Two years ago, the market plunged on news of a pandemic. Now stocks are again struggling with a new and unpredictable challenge. For weeks, Vladimir Putin sent mixed messages regarding his intentions in Ukraine, prompting urgent focus on geopolitical events. Russia’s subsequent invasion of Ukraine further increased tensions. The VIX measure of volatility rose from 20 to 30—a level seen in major disruptions such as COVID, the financial crisis, and the tech bubble. This conflict is now a significant event—both on the ground and in the ever-increasing sanctions being deployed by western allies to inflict pain on Russia. The clarity of communication and bravery of the Ukrainian leadership has rallied support, creating further pressure on Russia. There is no apparent off-ramp, and the key antagonist is a highly unpredictable individual.

We have made some assumptions for outcomes to guide our investment outlook. These range broadly, from a worst-case result of super-escalation, to a best-case move to a more stable and free Russia. In between those extremes are a long drawn-out stalemate of a conflict, a peaceful but unsettled truce, and countless other scenarios. Most outcomes involve Russia becoming marginalized and detached from the global economy. This means that fewer resources from Russia—oil in particular—will be on the global market. Our estimate is that oil around $125 will continue to put upward pressure on inflation as it has in recent quarters. High energy costs can also create a “tax” on spending elsewhere as income is directed towards energy expenses. As compared to history, this effect is likely to be less substantial as incomes have risen while energy intensity of the economy has fallen due to productivity and fuel efficiency. Even so, high prices for oil, and now at the gas pump, are a tangible source of consternation for consumers and politicians.

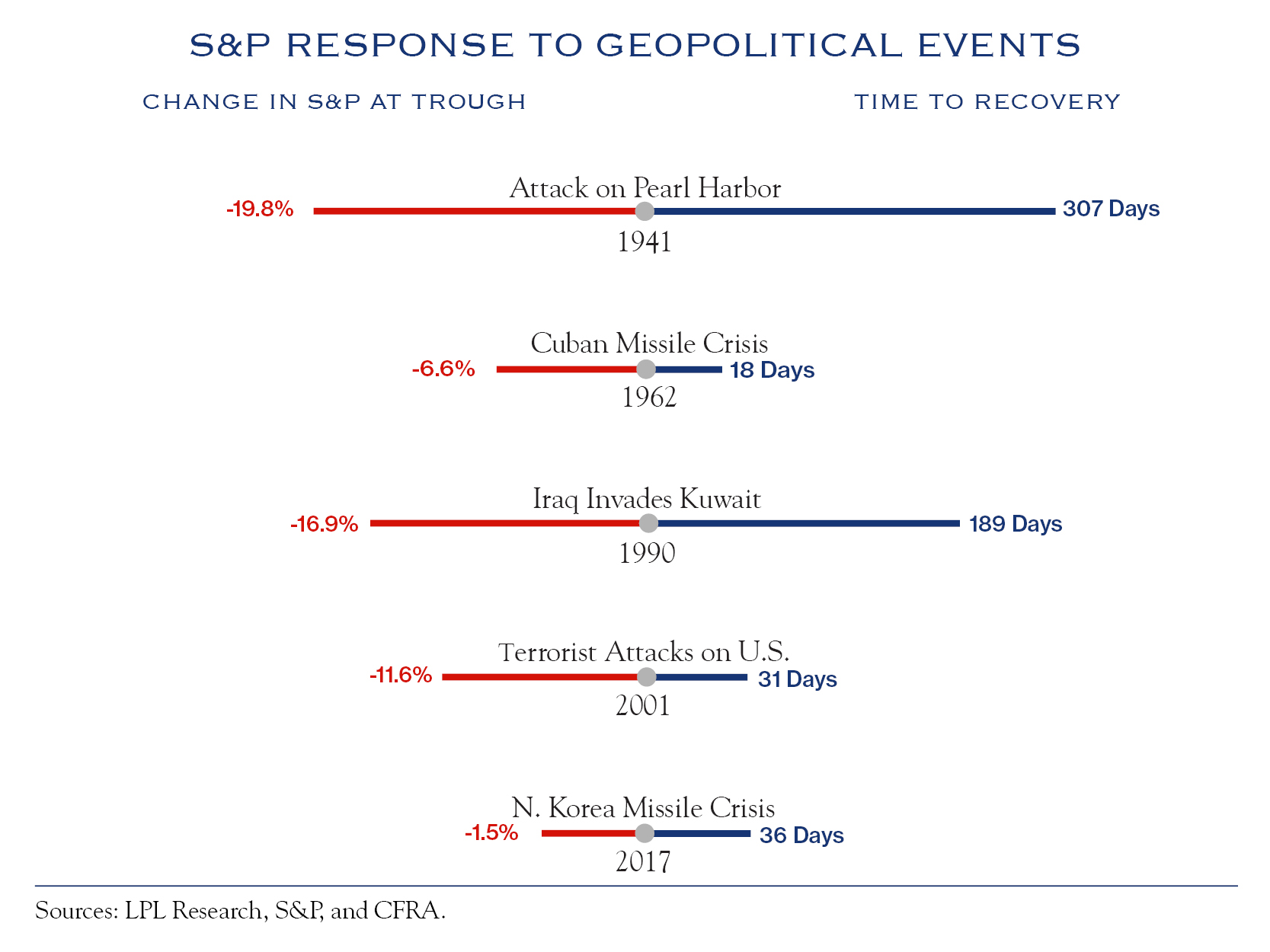

Markets are doubly reacting to the pain of higher oil prices and the mounting uncertainty of the effects of financial sanctions. How long will events remain this unsettled and troubling? Historically, markets react to negative geopolitical events with a quick selloff, and a quick rebound.

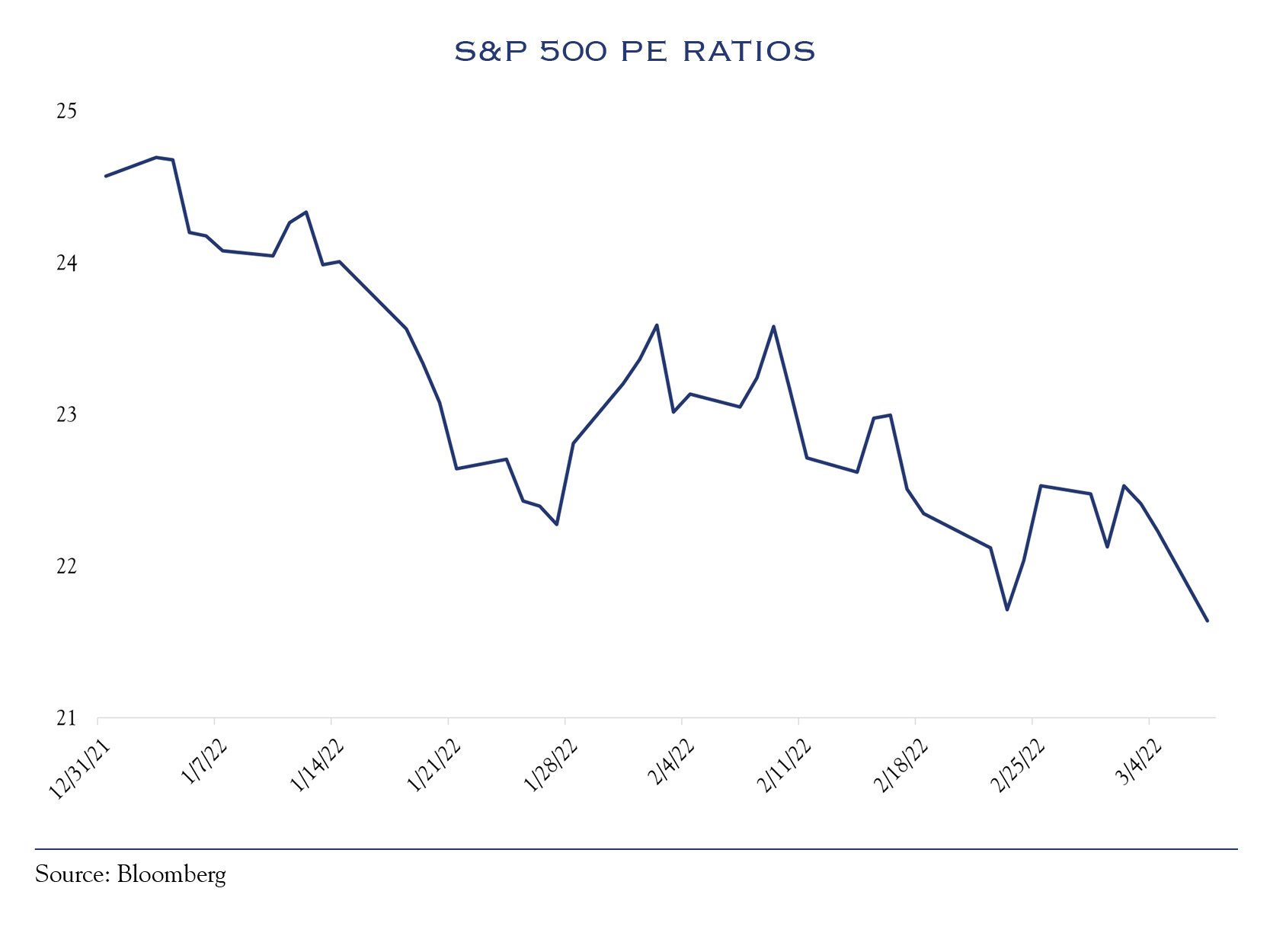

Higher volatility has led to valuation compression and the recent market decline looks similar to those of prior geopolitical corrections. Does that mean stocks have found a bottom here? Perhaps, though we think the better response to uncertainty is to avoid guessing on short-term direction and to focus on long-term fundamentals.

As an example, the NASDAQ index swung by 7% in one day, from pre-market trading to the eventual close. Russia represents a relatively small portion of global trade and corporate earnings, and therefore, the conflict is more directly applicable to valuations, rather than the fundamentals of economic growth and earnings.

Our base case incorporates a view of either a long stalemate type of conflict or an unsettled peace/cease-fire and potentially an eventual regime change. Over time, financial markets will adjust to the expulsion of Russia from the global economy, and this implies continued near-term volatility. A deeper short-term downside could ensue if markets start to price in an escalating conflict. In that case, we see support for stocks at levels just a bit lower than here, as PEs have corrected to near long-term averages.

Interestingly, the past few weeks have seen strong earnings reports, paired with stock declines, which have led to a decline in valuation metrics. As with prior geopolitical events, we anticipate an eventual return of focus to fundamentals. Here we expect solid earnings growth, modest valuation levels, and strong profit margins creating a favorable backdrop over our investment time horizon of three years.

In our earnings and valuation model, we recently moved our short-term view on geopolitical to strongly negative, though we anticipate a return to a modest positive over the next three years. We also assess other factors: interest rates (rising, but still low), inflation (high, but likely peaking), sentiment (quite negative, usually a contrarian positive indicator), and domestic policy (slightly positive—gridlock is good). These views are used to adjust against average PE ratios for both short and long time horizons.

Overall, across our three-year horizon, we factor in a modest recovery in PE ratios and strong earnings as key drivers for equities. In the short term, we urge patience. Attempting to time geopolitical events and gauge market reaction to those events is rarely a winning strategy.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. Data for illustrations were sourced from Bloomberg and Macrobond. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC