Rotation reigned in May with COVID winners in large cap and technology taking a back seat to small caps and cyclicals. The economic environment supports the leadership change, as most data were quite strong.

Consensus GDP estimates expect 6.5% growth for 2021 and over 4.0% for 2022. These figures are strong, and while this year is largely a cyclical recovery following the pandemic, next year’s estimate also ranks among the highest in the past 30 years.

Reports on manufacturing and services from the Institute for Supply Management (“ISM”) continue to show an expanding economy, although they are still facing some logistical and supply challenges resulting in delayed delivery times for certain goods. A multitude of these issues are consequences of COVID imbalances, while others are one-off events, such as the shipping slowdown in the Suez Canal.

Jobs are returning at a quick pace, though perhaps not as fast as expected, or hoped for. Many issues in the labor market are also related to COVID. Employers cite lingering health concerns, disruption of school and childcare, career change friction, and robust stimulus benefits as reasons why it’s been difficult to hire workers immediately. Those complications will resolve in the coming months, and we expect continued improvement in total employed, though even a swift pace will not see a return of “full employment” until sometime in 2022.

Inflation is perhaps the most important metric to watch today. Price increases are readily visible in many areas. Given the current massive economic cycle and recovery from COVID-induced deflation, that is not a surprise. Our goal is to assess whether inflation is spiking, spreading, and sticking around. Briefly, we see some narrow areas with price spikes, we don’t detect widespread inflation across a high proportion of prices in the key Consumer Price Index, and we conclude that many pricing challenges will be met by innovation and productivity and will not stick around.

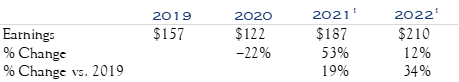

As for stocks, our earnings and valuation framework shows potential for continued gains, mostly driven by earnings growth. Gains in earnings have been spectacular. Consider that S&P earnings in 2019 were $157 on a per share basis, before dipping to $122 during pandemic-influenced 2020. Forecasts for 2021 include earnings of $187, a gain of nearly 20% as compared with 2019’s “normal” figure. The anticipated consensus is a +12% earnings gain for 2022. These gains have outpaced the economic recovery as GDP approaches pre-pandemic levels—a primary reason for expanded margins. While productivity is a difficult metric to measure, companies are finding a way to do more with less.

Source: S&P Global | 1 Estimates

Our earnings forecast is based on continued economic growth at or above trend levels through 2022, combined with the persistence of elevated margins. We currently project $200–210 in earnings, coinciding with consensus expectations.

While valuation multiples are elevated against historical averages, continued low interest rates provide valuable support. With respect to valuation, we consider and assess several metrics across fundamentals, sentiment, and policy with a current and forward-looking lens. We reference those conditions versus history to determine the appropriate valuation level. Today, we factor in modest concerns over inflation, a mild interest rate environment, sentiment that is bullish but not overly so, as equity risk exposures remain modest. Policy risk linked to tax law exists, though the more traditional and somewhat predictable pace of legislation is positive. The geopolitical environment is perpetually volatile, though we perceive no immediate or significant risks. Overall, these conditions are slightly better than the long-term average and align with current ~20x PE multiple valuation levels.

A normal correction of unknown origin always remains quite possible, especially against a backdrop of strong gains. As such, we remain advocates of rebalancing and pro-actively reviewing portfolios to ensure risk levels are consistent with risk tolerance.

Our outlook is greatly influenced by the earnings picture. We believe it is strong and will remain so. Nonetheless, stock selection is critical as this is the primary way to uncover which companies have been able to enhance productivity and margins. While the rate of change will slow, productivity and margin gains against a strong economic backdrop will continue as the key drivers of earnings and stocks.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC