High Valuations Raise the Bar on Good News

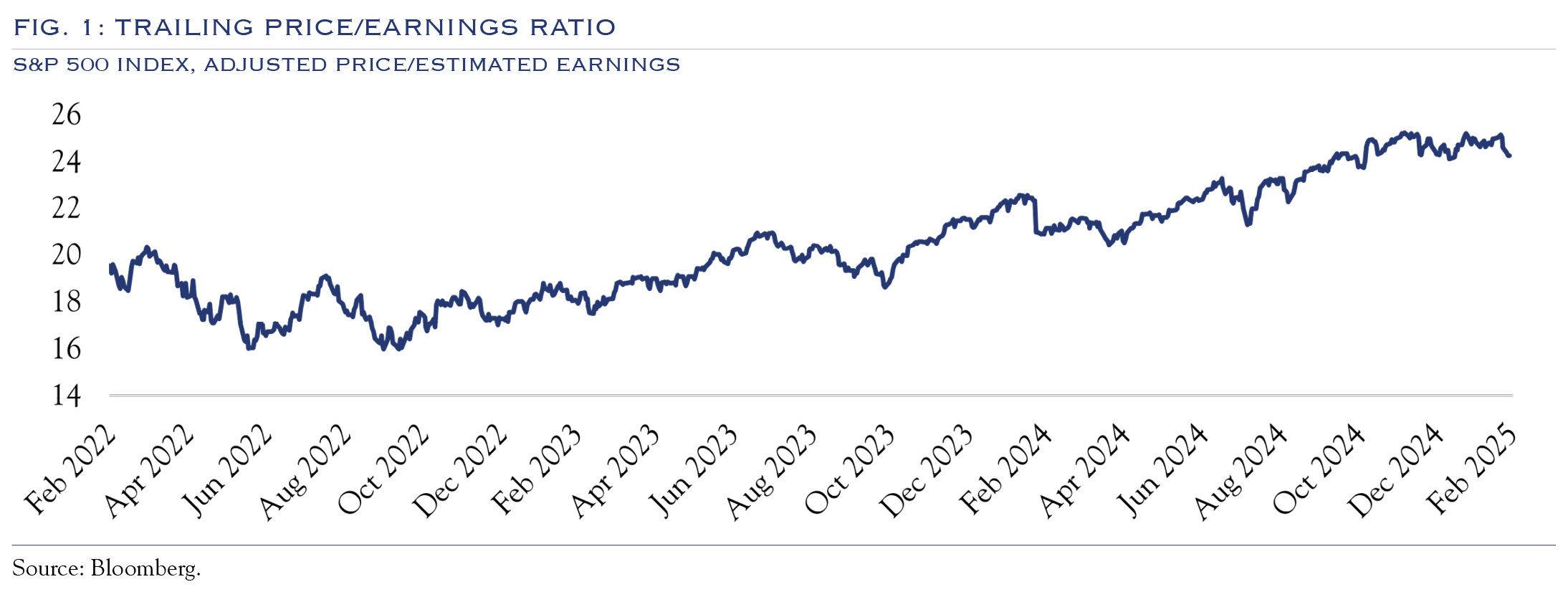

After marching ever higher for the past two years, the PE ratio on the S&P 500 is at a level that effectively requires a constant stream of good news (Figure 1).

Volatility and declines in the past two weeks have been modest by historical standards but still have critical implications. One prominent example is that investors have been jolted by a wake-up call to be more attentive to broad economic data.

When high valuations collide with uncertainty, the volatility ushers in an environment where various potential risks will be scrutinized. Stubborn inflation, Fed policy gridlock, possible consumer vulnerability, tariffs, uncertainty attached to policy announcements, and the perennial debt ceiling vote are all being evaluated against the very high standards that accompany elevated valuations.

Further, markets may become increasingly nervous if this year’s much-hyped M&A surge fails to materialize. Thus far, it is off to a slow start, with data from late February running behind last year’s numbers. The M&A trend could take a while to get underway, though a choppy market won’t help accelerate the process.

The economic outlook was reasonably encouraging after a solid earnings season. However, recent data on housing and consumer confidence and commentary from prominent consumer-facing companies suggest a downshift in economic growth.

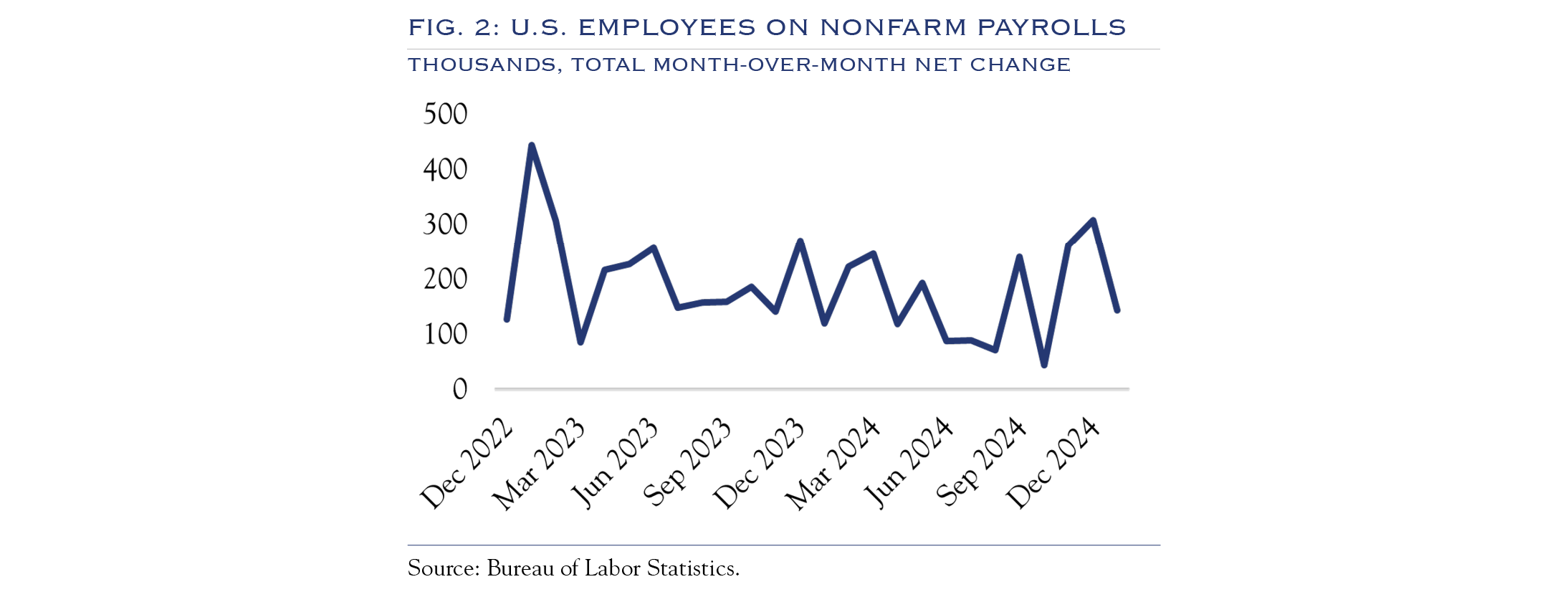

Modest payroll gains will continue to support GDP growth throughout 2025 at a level just above 2.0% despite market unsteadiness and recent data. Figure 2 shows the slowing but steady trend in job gains.

With current valuations among the highest 15% recorded over the past 30 years, any whiff of weakness has the potential to ripple across broad bands of the stock market.

Bonds

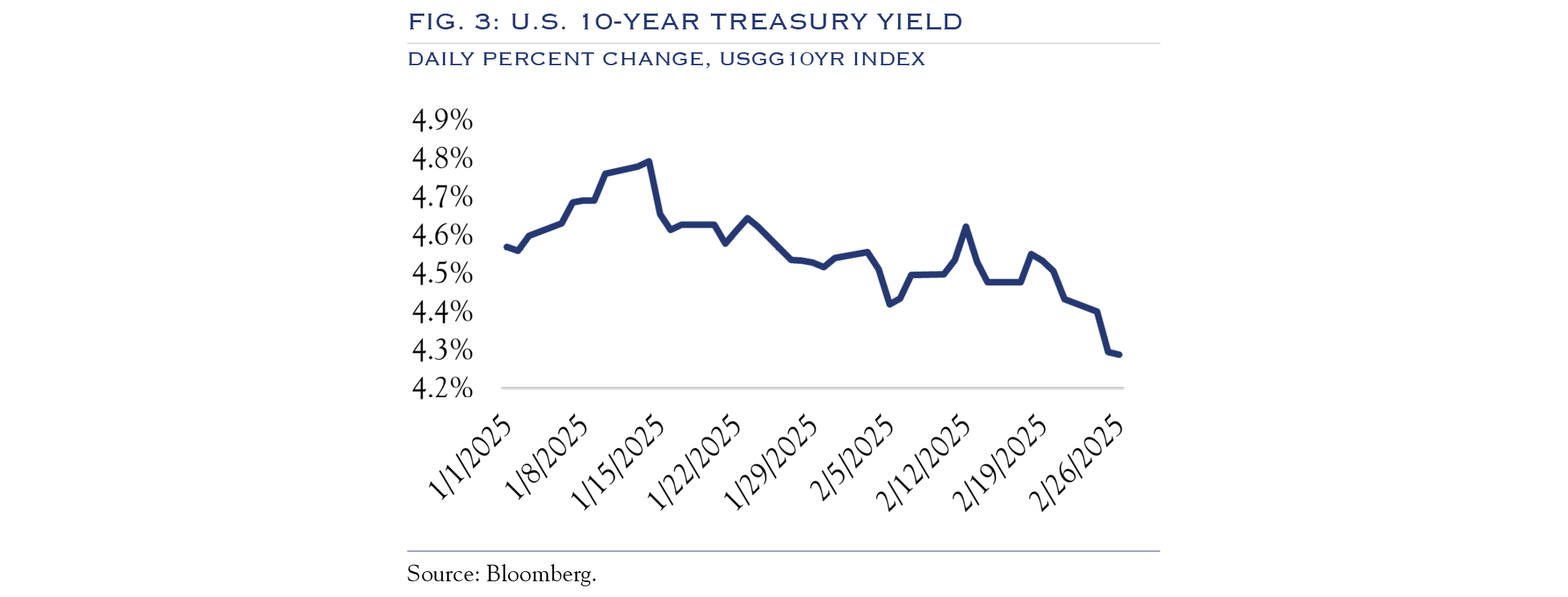

The bond rally over the past two weeks, which brought yields from 4.65 to 4.31 (Figure 3), appears to have happened for the “wrong” reason. In effect, bonds rallied out of economic concern rather than because inflation seems to be heading in the right direction.

The economic data indicates a downshift rather than a recession. Over time, interest rates will gradually follow inflation on a path to lower levels. Fed policy is on a hard pause and unlikely to change unless or until conditions change in inflation or the labor market. This sets up a delicate balancing act for the Fed as they must eventually remove policy restrictiveness to keep supporting an economy that is slowing but not faltering. It all raises the stakes on data releases and seems to be the root cause of recent volatility. For example, data releases that indicate economic weakness could be taken as a signal that the balance is tilting towards recession, at which point investors move towards a risk-off posture. Similarly, solid earnings reports and payroll gains signal that a configuration of stronger growth and higher inflation/rates could be in play.

The push-pull dynamics will continue with a path toward modest growth and lower rates.

Outlook

The PE ratio for the S&P 500 is in the top 15% vs. history. Those elevated valuations are driven at least in part by mega caps. Valuations will create a high bar on all data and news in the near term, leading to volatility. In the long term, valuations will be supported by lower rates and earnings that continue to rise (approximately 9% this year). In other words, future gains must come from earnings, not valuations. While the choppiness is likely to continue, stocks will grow into their valuations via higher earnings in the long term.

Productivity will lead to improved margins, though the process could get complicated given recent concerns over economic growth. Historically, productivity has been notoriously difficult to measure. Productivity for the economy will help with growth and essential metrics such as debt/GDP. However, our primary focus is on the effects on profit margin potential.

In our December article for Insights, “The Three Waves of AI Adoption & The Impact of Technological Innovation on Productivity”, we presented a simplified model of potential AI productivity/profit margin benefits. We assumed that 50% of workers would gain 14% in productivity. The 50% was an educated guess; the 14% was from research done by Erik Brynjolfsson. In a recent article from The Wall Street Journal, “The Rise of Artificial Intelligence at JPMorgan”, some back-of-the-envelope math shows that the data supports our view that productivity gains will be gradual but substantive. This will provide fuel for earnings in a slower-growth world.

For the first time since September 2024, the equal-weighted S&P 500 outperformed the S&P 500 by more than 50 basis points during a decline in the week of February 17. This appearance of strength within weakness demonstrates that diversification is starting to be rewarded.

Despite signs that investors are ready to move beyond the Magnificent Seven, the market is not yet ready to embrace small caps. Patience will be rewarded for smaller companies closer to year-end as profit margins begin to expand more broadly.

In the short term, in a textbook response to concerns over the economy, leadership will come from companies that are powering ahead with topline growth, margin gains, and positive earnings surprises, while companies with weaker balance sheets and those failing to boost profit margins will be left behind.

In this turbulent environment, we will embrace the mundane but prudent twin virtues of diversification and patience.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC