This year Silvercrest began its 20th year in business, to culminate in our 20th Anniversary celebration in May 2022.

Silvercrest 20th Year

Richard R. Hough III

Chairman and CEOThis year Silvercrest began its 20th year in business, to culminate in our 20th Anniversary celebration in May 2022. Founded on bedrock principles and a strong, proud culture, Silvercrest was at the forefront of the burgeoning independent Registered Investment Advisor business to serve clients as fiduciaries. It seems like an obvious choice in hindsight, but at the time it was largely an unproven model. Silvercrest’s launch came against the backdrop of storied private banking and investment counseling firms shuttering or sacrificing their independence to achieve scale, often at the expense of their clients’ interests. As with industry consolidation 20 years ago, unprecedented changes and waves of consolidation once again threaten business models dedicated to putting client interests first.

We have remained true to our founding principles. We never lost sight of our purpose: to provide excellent institutional-quality asset management and associated family office capabilities, delivered with superior client service and the highest ethical principles of a trusted fiduciary. Our partners remain dedicated to building an enduring franchise that will successfully serve clients for generations. Thanks to the loyal support of our clients, Silvercrest is stronger than ever with $31 billion in assets under management, an extraordinarily talented team of dedicated professionals, and a 98% client retention rate.

Founded in the wake of the Tech Bubble Crash and 9/11, and having successfully navigated the Global Financial Crisis shortly thereafter, Silvercrest is no stranger to adversity. And now that we have weathered a global pandemic, I have never been prouder of my Silvercrest partners and colleagues. We are grateful that our clients came to trust and rely on us more than ever, and thankful that we were well prepared to meet the unexpected challenge.

All of us at Silvercrest are focused on building upon the great legacy of our firm, true to the vision of our founding partners. We remain a proven and tested team with a long-term vision, intent on building a sustainable, innovative, forward-thinking, and enduring business for our clients’ benefit. By pursuing growth initiatives which are fundamentally compatible with our principles and our core wealth management business, we hope to continue to serve our clients with greater intellectual capital and resources.

We look forward to celebrating our milestone anniversary with you in 2022 and to working hard on your behalf for the next twenty years and beyond.

Economic & Market Overview

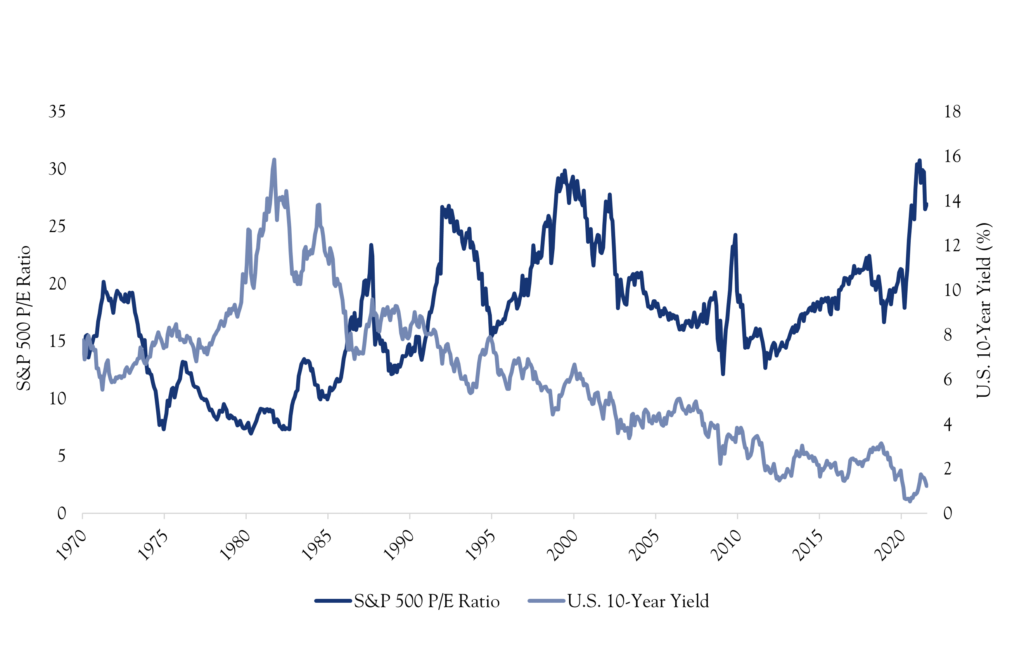

Price/Earnings Perspective

1970–July 2021

Source: Bloomberg

- Interest rates are an important influence on equity valuations

- Lower interest rates on bonds support higher valuations on equities

- Over the past ten years, interest rates have continued to decline making equities more appealing on a relative basis

Sentiment: U.S. Bond Yield/CPI YoY Perspective

Monthly

Source: U.S. Department of Treasury, CPI: BLS

- Inflation is an essential influence on interest rates

- When inflation is elevated, investors demand higher interest rates

- When inflation is lower, investors will accept lower interest rates

- Low and declining inflation in the past 40 years has supported low interest rates

- Currently, inflation is in focus, primarily for the effect it may have on interest rates

- We expect inflation to remain modest and supportive of interest rates around 2% where they have been for much of the past ten years

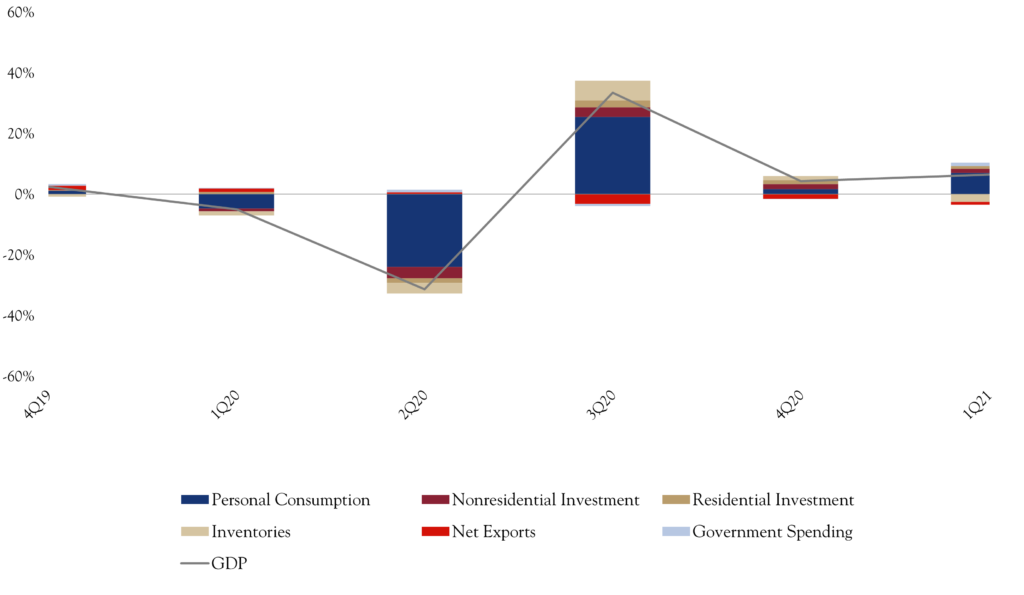

Contributions to GDP

Quarterly

Source: Bureau of Economic Analysis & Federal Reserve Bank of St. Louis

- The COVID cycle led to a rapid decline and recovery in economic activity

- Much of the collapse and rebound was in personal consumption (navy segment)

- This cycle has been unusually fast, owing to the unusual nature in which it unfolded

- Going forward, we expect growth slightly above prior trends, with continued strength in personal consumption

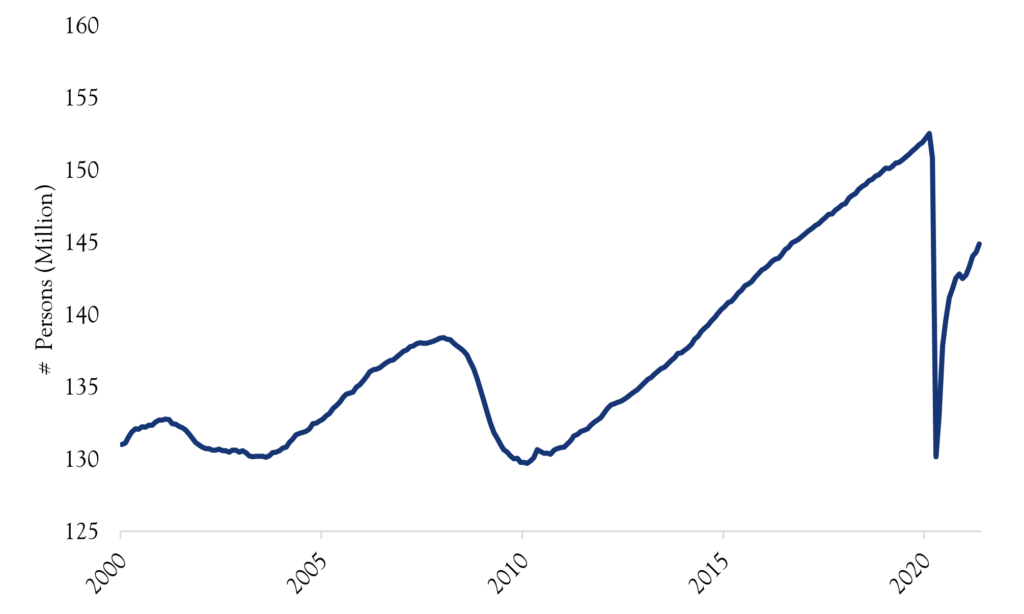

Total Employment

Seasonally Adjusted

Source: Macrobond

- Total employment had been fairly stable for some time, with gains coming in the past five years, prior to COVID

- The COVID decline in employment has not been re-captured, despite the economy largely recovering

- This points to increases in productivity, and challenges in getting labor participation and employment back to prior highs

- We expect employment to more fully recovery throughout 2022

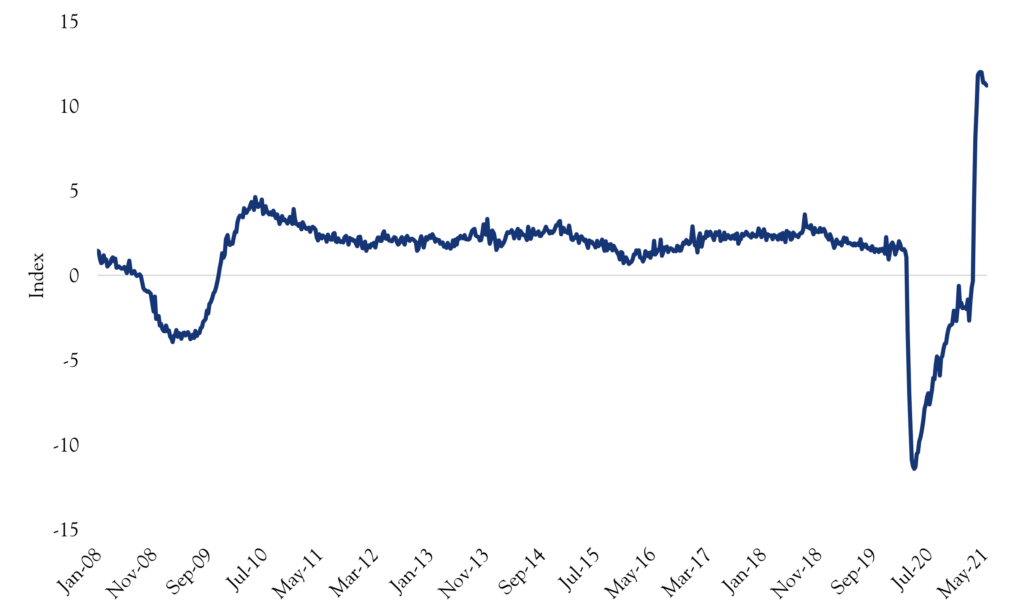

New York Fed

Weekly Index

Source: Macrobond

- The New York Fed tracks a variety of real time economic metrics providing a great gauge on economic activity

- While recent quarters have been exceptionally strong, this gauge will begin to return to prior trends

- We see 2022 growth of around 4%, better than long term trends, owing partly to continued recovery in the COVID cycle

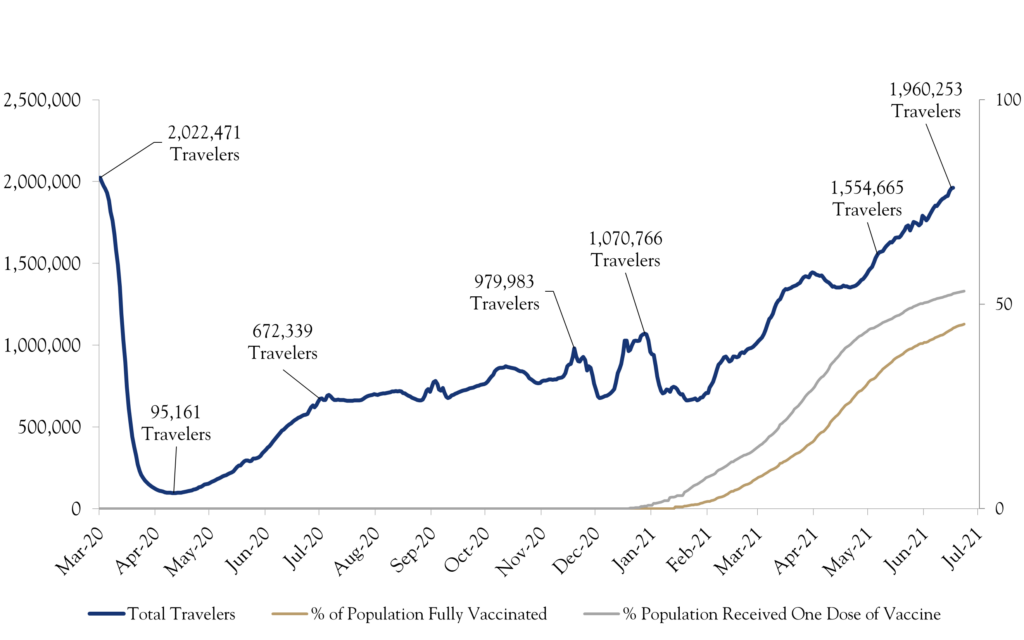

TSA Travelers & Vaccinated Population

Travelers in Millions

Source: Transportation Security Administration & Macrobond

- Traveler counts have been improving consistently with the increase in vaccinated

- Pre-COVID travel counts were roughly 2.1 million daily, while recent counts have been approximately 2.0 million

- International travel has remained largely restricted, while domestic travel has strongly rebounded—in most cases to levels seen prior to COVID

Robert R. Teeter

Managing Director, Chief Investment StrategistThinking About Inflation

read the insightFinding Value in Large Cap Growth

read the insight

Judy B. Morrill

Managing Director, Portfolio ManagerValues-Based Investing

read the insight

Patrick Chovanec, CPA

Economic AdvisorHow Psyched Are We?

read the insight

Allen J. Laufer, CPA

Managing Director, Head of Family Office GroupFrom Goals to Reality: A Case Study in Effective Wealth Management and Estate Planning

read the insightInvestment Outlook Summary

From the Investment Policy & Strategy Group

Earnings Drive Stock Returns in Coming Years

Overall, we see the most significant driver for equities being earnings growth into next year. Productivity gains, employment gains, and reversal of high savings rates will all contribute. Looking ahead over our three-year forecast horizon, it seems that at least the next 1½ years through year-end 2022 will see strong economic growth and earnings—that is a very favorable outlook for potential returns. We expect modest advances in interest rates, with the rate on the U.S. 10-year slowly grinding higher to a range of 1.75% to 2.25% from its recent range of 1.15–1.40%. Corporate balance sheets are generally sound, opening the possibility of continued buybacks and dividends as another source of support for stocks.

Maintain Balance Between Growth and Value

Due to the differences in approach to the pandemic, and the multiple company-specific actions taken or not, we believe stock selection to be an essential component of success and advocate a balance between growth and value exposures. For example, consider this quote from a soda and snacks company: “A lot of the things we did through the pandemic, continuing to invest in the business, are now paying dividends…”

Equities Outside the U.S. Will Have Some Time in the Sun

While most countries are lagging the recovery timeline of the U.S., we anticipate firms globally will see a resurgence of activity, rebounding earnings and stock performance and partially closing a longer-term valuation gap between the U.S. and foreign stocks. This metric, while distorted by the COVID cycle, has historically favored U.S. companies with higher valuations—a trend that is likely to continue, though likely at a smaller gap when non-U.S. economic recoveries begin in earnest. Considering the ample opportunities for great global companies, this recovery convergence and some diversification across different economic cycles makes a modestly sized non-U.S. allocation appealing for U.S. investors.

Small Caps Benefit from De-Globalization & Push for Jobs

In an increasingly global, yet fragmented world, companies seem eager to embrace a more robust and domestic supply chain. This, paired with a push for job recovery, will benefit U.S. domestic firms that comprise small cap stocks. One caveat—there is a wide range of quality within small cap, and we encourage careful, active security selection.

Fixed Income—Protection at a Cost

Fixed income plays a valuable portfolio role in generating income and protecting against decline. This is especially true for portfolios with careful credit selection and modest interest rate risk. However, because fixed income has had such strong performance in recent years, the potential returns are near historic lows. Those lower-than-average returns are tolerable, given the need for portfolio protection and income generation.

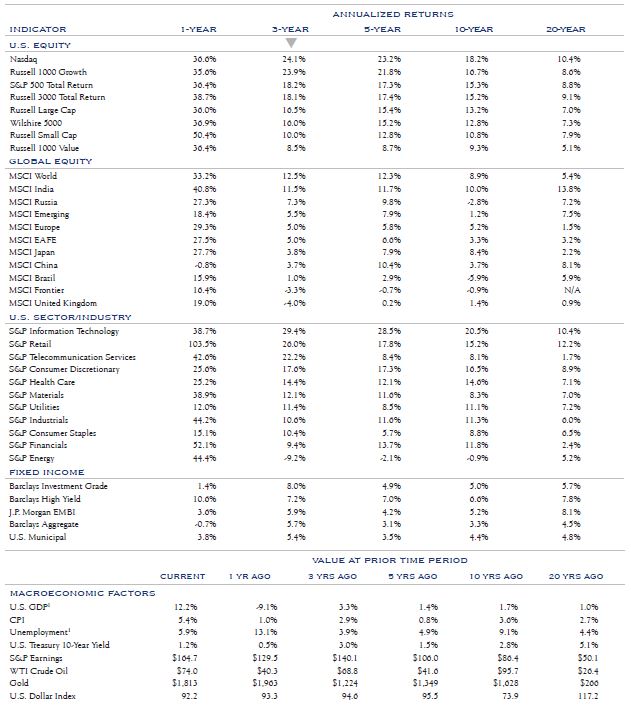

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing comparison of annualized returns while referencing the coincident economic conditions.

Source: Bloomberg, data is as of 7/31/21.

1U.S. GDP & Unemployment figures are as of 6/30/2021.