When constructing a portfolio, active managers should have a clear investment philosophy that outlines the types of companies that will align with their strategy. Growth investors typically seek companies that will outgrow the economy, their peers, or the market at large. Emerging Growth investors want to find those same companies early in their development. The challenge lies in sourcing these prospective companies, as they are often small, undiscovered, or not widely covered by Wall Street. This is where Thematic Investing can be a valuable tool, offering a strategic approach to finding these hidden gems.

What Makes for a Good Theme?

Research teams that can creatively identify thematic trends can be introduced early on to well-positioned companies that could benefit the most from those trends.

Thematic Investing starts with identifying undeniable tailwinds in a market, industry, or the economy at large and then broadly applying those indisputable market truths to potential new investment ideas. A dynamic, change-fueled marketplace, like the one we have invested in for the last three decades, constantly serves up these new trends. Whether driven by technological innovation, generational preferences, regulation, or changes in consumer behavior, trends often emerge that have the potential to improve the fortunes of many companies. Research teams that can creatively identify thematic trends can be introduced early on to well-positioned companies that could benefit the most from those trends.

The following three primary criteria are critical in an investment manager’s effort to identify promising themes:

- The theme is undeniable.

- The theme is secular in nature.

- The theme is broadly applicable.

Undeniability may seem like a very high hurdle at first glance. However, some inevitable trends do emerge in our market and the economy, after which there is no going back. One example, dating back about a decade, is that of minimally invasive healthcare. No reasonable person would argue against the merits of smaller incisions, all else being equal. Technological advances have made this possible. Another trend that goes back even further is the Smartphone Revolution, which has impacted nearly everybody, confirming its undeniability.

Good themes should also be secular in nature, resulting in multi-year disruption waves. Like the examples above, these themes do not require a specific economic environment in which to unfold and ultimately take over market behavior. They are also not short-lived events, such as a relief opportunity from a single natural disaster or a one-time event such as the Y2K bug. The strongest trends take years to unfold and penetrate, creating sustained, multi-year opportunities for aligned companies. However, it is not uncommon for a single event to awaken a marketplace to vulnerabilities that can instigate a more durable, permanent behavioral change. A contemporary example is the post-COVID crippling of global supply chains, which is causing businesses worldwide to reconstruct their approaches to their sourcing of goods, inventory management processes, and distribution architectures—this process will play out over a number of years if not decades.

Finally, the best themes are broad. The behavioral changes they can cause are usually so profound that they can revolutionize many companies across seemingly disparate industries. Identifying the multitude of potential opportunities requires a high level of creativity and intellectual curiosity. It takes a well-orchestrated investment team to effectively uncover the myriad opportunities a strong theme can provide.

How a Theme Evolves into Portfolio Investments

While themes can come from anywhere, they typically sprout from deep research on a single idea.

Which comes first, the theme or the stock? While themes can come from anywhere, they typically sprout from deep research on a single idea. As a research team’s knowledge about a company deepens, often the company’s success and robust outlook are shown to be only partly due to astute management and execution—an underlying tailwind frequently buoys the bright horizon, powerful enough to mask minor missteps and create lucrative opportunities. It would not be unusual for another company to reference the same tailwind at another time. At this point, the team should begin actively looking for and listening to other beneficiary companies, some of which might not yet recognize the assistance on the horizon.

Importantly, not all companies benefitting from a thematic tailwind become portfolio holdings, no matter how swiftly the tailwind blows. Each investment idea must stand on its own and meet company-specific fundamental criteria for inclusion in the portfolio. However, at the margin, a theme may allow a little more leeway on valuation or other risk factors, facilitating earlier investment. Being secular in nature allows teams to slowly build themes as second- and third-derivative beneficiaries become visible.

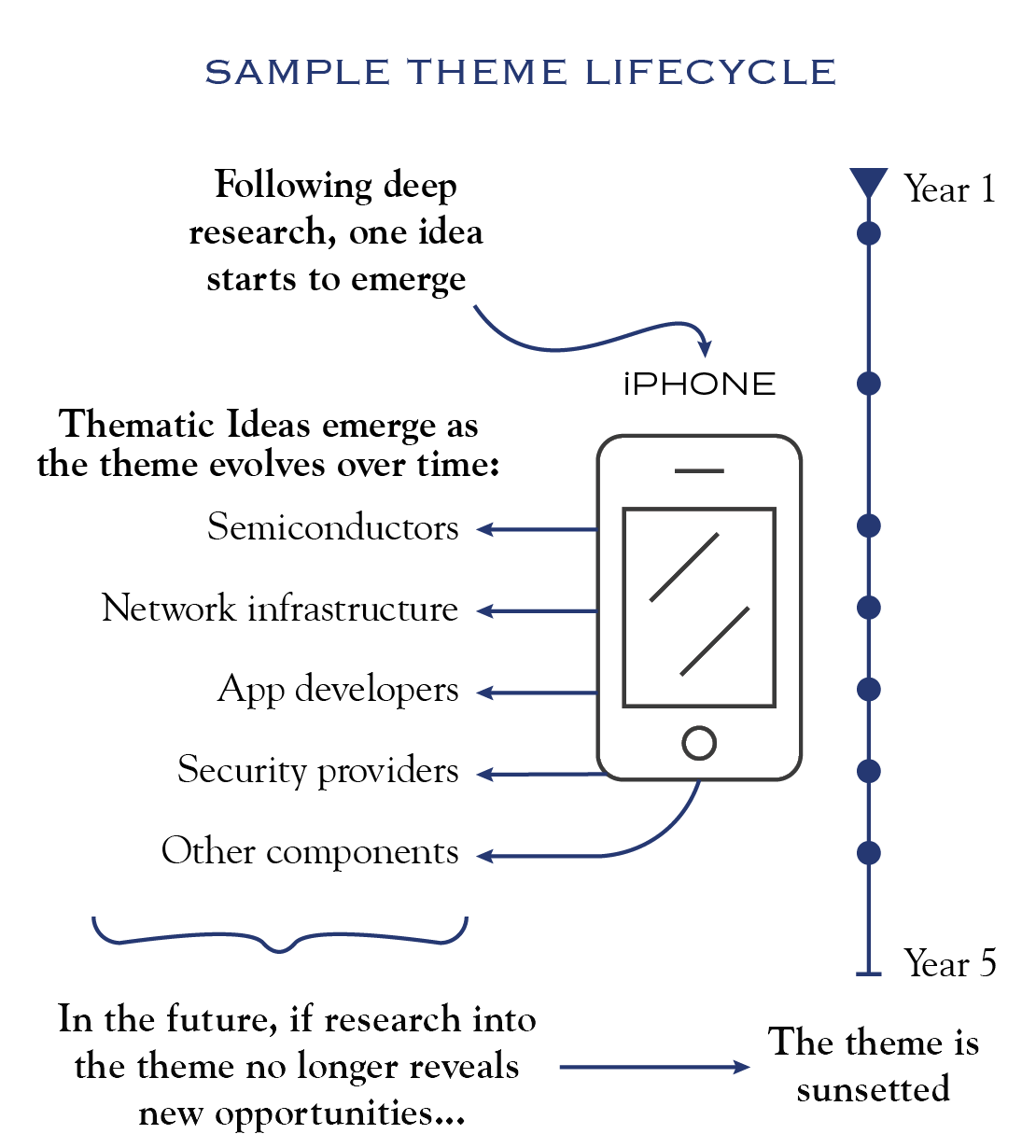

Individual themes remain viable as long as they are productive in identifying new stock ideas. After several years, if research into the theme no longer reveals new opportunities and existing holdings have, for company-specific reasons, been sold from the portfolio, the team can sunset the theme and begin exploring other areas.

Portfolio Benefits of Thematic Investing

Constructing and sunsetting themes in this manner provides many benefits. By moving deliberately and listening for less obvious beneficiaries, an investment manager can diversify the most successful themes across sectors and industries, as well as the timing of when companies enter the portfolio. In this way, themes can morph over time as the secular trend moves through various stages. Leveraging one high-conviction idea to bring in several holdings across industries and sectors provides prudent exposure to nascent, potentially explosive growth companies while easing liquidity constraints and reducing single-company risk. It also avoids the pitfalls of basket investing, whereby the most obvious beneficiaries of a current trend, often with identical business models, are purchased simultaneously. Basket stocks will tend to trade as a group, both rising and falling together, which requires deft entry and exit timing, thus limiting the portfolio exposure and potential positive influence. Basket investing can also be a trap, where lower-caliber ideas enter the portfolio simply because they fit the theme.

In the worst stock markets, when bearishness is pervasive and optimism is scarce, it can be challenging to remain long-term constructive. However, it is precisely at these times that having a forward-looking vision for when conditions improve is most crucial.

Thematic investing can also keep the portfolio invested in growth areas, even when the macroeconomy is at its weakest. In the worst stock markets, when bearishness is pervasive and optimism is scarce, it can be challenging to remain long-term constructive. However, it is precisely at these times that having a forward-looking vision for when conditions improve is most crucial. Stocks trade at the most attractive values during such times. Relying on the best themes for stock ideas fulfills a common refrain: “I don’t know when the market will want to return to growth ideas, but when it does, this thematic idea should be appealing.”

Let’s revisit the Smartphone Revolution, an early theme born during The Great Recession, to illustrate theme identification and evolution from our own experience. Our team’s discovery of the theme by our then-technology analyst came about during a trip to China to research the technology food chain. Upon returning, the team concluded that underutilized consumer electronics manufacturing facilities and downtrodden executives corroborated the unfolding recession. However, a single area was bucking the trend: the iPhone and everything related to it. Keep in mind that, in 2008, the most obvious utility of the smartphone was nothing more than the camera and a level app—smartphones were seen only as expensive novelties and did not appear to have mass appeal. Further analysis revealed a robust application development ecosystem. The Smartphone Revolution had begun. As small- and mid-cap investors without the option of owning the company with its name on the iPhone, we focused our early investments on enabling technologies like the handset’s semiconductors and other components. As popularity grew, it became clear that developer creativity was outpacing bandwidth, and our thematic attention turned to the network. Over the theme’s roughly five-year history, our team invested in handset components, network infrastructure, app developers, security providers, and others. Today, smartphones are ubiquitous and have changed human behavior, and while the theme has been retired for several years, new themes, including Next Generation Communications Infrastructure and Alternative Threat Landscape, can trace their roots to the Smartphone Revolution.

Theme Expectations

Not all portfolio investments are thematic, and entering the portfolio under a thematic banner does not ensure the stock will be a winner. Themes are not a panacea—even the best ones may still face negative exposure to economic cyclicality and other such pressures in the short term and management failure in the longer term. Nevertheless, we have found that incorporating a thematic approach into our process enhances our idea generation and portfolio construction. Discovering tomorrow’s great growth companies is like fishing—landing one can take many casts. However, we consider a thematic overlay as just one tool to help us find where the real trophy catches might be hiding, even if no other boats are there yet.

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Bies and Mr. Lilly. No part of Mr. Bies or Mr. Lilly’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC