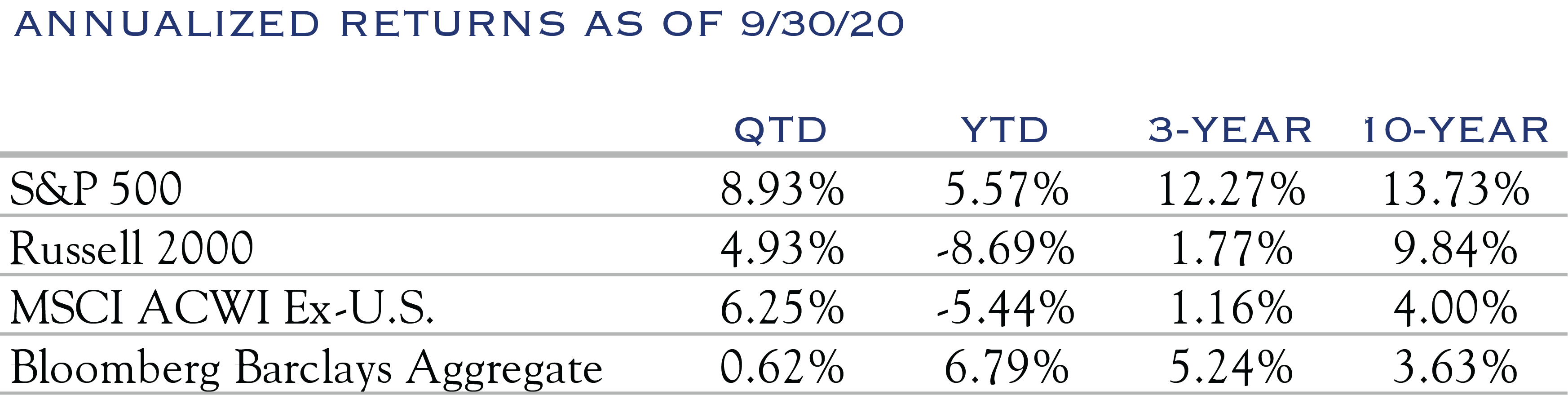

Despite a decline in September, equity markets posted a strong third quarter. Economically sensitive sectors improved, coincident with continued progress in gauges of activity and recovery. It is tempting to read this as a sign that markets are off to the races. It is equally possible that the fourth quarter is akin to the traditional third leg of horse racing’s triple crown—The Belmont Stakes—long, hard, and unpredictable. Signals are never clear and simple. Cautious optimism and patience for a modest time horizon along with reasonable expectations are the core of our thinking.

Earnings Outlook is Encouraging

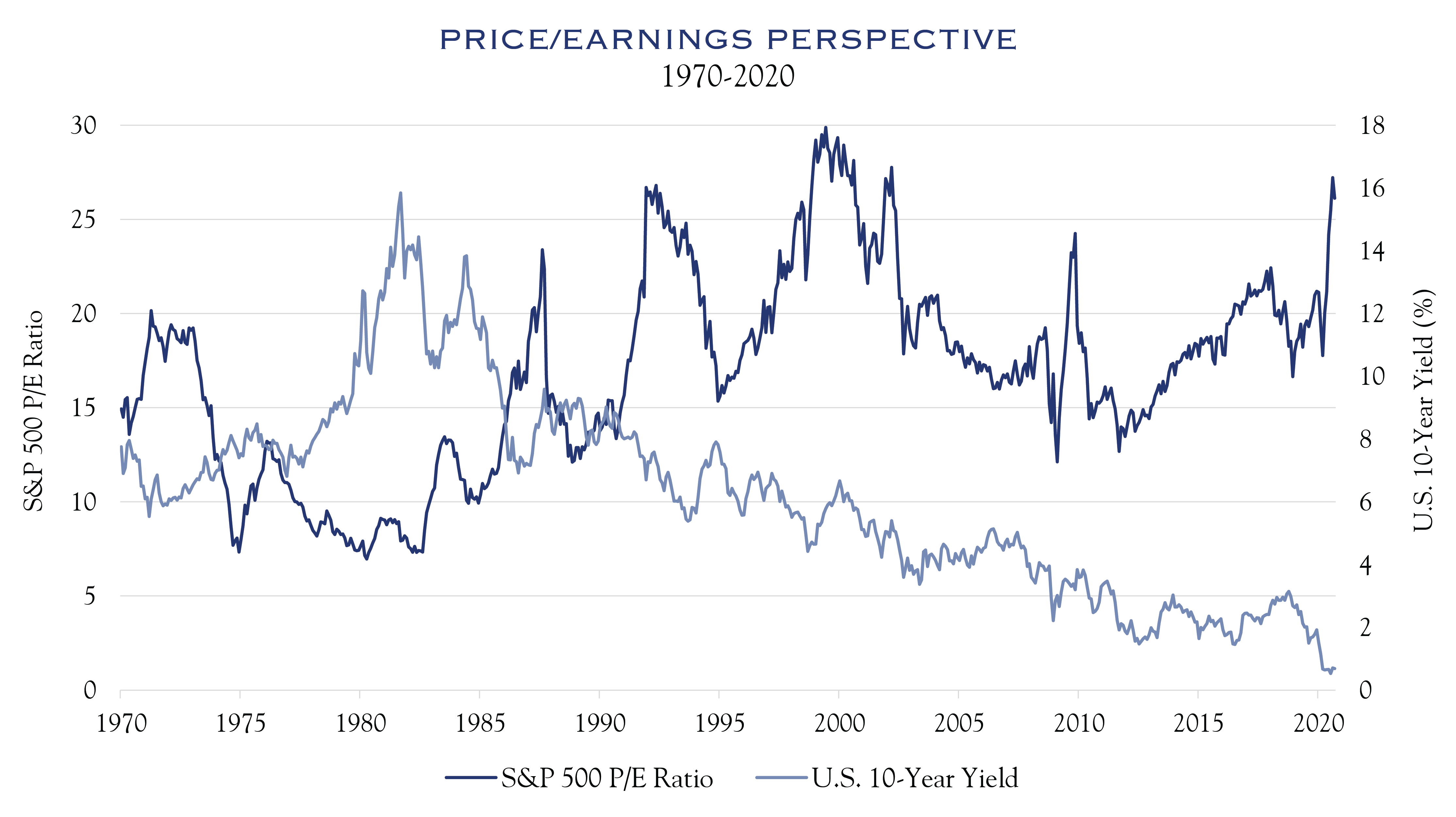

As we look ahead to 2021, we see an economy that is on the mend and progress against COVID. With the economy running at about 95% of 2019, and favorable tailwinds for growth, we expect 2021 to see earnings for the S&P 500 at a level comparable to 2019. This would put earnings around $155-165. Longer-term earnings growth is likely to resume at a level slightly below the long-term trend of 6%. Our expectation is 5%. This rate of earnings growth, paired with a dividend yield of around 2%, and an expectation for stable to rising valuation metrics, leads us to an expected return of 7.5% annualized return over the next three years for U.S. equities. The chart below shows the long-term relationship between low interest rates and higher valuation multiples. While there are some pockets of excess, U.S. stocks offer a favorable earnings outlook, a dividend that is compelling in comparison with risk-free rates, and the potential for rising multiples, particularly as COVID recedes and news allows sentiment to rise as it typically does on the other side of tumultuous times.

Source: Bloomberg

The environment in 2021 is likely to see periods of rotation into segments that are more cyclical and recovery oriented. Areas outside the U.S., particularly those with strong underlying growth trends, will also likely see capital allocated in their direction. Thus, it is probable that 2021 sees more segments of the market participating in recovery. This breadth should allow for continued success by talented stock selectors. For many years, any diversification away from U.S. large cap growth was painful. Looking ahead, we believe the outlook is favorable for broader swaths of the market—especially if care is taken regarding quality and stock selection.

Economic & Market Outlook

Through year-end, there will be excessive noise and news surrounding the election and COVID. Amidst this noise, our focal point remains on the fundamentals: economic growth, earnings, and valuation. As the calendar turns to a new year, our expectation is that conditions in the economy will continue to improve, perhaps in an uneven manner. Over time, the election and COVID will play a diminishing role for sentiment. This backdrop will be favorable for modest levels of risk—consistent with investment objectives—and favorable for investment research focused on individual companies.

October 14, 2020

Robert Teeter

Managing Director

Investment Policy & Strategy Group

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC