Recently, you gave an internal presentation at Silvercrest on Walter Bagehot. Why?

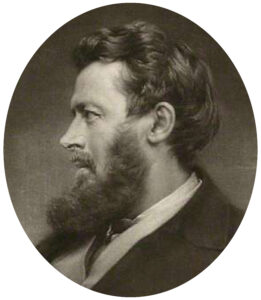

Walter Bagehot (pronounced Badge-it) was the man who established the idea, in the mid-1800s that central banks should serve as the “lender of last resort” in a crisis. He was the editor of The Economist, but he earned his living as an executive in a family-run regional bank in southwest England. This banking experience gave Bagehot a solid practical understanding of the “money markets” that he brought to bear in his broader commentary. During his shortened career (he died at age 51 of bronchitis), he lived through and wrote about a series of panics in what was then the financial capital of the world. Although there were notable differences during that era, many of the developments and transformations markets underwent are recognizably similar. As long-term investors, knowing these stories provides some much-needed perspective when faced with market uncertainty and turmoil today.

Before you tell us what is similar—and relevant—to today, what was different?

The biggest differences were the gold standard and unlimited liability. Some differences, like the role banks played, are more subtle. Today we think of deposits and lending as separate activities, but in that time period, they were more closely linked. Checking deposits that paid interest were a new innovation, and quite controversial. Say you went to the bank and deposited some gold coins; instead of opening an account, banks would give you their own notes in exchange, which you could save or spend as needed. You could also take other assets to the bank—notes from other banks, business IOUs (your own or someone else’s), or real property like a farm—and receive the bank’s paper money in exchange. So, the difference between a depositor and a borrower wasn’t as clear.

In principle, if you took this paper money to the bank that issued it, they had to give you gold in exchange. So, banks had to invest in assets that could be quickly and easily liquidated to meet those demands. Gold and notes from the Bank of England, which held most of the country’s gold reserves, were ideal, but paid no return. Conservative banks invested in business IOUs that would be paid off in a few weeks or months. To earn higher returns, though, banks were tempted to invest in longer-term assets that returned better profits. However, if a bank issued too many notes against such illiquid (and riskier) assets, it might not be able to honor them when requested—especially if people grew nervous and decided to present them all at once. If a bank failed to meet its obligations, its owners were personally liable to pay what was owed. Despite this looming danger, throughout the 19th century, banks repeatedly got overextended and sparked a series of widespread panics.

So how did the British government respond?

In 1844, Parliament passed a banking law that did two things. First, it barred new banks from issuing their own notes. Second, it placed a strict limit on the amount of notes the Bank of England could issue. The idea was to gradually shift to a single paper currency that could be tightly managed to avoid credit bubbles. Despite this, the effectiveness of the new law was undermined by its selective enforcement. The law was followed during good times when it wasn’t needed and was regularly suspended when things went belly-up.

When a panic ensued, there was immense pressure on the Bank of England to step in with its impeccable credit and issue as many notes were needed against all sorts of less liquid assets. There was no formal obligation for it to do so—it was a private, for-profit institution with its own shareholders, even if its charter made it a uniquely privileged one. However, when panics hit in 1847 and 1857, the law was suspended and the bank provided generous credit to backstop the entire system, just as it had in 1825. Critics worried that far from preventing crises, this would only encourage banks to keep taking unsustainable risks.

And did they?

Yes. One of the most important firms to get a credit backstop in 1857 was Overend Gurney. Their main business was brokering short-term notes and IOUs, which placed them at the center of London’s credit markets. In addition to this very conservative, low-yield business, they began getting a bit more adventurous. Overseas, the French were pioneering a new kind of bank, with names like Crédit Mobilier and Crédit Foncier, protected by limited liability and designed to deploy middle-class savings to finance longer-term projects. In fact, the verb “to finance” was introduced into the English language through them. Their popularity sparked imitators in Britain, which in 1862 passed a new law allowing anyone to form a corporation for any purpose instead of needing a special charter.

Overend Gurney, boosted with confidence from surviving the 1857 panic, started dabbling in longer-term lending. Some of the firm’s investments proved very bad, though, opening big (but hidden) holes in their balance sheet. The partners realized they were insolvent and decided to raise more capital by becoming a limited liability corporation and selling shares to the public. They didn’t disclose their problems, and the offering was extremely popular due to their stellar reputation. Bagehot, in The Economist, wasn’t explicitly critical of the IPO but had reservations, saying people should do their research. Soon though, there were hints Overend Gurney might miss dividend payments. An outbreak of war between Prussia and Austria in 1866 ultimately led to a run on the firm, which couldn’t meet its obligations and collapsed, unleashing a wider financial panic throughout London.

And did the Bank of England step in again?

It resisted for about a week, but as the crisis threatened to spin out of control, it capitulated, the 1844 law was suspended, and it served as the “lender of last resort.” This is where Bagehot’s legacy comes in, because the crisis served as the basis for his book “Lombard Street”, published in 1873, where he made his argument that this was the proper (and inescapable) role for the Bank of England to play. It wasn’t a popular argument at the time because many critics argued (just as they do today) that it would only encourage people to continue taking irresponsible risks. They said banks needed to hold sufficient reserves against panics, even if it reduced their profits. Bagehot, however, a banker himself, argued that this would cripple the functioning of London’s money markets, which were the engine of Britain’s economy. Over the next century, his view gradually became accepted orthodoxy.

So, we live in a world that Bagehot created, or at least advocated for?

Not entirely, as Bagehot was a firm believer in the gold standard, and that implied certain conditions on the generous provision of credit in a crisis. Bagehot argued the central bank should lend liberally to otherwise solvent institutions, against good assets, but at a penalty rate of interest. Today, with fiat currencies and floating exchange rates, central banks don’t face quite the same constraints. So, the modern version—in 2008 or 2020, for example—is for central banks to lend liberally at extremely low rates of interest, to institutions that may or may not be solvent but are seen as “too big to fail.” It’s rather different from what Bagehot had in mind.

The seeds of this were already present in Bagehot’s own proposal though. The whole reason the Bank of England could serve as the “lender of last resort” in a crisis wasn’t just the gold reserves it held, but the uncritical confidence people had in its notes. People weren’t counting the gold in its vaults; they presumed it was sound because it was the government’s bank. So, we see the subtle transition between the notion that “gold is money”, to money being the government’s promise, to “do whatever it takes” to ensure the economy functions.

Any other insights from Bagehot that are relevant today?

Bagehot had an interesting rule of thumb about bubbles. He wrote that a promised return of 15% is the threshold above which people take leave of their critical reason. They are tempted to buy any story that promises 15% or more. At the same time, 2% interest is the floor below which people feel pushed to take risks they otherwise wouldn’t. Combine the two and you get a bubble. It’s an interesting pair of benchmarks, especially given the near-zero interest rates of recent years and the popularity of growth stocks. It’s a good reminder for investors to be on their guard and stay disciplined under such conditions.

Bagehot’s world of London finance may seem very different, and few people today have ever heard of Overend Gurney, but some aspects of human nature are timeless, and some lessons need to be learned over and over again. The more we are aware of what those lessons are, the better.