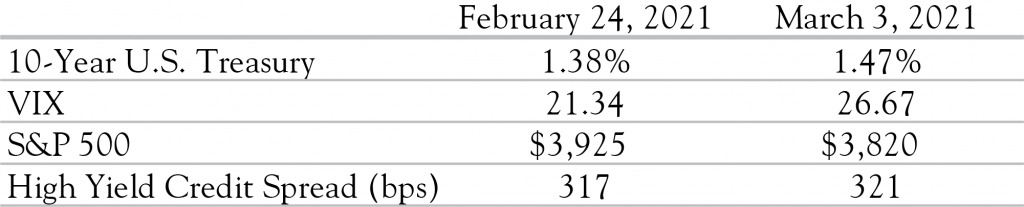

March brings volatile weather, volatile markets, a new vaccine, and a new concern for markets—rising interest rates. Bonds and stocks sold off together in recent weeks; this is a relatively uncommon outcome. Typically, investors buy bonds for safety during periods of market turmoil. That turmoil made itself present in the VIX index—a measure of volatility—which rose during the month. Despite the volatility, credit spreads remained firm, indicating a lack of concern over the economy. In other words, all signs point to rising interest rates as the likely culprit for the recent dip in stocks.

Sources: Bloomberg, U.S. Treasury, CBOE

Some inflation concern is rooted in fear of significant fiscal spending, such as Congress’s planned $1.9 trillion stimulus package. An expansionary monetary policy adds to these fears. If passed by Congress, the stimulus package would compound the already substantial government spending related to the pandemic. For perspective, the most recently proposed package represents about 10% of total U.S. GDP. Some elements are intended to offset COVID damage, while others are not so clearly linked. Monetary policy has been similarly aggressive, with the M2 metric expanding by $4 trillion since January 2020, an increase of 25%. It is a significant increase, representing about 20% of GDP. The increased liquidity was made to help offset economic loss during the pandemic, but investors are now correctly scrutinizing the level and location of stimulus and its effect on inflation.

Where will the spending take place? There are significant differences between capacity constrained industries that are likely to see price increases versus those that have elastic supply curves. The U.S. economy is resilient and flexible, possessing a flexible supply curve in many areas. Further, the structural traits of global competition and ease of price comparison will help avoid any sustained and significant increases in general price levels. There are certainly pockets of price increases—most prominently in financial assets and commodities. This makes good sense: COVID created a widely disparate set of outcomes across industries which ultimately results in varying degrees of price pressure.

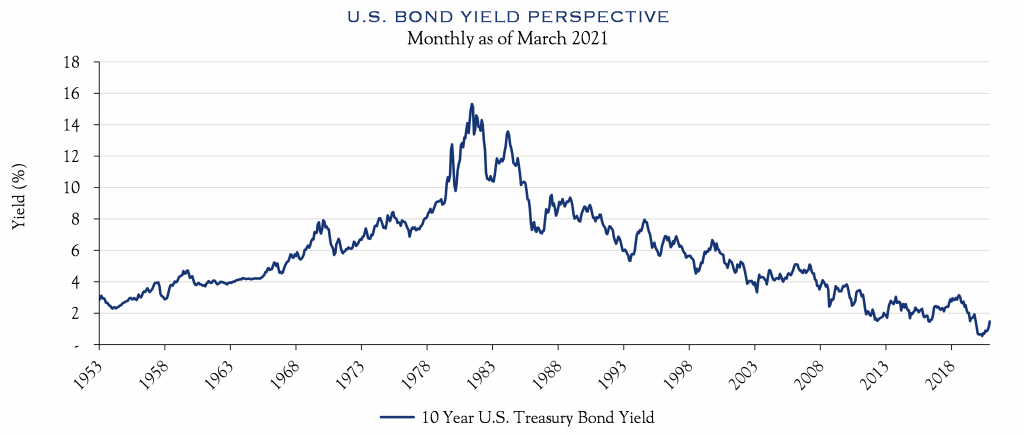

Maintaining perspective is important as well. While the bond move was swift and rates lifted to around 1.5% for the U.S. 10-Year note, yields remain historically low. In fact, at the start of 2020, rates were around 2.0% and were over 3.2% in late 2018.

Source: U.S. Treasury

Despite the headlines, inflation expectations remain constrained. Consensus expectations are for CPI of around 2%, while the TIPS market forecasts inflation of 2.7% in the next year, and 2.2% to 2.5% over the next 5–10 years. The yield curve has steepened, indicating higher rates in future years; however, the steepening has been modest and remains normal for an economy building momentum.

The Institute for Supply Management (“ISM”) surveys of economic activity indicated continued expansion, although with some logistical and supply chain issues. The gauge of economic activity from the New York Fed shows an economy running at −2.3% as compared with one year ago.

Thus, the focus on inflation is healthy in the context of an expanding economy. It also is encouraging that an issue other than COVID has captured the attention of markets.

Taken together, increased volatility and a focus on new issues is typical of a market in transition such as from the COVID era to the post-COVID era. With vaccination rates picking up and state governments lessening restrictions, it is reasonable for investors to look ahead.

We expect a massive increase in GDP—Atlanta Fed forecasts +10% for the first quarter—coupled with modest increases in overall prices. We also expect significant price increases in supply-constrained areas, such as some commodities. This condition may persist for a couple quarters, followed by the resumption of long-term structural trends. Nonetheless, the post-COVID economy may be more compelling, owing to an increase in productivity, likely bringing with it higher profit margins.

Current market values are well-supported despite the uptick in rates to 1.5%. Confidence levels in future earnings are appropriately high. An uncertain future should result in lower valuations. Likewise, more confidence should support higher valuations. It does not take a leap of faith to assume earnings will rise in future quarters. Thus, the higher confidence in future earnings supports valuations. We believe stocks will follow earnings higher, although we expect bouts of volatility, as investors digest news on inflation and rates.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC