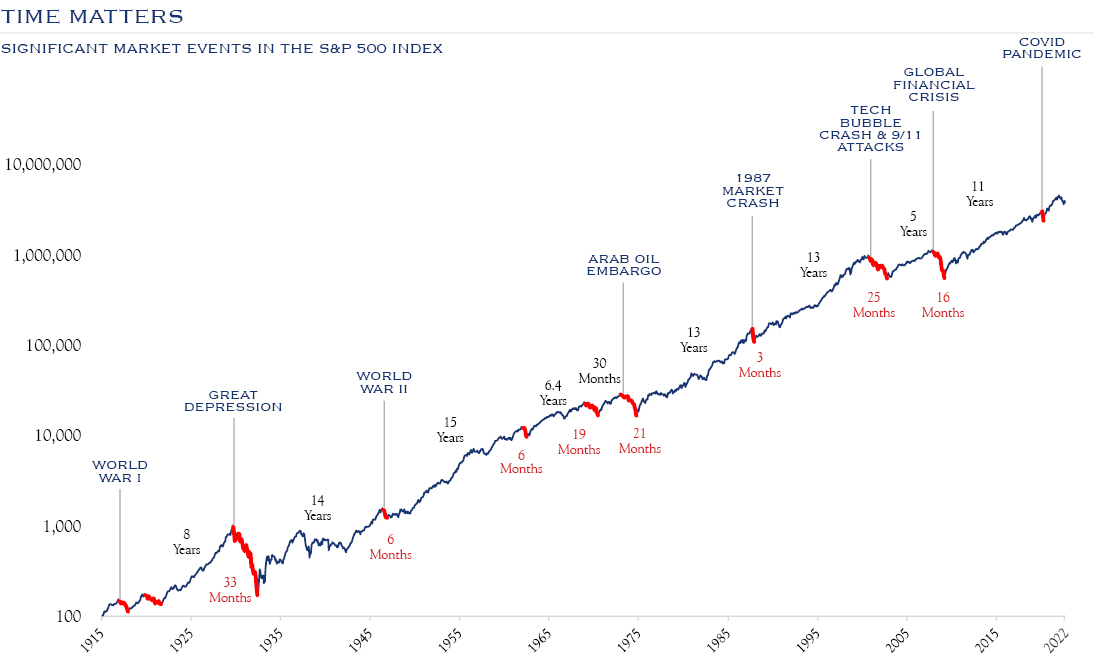

Investing this year has at times felt like an expedition across Antarctica, cold and unpredictable. Yet sometimes we must silence the day-to-day sounds of the markets and focus on other critical elements of investing.

Introduction

Robert R. Teeter

Managing Director, Chief Investment StrategistWhile traversing the 932 miles across Antarctica, Colin O’Brady endured endless days of solitude. His book, The Impossible First, shares his journey from a debilitating leg injury in Thailand, to the South Pole and beyond. Amidst the sea of mental and physical challenges, he recounts an inspiring conversation he had with Paul Simon. They discussed how silence, like O’Brady endured, can open a door to insight and discovery and how art is a process and a journey.

Investing this year has at times felt like an expedition across Antarctica, cold and unpredictable. Yet sometimes we must silence the day-to-day sounds of the markets and focus on other critical elements of investing. Despite the noise of war, inflation, and the lingering effects of COVID on the economy, our talented team has provided insight on numerous issues throughout the year. In addition to the

latest economic and market news, we share our thoughts on how to choose amongst the different types of investment managers, we outline our asset class valuation framework, we provide a hype-free and clear view of bitcoin, and we consider options for effective planning of stock option ownership.

Please find your own silent moment to reflect on things outside the news, and we hope you’ll share a moment with us, enjoying our latest Insights.

Economic & Market Overview

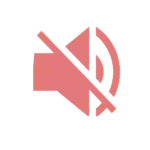

Source: Bureau of Economic Analysis & Federal Reserve Bank of St. Louis

- The COVID cycle led to a rapid decline and recovery in economic activity

- Much of the collapse and rebound was in personal consumption (navy segment)

- This cycle has been unusually fast, owing to the unusual nature in which it unfolded

- Going forward, we expect growth slightly above prior trends, with continued strength in personal consumption

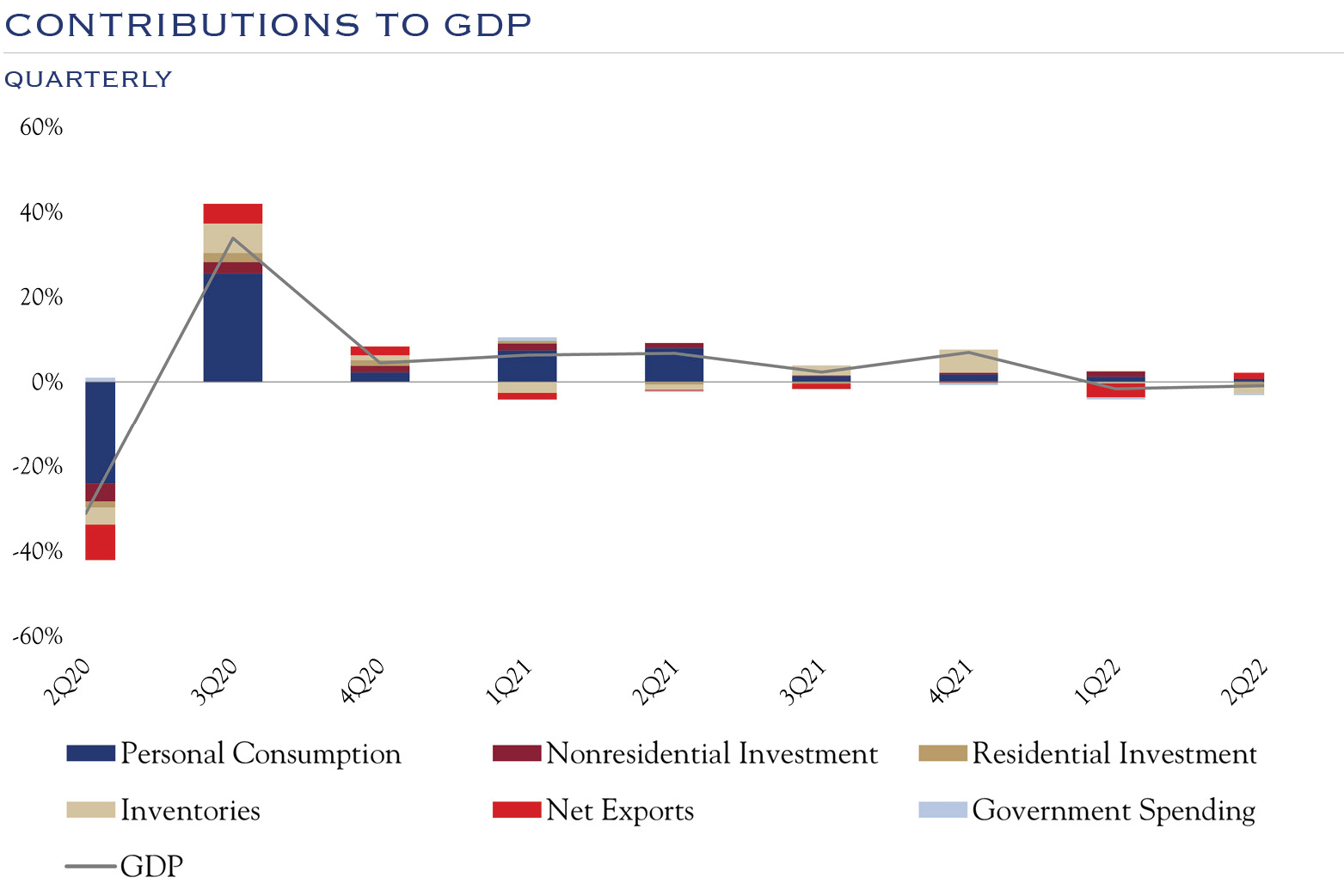

Source: Macrobond

- Total employment had been fairly stable for some time, with gains coming in the past five years, prior to COVID

- The COVID decline in employment has not been fully re-captured, despite the economy largely recovering

- This points to increases in productivity, and challenges in getting labor participation and employment back to prior highs

- Workforce participation rates have also improved, but not yet regained prior highs

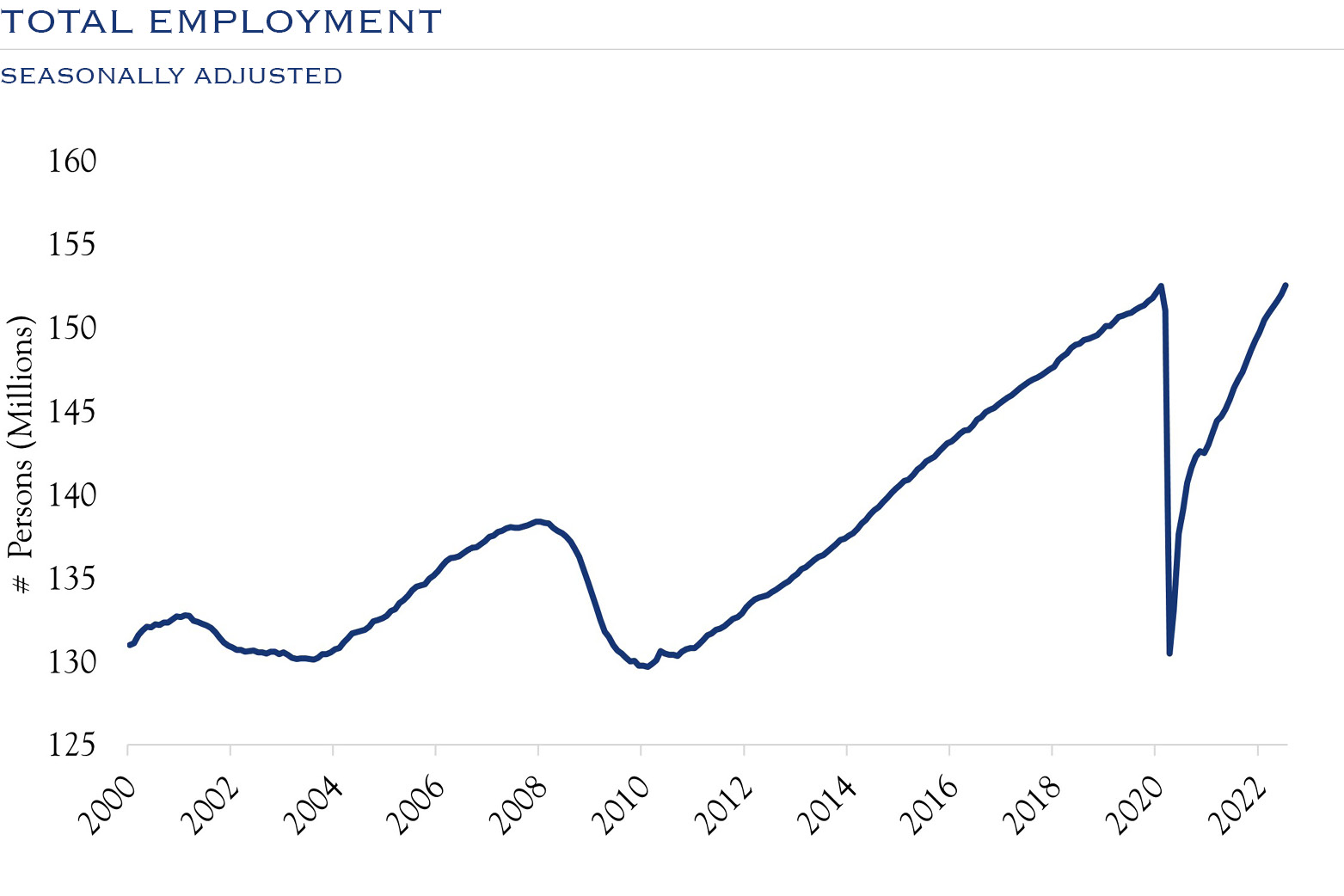

Sources: Federal Open Market Committee & CPI Data

- Interest rates are an important influence on equity valuations

- Persistent inflation has led to higher interest rates, and higher interest rates have put downward pressure on P/E ratios

- History shows that interest rates around 4% have co-existed with P/Es around 20

- As soon as interest rates peak, we expect valuation (P/Es) to improve

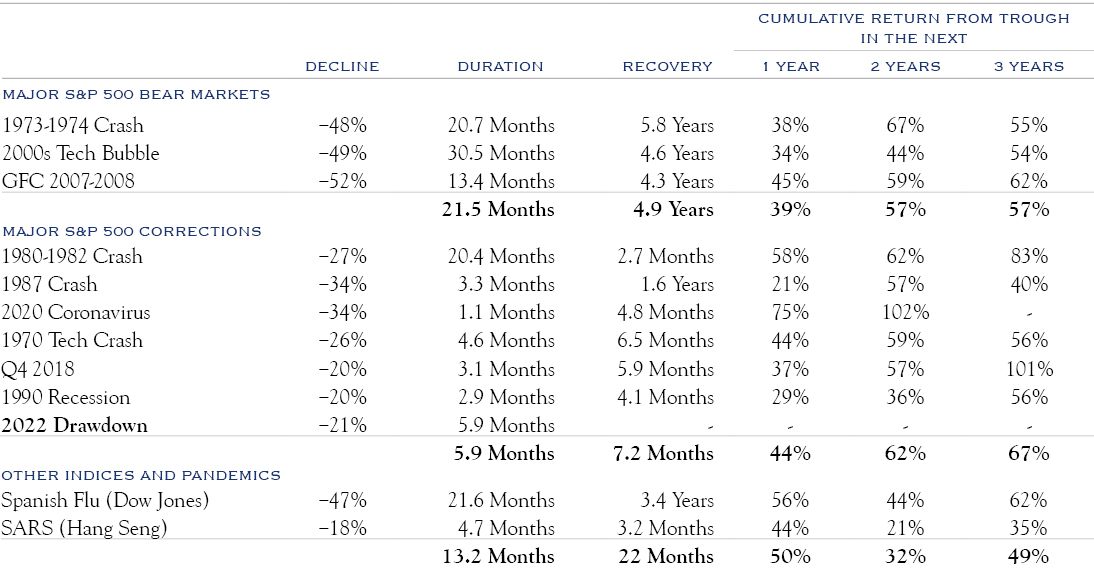

Source: Bloomberg. Data as of 8/31/2022. Note: Duration measures length of period from start price (peak) to bottom price (trough). Recovery measures length of period of recovery from bottom price back to start price (prior peak). S&P 500 data unless otherwise noted for Spanish Flu (Dow Jones Index) and SARS (Hang Seng Index).

Scott Brown, Jr.

Managing Director, Portfolio Manager

Jennifer M. Baker

Director, Portfolio ManagerThe Informed Investor

read the insight

Bernard M. Paternina

Portfolio ManagerBitcoin—Beyond the Hype

read the insight

Nathaniel M. Kluttz

Managing Director, Portfolio Manager

Evan Kwiatkowski, CPA

Director, Senior Tax ManagerDemystifying Employee Stock Options: Navigating Tax Implications and Investment Strategies

read the insight

Robert R. Teeter

Managing Director, Chief Investment StrategistLooking into the Future: Navigating Asset Allocation with a Three-Year Outlook

read the insightInvestment Outlook Summary

From the Investment Policy & Strategy Group

Inflation

Inflation persists above expectations across Q1 and Q2. Damage in stock returns has mostly come when CPI readings have been worse than expected over the past year. Signs of peaking emerge as consensus expectations point to lower rates of inflation later in 2022 than the most recent readings.

GDP

While recent readings have been distorted by the pandemic and quirks in the calculation–such as inventory changes and imports–the expected long-term U.S. GDP growth remains unchanged at around 2%. This long-established trend has been a result of anemic population growth and small productivity gains.

Earnings

Slow GDP growth has been adequate to support the long-term trend in corporate profits of 5-7%. Ongoing disruptions in supply chains and labor suggest this trend will continue at the lower end of the range. We expect a wider than average dispersion of results within sectors, as individual companies are likely to have varying degrees of success in problem solving.

Rates

We expect further policy tightening from the Federal Reserve, including additional hikes in the Fed Funds rate. The Fed has noted that market-based financial conditions have constricted in response to both prior hikes and future anticipated actions. This view, along with an expectation of a peak Fed Funds rate in the 3-4% range, means that interest rates may be getting close to a peak. Our expectation is for a wide range between 3-4% for the U.S. Ten Year.

Stocks

Over our three-year horizon, we expect stocks to generate gains based largely on earnings growth, but also on some degree of valuation recovery. Historically, interest rates around 3-4% have been consistent with P/Es around 18x. Another approach shows that when P/Es are in a range around 20x, interest rates have averaged 4%. This provides some comfort that there is room for valuation recovery as rates further stabilize.

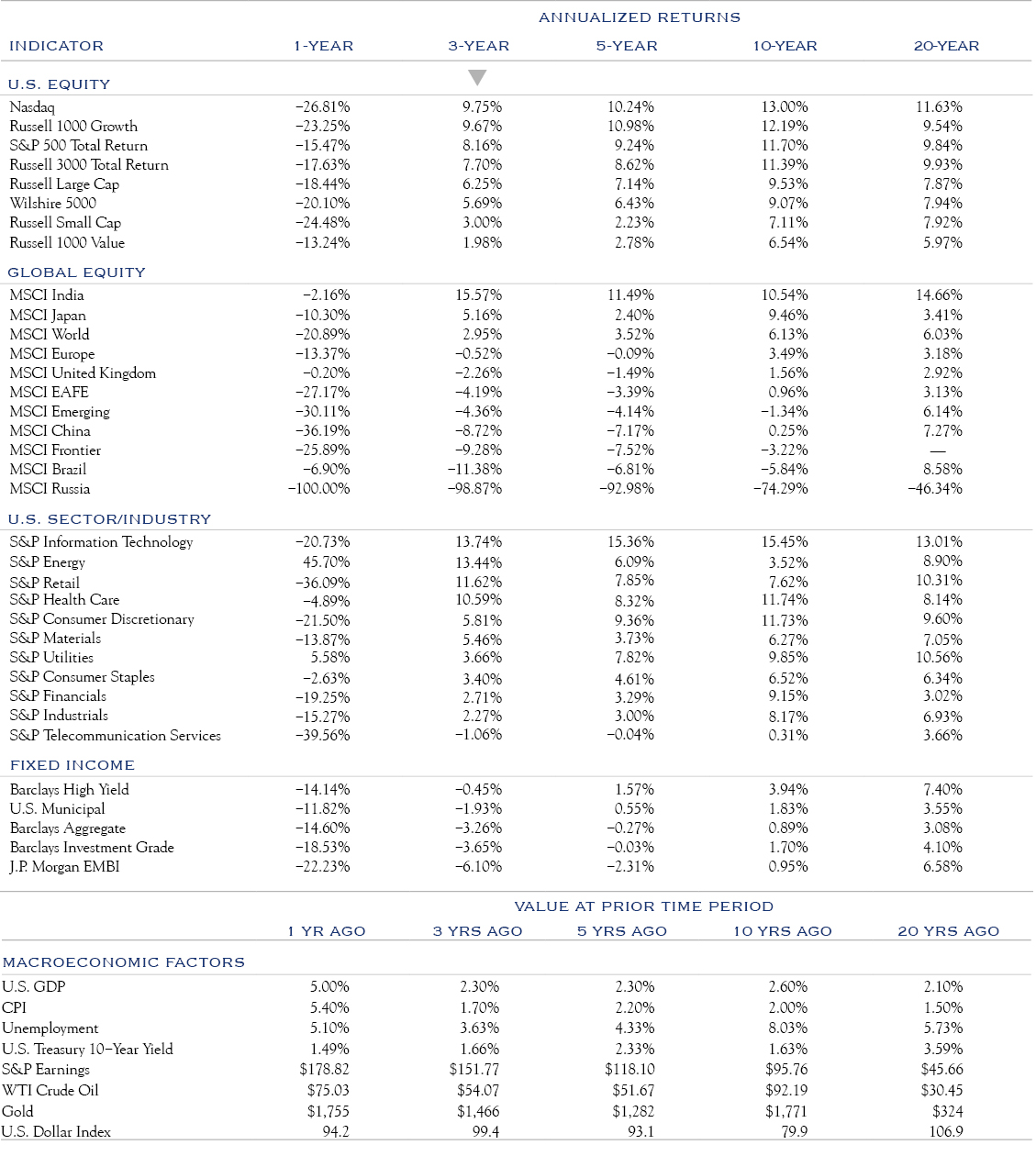

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing comparison of annualized returns while referencing the coincident economic conditions.

Source: Bloomberg. Data is as of 9/30/22.