Finding the Next Theme

The middle of the 19th century was an era of explosive innovation in the United States. The Erie Canal, the telegraph, and the expansion of railroads dramatically increased the speed of movement for goods, people, and information. These technological advances resulted in prosperity, as eras with considerable innovation often generate gains in corporate earnings. However, the period experienced some significant “creative destruction,” a term coined by the economist Joseph Schumpeter to describe the disruptive process of progress and innovation. Not surprisingly, the limited historical economic and market data from this period depict a volatile path with significant wealth creation.

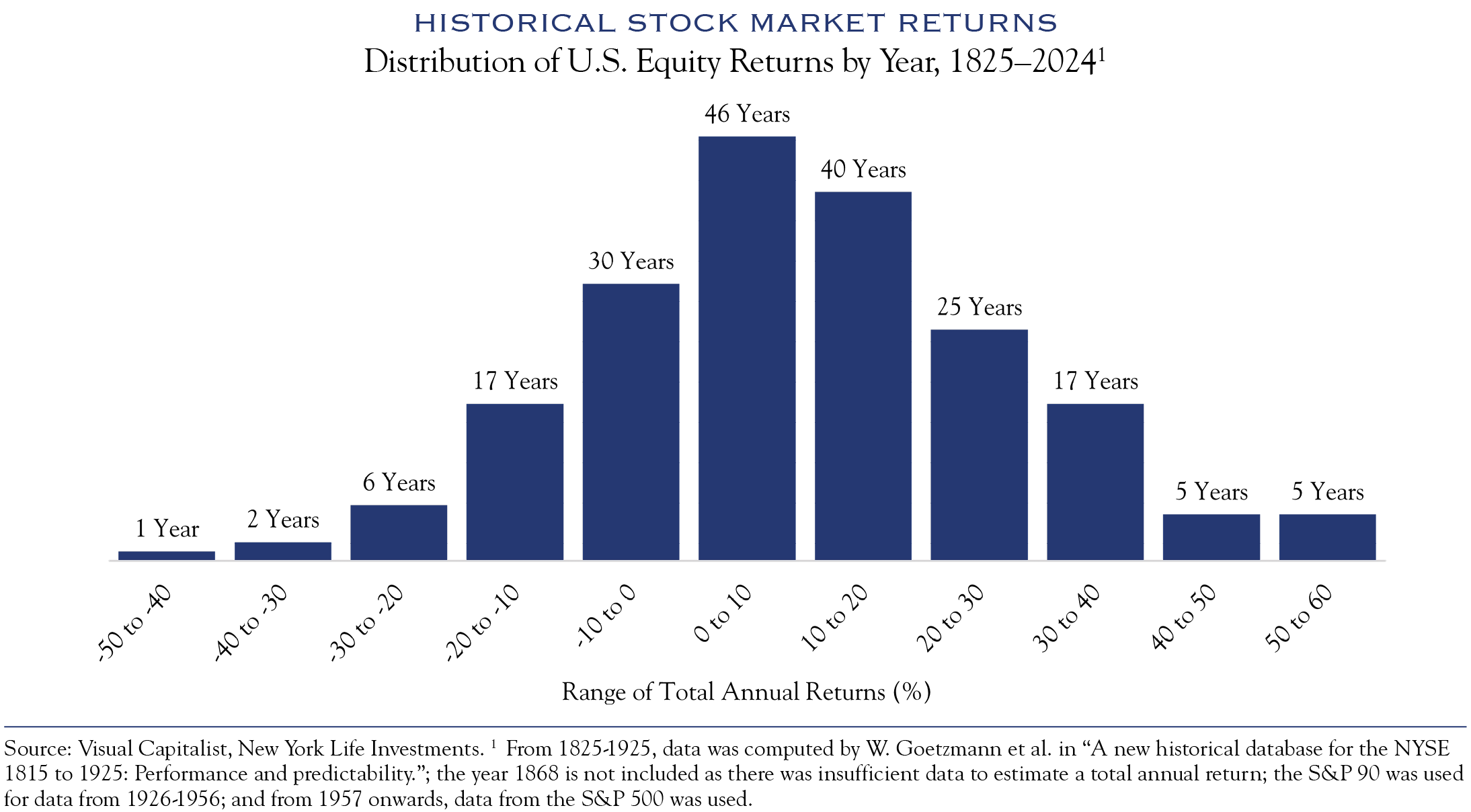

Annual returns span a wide range of outcomes, with outlier years often catalyzed by dramatic and unexpected events. Equally important are the long stretches of time when one metric or another dominates investor thinking.

In hindsight, it is easy to identify trends and characteristics that define specific eras. Likewise, with hindsight, it is simple to attribute economic and market action to a particular issue. Prominent examples include the internet bubble, the banking crisis, and the inflationary 1970s. More recently, the period from 2020 to 2023 is defined by the pandemic cycle of boom, bust, and recovery. In 2024 and beyond, as conditions normalize for the economy, we must ponder what comes next. What narrative or theme will capture investor attention?

To answer the question, we evaluated signals from the market and economy (slow growth is the new story) and built a view of the future (technology will enable productivity). This enabled us to determine what might become the next relevant metrics for investors: we expect a challenging but profitable future centered on profit margins and dividends.

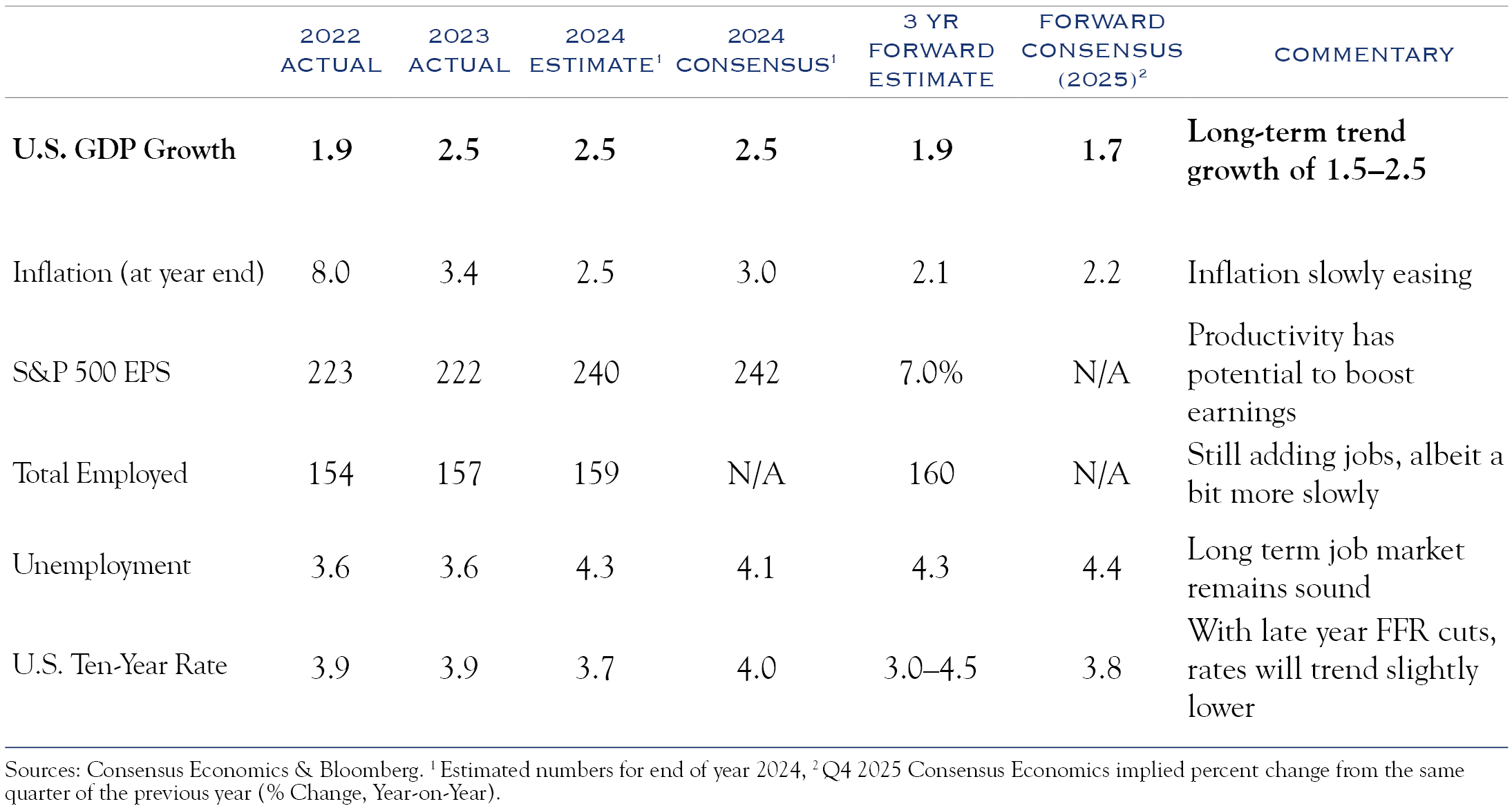

In the near term, we anticipate continued volatility as investors adjust to the new normal and seek a new set of guideposts. A data-driven Fed and the upcoming presidential election cycle further contribute to a volatile backdrop. Looking over our three-year forecast horizon, we see earnings growth as the primary value-creation mechanism through all this choppiness and look for stocks to follow earnings modestly higher.

Current Market Signals Point to Increased Focus on Margins & Dividends

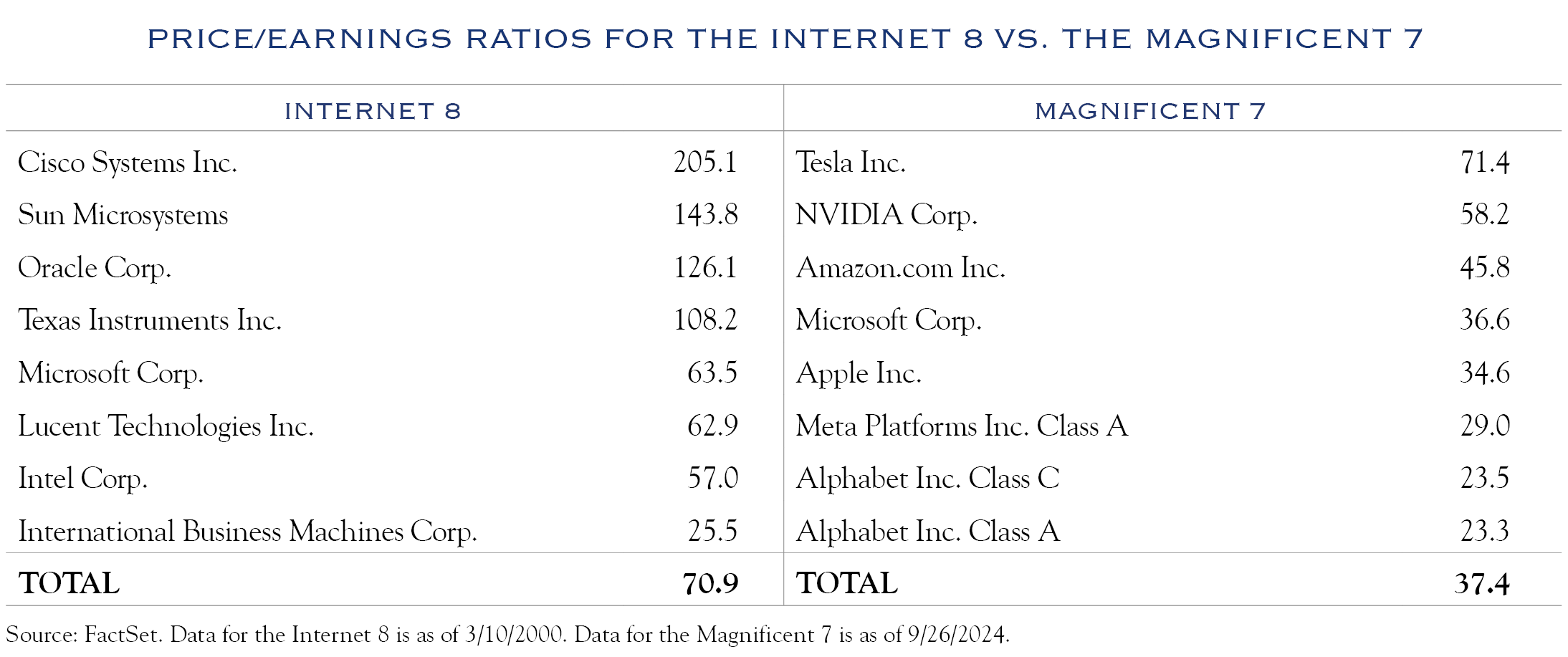

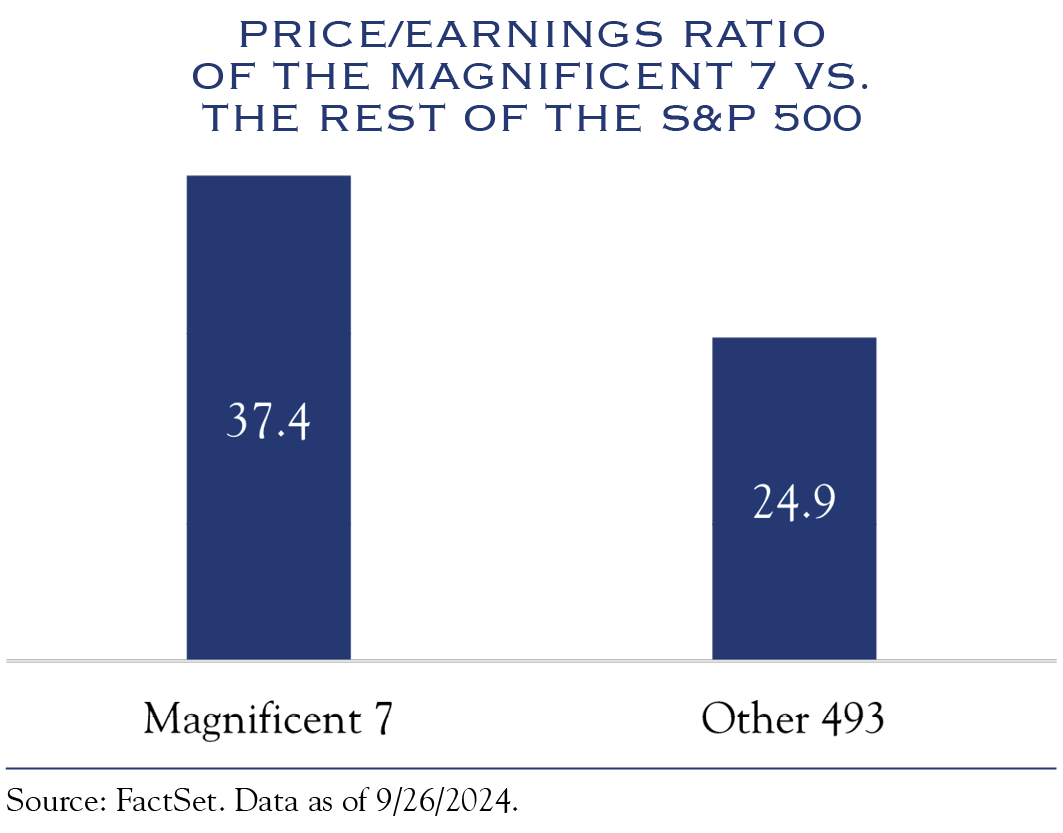

Presently, equity valuations are elevated compared to historical norms, though far from the extreme levels seen prior to valuation-driven declines, such as the reversal of the 1990s internet bubble. This is true even for the most popular market segment, the Magnificent Seven.

With the dominant performance of this small segment, it is worthwhile pondering why leadership is so concentrated. One reason: that’s where the earnings are.

A traditional cycle would see an acceleration of economic growth, leading to broader earnings gains. Currently, the economy is expanding at a modest pace and continuing to cool from the post-pandemic boom. This cycle seems unlikely to see accelerating economic growth but may see an extended expansion. Companies will need to control their destiny by generating profits in a slow-growth environment or by pleasing investors with a return of capital through dividends.

Additionally, interest rates have declined in recent weeks. The U.S. Ten-Year Note yield has dropped from a recent high of 4.5% to around 3.6%. Meanwhile, the Federal Reserve Open Market Committee recently voted to lower the Fed Funds rate from a 5.50% upper limit to a 5.00% upper limit. The decline in interest rates is likely to increase the appeal of a larger swath of companies, including smaller companies and dividend payers. A continued favorable outlook for interest rates will alleviate fears of financing stress, making investors more amenable to investing in a broader set of companies. The reduction in interest rates also lessens the risk of recession and likely lengthens the time horizon for economic expansion. This should broaden the segment of companies seeing growing earnings, especially those that can increase profit margins even though growth is moderating.

Current Economic Signals Point to Slower Growth

The most recent data on U.S. GDP showed an economy growing at 3.0% in the second quarter.

Real-time models point to modest growth. The Atlanta Fed’s GDPNow model shows 2.50%, and the Dallas Fed Weekly Economic Index is consistent with 2.69% growth. Data on real-time spending, retail sales, and mobility data all reinforce those projections.

While the economy remains in growth mode, the pace will likely slow. Anecdotal evidence from various surveys and commentary on earnings calls indicates a deceleration in economic activity.

While the economy remains in growth mode, the pace will likely slow. Anecdotal evidence from various surveys and commentary on earnings calls indicates a deceleration in economic activity.

One example of this anecdotal evidence is the Beige Book. Dating back to the 1970s, the Beige Book has been an essential source of information for Fed officials. Numerous Fed Chairs, including Jerome Powell, have discussed their use of this publication’s timely, qualitative descriptions of business activity. The Beige Book is prepared before the Federal Open Market Committee meetings and summarizes economic conditions across 12 Federal Reserve districts derived from a vast network of sources. Academic research has supported the importance of Beige Book commentary in giving policymakers an early indication of the economy’s direction. The Federal Reserve’s description of the publication notes that it “creates an opportunity to … identify emerging trends in the economy that may not be readily apparent in the available economic data.”

If the Fed is watching the Beige Book, the publication becomes crucial. The most recent report includes information through late August, showing that only three districts reported slight growth in economic activity, while nine reported flat or declining activity. Though growth is lackluster, there is some stability, as employment levels held steady and layoffs were low. Overall, the Beige Book points to a slowing but stable economy.

A more recent qualitative tool for assessing the economy is the availability of Natural Language Processing (NLP) tools to rapidly review earnings reports. One aspect of our process is reviewing earnings commentary related to consumer and business activity.

On the earnings front, a major retailer noted that consumers are “discerning” and “value-seeking,” but there is no incremental fraying in consumer health. A major bank reported that consumers are employed and earning money but spending at a rate of about half that of the prior year, consistent with a “more normal growth economy.” A major transportation firm described customer activity by saying, “the sense of urgency isn’t there” and that it “usually happens when things are kind of tough when people are trying to save money.”

With a slower growth backdrop, the economy edges closer to the “danger zone.” Historically, when a quarter is slower than the prior quarter, and certainly if two quarters show declining growth, the economy is in the danger zone. That’s because growth will typically slow for a few quarters before turning negative. The most recent data for second-quarter growth of +3.0% was above the prior quarter, so a recession is not likely imminent. However, the anecdotal data in the Beige Book and from earnings commentary points to a slowing growth rate in the quarters ahead.

A typical recession path also sees a slowdown in housing and consumer activity before a recession. A National Bureau of Economic Research paper (Edward E. Leamer, “Housing is the Business Cycle.” September 2007) includes some data on the path to recession. On average, in the year before a recession, GDP weakens by 2.6%. In current terms, this would bring growth to a level hovering around zero. The paper also found residential investment is responsible for 25% of the decline, durables for 20%, and service for 11%.

After the pandemic, spending on durables has been weak, but services and housing have remained stable. The primary reason for continued strength in those areas has been the expansion of payrolls and growing wages that feed into continued spending.

The most significant driver of economic growth is expansion in the labor market. Though still expanding, monthly payroll gains have slowed to approximately 185K over the past six months from roughly 235K in the prior six months. Job openings number 7.7 million vs. a peak of 12.2 million. Wages are still rising, albeit at a pace of 3.8% vs. a peak of 8.0%.

We see job gains continuing but at a slower pace. Primary sources of strength have been healthcare and government, areas where we expect to see further hiring. The job openings rate is the number of job openings as a percentage of total jobs plus openings. It measures how much hiring the industry would like to do. Healthcare is still doing some catchup hiring from the pandemic and has one of the highest job opening rates at 6.0%.

The Future Looks Productive

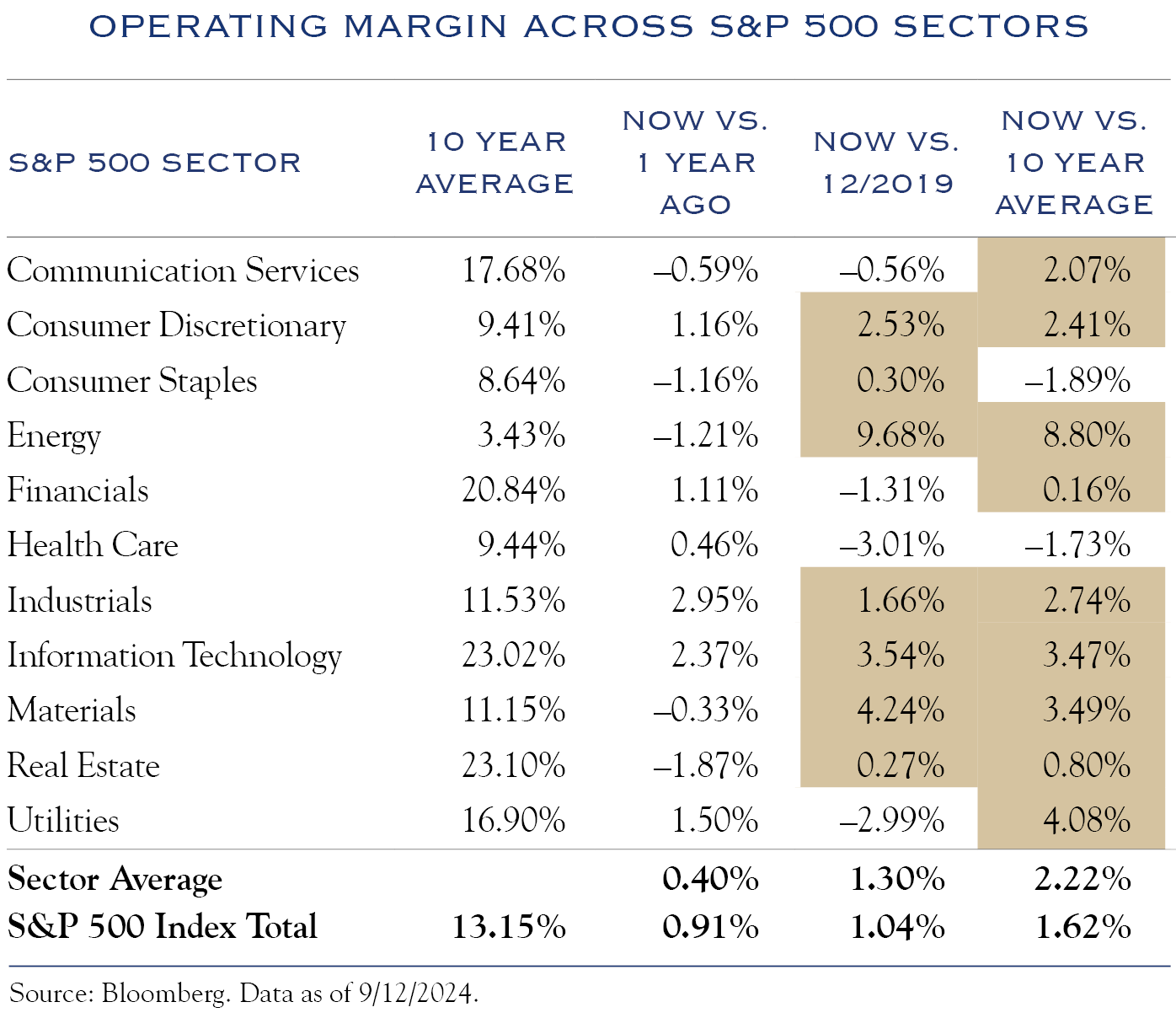

The disruption of the pandemic, the slowing economy, and the broadening application of productivity-seeking technologies all contribute to an uptick in productivity and profit margins.

We recently conducted an exhaustive review of profit margins across sectors within the S&P 500. Our research shows that nine sectors have exceeded their ten-year average profit margin, while seven have exceeded their pre-pandemic margins. For the index overall, margins reside 1.6 percentage points above the ten-year average and are up about 1.0 points vs. one year ago and vs. pre-pandemic norms. Clearly, companies are finding ways to innovate and increase profits.

In assessing future profit margin growth, we evaluated the applicability of new technologies across sectors. We found several large segments of the economy with significant potential for continued margin improvement via robotics and artificial intelligence.

Perhaps shocked by the staffing reductions at X/Twitter, many large technology companies have maintained stable staffing levels despite massive revenue increases. Healthcare has not yet recovered to pre-pandemic margins but has ample opportunity for improvement in productivity and cost control through robotics and artificial intelligence.

Within the field of artificial intelligence, large language models such as ChatGPT get a lot of attention (both positive and negative), and specific applications can boost productivity (shown in research such as that done by Brynjolfsson, Li, and Raymond, “Generative AI at Work.” April 2023). Further, the subset of AI known as machine learning also holds great potential for improved decision-making. Companies boost margins at the margin. As described by legendary football coach Chuck Noll, to be really great, you must do the small things extraordinarily well. Machine learning enables continued improvement in data analysis and decision-making. These small things, when done well, lead to increased profit margins. Not all companies will adapt to the new era, and we expect to see some dispersion and creative destruction in the years ahead.

The Path Ahead

“Over the past year, we have continued to see solid growth and healthy gains in the labor force and productivity… [S]trength in the labor market can be maintained in a context of moderate economic growth and inflation moving sustainably down to 2 percent.”

—Fed Chair Jerome Powell

Recent commentary from Fed Chair Jerome Powell is consistent with our view of the economy. Speaking at the National Association of Business Economists meeting, Powell noted that “Over the past year, we have continued to see solid growth and healthy gains in the labor force and productivity.” He went on to mention that “strength in the labor market can be maintained in a context of moderate economic growth and inflation moving sustainably down to 2 percent.”

In our view, labor is the critical driving force of the economy as employment and wage gains power consumption. Though labor market conditions have slowed a bit, they remain in solid territory and are more favorable than most historical comparisons.

With the economy returning to a normal, slower pace, attention will turn to companies that don’t require a high-growth backdrop to succeed. Expanding profit margins through increased productivity and returning capital via dividends are two characteristics that should appeal to investors.

This scenario does not lend itself to bold proclamations of categories that will outperform. Opportunities will be abundant within all market caps, styles, and geographies. Companies that adapt to the new normal of slow growth and a focus on profits and dividends will excel. Diversification into small-cap and non-U.S. equities should cease to be deleterious to portfolio performance, as opportunities for productivity will also exist in these areas.

We use an earnings and valuation model to assess expected returns for equities. On valuation, we review inflation, interest rates, sentiment, domestic policy, and geopolitics. Sentiment is already relatively favorable, offering little room for improvement. The domestic and global geopolitical backdrop will likely remain noisy but mostly stable, providing minimal prospects to boost valuation levels. Currently, valuations are elevated vs. history, though we think this is sustainable as inflation and interest rates are improving. However, the outlook for both inflation and interest rates remains subject to incoming data, creating volatility. We look for valuations to be choppy over short time horizons but to mostly reside around current levels in coming years.

With valuation likely to be rangebound, earnings and dividends provide fuel for future gains.

Presently, consensus estimates point to 15% earnings gains for 2025, which is too optimistic. Embedded within those estimates are substantial profit gains for companies in cyclical segments of the economy. We think those estimates might be hard to achieve with the economy slowing. Our research shows that economic growth of around 2.0% is consistent with earnings gains of 7-8%. If economic growth enters the danger zone of less than 1.5% and slows for multiple quarters, we will reduce our earnings growth estimates. Earnings gains could exceed our estimates if productivity gains become more widespread and companies continue to boost profit margins.

Within fixed income, we continue to emphasize careful credit selection. While credit spreads aren’t showing any signs of stress, a slower growth rate could pressure weaker companies. A positive influence is the likely move lower in interest rates, driven by Fed policy. It is important to note that current rates already embed a view of lower Fed Funds, so it will likely be a slow, grinding process rather than a eureka moment where rates drop suddenly.

The post-pandemic economy is no more. Economic growth is slowing, and investor attention will gravitate toward profit generation and dividend distribution. Innovation and productivity will be the important buzzwords of this slow-growth era.

Equities

With individual company actions becoming a key driver of profit margins, we see more benefit from stock selection than from choosing between value or growth. Diversification is worthwhile, and stock selection is critical.

Small Cap & Large Cap

Interest rates have peaked, and we expect market gains to broaden beyond mega- and large-cap companies. Financing pressures will ease, allowing investors to become more comfortable with smaller companies.

U.S. & Non-U.S.

The United States retains advantages in demographics, economic growth, and innovation, especially relative to other larger economies such as Europe and China. However, valuations remain attractive outside the United States, and careful stock selection creates an ample opportunity set for non-U.S. investing.

Fixed Income

In fixed income, we continue to emphasize the importance of careful credit selection. This is especially true as economic growth is slowing.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed.

© Silvercrest Asset Management Group LLC