In this latest issue of Insights, we explore topics that span artificial intelligence, renewable energy, inflation, free trade, and managing personal investment requests.

Introduction

Richard R. Hough III

Chairman and CEOIn this latest issue of Insights, we explore topics spanning artificial intelligence, renewable energy, inflation, free trade, and managing personal investment requests.

“The Three Waves of AI Adoption & The Impact of Technological Innovation on Productivity” compares the rapid adoption of artificial intelligence and the internet boom of the 1990s. Rob Teeter, Silvercrest’s Chief Investment Strategist, defines the three waves of AI adoption and models how AI could shape future productivity, profit margins, and long-term investment opportunities.

In “Understanding the Materials Powering The Renewable Energy & Electrification Revolution”, Ken Dennig, Managing Director and Senior Equity Analyst for our Global Value Opportunity team, examines the materials powering the clean energy transition, highlighting the risks and opportunities for investors interested in the renewable energy market.

“Monitoring Inflation—Why The Fed Prefers PCE Over CPI” provides a detailed analysis of the Fed’s preference for the Personal Consumption Expenditures (PCE) index over the Consumer Price Index (CPI). Senior Analyst Marcus Viscichini discusses their roles in monetary policy, consumer behavior, and investment strategies.

In “The Breakdown of Free Trade—What the U.S. Can Learn From History”, International Equity Analyst Kevin Hill examines the historical parallels between Britain’s industrial decline in the 19th century and America’s current challenges on the global stage. This article offers insights into how the breakdown of free trade affects industries, economies, and geopolitical dynamics.

Finally, “Investment Requests From Family & Friends—Preserving Relationships & Financial Security” addresses a more personal yet critical topic—managing high-risk investment proposals from close connections. By offering a structured approach to due diligence and declining offers respectfully, Seán O’Dowd, Managing Director and head of Silvercrest’s Family Business Advisory Group, helps investors protect their financial security while preserving valued relationships.

Thank you for your continued support. We hope this issue of Insights sparks thoughtful discussion.

Economic & Market Overview

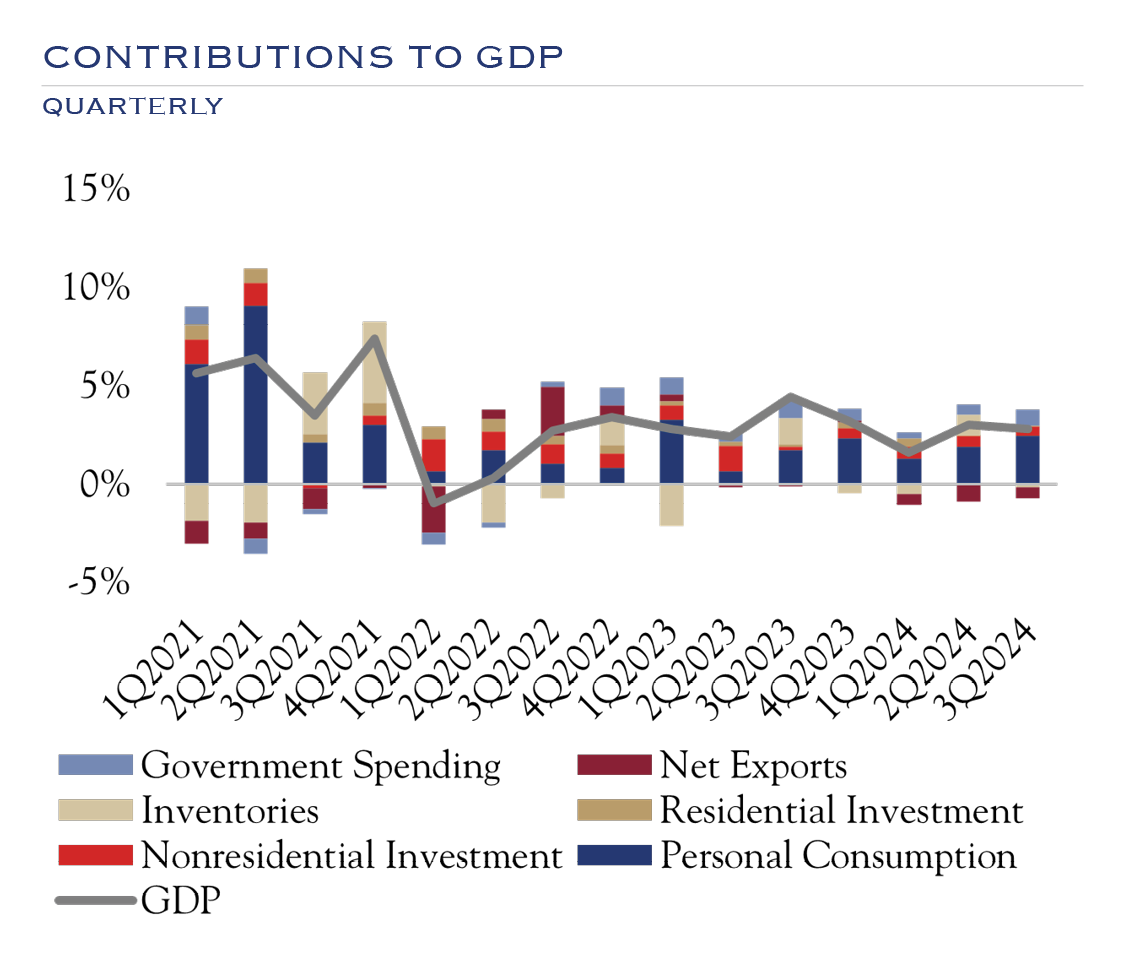

Sources: Bureau of Economic Analysis, Federal Reserve Bank of St. Louis.

- Growth conditions are remaining steady, averaging 3.2% since the beginning of 2021.

- Personal Consumption continues to drive the majority of economic growth, followed by Government Spending and Nonresidential (business) investment.

- Inventories and Net Exports continued to drag on economic growth in 3Q 2024.

- We expect growth around long-term trends of 2.0–2.5%, driven primarily by the consumer.

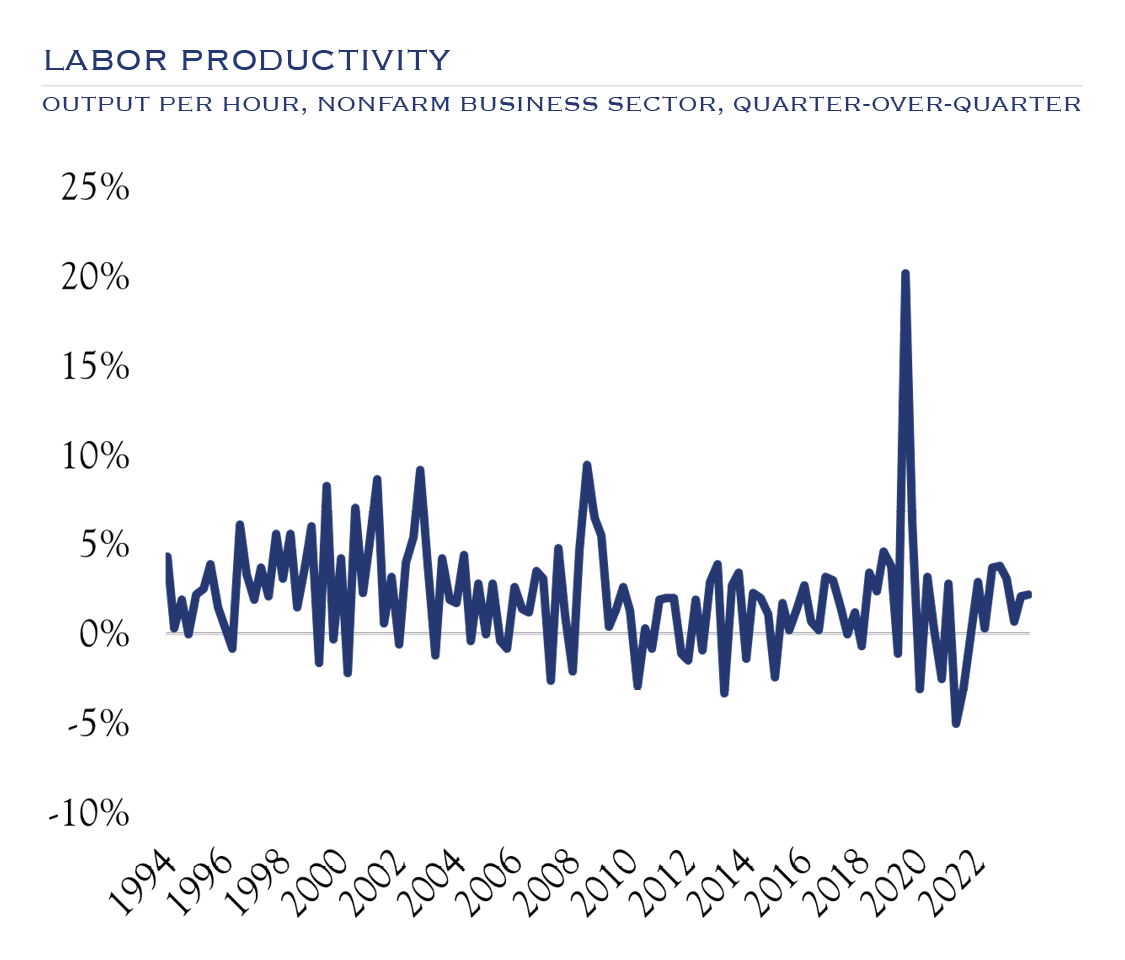

Source: Bureau of Labor Statistics.

- The data over the past 30 years show a stable productivity backdrop, with volatility around recessions. In the 1990s, there was a burst of non-recession productivity. We expect productivity trends will trend higher in the years ahead.

- The catalysts for better productivity are threefold: 1) a slower growth economy requires productivity to boost profits, and dynamic companies will seek out these gains; 2) the pandemic triggered a long-overdue work process review at many organizations; and 3) the emergence of AI and robotics will drive powerful efficiency changes.

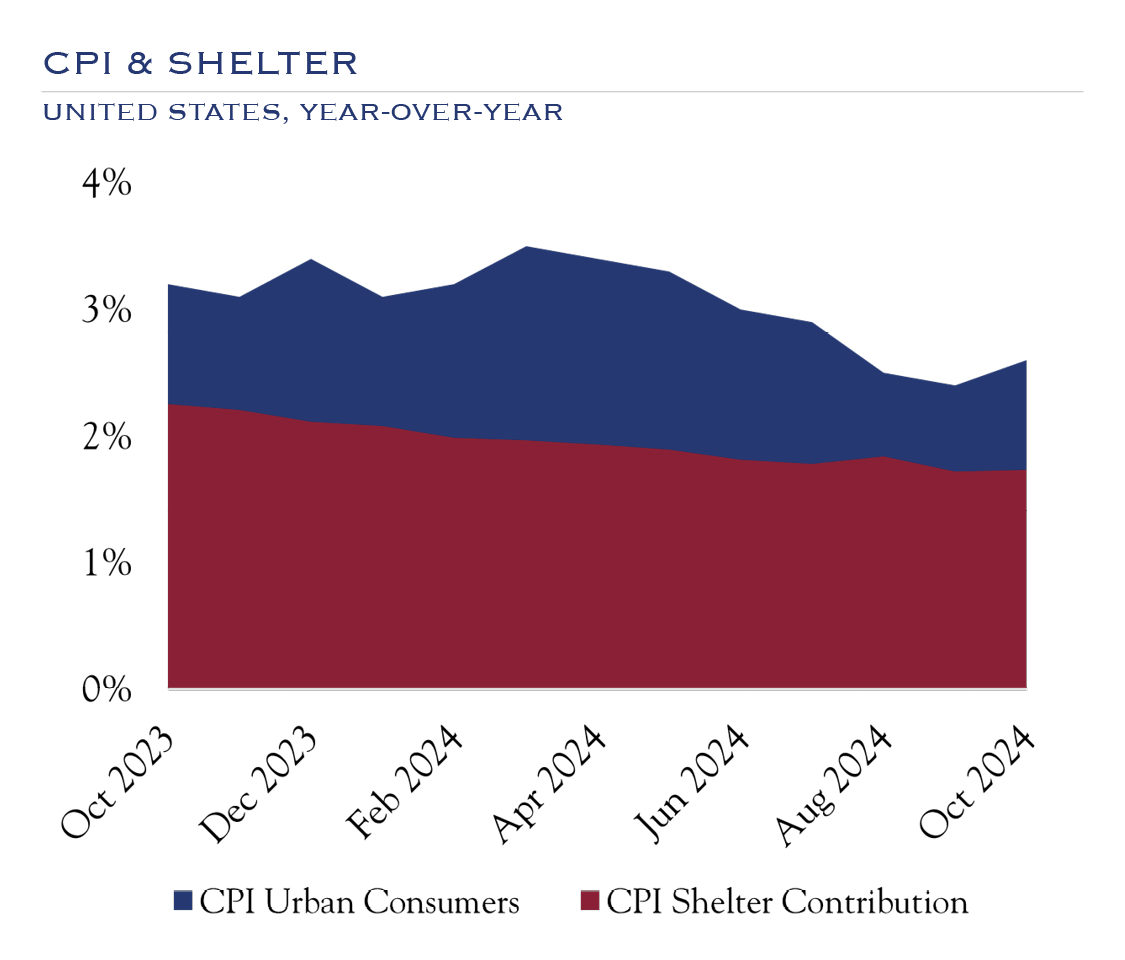

Source: Bureau of Labor Statistics.

- CPI is currently at 3.2%. Shelter, a 35.0% weighting, continues to be the primary driver of inflation over the last 12 months.

- The Shelter component of CPI is made up of two items. First, Rent of Primary Residence, which, simply put, is the cost of renting a residence. This metric accounts for around 7.7% of Shelter’s weighting in CPI. The second is Owners’ Equivalent Rent, which refers to the amount of rent that a homeowner would be paid if they were renting out their own home in the market. This metric accounts for around 25.8% of Shelter’s weight.

- With both homeowners and renters staying put for various reasons and the specific methodology of CPI, the effect of Shelter has worked against inflation.

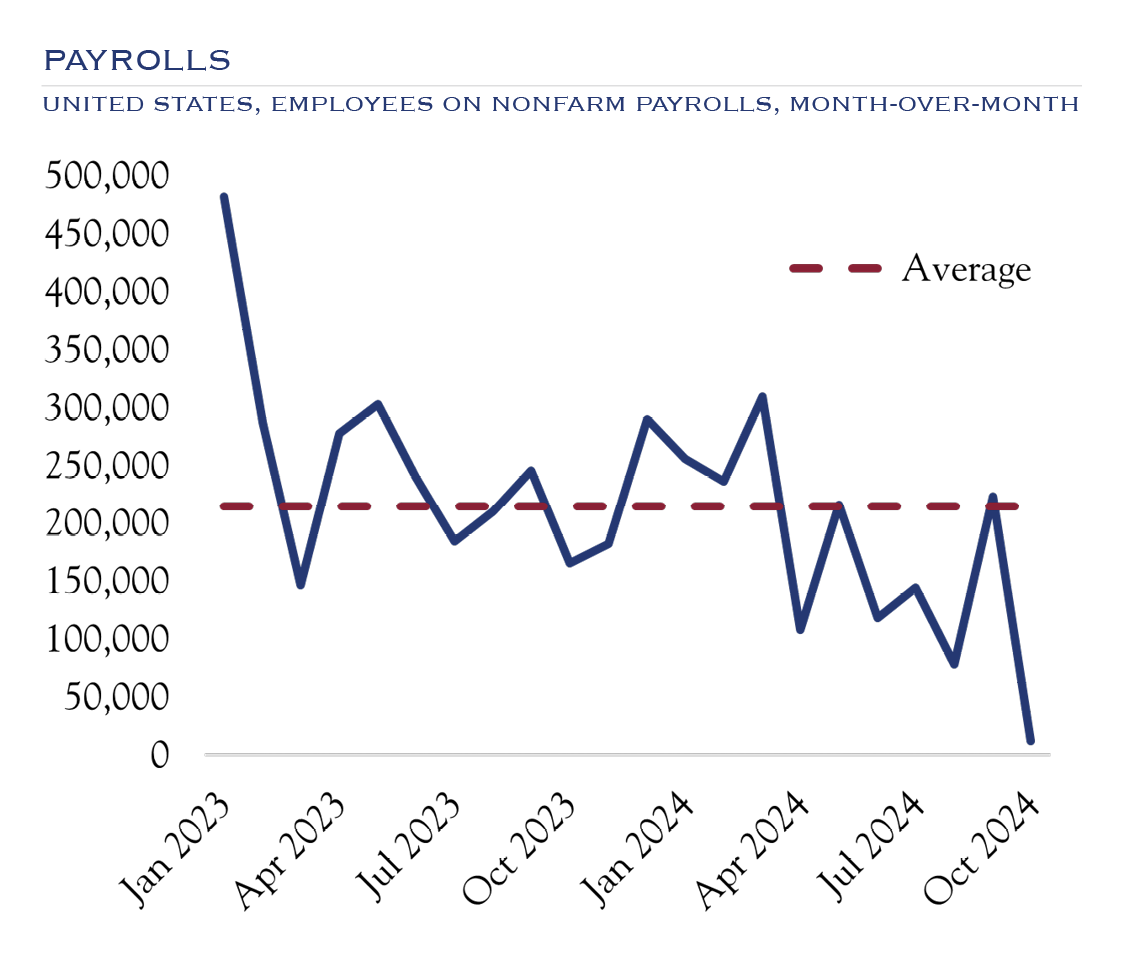

Source: Bureau of Labor Statistics.

- The expansion of payrolls has been beneficial in sustained economic growth. While overall still strong, there is some loss of momentum.

- Although an occasionally volatile series, since the beginning of 2023, payrolls have averaged 214,273.

Robert R. Teeter

Managing Director, Chief Investment StrategistThe Three Waves of AI Adoption & The Impact of Technological Innovation on Productivity

The rapid rise of artificial intelligence (AI) feels eerily similar for those who lived through the internet boom of the 1990s. While every technological innovation is unique, the adoption and market excitement patterns follow a similar trajectory.

read the insight

Ken Dennig, CFA

Managing Director, Senior Equity AnalystUnderstanding the Materials Powering The Renewable Energy & Electrification Revolution

Renewable energy and the ongoing process of electrification have been in the news with increasing consistency over the last couple of decades. By this point, almost everyone has heard about the “clean energy revolution,” but few people understand the building blocks of these new technologies: the raw materials they are made from.

read the insight

Marcus Viscichini

Senior AnalystMonitoring Inflation—Why The Fed Prefers PCE Over CPI

Despite its significance, inflation is not easily measured. While it is typically calculated on a broad basis, it can be measured more granularly for specific goods and services. The Fed, as the shepherds of monetary policy, relies on a broad range of data points to assess inflation properly. That being said, news articles often refer to the Personal Consumption Expenditures Price Index (PCE) as “the Fed’s preferred measure of inflation.”

read the insight

Kevin Hill, CFA

Senior Equity AnalystThe Breakdown of Free Trade—What the U.S. Can Learn From History

Imagine that the most powerful country in the world shifts its focus from manufacturing to finance while promoting free trade. The country subsequently deindustrializes as factories and jobs are outsourced to nations with cheaper labor. While this scenario resembles today’s saga of U.S.-China relations, it actually describes the economic rivalry between the United Kingdom and Germany from 1846 to 1914. While these sorts of pivotal events unfold more rapidly in today’s world, the underlying economic and political dynamics remain strikingly similar.

read the insight

Seán O'Dowd, CFA

Managing Director, Family Business AdvisoryInvestment Requests From Family & Friends—Preserving Relationships & Financial Security

Wealthy individuals often receive requests from friends, family, or acquaintances in their network to invest in new ventures. When clients come to their advisors for guidance, it is essential to address these requests thoughtfully to preserve both long-standing personal relationships and financial security.

read the insightInvestment Outlook Summary

From the Investment Policy & Strategy Group

Equities

While valuation levels are elevated, we look for equities to generate returns of 7.5% annualized over the next three years and maintain a slight +5% overweight vs. benchmark.

Growth & Value

Style: We generally recommend a balanced allocation to both growth and value-oriented investments, as there are compelling opportunities for stock pickers in both style buckets. We expect significant dispersion that transcends growth/value and is determined by individual company management team efforts to boost productivity and profit margins. Stock selection will be more important than style selection.

Small Cap & Large Cap

We see a three-part catalyst for a broadening of the market to small caps. First, likely changes in regulatory policy will spur M&A activity. Traditionally, smaller companies benefit as the target of M&A. Second, the continued (albeit slow) easing of interest rate stress will accrue to the benefit of small caps. This playbook has unfolded several times—any drop in rates is met by a rally in small caps. Third, the cost of access to productivity-enhancing technologies will spread to smaller companies, putting them on more even ground in seeking profit margins. This will help to narrow the earnings gap between large and small companies. We continue to recommend an allocation to small caps that is modestly above benchmark/policy targets.

U.S. & Non-U.S.

While many great companies based outside the U.S. have compelling valuations, we remain cautious about the global growth outlook. Continued geopolitical conflict, changes in political leadership, regulatory burdens, and less-compelling demographics in China and Europe present macro headwinds. However, numerous excellent companies (many with compelling valuations) are domiciled on exchanges outside the U.S. While the portfolio diversification benefits of globally diversified investing have waned, they do still exist. Over the past ten years, the correlation between the MSCI ACWI Ex-U.S. Index and the MSCI U.S. Index is 0.46. For U.S. investors, we see non-U.S. investing as an alpha opportunity more than a beta opportunity. We continue to advocate for modest exposure to non-U.S. equities through active management. For global investors, we recommend market weights across geographies for beta management but seek a high active share, allowing the pursuit of excellent companies. For all investors, non-U.S. investing is a rich alpha opportunity set, though for benchmark-aware investors, careful attention must be paid to geographic allocations.

Fixed Income

We expect a slow path to lower rates, as inflation will be slow to decline and employment has remained stable. We expect some volatility for bonds, with rates trading in a wide range. The Fed and markets will be heavily data-dependent and markets are apt to overreact to each data point. If employment weakens, the Fed will respond quickly. Overall, this is a good scenario as rate pressure will eventually be alleviated, with the economy still on solid ground.

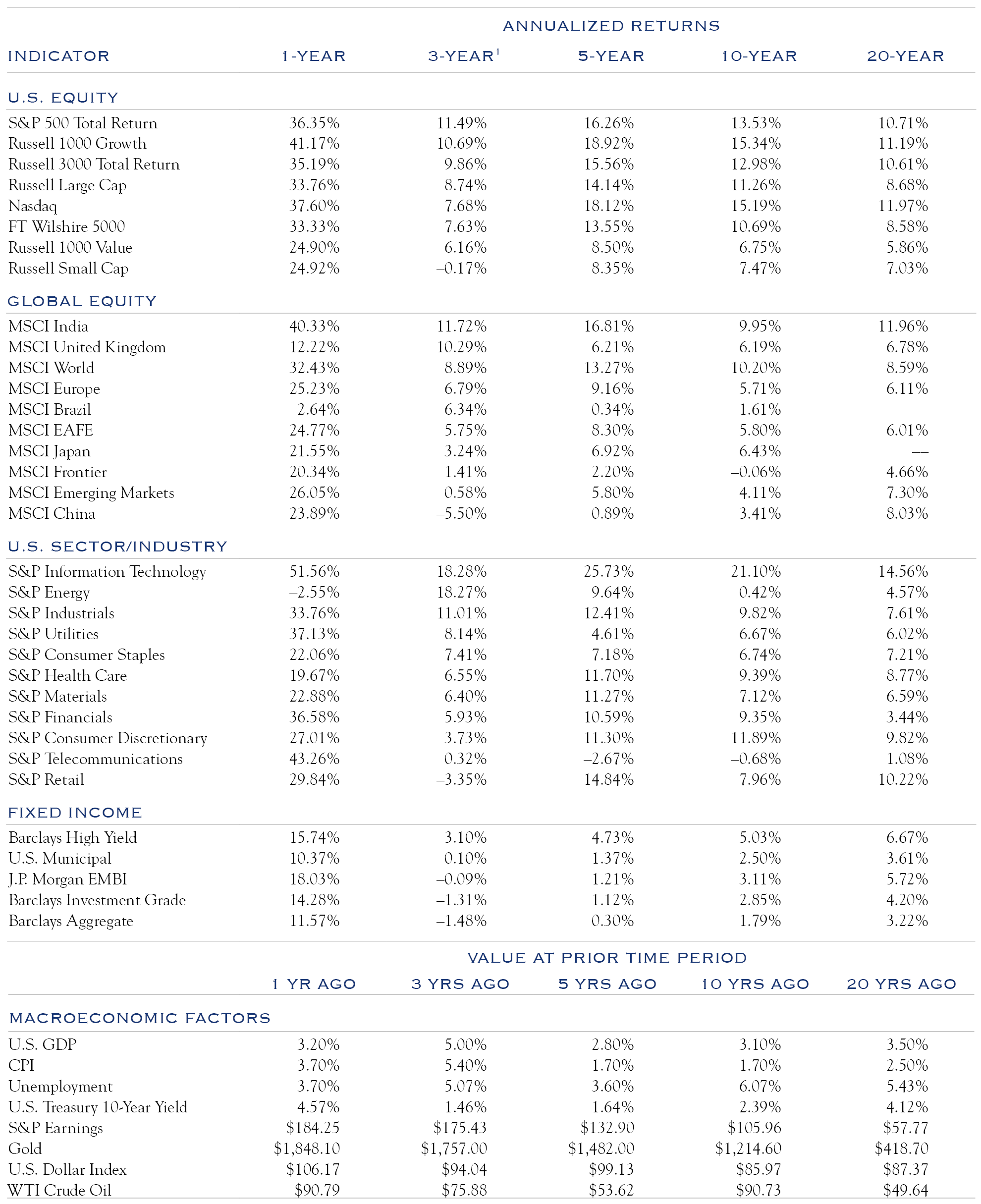

Market Monitor

This table provides a comprehensive view of returns across various markets across time. It is paired with a snapshot of economic data, allowing a comparison of annualized returns while referencing the coincident economic conditions.

1 Table rows are sorted by 3-year annualized returns. Source: Bloomberg. Data is as of 9/30/2024.