Election Aftermath

Elections are important, and this year, like every other election before it, is reported to be “the most important election ever.” Further, just like every other election before, this one is not “tradeable” for investors. We have identified several reasons why the election is important but not “tradeable”:

- With polls mostly tracking around 50/50 odds, each outcome is partially factored into current market pricing. Timeframes, “black swans” like the pandemic, and reasonable debate over which party is responsible for recessions all illustrate that simply knowing the winning party isn’t sufficient for forming an investment view.

- It is also unclear if either party will have “control”

or enough power to do anything substantive. - If one party does have some “control,” it’s a long and winding road from election day to drafting and passing legislation. Nothing will immediately change on November 5th.

- Even with tariffs that a President can often implement via executive order, there are likely to be exemptions and negotiations that delay their implementation. The tariff situation will remain unknown on election night.

No Matter Who Wins, Debt Matters. But When?

One outcome is highly likely, no matter the victor—the aggregate level of U.S. debt will continue to climb. While this is problematic, the critical question is: when does this become a detriment to investing? In our view, the debt issue has a few more progressions before it becomes a significant headwind for investors. First, some kick-the-can solution will likely emerge when the volume and attention on the issue increase to a level that starts becoming a problem (i.e., when the new bond vigilantes show up). There are then several steps both the Fed and Congress will take to delay the inevitable. For example, Congress could form a bipartisan committee to reform social security or other entitlement programs. Furthermore, the Fed likely could and would support bond markets if rates move higher.

Nonetheless, the ongoing deficit continues to add to what is already a big problem with the debt. The best way out is to reform spending and increase economic growth. GDP has a significant effect on debt ratios. A slight difference, for better or worse, in economic growth has a substantial effect on projections. Productivity, demographics, and economic growth matter greatly to future debt/GDP ratios and will be key indicators for determining when the U.S. debt becomes a strong headwind.

The Domestic Renaissance

On May 24, 1883, the Brooklyn Bridge was opened to the public. The bridge emerged as a testament to the spirit of the age: an unmatched feat of engineering built by American ingenuity, materials, and labor. Of the Brooklyn Bridge, historian David McCullough said, “One has the feeling that if you could pick it up and turn it over, you would see MADE IN AMERICA stamped on it” (The Great Bridge: The Epic Story of the Building of the Brooklyn Bridge). At that time, it was the longest suspension bridge in the world and used the recent innovation of steel cables. These cables were designed and manufactured in America and tested by John Roebling, the bridge’s designer, in the industrial hub of Pittsburgh. According to McCullough, Brooklyn was similarly well-suited to produce the materials for the bridge as “the third-largest city in America” and “a major manufacturing center—for glass, steel, tinware, marble mantels, hats, buggy whips, chemicals, cordage, whiskey, beer, glue” (The Great Bridge). America was transforming into an economic juggernaut, enjoying the fruits of its burgeoning manufacturing capacity and rapid technological innovations.

140 years later, we find ourselves facing a renaissance of domestic manufacturing. Of the many adverse outcomes of the pandemic, one very powerful and likely very positive outcome was the change in the trajectory of U.S. industrial activity. The ingredients had been falling into place over many years:

- Labor Cost Gap – The cost differential for labor has narrowed.

- Tax Policy – The U.S. is now on more even ground for multinationals.

- Energy – Domestic energy production has surged.

- Innovation – The culture of innovation in the U.S. is more pronounced than ever relative to other countries.

- Change in Mindset – The pandemic spurred various forms of pro-industry legislation and also shifted focus towards domestic supply chains and manufacturing.

It is still the early innings of this transformation, and it remains to be seen which initiatives and projects will have lasting benefits. Overall, we expect the trend of domestic industrial activity to continue, adding to economic growth in the coming years.

Productivity, Margins, & AI

With an end to the easy path to profits from inflationary price increases, companies must focus on efficiency. For example, a large shipping company noted that it all comes down to hours and people; they are overlooking nothing in scrutinizing costs and moving more volume to automated solutions.

The biggest battleground here will be the return on investment from expenditures in AI.

Our thesis is that companies that have invested in AI tools and training will begin to see higher productivity, allowing them to expand business (increase revenue) with smaller staffing increases than companies that chose not to utilize AI.

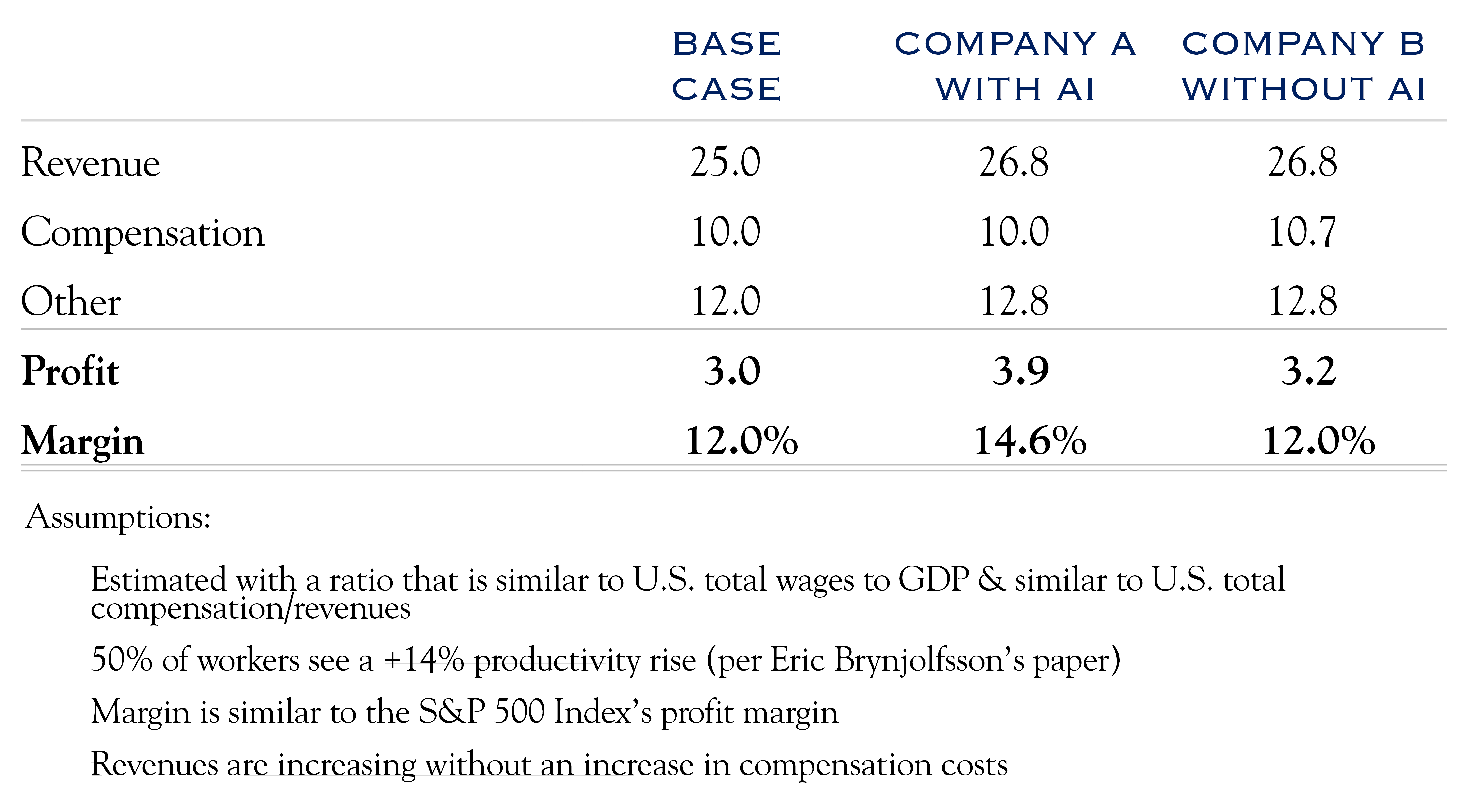

In the model below, we form estimates of revenue, compensation, and profit margin; the results are designed to be similar to U.S. equities and the economy overall. There is a case to be made that AI can also be additive to revenue, that AI can find other efficiencies in the cost structure, and that robotics play a role; those are excluded here.

This model is simple by design. It is not meant to be specific, but rather to illustrate the divergence between productivity improvers and status quo companies.

Note that Company A sees an increased profit margin, as they can increase staffing at a lower rate than revenue.

We estimate this benefit as handling a 7% revenue increase with no staffing change, assuming that AI provides a 14% productivity boost to 50% of the workers. This is a reasonably conservative assumption. A more pessimistic survey came from Daron Acemoglu, which pegged the productivity gain at 5%, while one of the most optimistic estimates was from Vinod Khosla, who predicted AI will handle 80% of the work in 80% of jobs. Our estimate is based on findings from one of the more extensive AI studies to date by Eric Brynjolfsson. We apply a 14% productivity boost to 50% of the workforce, netting a 7% labor productivity gain. Brynjolfsson coined the phrase “productivity J curve,” noting that technological advances take time to show up in productivity and profits.

Brynjolfsson also said in a recent Wall Street Journal article: “This is a time when you should be getting benefits and hope that your competitors are just playing around and experimenting.” Gains from AI will vary by industry and depend on how well companies implement change that unlocks productivity. We expect increased dispersion as some companies succeed in becoming more productive and profitable while others fail to adapt to these very powerful forces.

If the gains from AI come mainly from incremental efficiency, this should be an advantage to companies that are expanding. In our estimation, the path to AI usage does not allow easy staffing cuts. However, the productivity boost should allow more business (revenue) to be done by the same number of employees. This approach is also easier to implement and more palatable both politically and societally.

The road ahead for AI is the story of implementing technology to boost productivity and margins. This will place a higher-than-normal burden on the qualitative interpretation of management teams. It won’t happen overnight, but it will drive dispersion between those who adapt and those who don’t.

Investment Outlook

The Beige Book offers a summary of economic conditions across 12 Federal Reserve districts and is prepared before every Federal Open Market Committee meeting. The most recent Beige Book from the Fed notes unchanged economic activity in ten districts and modest growth in two districts. While payroll figures and real-time spending data indicate decent growth, it is becoming a decelerating backdrop. At the same time, investor bullishness is reflected in higher stock prices. At some point, investors’ optimism will collide with the realism of a slower economy. We expect that to manifest in a sideways movement of valuation metrics and an increased focus on earnings and profits. In this collision between rising optimism and a slowing economy, individual company actions around productivity will lead to higher earnings.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC