Fall Back, Spring Forward

It has been almost two years since we enjoyed a relatively normal world. Our understanding of society, the economy, and once normal events have all been viewed through a COVID filter since February 2020. With recent positive news of COVID treatments and a plateau of cases, we thought it timely to take a brief look at where we’ve been, so that we can evaluate where we are going.

Though markets have seemed irrational, they have in fact been logical since the end of 2019.

• Stocks have increased approximately 40%, which aligns with earnings having advanced over 30%.

• Interest rates declined from 2.0% to 1.5%, making risk-aversion more expensive and the slight increase in valuation levels tolerable.

• The size of the U.S. economy—roughly $23 trillion—has eclipsed its prior high of $21.7 trillion.

• Jobs, measured by total employed in the U.S., remain lackluster.

Participate, Please!

Presently more jobs are being offered than unemployed workers. This unusual situation leads many to believe that a “great resignation” is underway as workers rebel against too low wages. This in turn spurs fear of a wage-price inflationary spiral, an effect where higher wages (to offset increased cost of living) contributes to further price inflation. While there is some risk of this outcome, the picture is more complicated.

U.S. economic demand is running hot in an unusually narrow segment of the economy (goods). As demand shifts from goods to services with Americans reclaiming their normal lives, we expect demand for goods to cool, lowering inflationary pressure.

Labor force participation is key to future inflation expectations. If a substantial number of workers remain out of the workforce, it is likely we will see upward pressure on wages. Whereas if workers return, wage gains will moderate. As COVID cases continue to plateau we anticipate several critical labor force issues will improve. Childcare and schooling have been a challenge for many workers. In fact, women without a college degree represent a major segment of those out of the labor force. Retirements have surged, causing speculation that the wealth effect has enabled early retirement. That is true for some; however, other retirees typically return to the workforce, though this labor source dried up during COVID. If retirees feel safer as COVID recedes, it is likely they will re-enter the workforce, returning to the traditional pattern of un-retirement.

Savings and stimulus funds also allow people to temporarily leave the workforce, but conditions are changing. Lower wage workers experienced higher savings during the pandemic, allowing them to delay employment. The stimulus and associated savings are now beginning to draw down. We expect labor participation to improve and view recent strong increases in total payroll employment as a signal it will do so. This will take time, with some mismatches between jobs offered and jobs sought, but conditions are improving.

Fear Persists

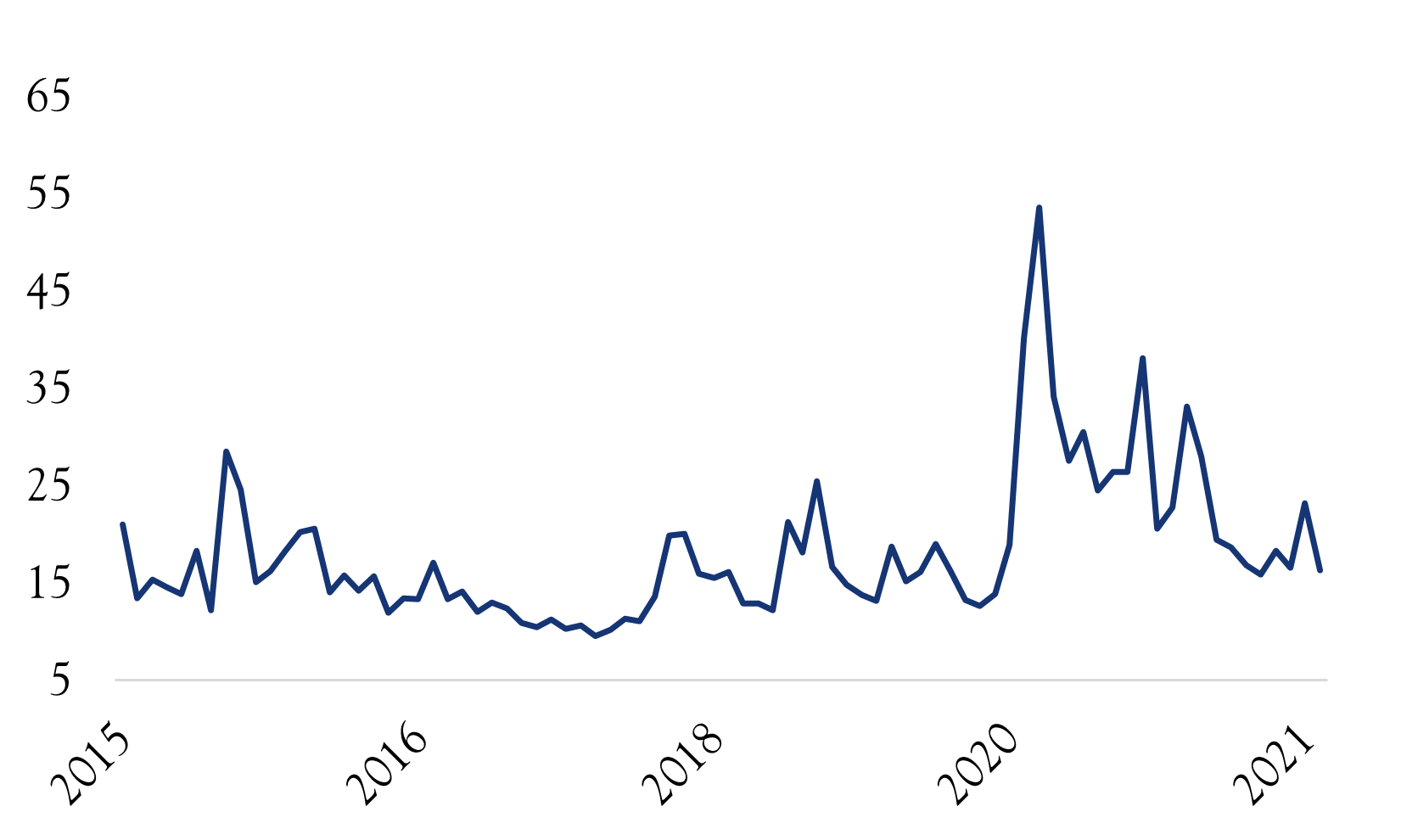

Survey and sentiment data indicates that COVID remains a prominent concern for Americans and investors. The VIX Index also shows continued fear; the measure of volatility has not dipped below 15, despite having spent much time there in pre-COVID years. This indicates that investors have not yet looked past COVID.

Source: Bloomberg

Outlook

The fiscal and tax picture remains murky. The recently passed infrastructure bill, an additional proposed spending bill, an upcoming return to debt ceiling debates, and the imminent 2022 elections make for a complex brew. We expect the outcomes to take time and be muted—not only for the legislative process but for the implementation of any enacted changes. Recent elections imply Americans would like politicians to return to the middle. If that signal of moderation prevails, typically equities will respond positively.

Job creation will be a strong force for generating above average economic developments. Similarly, the continued recovery for disrupted sectors (particularly the leisure and hospitality space) will add to growth. Reduced health and safety concerns should lead to lowered U.S. restrictions—such as re-opened borders—fueling gains in areas hit hardest by COVID. We estimate that 7% of GDP is running approximately 30% below normal. We anticipate that recovery in these areas will produce an additional 1-2% gain in GDP over the next year.

The economy will likely run hotter in coming quarters than it did in the third quarter. The Atlanta Fed and New York Fed respectively forecast +8% and +7% for the fourth quarter. That stellar growth, along with productivity investments, should allow companies to absorb increased costs while generating solid earnings gains.

Earnings growth represents our North Star for the equity market. Valuations are well-supported by low interest rates and a favorable economic backdrop. Analysts have expressed concerns that increased costs (due to labor shortages and supply chain challenges) will reduce profits. While these are formidable issues, it appears that companies are navigating the situation and maintaining profits. Of the 455 stocks within the S&P 500 reporting earnings, the average sales surpassed expectations by 2.6%, while average earnings beat expectations by 9.5%. This means companies are doing better than expected with regard to profit margins.

We expect earnings gains in the neighborhood of 8% in 2022. We think sentiment will improve as the pandemic hopefully fizzles. As a result, we anticipate that PEs will remain stable or drift slightly higher. Over our three-year time horizon, we expect 7.5% annualized stock gains that are mostly powered by earnings.

November 16, 2021

Robert Teeter

Managing Director

Investment Policy & Strategy Group

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. Data for illustrations were sourced from Bloomberg and Macrobond. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC