Endowment funds, particularly those of colleges and universities, have a well earned reputation for being at the forefront of innovation in investing. With their long time horizons (often humbly referred to as “perpetuity”) and tolerance for illiquidity, these funds have been pioneers in diversifying away from traditional U.S.-centric stock and bond portfolios, and allocating their capital to exotic asset classes like timber, venture capital, and frontier markets. Their broad success in preserving capital during the bear market of 2000-2002 made endowment funds the envy of the traditionally invested crowd.

However, more recently in a Fortune magazine article entitled “Why Colleges Are Getting a ‘C’ in Investing” (Fortune magazine 12/15/16), Roger Lowenstein noted that “Through 2016, the average university endowment has had a poorer record—over one year, three years, five years, and 10 years—than the average public pension fund, according to the Wilshire Trust Universe Comparison Service. Even over 20 years, endowments and pensions are in a virtual dead heat (the latter trailed by 20/100th of a percentage point), meaning that over a generation, academia’s vaunted edge has vanished.”

The biggest source for endowment funds’ outperformance during the bear market of 2000-2002 came from what they didn’t own, namely large capitalization U.S. equities.

The biggest source for endowment funds’ outperformance during the bear market of 2000-2002 came from what they didn’t own, namely large capitalization U.S. equities. Stocks, especially those in the first wave of internet mania, had a huge run up in the late 1990s, reaching valuation levels that reflected “irrational exuberance”. Large sophisticated endowment funds, led by Yale University, diversified away this risk by switching to more compellingly valued asset classes like non-U.S. equities, private equities, and hedge funds. When other fund managers saw how well these large endowments had protected capital during the bear market, the great rush to make their portfolios look like Yale’s was on. But their timing couldn’t have been worse.

Fast forward to the decade of 2007-2016, a period which began with the global financial crisis. From mid-2007 to March 2009, most major asset classes saw their prices decline precipitously in lock step. The only investments that didn’t go down were bonds and gold. Large and small endowments alike suffered significant drawdowns, and articles were written about the “death of the endowment model.” Broad diversification hadn’t worked like it did during the prior bear market. Hedge funds, as their name implies, were supposed to “hedge” their risks and protect capital during bear markets. Suffice it to say, they didn’t!

So which is it for endowments—investing savants or average performers? As with most dichotomies, the answer lies somewhere in between.

Since the global financial crisis, public stocks have been on a tear, making a traditionally invested stock/bond portfolio perform very well. There hasn’t been the need for diversification into complex or illiquid asset classes, as investors haven’t been meaningfully compensated for taking those risks. So those who decided to try to copy the endowment model of the late 1990s and early 2000s got double crossed.

So which is it for endowments—investing savants or average performers?

As with most dichotomies, the answer lies somewhere in between.

Regardless of whether you are investing an endowment fund, a family foundation, or corporate pension fund, a robust investment process for the management of any complex pool of capital begins with an evaluation of the unique characteristics and needs of the underlying entity. These characteristics are often codified in an Investment Policy Statement (IPS) that incorporates:

- Return objectives

- Tolerance for volatility

- Time horizon

- Spending requirements

- Liquidity needs beyond spending

- Asset classes to be included/excluded

- Other specific needs

It is these characteristics that are used for the construction of an asset allocation for a pool of capital. If an endowment fund and a family foundation have similar IPSs, then it is reasonable to conclude that the portfolios could look quite similar. The wide variations in expected return and volatility of portfolios can stem from the implementation of these asset allocations.

Combining our client-centricity, investment-driven culture, deep industry experience, and world-class risk management, Silvercrest brings a team approach to the management of complex pools of capital. Through our Outsourced Chief Investment Officer (OCIO) practice, we work in partnership with our endowment and foundation clients to carefully review the IPS and develop a full understanding of each client’s objectives and constraints. We then construct a customized asset allocation designed to meet the specific needs of their organization. We don’t try to mimic large funds, but rather strive to create the right mix of assets, with the right investment managers, to create a portfolio with the most efficient risk/reward balance that meets our clients’ needs.

We don’t try to mimic large funds, but rather strive to create the right mix of assets, with the right investment managers, to create a portfolio with the most efficient risk/reward balance that meets our clients’ needs.

The endowment model is most definitely NOT dead. The time tested strategy of portfolio diversification continues to be an important principle for any portfolio, whether a university endowment or a family foundation. The rigorous investment process needed to create an asset allocation that dovetails with an organization’s IPS is equally critical. What is different today is that alternative strategies are available to most all investors, not just large endowments. University endowments will continue to use their long time horizon and tolerance for illiquidity to seek out new investment opportunities, but the days of their dramatic outperformance relative to other investors may have come and gone.

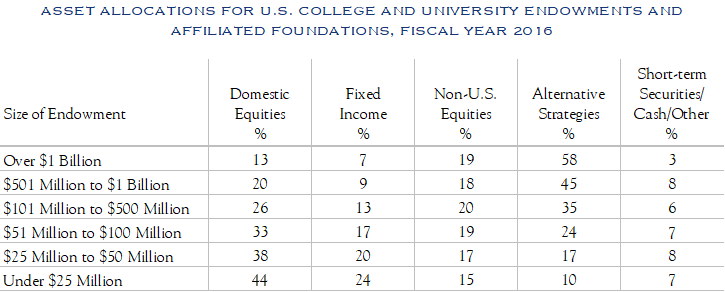

Note the larger the pool of capital, the stronger the appetite for alternatives

Source: NACUBO

This communication contains the personal opinions, as of the date set forth herein, about the securities, investments and/or economic subjects discussed by Mr. Brown. No part of Mr. Brown’s compensation was, is or will be related to any specific views contained in these materials. This communication is intended for information purposes only and does not recommend or solicit the purchase or sale of specific securities or investment services. Readers should not infer or assume that any securities, sectors or markets described were or will be profitable or are appropriate to meet the objectives, situation or needs of a particular individual or family, as the implementation of any financial strategy should only be made after consultation with your attorney, tax advisor and investment advisor. All material presented is compiled from sources believed to be reliable, but accuracy or completeness cannot be guaranteed. © Silvercrest Asset Management Group LLC