Over the past few days, Western governments have decided to aggressively stop economic activity similar to the approach taken in China to deal with COVID-19. The strong opinions on the wisdom of that decision will not be debated here. It appears the Chinese approach worked to stem the spread of the coronavirus. It is, however, economically costly, if not devastating in some segments of the economy. All companies must somehow fund their businesses for the duration of the stoppage.

Adding to funding fears is the fear of the unknown as it relates to the virus. While certainty is impossible, the basics remain unchanged from when the world first learned of this coronavirus. It is more contagious and less deadly than SARS and more deadly than the common flu, particularly for older and higher-risk individuals. What was unknown was that the actions taken by China in late January would ultimately be taken, in some form, by many Western governments.

Gauging the depth and duration of economic disruption allows some sense of the scale of liquidity support required when businesses aren’t able to generate revenue. The market has quickly reflected this with a disparity of losses between companies with stronger and weaker balance sheets. Further dispersion results from the unequal effect of stoppages and the resumption of activity after the immediate crisis. Active stock selection can find and create value by making decisions based on these relative valuation differentials. During this decline, there has been a relative outperformance spread of nearly 10% between companies with stronger balance sheets vs. those with weaker balance sheets. In addition, during economic stoppages and during the eventual recovery, there will likely be strong dispersion across various industries. As an example, The Wall Street Journal recently titled a piece “Coronavirus Sparks Business-Tech Deployments.”

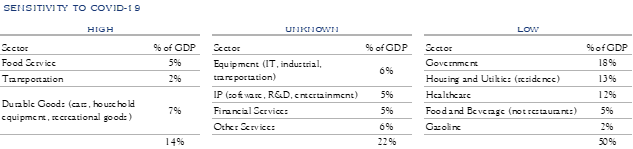

Without falling into a false precision trap, the table below outlines key segments of the U.S. economy and some work on whether the effects from current stoppages is high, low, or mixed.

Using that framework, it is easy to paint a picture of dire consequences for GDP for the period of the stoppage. A simple framework whereby one month equals 1/12 or approximately 8% of GDP and a halving of activity would imply a 4% monthly cost. A more nuanced approach would review each segment above and adjust accordingly; this would imply something closer to a 2% monthly cost. In any event, the market has reacted quickly. The total market cap of all U.S. stocks has declined by over $10 trillion from its peak through March 16th. In other words, market cap destruction has been on the order of nearly half of annual GDP. This decline brings the valuation ratio of total market to cap to GDP to a much-reduced level of just over 100% vs. recent highs near 160%.

This brings us full circle—how long will it take to beat back COVID-19 such that economic life can resume? Further, how to best finance companies during this stoppage? These financing fears led the Federal Reserve to take action on several fronts. While the equity market reaction was negative, a single day vote is not a measure of success or failure. The Fed’s message seems to be two-fold. First, it will take any action needed to support freely functioning markets during hectic and volatile trading. Choppy trading and illiquidity in segments of the fixed income market led to this move. The Fed’s second message pledged help for banks to support businesses and individuals disrupted by the economic stoppage. This funding gap is large, particularly in certain industries. Yet the challenge is not nearly as opaque as the challenge of funding failed bank balance sheets during the financial crisis. Making a lending decision for an airline, or the local restaurant, in this uncertain time is complicated, but far less so than making a lending decision on Lehman Brothers or Bear Stearns. More hard work lies ahead for business leaders, banks, and the government to devise reasonable funding plans to support businesses that are effectively under work-stoppage orders. On March 17th, officials from the Federal Reserve and the Trump administration continued to unveil proposals and packages of historic proportions, all geared toward providing support during this challenging time.

This realm of uncertainties has caused some investors to crowd the exits hoping to wait it out and find the perfect re-entry point. Much of the money exiting and re-entering across days that see moves of +/−5% or more seems to be from short-term trading strategies, often managed using overly simplistic Value at Risk (“VaR”) models. Dodging short-term pain has appeal, but often does not work. It requires perfect execution of two market timing decisions. Long-term success comes from holding a portfolio that can endure the challenging times and benefit from the rewarding ones.

We have seen reports of cash holdings in portfolios reaching levels last seen in the financial crisis and have been monitoring the effect of volatility on VaR-driven models. We have been closely tracking COVID-19’s spread around the globe, as well as the economic shutdowns and resumption of activity seen in parts of Asia. We don’t intend to attempt to call a bottom, however, this work provides some framework for understanding shorter-term trends. Changes in the rate of change of those trends—the second derivative—will inform our thinking. Our asset allocation work contemplates a forward-looking, three-year horizon, allowing time for fundamental business activity to earn a return. In the meantime, Silvercrest’s analysts managing our proprietary equity strategies and our outside equity partners are taking advantage of the steep decline in the price of high-quality companies.

It is estimated that the first instances of the coronavirus appeared in November in China, while China’s peak economic stoppage occurred in late January. China is not yet back to normal, although it is in the re-opening phase. The measures taken in the Western world are not quite as extensive as China’s and, while March in New York City has some similarities to January in Beijing, it is an oversimplification to assume the same path. Fundamental business activity in large segments of the economy have ground to a halt. Yet, there will come a time when activity resumes in those areas. At that time, interest rates will be at record lows and it appears that massive stimulus will flood into the economy. Bloomberg reports ICI data showing that investor holdings of cash, as measured by money market funds, are near highs last seen since the financial crisis—this is often coincident with a market that is at or nearing lows. Some sectors, companies, and individuals will face significant challenges in the weeks ahead. The depth of slowdown and pace of recovery will vary widely across economic and market sectors and will be further influenced by the actions taken by business leaders and in Washington, D.C. In these challenges lie opportunities for long-term investments made when excellent companies are on sale. Often, markets anticipate these turns before they become evident. For portfolios that endure the storm, the re-opening of the U.S. economy will reward the businesses owned by our internal and external equity managers.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Teeter. No part of Mr. Teeter’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC