The Three-Body Problem Facing Investors

GDP, inflation, and the Fed are becoming more unpredictable in their interaction. For investors, the complicated set of circumstances evokes a famous physics conundrum called “The Three-Body Problem.” This is the vexing issue of predicting the volatile interaction between three celestial objects (in addition to being the central theme and name of a successful novel and its recent TV adaptation). Space.com provides the following definition:

The three-body problem is a notoriously tricky puzzle in physics and mathematics, and an example of just how complex the natural world is. Two objects orbiting each other, like a lone planet around a star, can be described with just a line or two of mathematical equations. Add a third body, though, and the math becomes much harder. Because each object influences the others with its gravity, calculating a stable orbit where all three objects get along is a complex feat.

In the investing world, GDP, inflation, and the Fed are three forces in motion. While conditions have been mostly stable in recent quarters, the situation is becoming more complex. In late 2023, the Fed laid the groundwork for cuts in the Fed Funds rate, seeking to manage the difference between rates and inflation to not be overly restrictive with policy. This approach, known as managing “real rates,” gave rise to expectations that a smooth and balanced soft landing would lead to modest growth, minimal inflation, and rates returning to “normal.” However, as 2024 unfolds, the economy and inflation remain more robust than predicted. With minor indications of economic deceleration starting to appear, investors and the Fed must recalibrate their views of the interaction between the economy and inflation. In our view, the Fed must once again start outlining a case for lower rates; otherwise, they risk falling behind the curve of economic growth, which appears to be sloping downward.

The First Body: The Economy

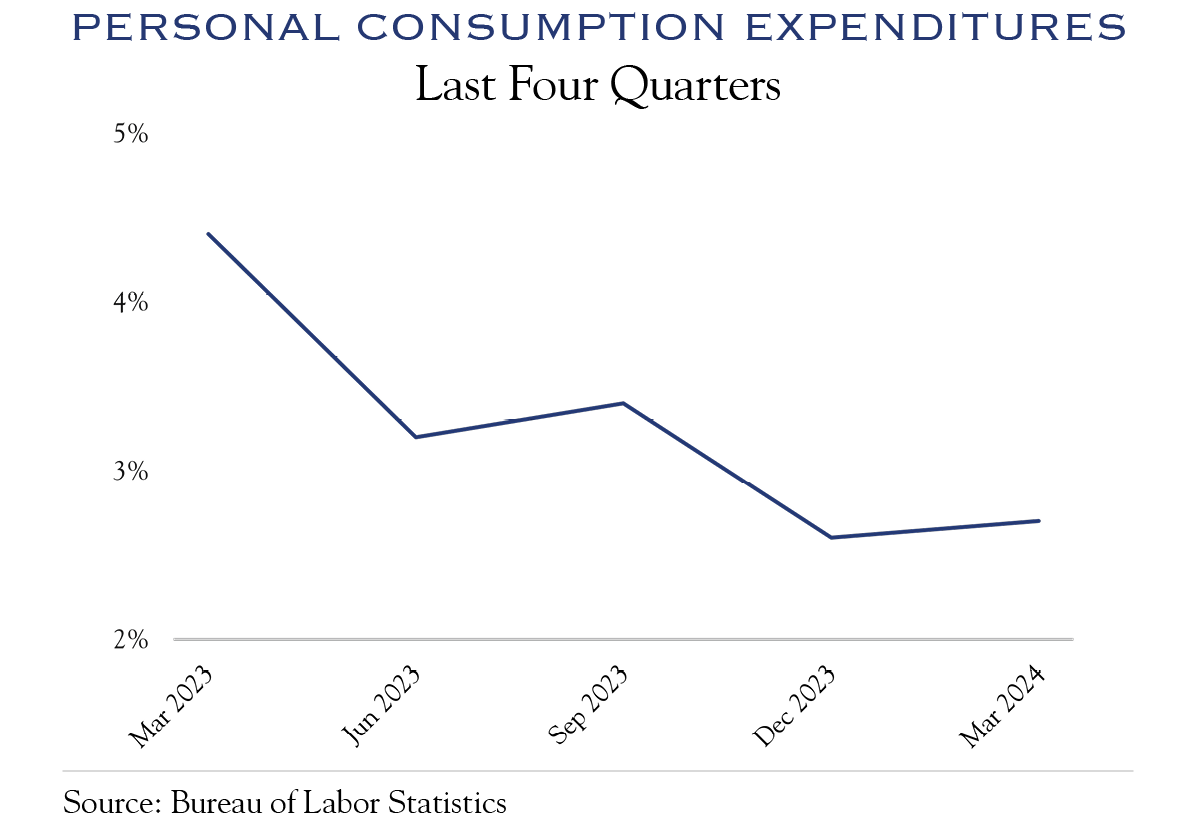

Economic growth slowed in the first quarter of 2024, with U.S. GDP posting a gain of just +1.6%, though inventory adjustments and imports weighed down this figure. One key metric, personal consumption expenditures (PCE), grew at +2.7%. However, this growth rate is a slowdown from the same time a year ago of 4.4%.

Job creation has accelerated slightly, with payrolls increasing by (+303K in March, as compared to a +276k average in the last three months, and a +244k average in the previous six months). The next reading is expected on May 3rd. Real-time data point to continued spending at a level consistent with the 2%+ growth in consumption seen in the GDP report. When economic growth begins to slow, the average lead time to the start of a recession is two consecutive down quarters. With Q1 posting slower growth, it will be essential to see continued payroll gains.

Ever since the Fed began to increase interest rates in early 2022, there has been a lingering fear that the rate hikes would squash economic growth. Large segments of the economy are financed in a manner that is not immediately sensitive to higher interest rates. Solid rates of economic growth also offset higher financing costs. With growth beginning to ease, interest rates will feel ever more restrictive.

Overall, the GDP report was consistent with our view that the economy is still growing, albeit with some pockets of slowing with consumers, and with reasonable business confidence and capital expenditures related to tech/productivity trends. Changes in payrolls and real-time spending data will be critical to our view of the economy in the coming months.

The Second Body: Inflation

Inflation remains above the Fed’s target of 2.0%, with a primary sticking point being the contribution to inflation from slow-moving metrics for the shelter (housing) component. Over the last 12 months, shelter metrics in CPI have declined and detracted 0.7% from CPI. Shelter’s contribution to CPI of 1.97% remains above the 1% level in the pre-pandemic economy. The methodology for calculating shelter inflation ensures any declines unfold slowly.

The Third Body: The Fed

The Fed is on a “hard pause” until growth or inflation turns downward more definitively. This status is especially evident given the Fed’s limited guidance on the conditions that would precipitate a rate cut. Currently, there is no clear rationale for lowering rates. If inflation readings show slight improvements in May and June (our base case), the Fed could use the July meeting to reset the clock and outline reasons for a cut in September that would avoid a politically inopportune policy change in November. The modest deceleration in economic growth may eventually become part of the justification for cuts. However, this will depend heavily on the payroll gains reported in May and June.

The Path Higher for Equities Runs Through Earnings

In April, yields on the U.S. Ten Year Note rocketed from 4.2% to 4.7% as investors weighed the balance between elevated inflation and strong but slowing economic growth. Valuations are slightly elevated at current levels of interest rates. Until economic growth, inflation, and the Fed find a new and stable configuration, the path higher for equities can only come from earnings growth.

AI’s disruption is evident in many headlines and earnings calls, prompting a common question from investors: will AI look like the internet era for company earnings? One reason for optimism is the potential for better profit margins as the use of artificial intelligence spreads through the economy. The rise of artificial intelligence often prompts comparisons to the Internet, though the implications are rather different. AI is primarily a productivity tool fed by data and refined through computing power whereas the internet was initially a land grab for site visits and eyeballs. Some of the productivity gains are so massive that they enable the completion of tasks that previously would have taken lifetimes. Many AI deployments have a stated goal of efficiency. Early indications from research studies and anecdotal company commentary in earnings transcripts show the potential for significant productivity improvements.

Thus far, earnings reports have been mostly encouraging, with broad-based beats across sectors. With 232 companies in the S&P 500 reporting earnings, growth has been +3.37%, with gains in 8 of 11 sectors. In general, commentary and guidance have been decent, though a bit less ebullient than in prior quarters.

We expect earnings to be the driving force of modest gains for the remainder of the calendar year. The Fed will begin to outline a path forward for rates, and we expect further volatility until the three bodies of inflation, growth, and the Fed come into a more favorable equilibrium.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC