Renewable energy and the ongoing process of electrification have been in the news with increasing consistency over the last couple of decades. By this point, almost everyone has heard about the “clean energy revolution,” but few people understand the building blocks of these new technologies: the raw materials they are made from. Where these materials come from and how they are developed largely dictate their supply and demand dynamics. Even experts agree that the resulting economics are complex. But what does this mean for investors? Major risks are abundant, as are opportunities. The important thing is understanding how the pieces fit together.

What are Green Energy Materials & Where Do They Come From?

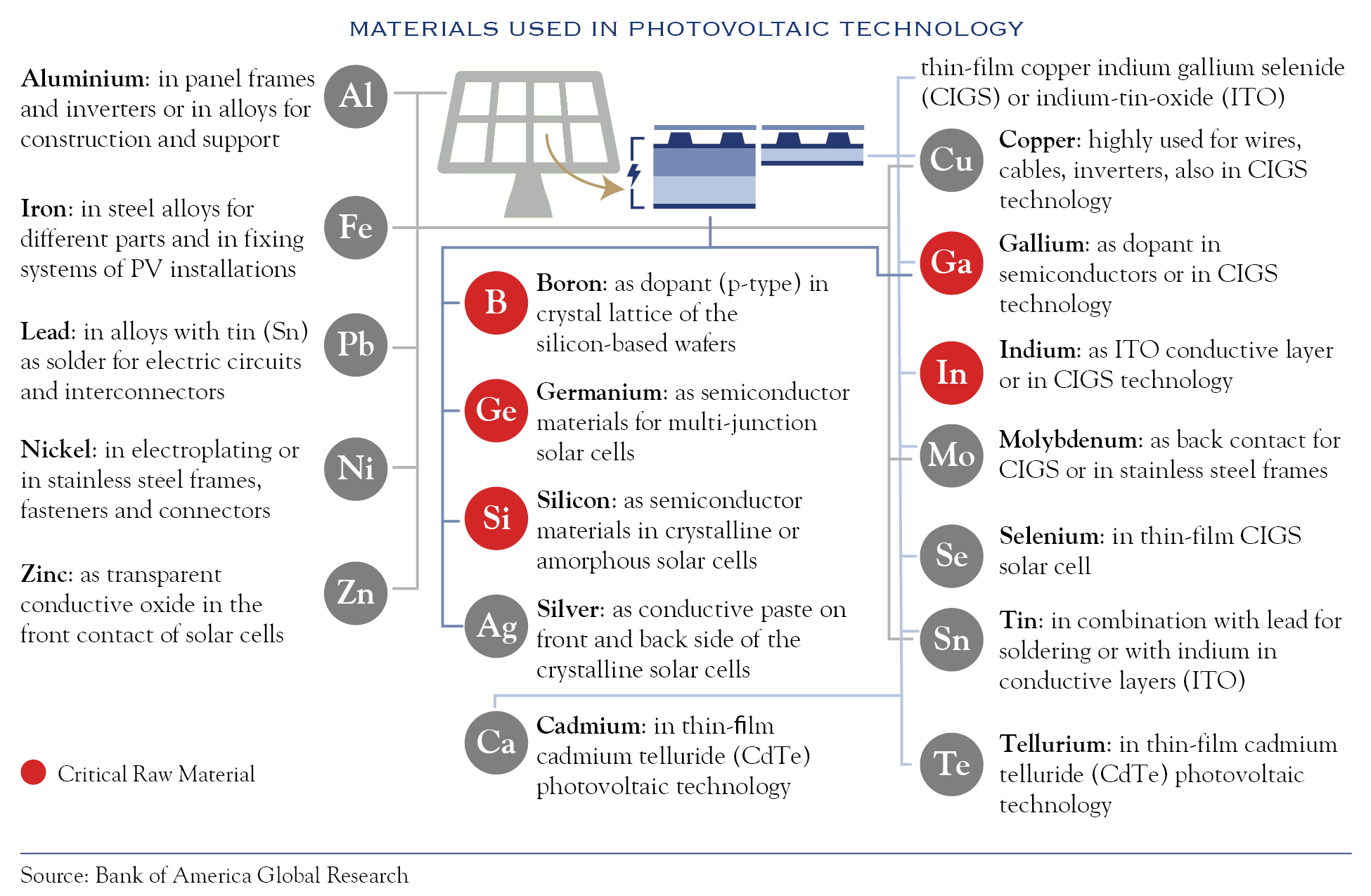

All the significant technological advancements in renewable energy and electrification require a variety of metals and elements. The list of materials required for a single technology can be extensive. Take solar panels, for example. The most common solar panel technology uses 17 different materials in its structural frames, inverters, wiring, electric circuits, semiconductors, and photovoltaic cells—some are as commonplace as steel, and others, like indium, are not so abundant.

Solar panel technology isn’t the only one that uses indium; indium is needed for carbon capture as well. Most of these rare earth elements have multiple uses, and there is significant overlap in required materials between technologies. A single element could have different advantageous properties, so the use cases are not always the same. For example, molybdenum is an essential alloying element in stainless steel due to its resistance to corrosion and hardening properties. This makes molybdenum a critical component of wind turbines as it enables the gears to withstand the immense forces of the massive rotating blades. However, it is also used in solar for its excellent electrical conductivity. Separately, the ability to act as a catalyst to convert carbon dioxide into carbon monoxide makes molybdenum invaluable for carbon capture technologies.

Many necessary materials are scarce and very difficult to mine and refine. Often, the use of these materials was limited before renewable electrification, so there was no incentive to discover new deposits or to create more efficient processing methods. Many materials are brought to market as a byproduct of another mining operation because it is not economically feasible to produce them otherwise. Materials like gallium are found in low concentrations in the earth’s crust and do not fetch a high enough price on their own; therefore, gallium production is highly dependent on the production of other metals, such as bauxite and zinc.

Complicating things further, some materials can be highly concentrated in a few deposits scattered across the globe. Processing capabilities can be just as concentrated as raw deposits. Many resources are mined in one country, refined in another, and used to manufacture a final product in a third. Dominant players emerge at each step of the value chain, whether due to economic advantages or favorable geopolitics. This creates a complicated interdependence within the market, threatening volatility if the supply chain is pressured.

Supply and Demand for Green Energy Materials

Such a variety of factors have a significant impact on the supply and demand for individual resources.

Supply constraints are only expected to get tighter due to ambitious net-zero targets from government mandates and corporate commitments to clean energy.

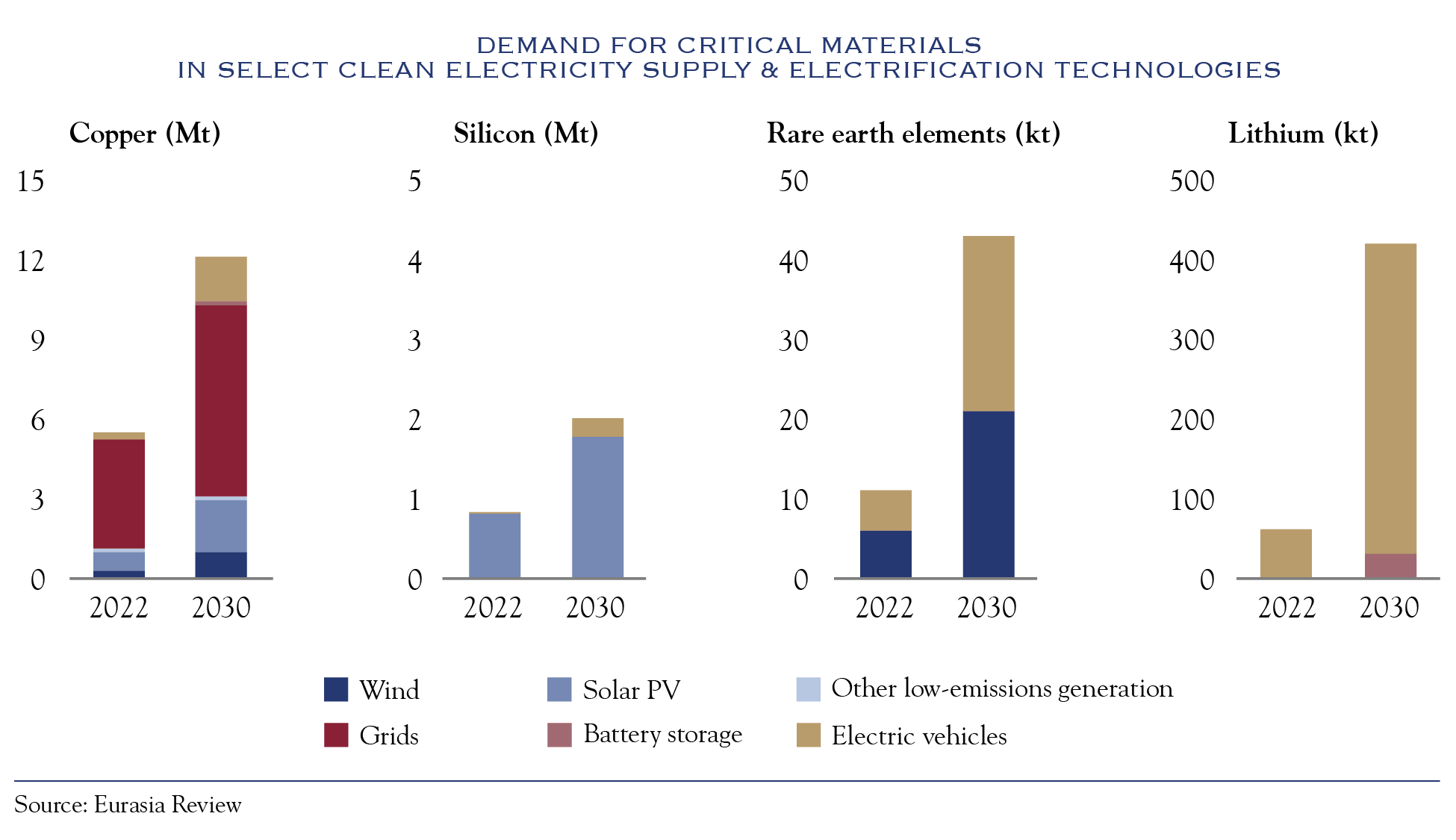

As the adoption of renewables increases across wind, solar, and batteries, these subindustries will compete over limited supplies. The supply of certain materials has struggled to keep pace with the recent explosion of demand due to difficulties in producing them at the necessary scale. These supply constraints are only expected to get tighter due to ambitious net-zero targets from government mandates and corporate commitments to clean energy.

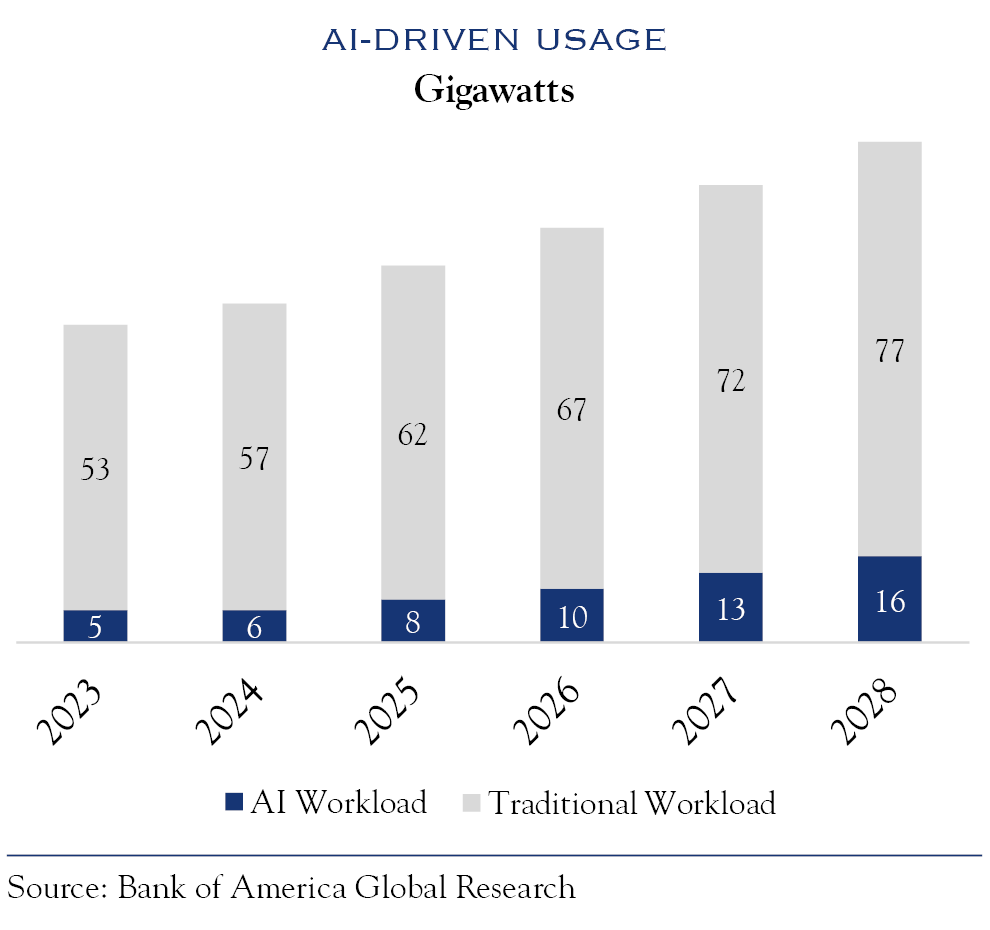

Additionally, energy demand itself is not static. With increasing development among emerging markets and the emergence of power-hungry AI technology, energy demand is generally growing. While regulation and commitment to decarbonization have been mixed, the increasing penetration and investment in renewables indicates an undeniable trend of growing demand for these energy needs to be met with renewables. Furthermore, the surge in data center power required for AI and the ongoing effort to electrify will put immense pressure on electrical grids in the coming years. This will require extensive infrastructural upgrades made from many of the same metals used for renewables.

Demand projections for most materials are strong over the next decade and are expected to exceed historical growth rates (except steel and thermal coal). These demand forecasts can be tricky, however. Amid a rapidly innovating environment, materials can see sudden changes in their demand. Nickel and rare earth metals have recently been on the short end of this stick, as advances in battery chemistry and electric motors have resulted in reduced expectations for their use in future automotive products. Lithium is among the beneficiaries of this innovation, with demand projected to grow 400% in the next ten years.

On the supply side, production is being ramped up for energy transition materials in anticipation of the need for these materials in the future. For some resources, production cannot increase fast enough, often due to a combination of unfeasible economics, unfavorable geopolitics, and scarcity. Some materials, such as lithium and nickel, are in a great position to increase production. The development of lithium assets has occurred faster than expected, primarily because of relatively abundant reserves and short development timelines. Similarly, nickel supply has scaled up much quicker than anticipated as Chinese processors have converted Indonesia’s relatively low-grade ore and flooded the market.

An Investor’s Point of View: Copper as a Case Study

Making sense of all the above can be difficult, and the task gets more complicated when investment decisions come into play. The easiest way to analyze this situation from an investor’s perspective is through a case study. We’ll use copper because of its unique position as a key resource for electrification.

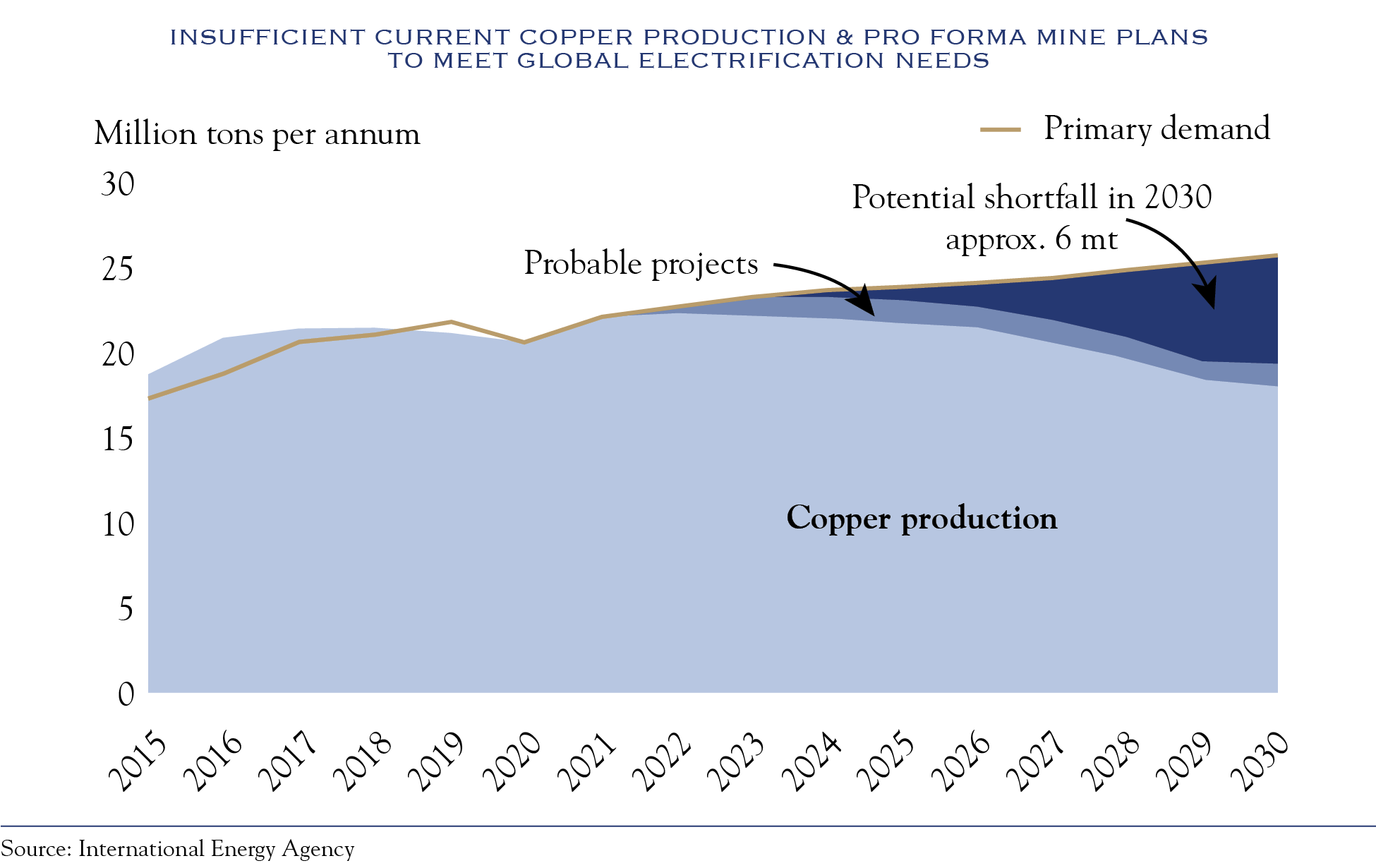

Copper stands out with lagging supply projections due to new mines not coming online quickly and decreased production from existing ones. This output gap implies a growing global supply and demand imbalance. Existing reserves are depleted, and it is becoming more difficult and taking much longer to discover and develop new assets. Keep in mind that the decreased production of copper also negatively affects all its downstream byproducts.

This is a broad trend within the mining industry. Focusing on near-term cash flows reduces mining capital expenditures along with exploration budgets, contributing to fewer new discoveries. Geopolitical risks include changing taxation and royalty regimes, illegal artisan mining, social conflict zones, and lengthy bureaucratic processes associated with ESG considerations. With over a third of copper production coming from Chile and Peru and another 14% from the DRC and Zambia, it is hard to ignore the inherent risks in global supply. It now takes 10–15 years to bring a copper mine from greenfield (projects requiring further exploration to become development-ready) to first production.

The mining industry is also seeing declines in average grade (the percent concentration of a metal in the ore being mined). The copper industry’s largest mine, had grades between 2.5–3.0% when it first started production, but now, reserve grades are close to 0.5%. The easy mining has been done, and the industry is now grappling with more difficult and costly ways to meet demand.

China’s effect on copper is an excellent example of concentration across the value chain. China accounts for roughly 56% of global copper consumption and less than 10% of mine production. This short position and the country’s consumption intensity make China a major swing factor in global copper trade. This year, a weak Chinese real estate market and delayed economic stimulus combined with a global downturn in electric vehicle sales growth slowed the demand for copper. This was reflected in elevated inventories that came off historical lows, specifically in Shanghai warehouses. Additionally, the U.S. election result introduces the added risk of tariffs on Chinese trade, potentially placing further pressure on demand growth in the near term.

The story of copper offers a clear lens through which to view the broader energy transition materials landscape. Despite these current challenges to demand, the critical use of copper in important sectors of the economy and the energy transition remains a significant medium-term driver of consumption that can’t be ignored. For example, tight copper markets with low inventories at the beginning of 2024 are projected to be followed by critically tight markets by 2026. The expected deficits will require elevated pricing to incentivize production. Likewise, the long-term equilibrium price of copper needed to balance supply and demand should rise with inflation and the higher capital intensity of new projects.

By recognizing these dynamics, investors can better assess when and where to act—whether that means identifying opportunities during periods of market volatility or positioning for long-term gains driven by structural demand growth.

Remember that copper’s use is not singular. Because new developments in a particular technology can make a once-essential material obsolete, a resource’s demand must be analyzed to determine its dependence on any single trend or consumer. Copper enjoys an almost universal demand for every aspect of the energy transition and emerging sectors like AI and the developing energy grid. Supply is no different. The cause of constraints is diversified across tight inventories, decreased production, lower-quality ore, geopolitical risks, regulatory hurdles, and long development timelines for new mines. But these key drivers of supply and demand are not just challenges—they are signals of potential opportunity. By recognizing these dynamics, investors can better assess when and where to act—whether that means identifying opportunities during periods of market volatility or positioning for long-term gains driven by structural demand growth.

With all the interest and investment in the renewable energy sector, it is no surprise that many investors are considering it for their portfolios. However, like any investment, it is crucial to have a fundamental understanding of the industry’s key components and value drivers. For renewable energy, this amounts to understanding the base materials that make up the technology and the economics of these commodities. Investors should discount short-term concerns that overlook the underlying value and fundamental use cases of materials. For many materials, opportunities will arise for investors trying to take advantage of a longer investment horizon.