Picking Up the Pace

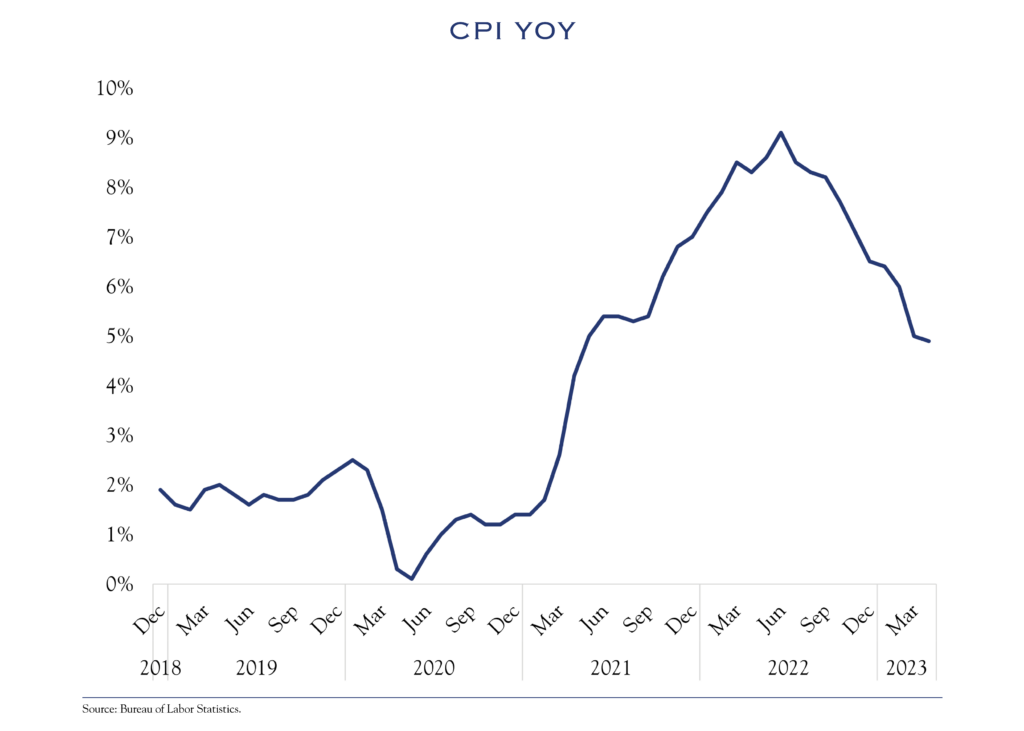

America’s cherished pastime, baseball, is traditionally hailed for its languid pace of play and lack of a clock. That changed this season as baseball introduced a clock and other modifications to quicken games, earning largely positive feedback. Less welcome is the increasing cost of America’s iconic food items—hot dogs and apple pie. From December 2019 to April 2023, food prices have surged +23%. Few areas were spared, as the year-over-year rate of inflation peaked at +9.1% in June 2022.

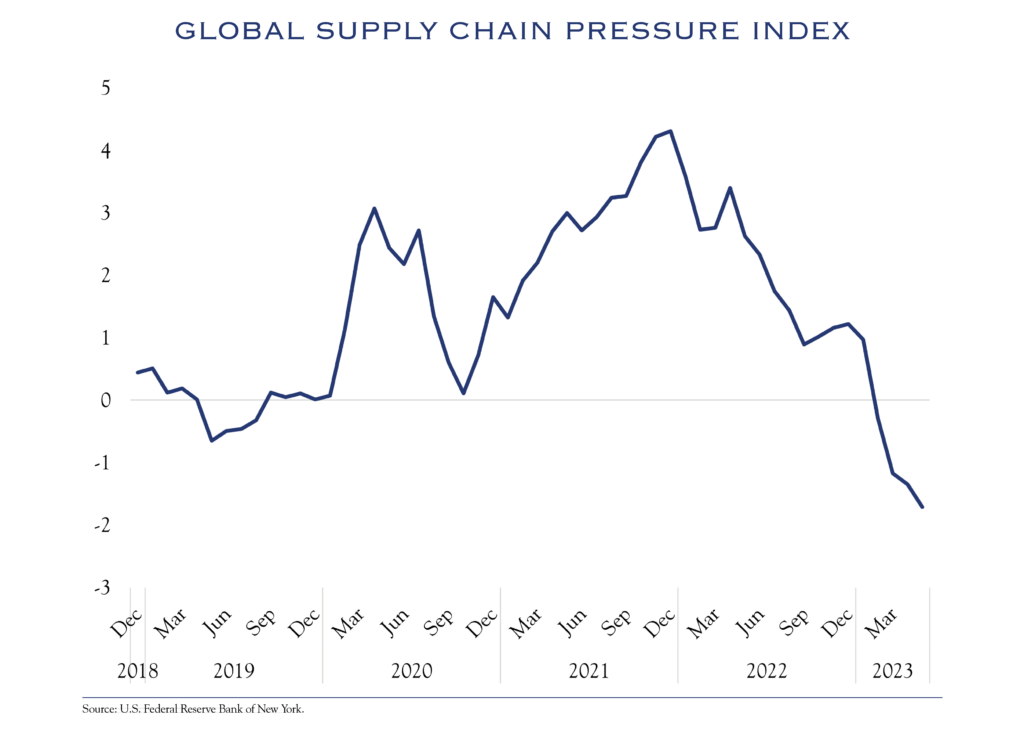

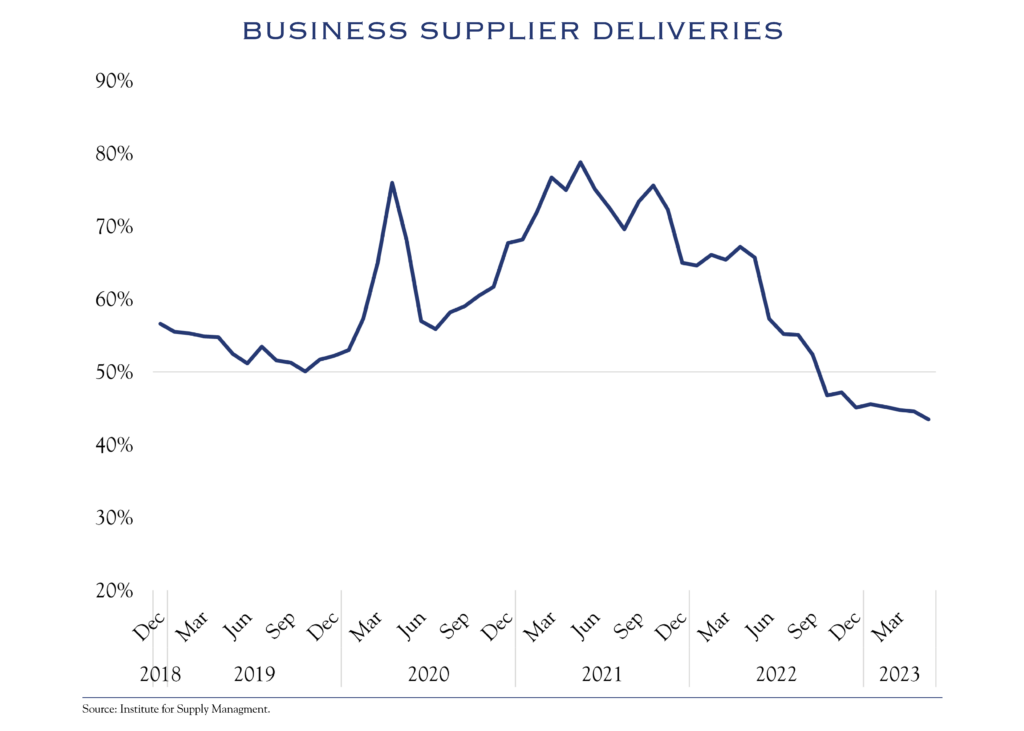

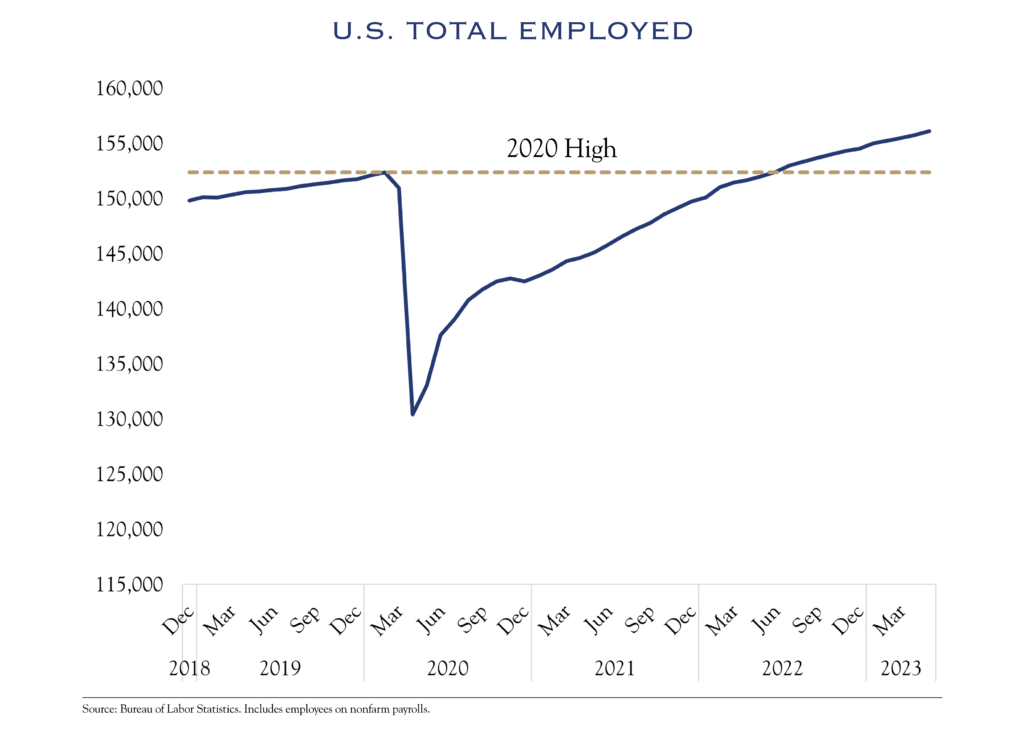

Perhaps this is simply the price to pay (literally) for a new and improved economy. After all, wages climbed +18% during the same period, and the total employed in the United States rose above 156 million for the first time in history. Labor participation is up as well. And those food prices? After rising for 23 months, they are starting to ease. Overall, prices are stabilizing in the economy. Supply chains are healing along with improved supplier delivery times. The economy might be more expensive, but it is beginning to move faster.

Getting a Bit Better

Rampant pessimism reigned regarding the economy, inflation, and earnings to kick off 2022. Those views turned more dour with the arrival of stress in the banking system.

For now, most signs point to lending stability, a key economic driver. We do expect some drag, however, from stress and friction in the banking system. The economy also will have to reckon with lower valuations in some segments of commercial real estate. However, differences in property type (office or warehouse or data center) and the age-old maxim of “location-location-location” means that the range of outcomes will be wide, with the worst outcomes concentrated in a handful of narrow segments, mainly lower quality properties in less desirable locations.

The economy is growing at an estimated annual rate of +1.5% based on real-time economic models, spending and mobility data, and earnings reports. Despite ongoing recession predictions, the labor market’s strength is fueling ongoing stability in the economy. Monthly gains in payrolls averaged 266,000 over the past three months. Similarly, job postings have remained elevated, increasing in the past month from 9.7 million to 10.1 million according to the JOLTS survey (though there are divergences across categories). The head of the Philadelphia Fed described conditions across three segments:

- Skilled labor, such as construction and nursing, is quite strong

- Unskilled labor, often in service industries such as hotels and restaurants, has returned to a more balanced condition, as companies are substituting capital for labor to close the employment shortfall

- Professional services, like technology, have seen job cuts, though laid off workers are being re-hired rather quickly

Inflation

Recovery in supply chains and inventories means a return of price competition, evident in survey data and transcripts of earnings calls. At a recent conference, management from one private equity firm spoke of cost conditions across their portfolio of hundreds of companies and thousands of employees. They noted that input costs were now rising only +2.0%. Truflation, a real-time inflation tracker, points to a current rate of inflation of +2.9%. The progress on inflation has been rapid, and while the Fed won’t hit its 2.0% target in the immediate future, all signs point in the right direction.

Earnings

During the first part of 2022, investors were concerned that earnings would collapse. While earnings have declined a bit, they have been much better than expected. Likewise, margins continue to be better than anticipated. Companies have admirably managed rapid changes in demand patterns and pricing dynamics. Better data is surely one part of the success story. Looking ahead, we expect slow economic growth to weigh on demand for companies. However, usage of data analytics, artificial intelligence, and robotics are all reasons to believe that companies will find innovative techniques for driving productivity and protecting or expanding margins.

As inflation cools, the Fed will gain flexibility for setting rates. We believe a pause is imminent and expect the Fed Funds Rate to remain steady over the remainder of the year until inflation is closer to the Fed target of 2.0%. Inflation is clearly trending in the right direction and, as that improvement continues, we expect modest increases in equity valuations.

One criticism of recent gains in stocks is that the market has been “narrow,” with gains concentrated in a small handful of winners. That’s a typical configuration in times of market stress, and we attribute the narrow advance more to concerns over the U.S. debt ceiling than to a lack of confidence in equities. In recent days, market breadth has improved as stress about the debt ceiling has waned. We expect to see a continuation of that trend with more stocks advancing.

Outlook

The second half of the year is likely to see more of the same on the economy—a slow rate of growth, hovering just above zero, and supported by a strong job market and consumer. The improving inflation rate will help bonds to continue to rally and equity valuations to improve. That valuation improvement should be especially pronounced in small cap stocks, as gains broaden out now that the debt ceiling issue is resolved. Earnings may remain stagnant, though dispersion could become quite extreme as some companies will be better at implementing technology to reduce costs and increase margins.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC