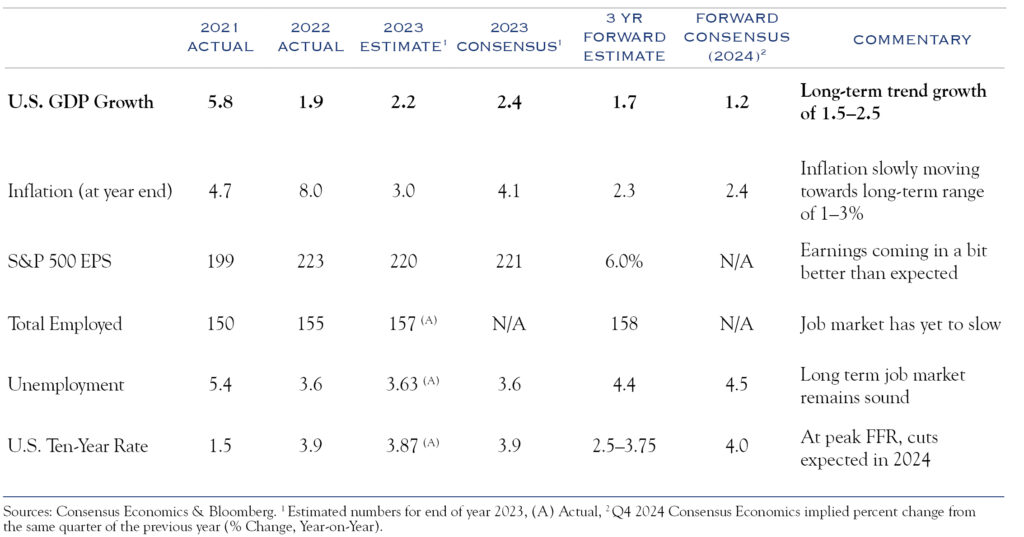

Unexpected ebullience gripped equity investors during 2023, especially in favor of the largest U.S. companies. Due to investor concerns about inflation, interest rates, and economic weakness, they naturally favored large companies presumably better positioned to weather turmoil. As rampant inflation fears abated and the economy muddled along, the market rally spread to bonds and then smaller companies. Valuations continued to rocket higher over the past eight weeks, although conditions are rapidly becoming more complicated.

In some ways, 2023 was easier than most for market participants and prognosticators. Three obvious themes led the way during the year: inflation, consumer strength, and Federal Reserve interest rate policy. Markets followed observable expectations and data related to these factors. Inflation clearly improved, and the U.S. consumer remained highly resilient. Interest rates proved more complicated—and volatile—as Federal Reserve commentary occasionally conflicted with the improving inflation figures.

The coming year will prove harder for strategists to forecast. As Scott Cairns wrote in his poem Early Frost, “Life intends to become serious again.” There are hints of an early frost of slightly more challenging conditions. While inflation and interest rates continue improvement, the consumer shows signs of weakening. The Federal Reserve will play an outsized role in sentiment. That’s not cause for alarm, but we expect a choppy market to reflect a typical environment of slow growth and minimal inflation. Let’s review our perspective on the three themes of inflation, the Fed, and the consumer.

Inflation Continues to Improve and is Nearing Fed Targets

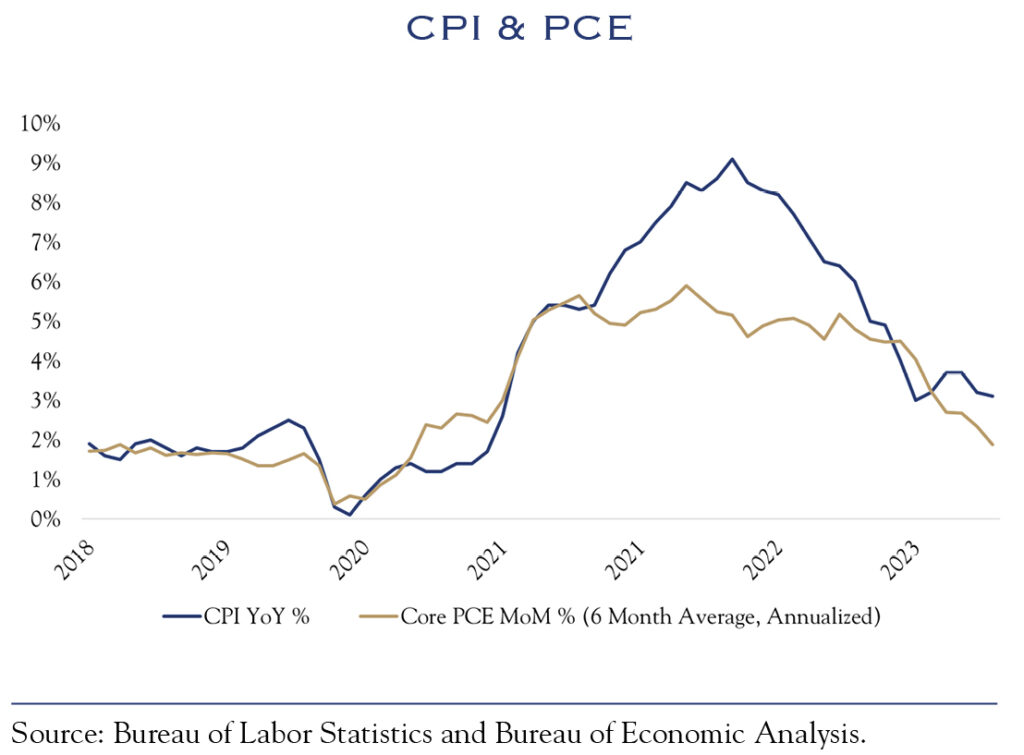

Inflation has been the most important driver for both stock and bond performance over the past two years. Thankfully, inflation should relinquish that role in 2024. Most metrics of inflation are approaching targets set by the Federal Reserve for acceptable levels of inflation. There are three basic takes on inflation:

- Inflation is too high. This belief is important to sentiment and politics. Views on inflation are strongly influenced by the level of observable prices, such as gasoline, and represent the concern that inflation has risen and not receded. For example, an item that cost $100 in 2019 now costs $110 and has since December 2022. In that case, measured inflation has receded to 0%, but the price is

higher than pre-pandemic levels. - The Consumer Price Index (“CPI”) has retreated to 3.1%. CPI is the most widely reported statistic on inflation. Historically, CPI readings around 3.0% have not been detrimental to equity valuations. The question is whether inflation will continue to decline or flare up again. We expect the CPI to continue to decline. Inflationary fuel has been spent, and the lagged housing effect is still to be felt. Using analytics from the San Francisco Fed, we expect another 1% to come out of inflation due to housing in 2024.

- The Core Personal Consumption Price Expenditures Index, or Core PCE, has declined to 1.9% measured on an average six-month annualized basis. The Fed prefers this measure of inflation which has slightly different weightings (lower proportion from housing). The Fed has stated that it observes six-month trailing data, annualized. That’s a key reason the Fed’s tone (and market expectations) shifted from expecting rate hikes to expecting rate cuts.

Inflation has mostly receded without any meaningful economic weakness. With the benefit of hindsight, this inflationary experience appears more like the immediate post-World War II era, rather than the “inflation spiral” of the 1970s.

Why and When Will the Fed Cut?

Federal Reserve speakers have given three important clues about the methodology and potential timing

of rate cuts.

- The first was in August when John Williams of the New York Fed said, “If we don’t cut interest rates at some point next year, then real interest rates will go up, and up, and up. And that won’t be consistent with our goals.”

- Next up was Patrick Harker of the Philadelphia Fed, speaking in October: “So if we get into the range of, I don’t know, let’s call it 2.5%, [and] we’re continuing to move down, then something like that would at least have me considering whether or not it’s time for rates to start coming down.”

- Third was Christopher Waller, speaking to the American Enterprise Institute in November: “If inflation continues to cool “for several more months—I don’t know how long that might be—three months, four months, five months—that we feel confident that inflation is really down and on its way, you could then start lowering the policy rate just because inflation is lower.”

In December, a Bloomberg Economics headline read “Fed Ready to Talk About Conditions for Rate Cuts.”

Projections published in the Summary of Economic Projects, or the SEP “dot plot,” as well as comments following the most recent Fed meeting, indicate the next move will be a cut in rates, not a hike.

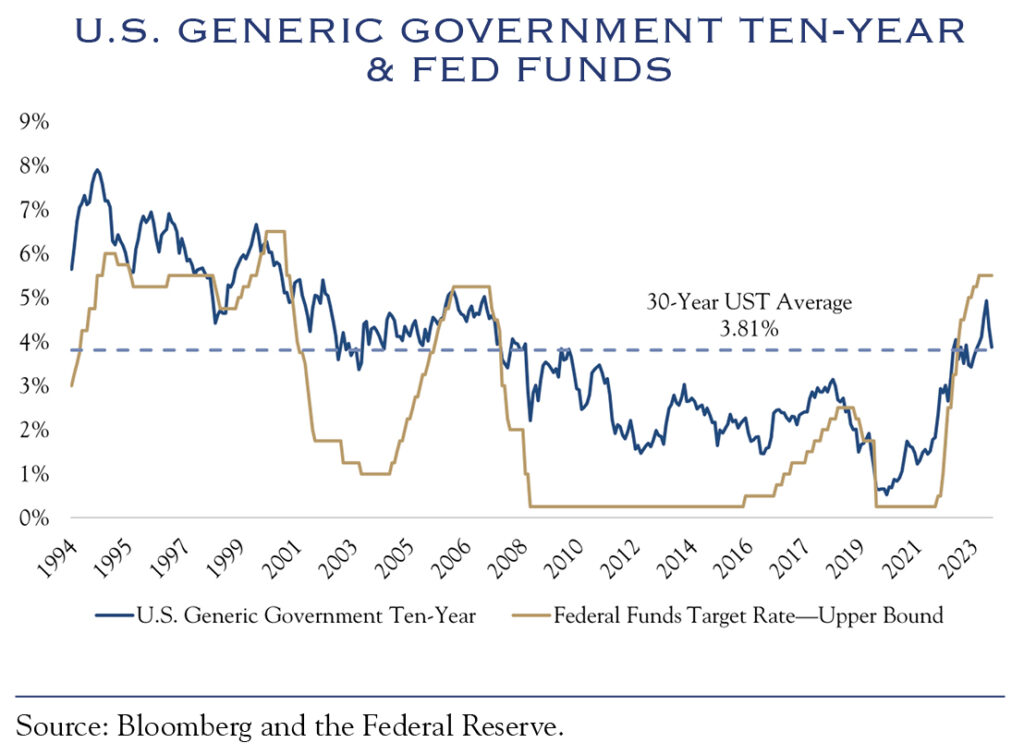

The market’s expectations, gauged by futures pricing, reflect these changed views. Market participants anticipate six cuts in 2024, bringing the Fed Funds rate from 5.5% to 4.0%. This metric of rate expectations has been useful since the yield on the U.S. Ten-Year Note has largely followed the path of expected rates one year in the future.

Bonds rallied dramatically and interest rates declined over the past two months due to changed expectations of Fed Policy. The yield on the Ten-Year Note has dropped to around 3.85%. That was the easy part; further predictions are going to get much more difficult.

We agree with the consensus market view that rates will decline. The timing of rate cuts, however, remains a challenging question. The 2024 U.S. Presidential Election further complicates the situation. The Fed typically minimizes policy action during election years. For now, with solid but slowing conditions for the labor market and consumer spending, we expect the Fed to wait as long as possible to cut rates. Currently, the market expects a cut at the March 20 policy meeting.

Our base case, at 60% probability, agrees with a first cut in March, and a reduction of 150bps throughout 2024. Two less likely possibilities are: 1) a 20% probability of a cut in January, if inflation declines more than expected along with more economic weakness. This would allow the Fed to front-end load easing of policy restrictions while avoiding the heart of the election cycle; and 2) a 20% probability of delaying a cut until economic weakness appears and then cutting more rapidly—perhaps a 50bps cut—in summer 2024.

The Economy & Consumer Will Remain Resilient

The resiliency of the U.S. consumer throughout 2023 was a surprise to many. Two concepts underpin that strength. One is fleeting, and the other should remain intact.

The pent-up savings/spending patterns of the post-pandemic era boosted spending levels. This trend nears an end. Social conditions have been back to normal long enough that spending patterns are returning to normal. Early indications of 2023 holiday season retail sales reflect this; they are up from last year but not by much.

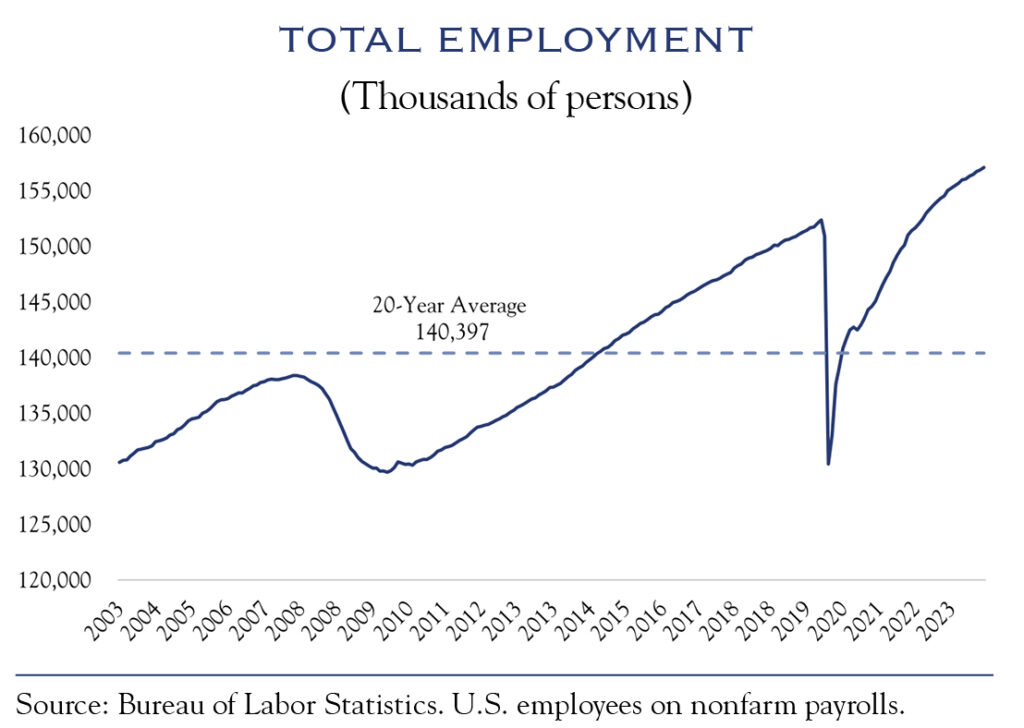

The labor market continues to expand, though at a slower pace. The JOLTS survey shows 8.7 million job openings. While openings are down from a peak of nearly 12 million, they are still well above the 5.0–7.5 million average range of the pre-COVID era. Elevated levels of job openings are from demographic shifts, including U.S. population growth and millennials reaching peak earning and spending years; a continued focus on U.S. manufacturing; supply chain resiliency; the lagged effects of government spending such as the CHIPS Act; and the increased focus on domestic energy production—both traditional (oil) and new green energy.

The New York Fed and the Atlanta Fed models show current economic growth of 2.4% and 2.5%, respectively. Real-time data on spending and mobility are consistent with that growth range. We expect growth to slow more but think it will remain positive, with 2.0% GDP expansion in 2024.

Earnings Will Not Post an Average Year

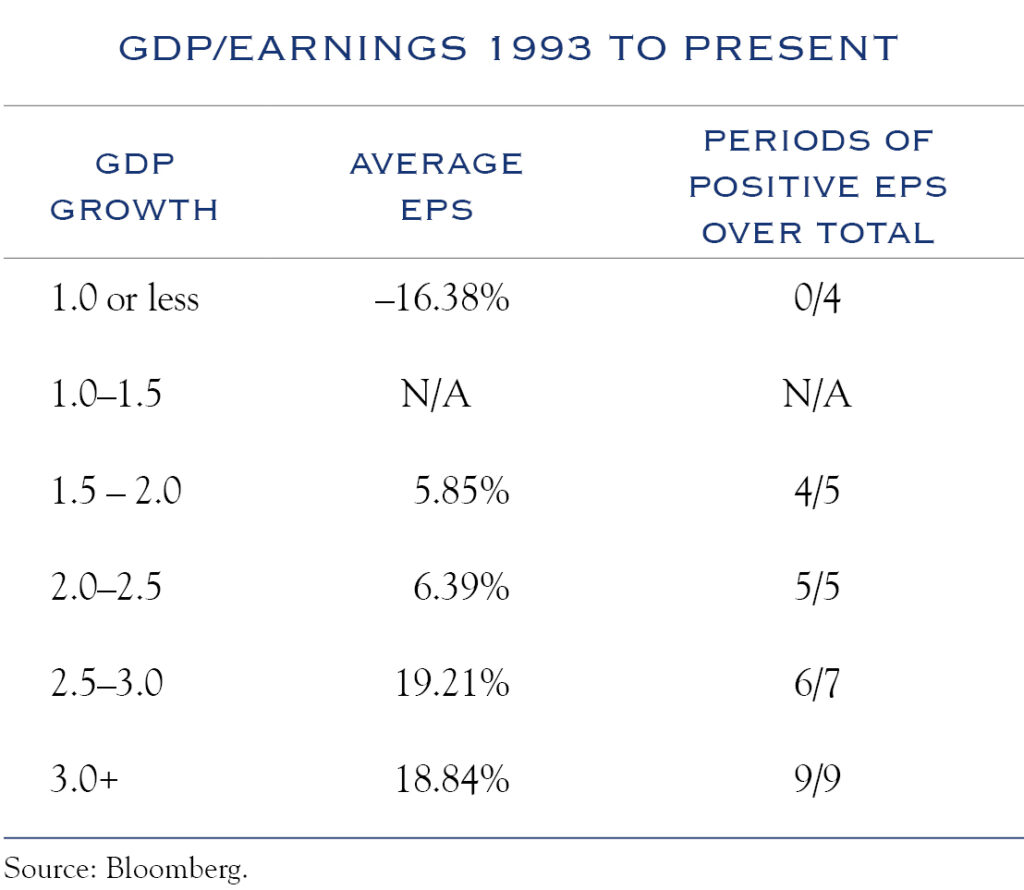

Economic growth and earnings growth have a long-standing relationship, like the concept of operating leverage for business earnings. Typically, earnings will outperform the economy when growth is positive and underperform during recessions.

We reviewed the past 30 years of earnings and economic data and found some interesting and stable patterns. When GDP growth is above 2.5%, earnings averaged gains of +19%. Earnings growth appears to stall at around 1.0% GDP growth. In two instances of 1.0% or slower growth and two instances of recession, earnings fell by –16% on average, within a range of –14% to –18%.

The past 30 years have seen 10 instances of GDP growth between 1.5% to 2.5%, similar to our 2024 forecast. Earnings were positive in 9 of 10 slow-growth years, and earnings growth for the S&P 500 averaged 5.8%. During those slow growth years, 75% of companies in the S&P 500 posted earnings gains. Even in periods of slow economic growth, most companies eked out higher levels of earnings growth.

Three important takeaways:

- Growth above 2.5% can produce powerful earnings, often above +15%.

- Growth below 1.0% can be a problem, even without turning into a recession.

- Growth of 1.5% to 2.5% leads to widespread earnings gains, averaging nearly 6%.

Given our forecast for 2.0% GDP growth, the economy is likely to support broad-based, mid-single-digit earnings gains.

Consensus earnings forecasts are higher than ours, expecting an +11% gain in 2024. Earnings expectations tend to decline throughout the year, with optimism replaced by realism. We expect the same dynamic to unfold this year.

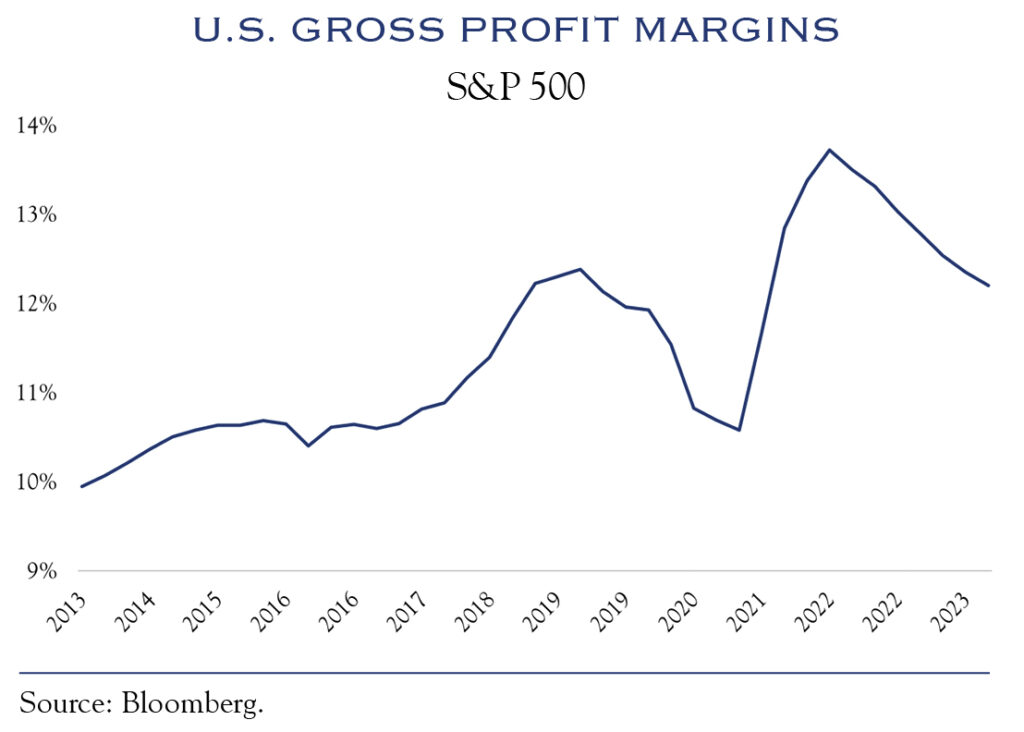

We predict 2024 earnings of $235, a gain of +7%, consistent with years of 2% GDP growth, aided by productivity and margin gains. The potential for margin expansion supports our view of earnings. Although corporate margins are elevated versus history and costs have increased (especially for labor), we expect corporate leaders to drive cost savings and efficiency in 2024. Expanded availability of artificial intelligence and robotics, to name only two examples, will enable myriad possibilities for productivity.

Valuation Levels are Fair with Some Room to Improve

Valuations expanded following the massive rally in equities in late 2023. With 2023 earnings running around $220, the Price/Earnings (P/E) ratio has expanded from 18.7x to 21.6x since late October. This is consistent with the significant bond rally, in which interest rates declined from 5.0% to 3.8%.

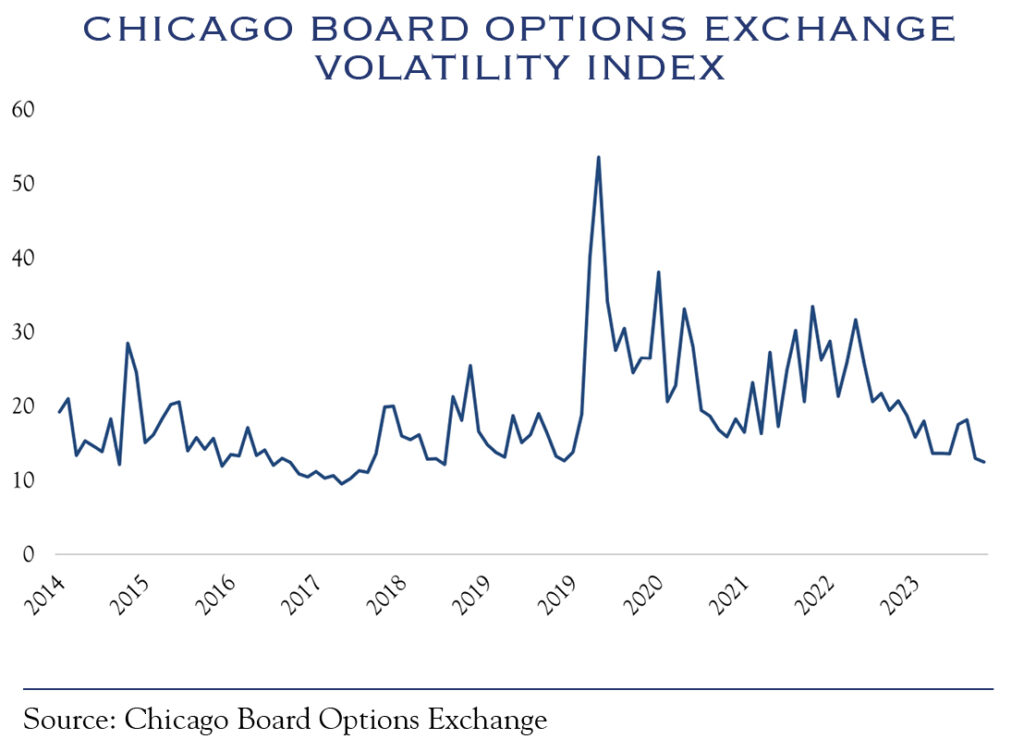

Declines in the VIX volatility index also indicate the good news is causing some complacency to set in.

Equities currently trade near fair value, with the potential for upside in 2024 if inflation and interest rates improve and election year dynamics do not become too heated.

Our valuation model includes five elements.

- Inflation—Inflation has declined to tolerable levels and should improve. The market, however, already priced in much of the good news.

- Interest Rates—The outlook for rates has improved significantly over the past two months, during which rates dropped from 5.0% to 3.8%. Prior to the pandemic, rates averaged near 2.5%. We expect rates to continue declining, at a slower pace as inflation improves throughout the year.

- Sentiment—Sentiment and risk exposure levels remain mixed. Election year rhetoric is likely to dampen sentiment gains.

- Domestic Policy—We are unlikely to see major changes in an election year. Post-election, domestic policy will play a more important role in valuations.

- Geopolitics—Although two conflicts continue to dominate global news, the heated geopolitical environment has stabilized. U.S./Chinese trade relations also have stabilized.

With most of the easy boost from inflation and rates factored into valuations—and absent any major changes in sentiment, policy, or geopolitics—we expect only a minimal increase in valuations throughout 2024.

Outlook

We think 2024 and the years ahead will reflect a traditional economic environment of slow growth and low inflation. This places a greater burden on in-depth security selection, multi-faceted portfolio construction, old-fashioned research,

and new-fangled data sets.

A forecast for interest rates underpins any outlook for stocks and bonds. This is an exercise that is both simple and complex in the current environment. The simple part is that inflation will continue to decline. Far more complicated is an assessment of how the Fed will act in the year ahead. In other words, the focus moves from data (inflation) to the nebulous art of interpreting Federal Reserve commentary—“Fed Speak.”

Equities

Modest earnings growth and minimal further advances in valuation will generate mid-single-digit gains for stocks.

We continue to favor diversification and balance across the growth and value equity segments. Growth stocks, while more richly valued, bring organic growth that is so valuable in a low-growth world. The value segment contains sectors that will continue to benefit from a stable employment environment and expansion of domestic economic activity in manufacturing and energy, reshoring trends, and fiscal spending.

The small cap segment has the potential for outsized gains, as valuations and price levels have yet to fully regain levels set two years ago. The decline in interest rates provides an extra boost to small caps, as it helps alleviate some of the financial stress often borne by smaller companies.

Non-U.S. stocks retain their longstanding valuation advantage. However, overseas economies appear more fragile, and the culture of innovation is generally less strong in comparison with the United States. Nonetheless, there are great companies found in markets all around the globe, often at compelling valuations. Skilled security selection is a critical part of overseas investments.

Bonds

We expect bonds to rally further and rates to decline albeit at a much slower timeline than what has occurred in recent months. The U.S. Ten-Year Note ought to continue to follow one-year forward expectations for Fed Funds. The middle part of 2024 could see another bond rally, so long as inflation declines continue. Within the credit segment, we continue to favor high-quality, detailed security selection. A slowing economy is likely to be neutral for credit, so security selection will take on an outsized role.