The amount of wealth being passed from one generation to the next has reached unprecedented levels in the United States. According to a study by the consulting firm Accenture, approximately $30 trillion is set to pass from Baby Boomers to Generation X and Millennials over the next several years.

Taking the time to prepare the next generation through communication, education and strategic transfer of responsibilities can help ensure future wealth holders have a concrete understanding of the values underpinning a family’s legacy. Additionally, it can enable them with the ability to preserve and grow a family’s wealth.

Components of Generational Wealth

The three primary aspects to generational wealth are financial assets, financial acumen, and financial principles. Financial assets are the actual pool of monies, securities, investments and/or other property that comprise a family’s wealth. Financial acumen involves having the knowledge and understanding of basic financial and investment principles to display sound judgment in the execution of financial decisions. This is a critical aspect in preparing and educating next-generation wealth holders. Financial principles are the most nuanced dimension of generational wealth. Communicating and modeling beliefs around wealth is an essential component of the dialogue across familial generations. Expressing family values with respect to wealth preservation, spending, intergenerational transfer, and philanthropic objectives is crucial to not only preserving assets, but also a family’s values.

Involving the Next Generation

Wealth creators and owners are well-served by beginning a dialogue early. This involves building prospective heirs basic financial understanding of asset types, cash flow potential, risk tolerance, asset allocation, and portfolio construction. Building a financial vocabulary is a useful way to begin to engage with next generation wealth holders.

For example, a meeting with an advisor to explain how a basic trust works, covering the roles and responsibilities of trustees and beneficiaries while demonstrating how advisors support the parties involved. This provides an easy way to engage and educate prospective heirs without having a conversation around specific dollar amounts.

An added benefit of engaging future generations early is that it presents an opportunity for wealth holders and future wealth holders to develop a rapport with the advisors that will ultimately assist them.

Value-Added Practice

In addition to building a financial vocabulary, it can be helpful for the next generation to gain experience through involvement in the management of a beginner portfolio. A common example of this can be seen when parents might begin to gift assets into a trust or gift account, where a child is the beneficiary. The child then works with the advisor on the management of those assets. This is a practical way in which children of wealth creators, or wealth holders, can use their financial education and develop a deeper understanding of investment types, principles of diversification, risk management, and cash management.

Another way in which wealth holders might engage the next generation is through charitable giving. Where investors have a donor advised fund or a family foundation, children and grandchildren can help decide what charities the family supports.

These examples can serve as a forum not only for education but also for spurring intra-family dialogue around familial values and financial priorities.

Conclusion

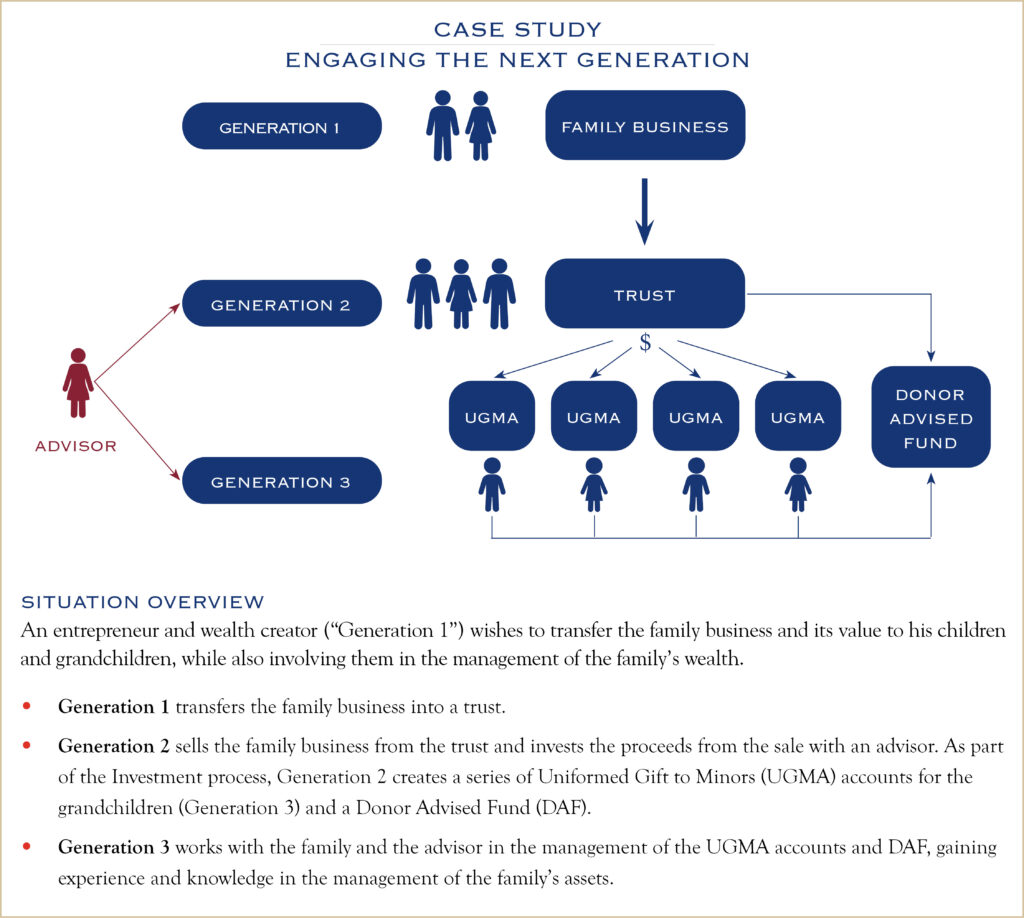

The key is to allow the next generation to participate in decision-making in order to become effective and responsible stewards of their money. It is important to help the next generation become financially literate, so that they can create the life they want and manage the assets that eventually will become their own privilege and responsibility. In the following case study, a number of these concepts are illustrated in a successful real-life example following three generations in one family’s wealth story.