What do you do with young inheritors who want go-go, exciting stocks in their portfolios and are hesitant to follow any guidance from the grown-ups?

The wealth transition between generations is an opportunity to further engage and educate the younger generation about the importance of due diligence, diversification, the pitfalls of market timing and speculation, and the history of hot trends and market bubbles.

Advisors to multi-generational families should make it a point to acknowledge and respect the younger generation’s different perspectives, experiences, and values. The wealth transition between generations is an opportunity to further engage and educate them about the importance of due diligence, diversification, the pitfalls of market timing and speculation, and the history of hot trends and market bubbles. Rather than speak down to them, advisors should listen and work together to arrive at an appropriate portfolio.

Consider the following scenario—quite typical among our client base:

The Do-It-Yourselfer

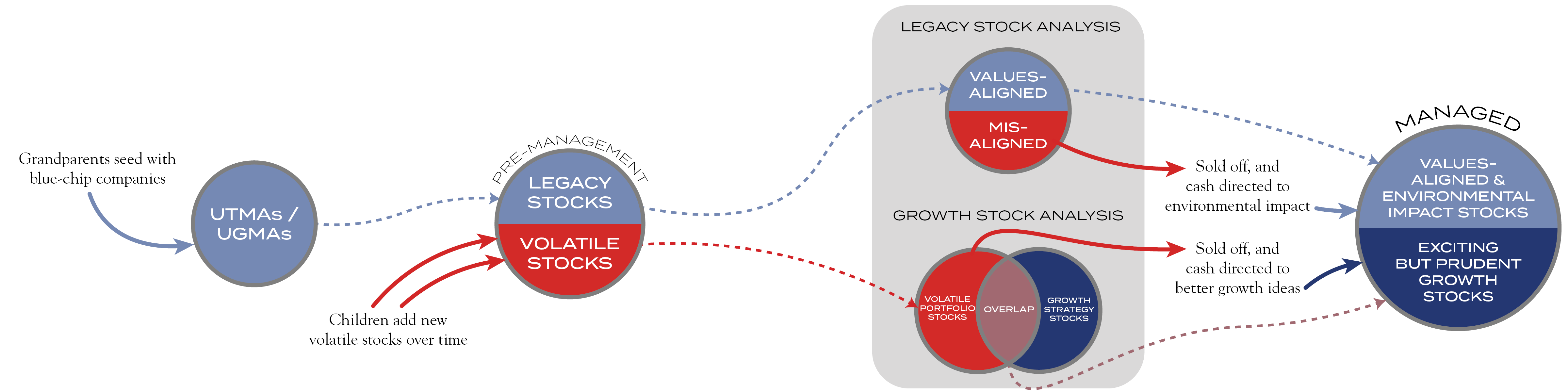

The Jones children had relatively small UTMA/UGMA accounts, which they managed on their own. These accounts were originally seeded with a handful of low-cost blue-chip companies given to them by their grandparents. Over the years, the Jones children added to these portfolios with their savings. They began investing in companies they thought were on the leading edge of the next big technological, healthcare, or consumer breakthrough. Despite the more stable legacy stock positions, the portfolios were volatile as the new stocks either skyrocketed or tanked with market gyrations. Several holdings declined to penny-stock status. As the Jones children started thinking about owning homes, educating children, and saving for retirement, they recognized a need for more professional oversight to help manage risk and volatility. They sought such guidance from Silvercrest but specified that they did not want to give up investing in exciting growth stocks, expressing concern that their parents’ manager would be unwilling to work

with them on these terms.

Building a Resilient Portfolio

This presented an opportunity for us to engage each child more fully in intentionally managing their portfolios. The Jones children were encouraged to view their portfolios as vehicles built to last a lifetime, providing a stable nest egg to supplement the various financial needs that arise over 10, 25, or even 50 years—not as a vehicle for speculative trading and market timing. After receiving a primer on portfolio diversification’s impact in reducing volatility, each child was able to arrive at a set of investment objectives and a plan to achieve those objectives by building a more resilient portfolio. This did not mean they had to sell all the stocks they had purchased on their own; instead, they made a case for broadening out the portfolio to include a balance of growth, value, non-U.S., and values-based investments.

Keeping Growth in the Mix

This did not mean they had to sell all the stocks they had purchased on their own; instead, they made a case for broadening out the portfolio to include a balance of growth, value, non-U.S., and values-based investments.

In the process of diversifying the portfolios, the individual stocks each child had previously invested in were reviewed to get an idea of what trends and industries they were excited about. Comparing these securities to the holdings in established growth equity strategies revealed an overlap. However, the portfolio weightings for these companies were quite a bit higher than advised. Rather than just selling down to the recommended weight, a plan for gradual diversification was developed with each child, realizing some of the losses from their less successful ideas and using those proceeds to invest in the best ideas from a multi-cap growth strategy. For any stock not followed by the growth managers, a better alternative within that same field of interest was offered.

Investing with Values in Mind

Legacy stocks were also considered within the context of their stated value of protecting the environment. For the legacy stocks that were contrary to this value (e.g., an oil company or a chemical company), a plan was developed for gradual, tax-aware diversification out of these companies into an environmental impact strategy.

Ultimately, each child ended up with a balanced portfolio that included the right amount of exciting growth companies and reflected their values while providing proportionate ballast to offset market volatility. What were once wild, roller-coaster-ride portfolios became steady growth portfolios that would last well into the future and provide for all of life’s unexpected financial needs.

Advisors for ultra-high-net-worth families must be able to engage with and understand the varying objectives and values of multiple generations. Portfolio managers should take time to listen to their clients, acknowledge and respect their experiences and interests, and build dynamic portfolios that work for them. What worked for grandma might not work for every case, and that’s okay—so long as you build a portfolio that reflects the client’s needs while protecting against the unpredictability of the markets!