Emily Dickinson poetically reminds us that “Forever—is composed of Nows.” The new “now” emerging contains aftershocks of the recent past but primarily mean returning to long-standing trends.

The tumultuous COVID years have dominated investment themes. As the economy and markets return to pre-COVID trends, several themes emerge:

- A slowing economy with low population growth

- Mixed earnings due to slowing revenue, increased costs, and disparate conditions across industries

- Lower interest rates as inflation declines

- A stable job market, despite layoffs, due to reduced participation rates and high numbers of jobs offered

- An improving but slow pace of deal activity that must address increased diligence in light of

the FTX bankruptcy - A geopolitical wildcard of unpredictable leaders in countries of major significance

- A push towards reshoring as major industries must diversify complex supply chains

A Slowing Economy

A recent Bloomberg survey reports that 70% of economists predict a recession within the next year. The yield curve is inverted, with short-term interest rates higher than longer-term interest rates. Historically this inversion has served as a nearly infallible recession indicator. Interestingly, economist Campbell Harvey, a pioneer of the yield curve indicator, said recently, “I have reasons to believe, however, that it is flashing a false signal.”

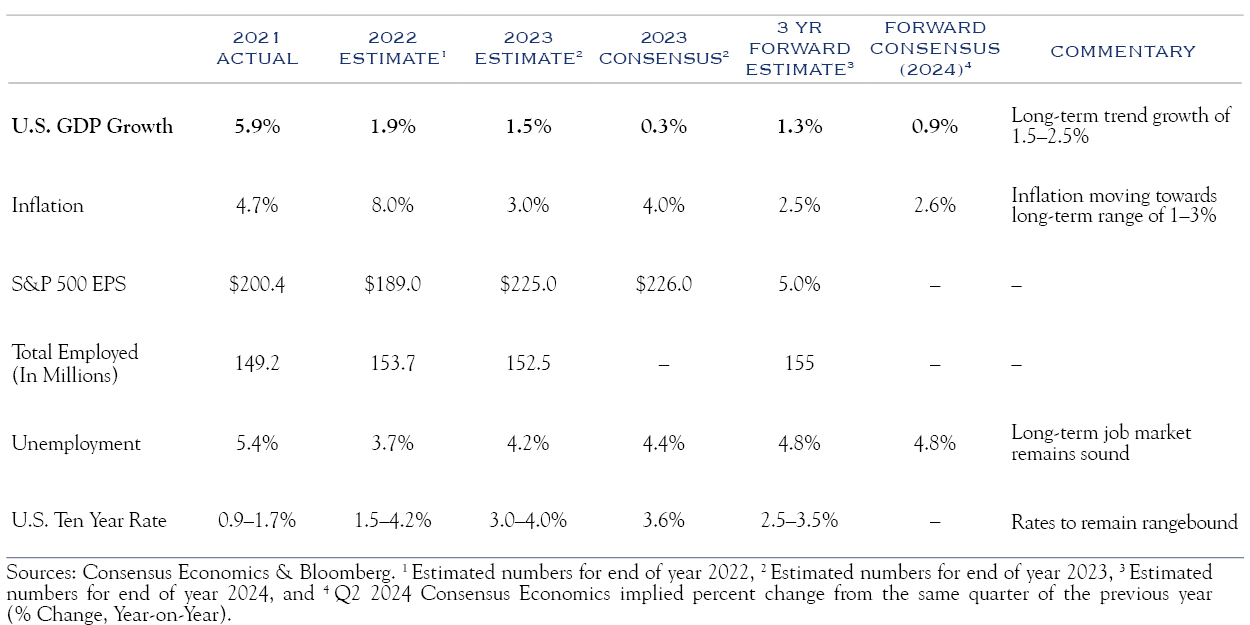

For the time being, recession is only a prediction. The Atlanta Fed and New York Fed each utilize financial models to forecast real economic growth. The methodologies vary, with the Atlanta Fed drawing on a broad range of economic statistics and the New York Fed using a short list of high frequency data. These models anticipate a GDP reading of +4.0% and +0.87%, respectively. Similarly, real-time readings of auto and pedestrian traffic (particularly around retail and travel locations) and spending show stability, not contraction. Savings remain elevated, jobs are plentiful, wages are rising, and the real near-term economic growth rate is around 2%. This could dip lower if interest rates—especially mortgage rates—remain higher over time. Perhaps not coincidentally, our estimate of current economic growth is similar to most long-term estimates. The Bureau of Labor Statistics (BLS) anticipates +2.1% GDP growth for the upcoming ten years.

This is no surprise, as the conventional formulation for expected economic growth depends on population and productivity. Simply put, more people equal more economic activity, and more productivity creates economic activity for a given population.

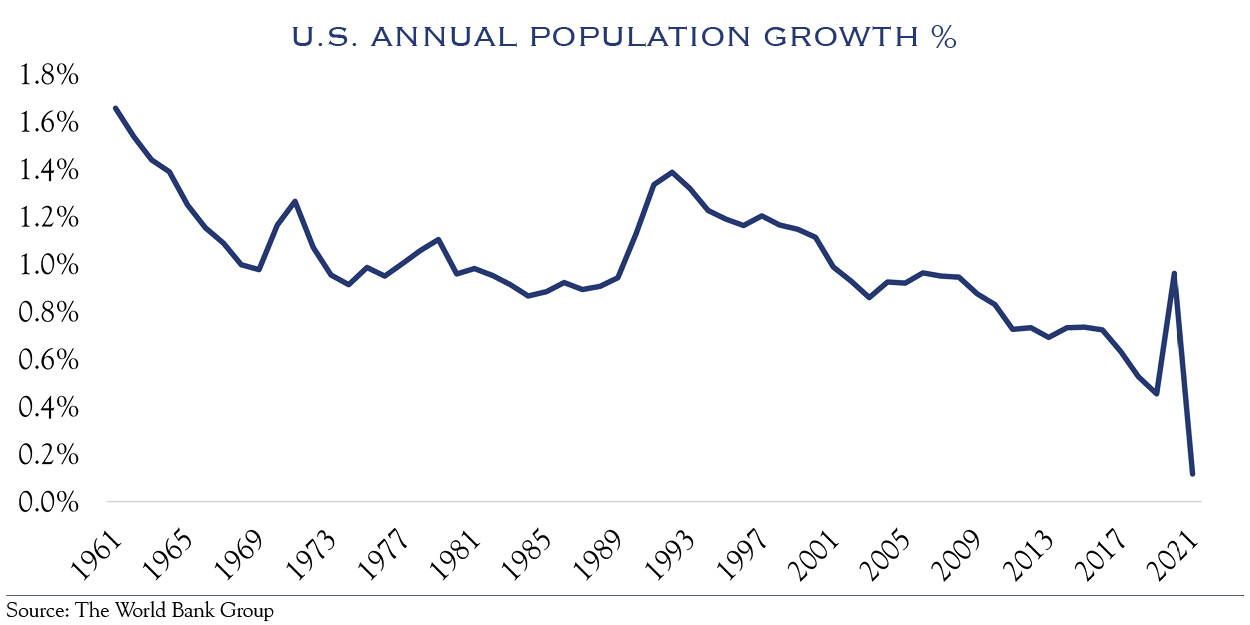

Population growth in the United States recently has been volatile and has been trending down for nearly three decades. A reasonable estimate for population growth in the years ahead is 0.50% to 0.75%.

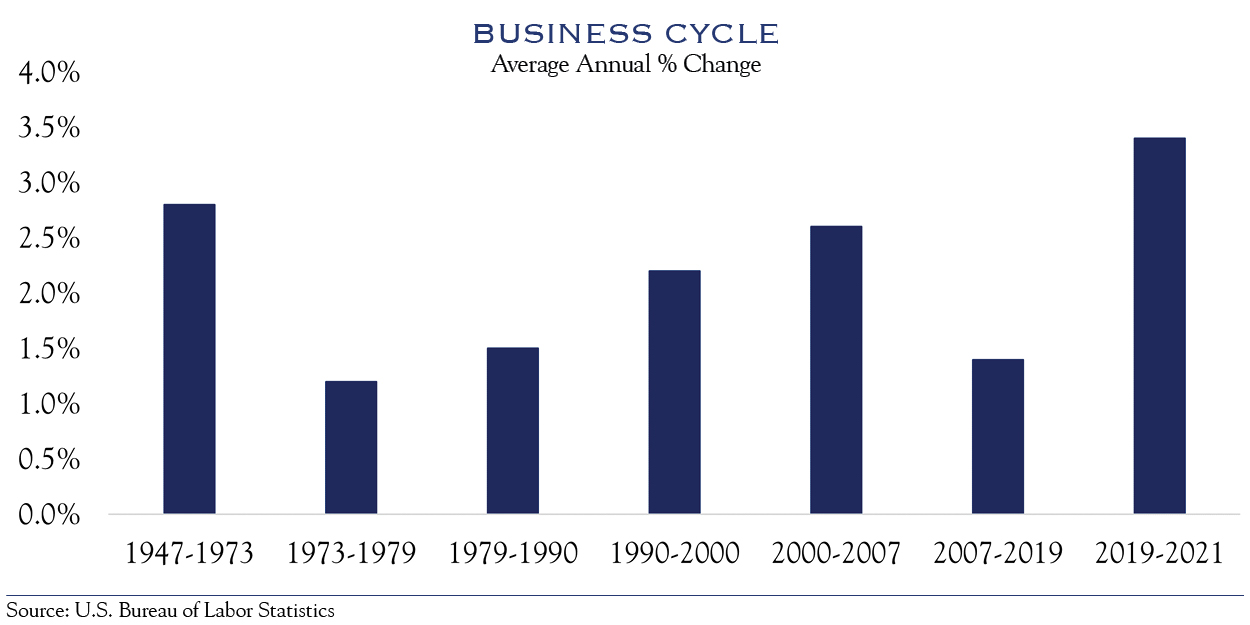

Productivity is notoriously challenging to measure, though gains have been muted for much of the past 15 years. For 2007–2019, BLS reported 1.4% annualized productivity gains for nonfarm businesses (76% of GDP). Recent figures have been volatile, although there is reason to believe that technological and process changes implemented over the past few years will lead to elevated productivity. A reasonable estimate for future productivity gains is around 1.25% to 1.75%.

Adding the two, population growth and productivity gains imply economic growth between 1.75% and 2.50% in the coming years. Unsurprisingly, this is close to the long-term forecasts of most experts.

Implication: While COVID aftershocks continue to create distortions (and perhaps a mild slowdown or recession), the long-term outlook for economic growth remains slow and steady. We expect real GDP to grow around 2% over the long term.

A Mixed Bag for Earnings

Consensus earnings estimates have gradually declined and now anticipate the S&P 500 to deliver $225 earnings per share (EPS) for 2023. We estimate earnings to remain within +/−5% of 2022 results, or EPS of $220-$230. As fourth-quarter results roll in, look for refined earnings estimates; many companies provide the most extensive annual outlook on their first earnings call of the new year.

We see the potential for a wide range of results across industries and companies. For example, our analysis of economic growth over the past five years shows that the goods side of the economy had been running ahead of typical trends and is beginning to slow. Meanwhile, the services side of the economy remains below trend and is making up for lost time. These conditions will lead to mixed revenue across industries. At the same time, costs will also vary as increased labor costs compete against the accelerated adoption of robotics and technology-driven productivity.

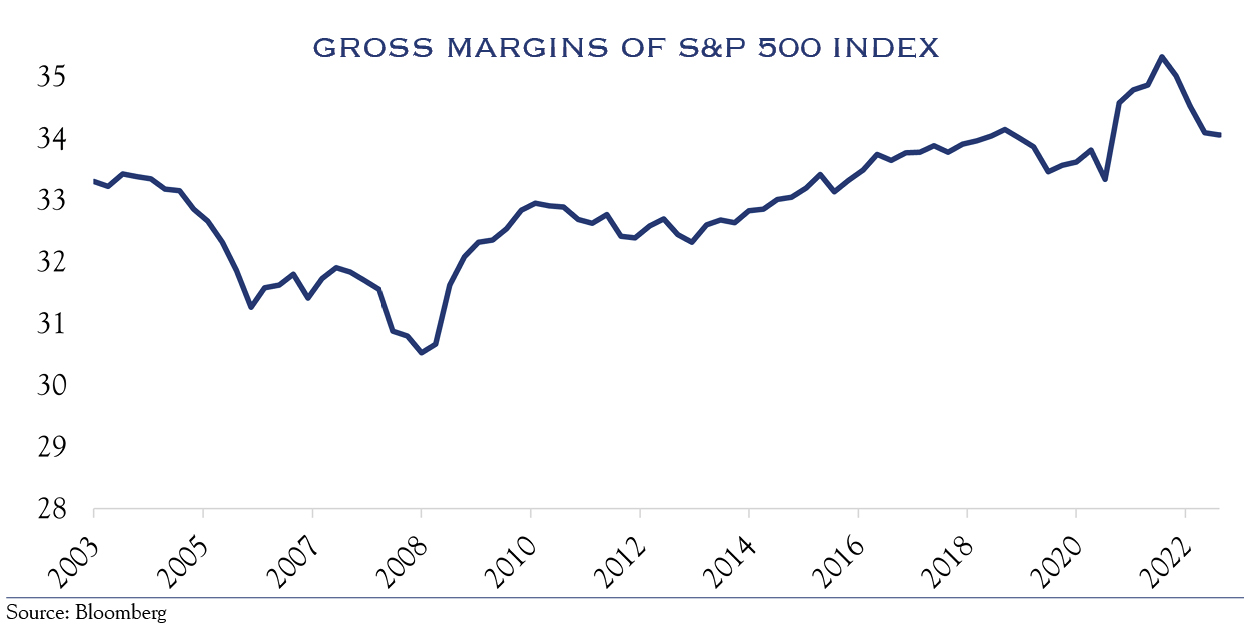

Margins have consistently expanded following the financial crisis in 2009 and continue to defy expectations. The past few years have been noisy, and we expect margins to stabilize at a level around those seen prior to the pandemic.

Companies, however, are navigating rapidly changing post-COVID conditions, and management ingenuity will largely determine success or failure with profit margins and earnings.

Implication: The earnings outlook remains especially uncertain and complex. The influence of strong management teams cannot be understated. We expect profit margins to slip a bit and for earnings to remain slightly positive in aggregate, with a lot of dispersion among individual companies.

Inflation Improves & Rates Decline

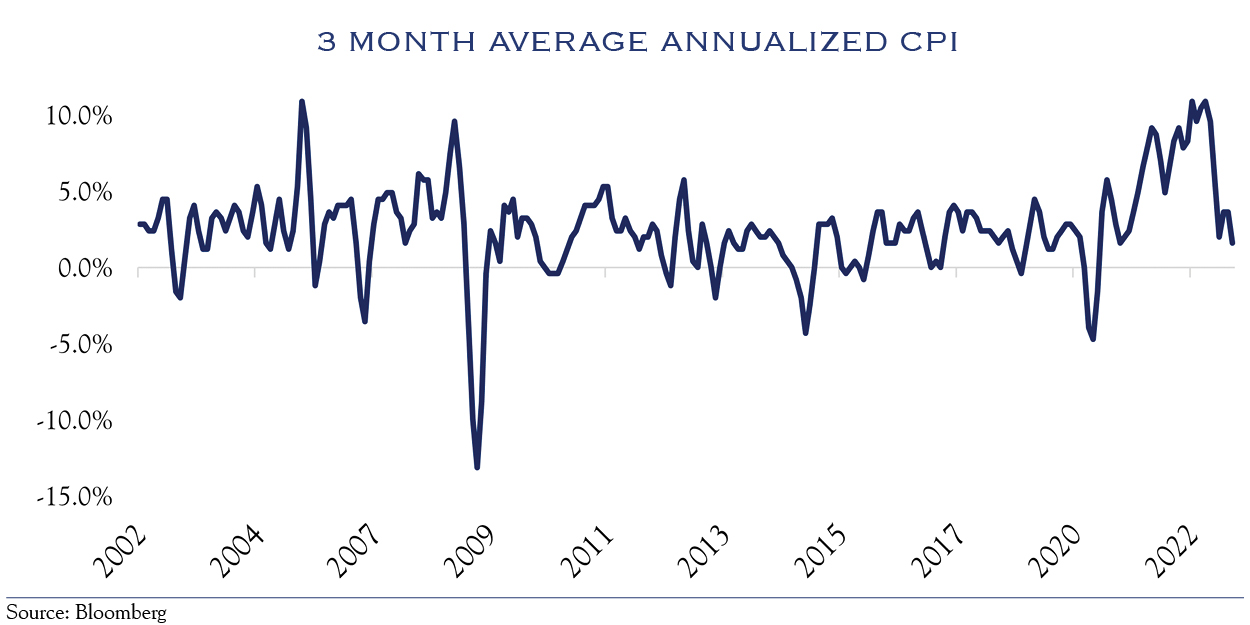

The Federal Reserve uses the three-month average annualized inflation rate as one important signal of current conditions relative to the longer-term year-over-year rates. As shown in the following chart, the three-month inflation rate is improving. Still, with the Fed focused on headline year-over-year inflation, achieving their target of 2% will take time.

Fed Chair Powell has recently segmented inflation into three components: goods, shelter, and services (excluding shelter).

Goods inflation has been falling rapidly, following several years of inflationary supply chain disruptions which are now fading. Supply chains have nearly healed, according to the New York Fed Global Supply Chain index, which implies that goods prices will moderate.

While housing prices and rents remain elevated, real-time metrics show significant cooling of shelter prices. With mortgage rates above average, shelter costs will likely continue to moderate. That moderation will eventually flow through to the shelter component of Consumer Price Index (CPI).

Services prices remain elevated, and the Fed has expressed concern that strong wages and labor shortages will conspire to keep services prices high. In his speech at the Brookings Institute, Powell said, “This may be the most important category for understanding the future evolution of core inflation.” While this is likely true, it is unclear at what level services prices might remain “sticky.” Wage gains have been stable around 5%, which is below current CPI readings of 6.5%. This means “real” incomes have declined, as wages aren’t keeping pace with prices. Furthermore, not all the 5% gain in income will be spent in services; some wage gains are spent on goods or shelter or saved. Lastly, with increased recession fears, it seems likely that gains in wages and spending will moderate. This likely will limit any spiraling increases in services inflation.

Inflation is fading and has improved since peaking at a level of 9% year-over-year CPI in June. The most recent reading was 6.5%, and while signs of improvement abound, the path may not be smooth, and a 2% target remains far off. We expect the Fed to remain tough while starting to incorporate some balance into their commentary.

Implication: Inflation was the leitmotif of 2022. Look for this to change during 2023. While the problem remains bad, inflation is now clearly improving. Interest rates should stabilize around current levels and follow inflation lower over the next four-to-six quarters.

Job Market

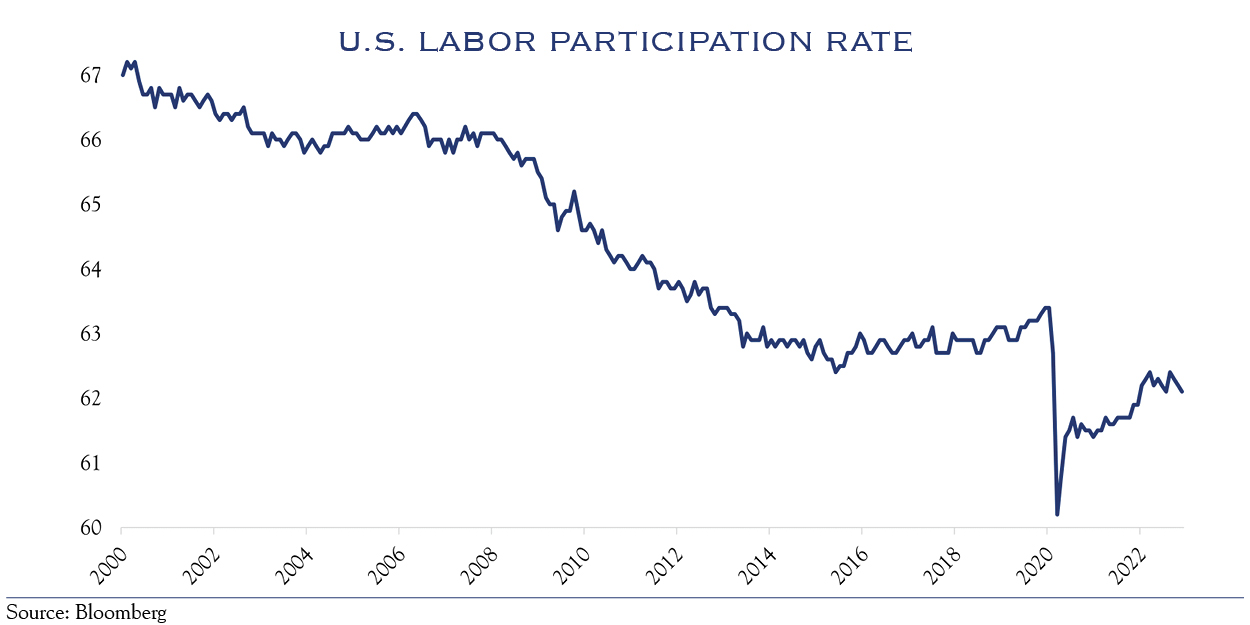

Despite recession fears and high-profile layoffs in technology and finance, the job market remains strong. The charts depict the total number of jobs being offered and the participation rate of workers in the job market. Each tells an important story about the current jobs situation.

Presently, just over 10 million jobs are being offered in the United States. This is nearly twice the average for the preceding 20 years. Employers have an interest in hiring. More jobs create more income which leads to higher levels of economic activity. While we expect higher interest rates and recession fears to bite into these job openings figures, the high starting point will provide a cushion.

While employers want to hire, some potential workers don’t want to work. Over the past 20 years, job participation has significantly declined. The trend accelerated during COVID: participation dropped from over 63% to just over 60%, and presently sits at 62%. The long-term trend is influenced by the emergence of jobs such as gig work that aren’t well-captured by the dataset. Recent years mark a different situation. The acceleration of retirements, lifestyle changes, childcare challenges, and healthcare fears have contributed to some workers remaining out of the workforce. Progress has been slow and sporadic and is unlikely to improve dramatically.

Overall, labor market conditions remain strong, yet there are mixed conditions across industries. Companies have announced significant layoffs which are countered by surveys that show continued hiring challenges in some segments of the economy.

Implication: Company desire to hire workers remains strong, and the participation rate of workers remains weak. The job market will likely remain firm. For any recession to be especially painful, the job market must weaken substantially. As it stands, a solid job market will support incomes and consumer spending.

The consumer is the largest segment of the U.S. economy, and therefore economic conditions likely will remain stable.

Declining Deal-Driven Activity

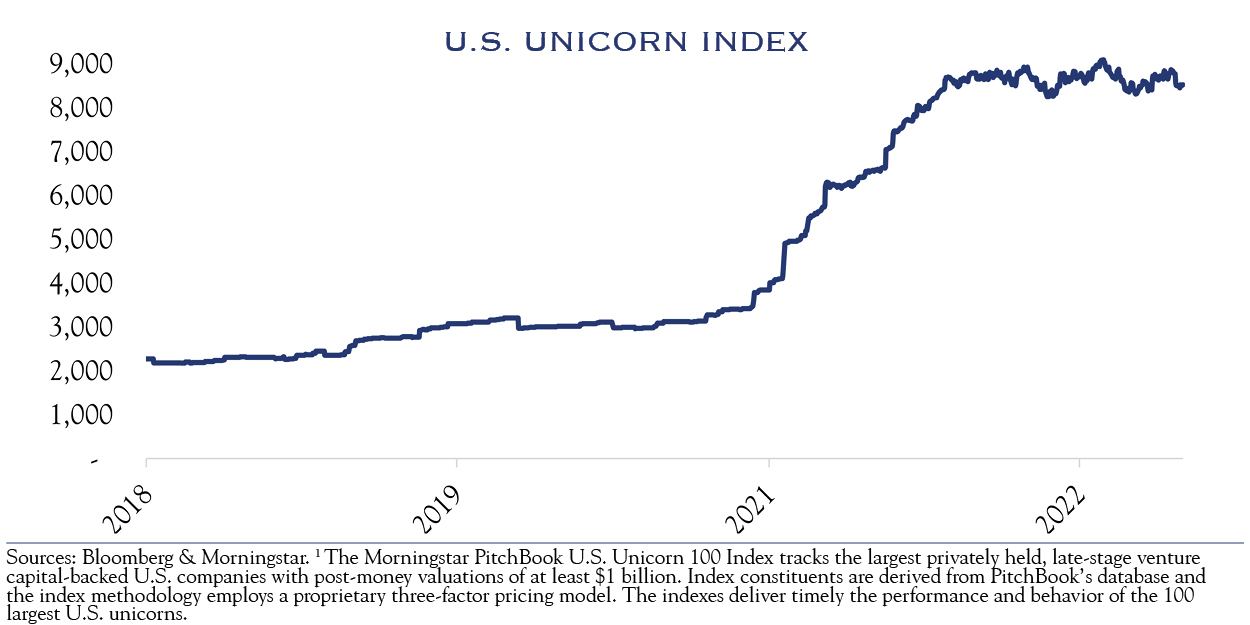

A flurry of venture capital and related activity in recent years spurred new business creation and fed investment gains. Below is a chart of the Morningstar Pitchbook Unicorn Index¹ of $1+ billion venture-backed firms.

While some pullback would be expected due to the economic slowdown, the bankruptcy of FTX will likely further slow venture activity. In recent years, many firms competed by being “quick to close.” That speed necessarily limits due diligence. Our view has always been that the longer one is stuck in the investment, the longer one should take to evaluate the investment; mistakes cannot be easily corrected. We think an increase in deal times and a slowdown in activity will be a positive development. Nevertheless, this will reduce the amount of economic activity from startups and likely reduce portfolio gains from venture capital investments.

Implication: The outsized returns in some private equity segments (especially venture) may cool as both investors and venture capital firms pause to re-assess and re-evaluate.

Geopolitical Wild Cards

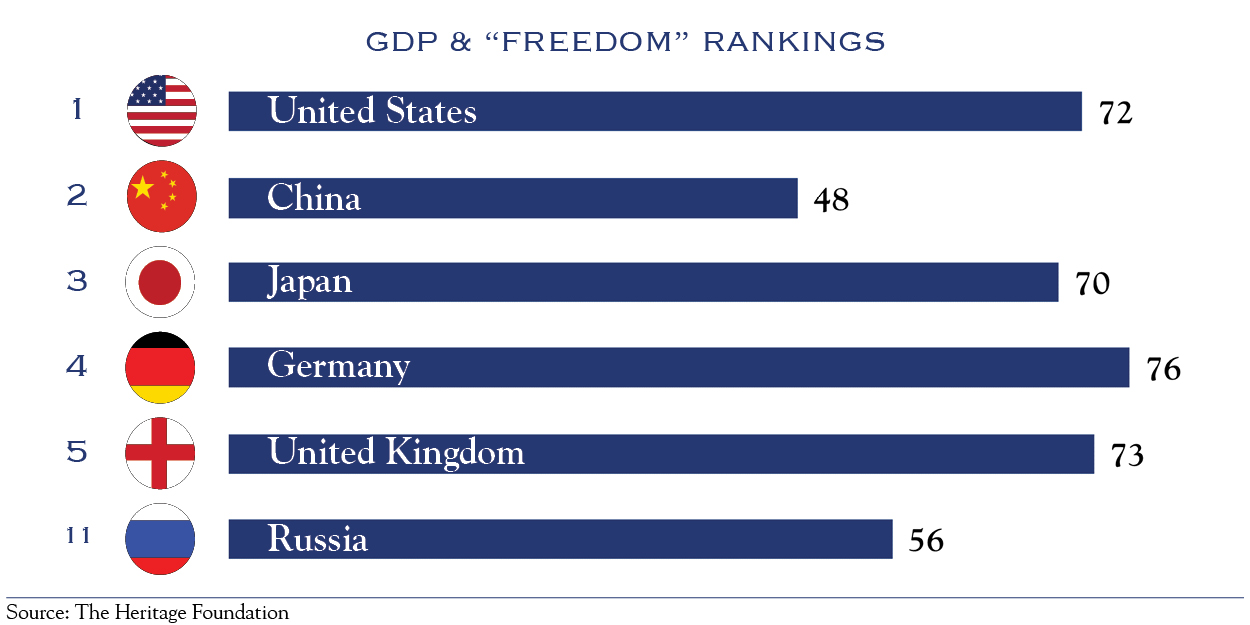

While most of the largest world economies rank highly on the Heritage Foundation 2022 Index of Economic Freedom, the large and influential economies of China and Russia rank much lower.

In “less free” countries, economic outcomes are highly influenced by a country’s leadership rather than by dispersed decision-making at the individual or firm level. This makes economic outcomes far more uncertain in those countries. In addition, leadership in both China and Russia have ambitious views regarding the scope of their political influence. China’s increased focus on Hong Kong and Taiwan, and Russia’s militaristic ambitions in Ukraine are two recent examples.

Throughout the third and fourth quarters of 2022 and in the early days of 2023, geopolitical conditions stabilized, and no new conflicts or challenges emerged. Our Earnings & Valuation model (used for calculating expected returns) includes geopolitical risk. All else being equal, lower levels of geopolitical risk—and stable known risks—are better for equity valuations.

Geopolitical risk remains quite high, though it appears to have stabilized. China’s re-opening offers a new window into the current thinking of party leadership and provides insight into the country’s geopolitical risk temperature.

Implication: While our base case is stability, we anticipate geopolitical risk to be more unpredictable than usual, with the potential for both positive and negative surprises flowing through to equity valuations.

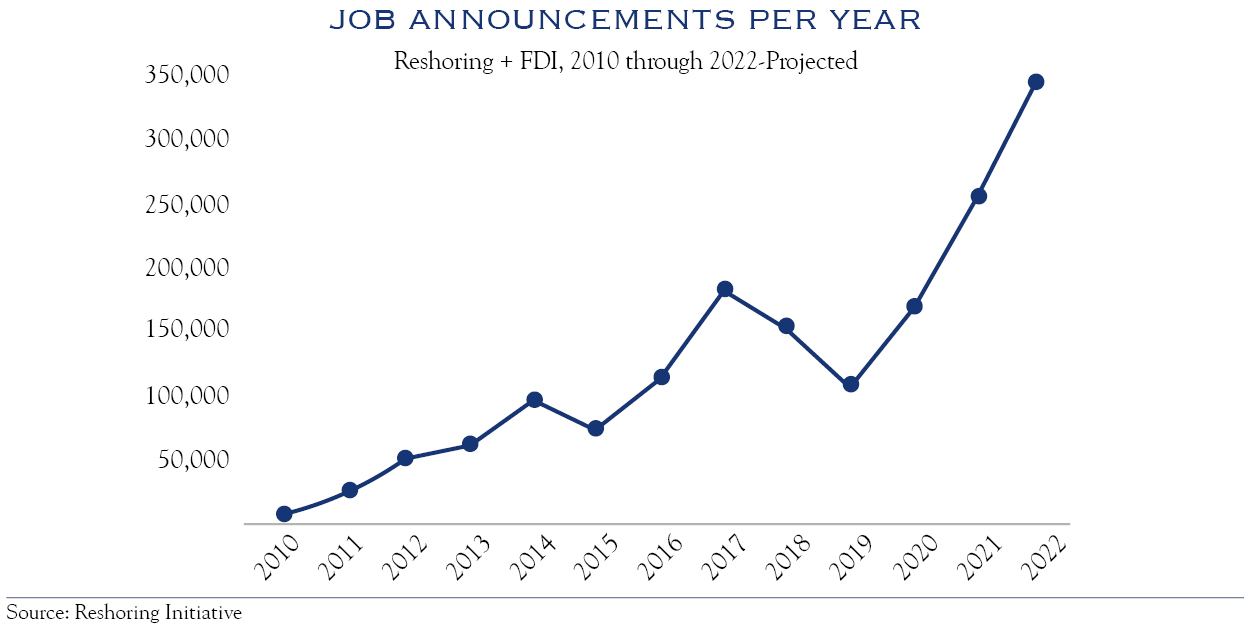

Reshoring Refuels the U.S. Economy

A confluence of events has led to a renaissance of manufacturing activity in the United States. A desire to diversify supply chains, bring capacity closer to customers, and a newfound recognition of the benefits of a stable and secure location for doing business have led companies to revisit manufacturing at home vs. abroad.

Notable examples include the announcements of semiconductor facilities in Arizona, Ohio, and New York; increased employment in the U.S. chemicals industry; and additional manufacturing of batteries in the South.

The following chart highlights the increase in job announcements related to reshoring.

Implication: Reshoring is a robust trend arising from both private industry and government action (CHIPS Act). In addition to jobs, the capital expenditures and the “multiplier effect” mean that these decisions to reshore will have lasting positive effects on U.S. economic activity.

Outlook

Our outlook for equities is predicated on several basic and primary drivers of return: revenues, costs, and valuation changes, as well as dividend income. Many times, a focus on earnings is sufficient. We think, however, it is important to consider revenue and cost separately, by sector. Revenue varies significantly since the goods/services divergence during COVID has created multiple economic cycles across sectors. Similarly, long-term trends of manufacturing re-shoring and the industry dynamics of energy are creating unique cycles in those economic segments. Thus, there are several different economic cycles: goods spending, services spending, U.S. manufacturing, and continued changes in the energy sector. Myriad employment conditions and differences in supply chain management have created unique expense profiles for each industry. We continue to strongly emphasize individual stock selection over bold and broad calls on equities.

We expect small gains in earnings, dividend gains in the mid-single digits, and modest improvements in valuation to generate 6–8% annualized returns in U.S. equities for the next three years. Fading inflation and improving sentiment—near all-time records for bearishness—could create the potential for higher gains. Conversely, an economy that encounters a severe recession would see lower returns. Surprises in geopolitics or domestic policy could tilt the equation. We mostly expect gridlock in Washington, D.C. and hope for stability overseas, both good for valuations. Our base case calls for slow gains in the economy and earnings and improving valuations.

Within equities, small cap equities offer favorable valuations and exposure to increased U.S. manufacturing activity. Equities outside the U.S. also offer compelling valuations, albeit with a massive range of conditions in individual regions and countries. Skilled stock pickers should be able to generate solid returns in non-U.S. companies.

Fixed Income opportunities have improved significantly. A higher starting point (current yields) and the potential for improved inflation and Fed Policy create a favorable risk/return profile for fixed income. As with equities, security selection is paramount, and we continue to favor keeping it simple in fixed income. While 2022 was an outlier of epic proportions, fixed income normally provides a cushion to equity risk and should be constructed to do so rather than stretching too much for extra returns. For modest duration fixed income, we recommend focusing on high-quality instruments and collecting yield through maturity—boring, but rewarding, given the starting point.

After three highly disrupted years, we think 2023 will represent a return to normal—a new now. In years ahead, this new now may prove boring (outside of geopolitics), delivering slow growth and modest gains. It will require significant work to uncover individual opportunities in stocks and bonds. Yet, after the turmoil of the past few years, investors may find that the new and boring now might not be so bad.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC